After the market closed on December 11 EST, Broadcom released its Q4 financial results for the 2025 fiscal year ending November 2, 2025.

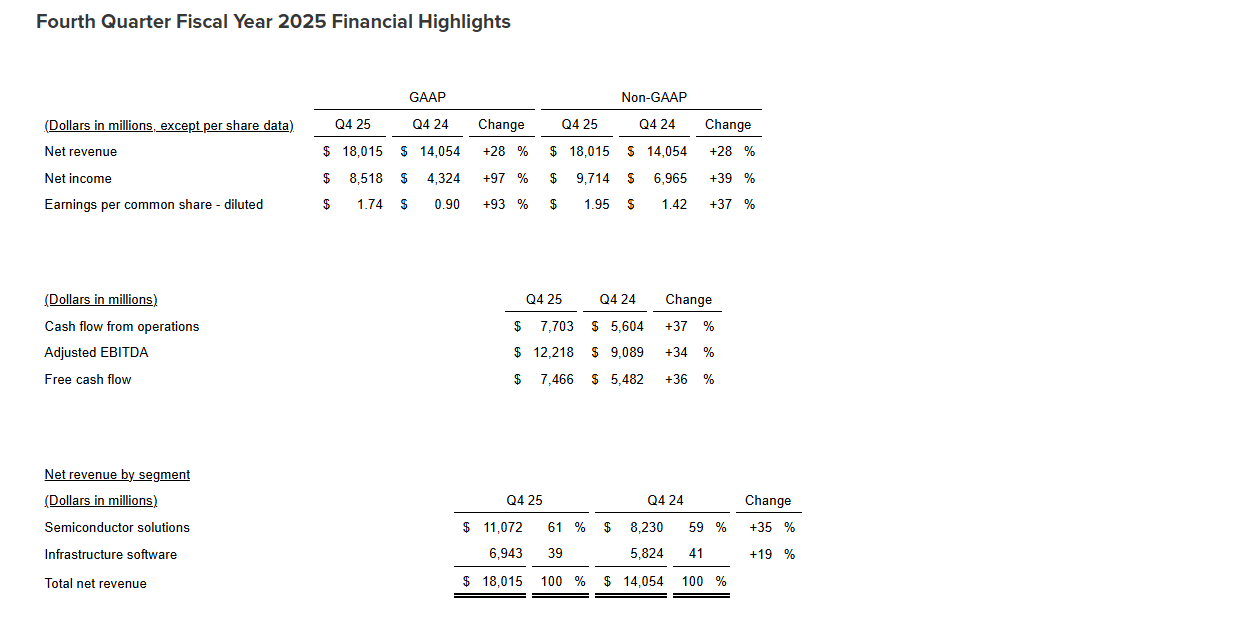

Q4 revenue was US$18.015 billion, an increase of 28% compared to the same period last year.

Q4 GAAP net profit was US$8.518 billion; Q4 non-GAAP net profit was US$9.714 billion.

Q4 adjusted EBITDA was US$12.218 billion, representing 68% of revenue.

Q4 adjusted EBITDA was US$12.218 billion, representing 68% of revenue.Q4 GAAP diluted earnings per share were US$1.74; Q4 non-GAAP diluted earnings per share were US$1.95.

The cash flow generated from operating activities in the fourth quarter was USD 7.703 billion. After deducting capital expenditures of USD 237 million, the result wasFree cash flowUSD 7.466 billion, accounting for 41% of total revenue.

The quarterly common stock dividend increased by 10% compared to the previous quarter, reaching US$0.65 per share.

Revenue for the first quarter of the 2026 fiscal year is expected to be approximately US$19.1 billion, representing a year-over-year increase of 28%.

Adjusted EBITDA for the first quarter of fiscal year 2026 is expected to be 67% of projected revenue.

Hock Tan, President and CEO of Broadcom, stated: 'In the fourth quarter, the company achieved a record revenue of $18 billion, representing a year-over-year increase of 28%, primarily driven by a 74% year-over-year growth in AI semiconductor revenue. We expect this momentum to continue into the first quarter, with AI semiconductor revenue forecasted to double year-over-year to $8.2 billion, led by custom AI accelerators and Ethernet AI switches. We project total revenue for the first quarter of 2026 to reach $19.1 billion, with adjusted EBITDA at 67%.'

Kirsten Spears, Chief Financial Officer of Broadcom, stated: 'In fiscal year 2025, adjusted EBITDA increased by 35% year-over-year to a record $43 billion, with strong free cash flow reaching $26.9 billion. Based on the growth in cash flow for fiscal year 2025, we are raising the quarterly common stock dividend for fiscal year 2026 by 10% to $0.65 per share. The target annual common stock dividend for fiscal year 2026 is set at $2.60 per share, marking a new high and representing the fifteenth consecutive year of annual dividend increases since dividends were first paid in fiscal year 2011.'

Financial Highlights for the Fourth Quarter of Fiscal Year 2025

As of the end of this fiscal quarter, the company's cash and cash equivalents amounted to $16.178 billion, compared to $10.718 billion at the end of the previous fiscal quarter.

In the fourth fiscal quarter, the company generated $7.703 billion in cash from operating activities, incurred $237 million in capital expenditures, and recorded $7.466 billion in free cash flow.

On September 30, 2025, the company distributed a cash dividend of $0.59 per share, totaling $2.797 billion.

Business Outlook for the First Quarter of Fiscal Year 2026

Based on current business trends and conditions, the outlook for the first quarter of fiscal year 2026, ending February 1, 2026, is as follows:

First-quarter revenue is expected to be approximately $19.1 billion.

Adjusted EBITDA for the first quarter is expected to be 67% of projected revenue.

Editor/Joryn