After market close on December 18 EST, $BlackBerry (BB.US)$ the company announced its third-quarter financial results:

Financial Highlights for the Third Quarter of Fiscal Year 2026

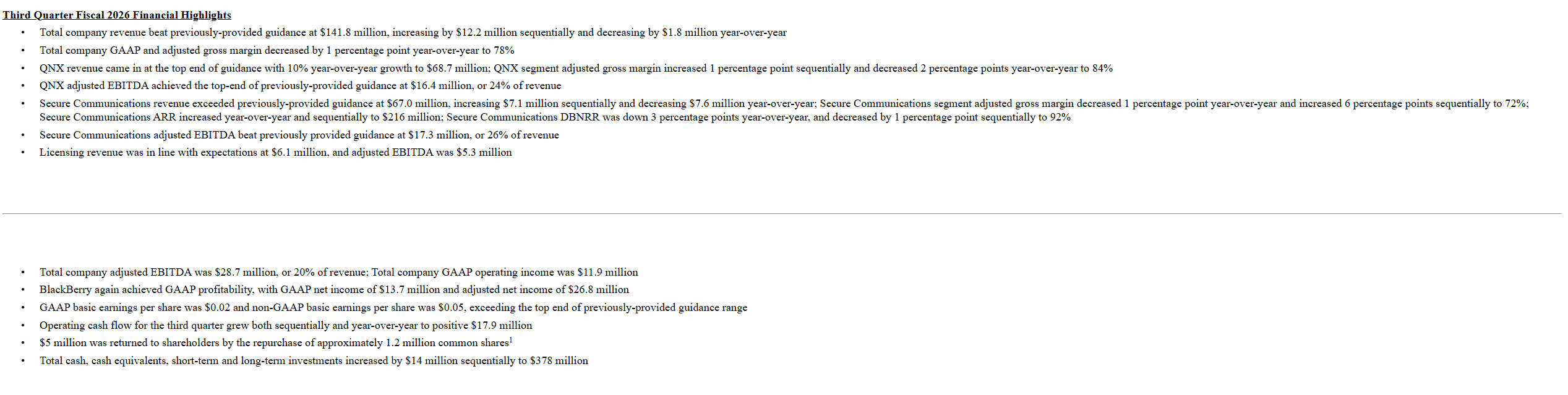

Total company revenue exceeded prior expectations, reaching USD 141.8 million, representing a sequential increase of USD 12.2 million and a year-over-year decrease of USD 1.8 million.

The company’s overall GAAP and adjusted gross margin decreased by 1 percentage point year-over-year to 78%.

The company’s overall GAAP and adjusted gross margin decreased by 1 percentage point year-over-year to 78%.QNX revenue reached the high end of expectations, growing 10% year-over-year to USD 68.7 million; QNX segment’s adjusted gross margin increased 1 percentage point sequentially but declined 2 percentage points year-over-year to 84%.

QNX’s adjusted EBITDA reached the upper limit of prior expectations at USD 16.4 million, accounting for 24% of revenue.

Secure Communications revenue exceeded prior expectations, reaching USD 67 million, with a sequential increase of USD 7.1 million and a year-over-year decline of USD 7.6 million; Secure Communications’ adjusted gross margin decreased by 1 percentage point year-over-year but rose 6 percentage points sequentially to 72%; Secure Communications’ Annual Recurring Revenue (ARR) grew both year-over-year and sequentially to USD 216 million; Secure Communications’ Direct Billing Net Revenue Retention (DBNRR) declined 3 percentage points year-over-year and 1 percentage point sequentially to 92%.

Secure Communications’ adjusted EBITDA exceeded prior expectations, which were set at USD 17.3 million, accounting for 26% of revenue.

Licensing revenue met expectations at USD 6.1 million, with adjusted EBITDA of USD 5.3 million.

The company’s adjusted EBITDA was USD 28.7 million, representing 20% of revenue; its GAAP operating income was USD 11.9 million.

BlackBerry achieved GAAP profitability again, with a GAAP net profit of USD 13.7 million and an adjusted net profit of USD 26.8 million.

Basic earnings per share calculated under Generally Accepted Accounting Principles (GAAP) were USD 0.02, while those calculated under non-GAAP were USD 0.05, both exceeding the upper limit of the previously provided guidance range.

Operating cash flow in the third quarter reached a positive USD 17.9 million on both a sequential and year-over-year basis.

The company returned USD 5 million to shareholders through the repurchase of approximately 1.2 million common shares.