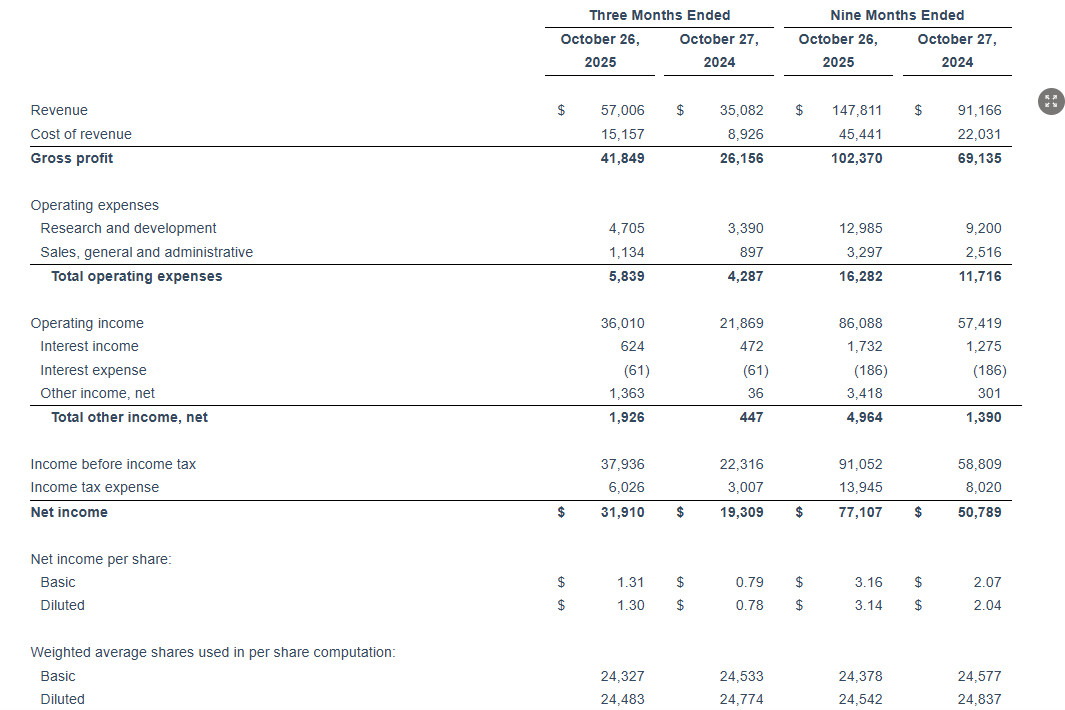

$NVIDIA (NVDA.US)$ Q3 revenue for the fiscal year 2026 came in at USD 57.06 billion, representing a 62% year-over-year increase and exceeding market expectations of USD 55.21 billion. Net profit reached USD 31.91 billion, up 65% year-over-year, with adjusted earnings per share at USD 1.30.

By segment, data center revenue reached USD 51.215 billion, representing a year-over-year increase of 66%; gaming revenue amounted to USD 4.265 billion, up 30% year-over-year; professional visualization revenue stood at USD 760 million, reflecting a 56% year-over-year growth; automotive revenue reached USD 592 million, growing by 32% year-over-year; OEM and other businesses generated revenue of USD 174 million.

NVIDIA forecasts revenue for Q4 of the fiscal year 2026 to be $65 billion, with a margin of fluctuation of 2%.

Jensen Huang, founder and CEO of NVIDIA, stated:

Jensen Huang, founder and CEO of NVIDIA, stated:

"Sales of the Blackwell chip have significantly outperformed expectations, with cloud GPUs completely sold out. Demand for computing power, whether for training or inference, continues to accelerate at an exponential rate. We are now in a virtuous cycle of artificial intelligence: the AI ecosystem is rapidly expanding—more new foundational model developers, more AI startups, and broader adoption across industries and countries. AI is simultaneously reaching every corner of the globe, empowering everything it touches."

In the first nine months of fiscal year 2026, NVIDIA returned USD 37 billion to shareholders through stock repurchases and cash dividends. As of the end of the third quarter, the company still had an unused stock repurchase authorization of USD 62.2 billion.

NVIDIA will pay a cash dividend of USD 0.01 per share for the next quarter on December 26, 2025, with the record date set for December 4, 2025.

![]() Earnings Express has been fully upgraded, giving you a head start in mining opportunities! Open Futubull > Stock Page > Click [Company] >Earnings Express

Earnings Express has been fully upgraded, giving you a head start in mining opportunities! Open Futubull > Stock Page > Click [Company] >Earnings Express

Editor/Rocky