Eastern Time, December 18, $NANO Nuclear Energy (NNE.US)$ released its financial report for 2025:

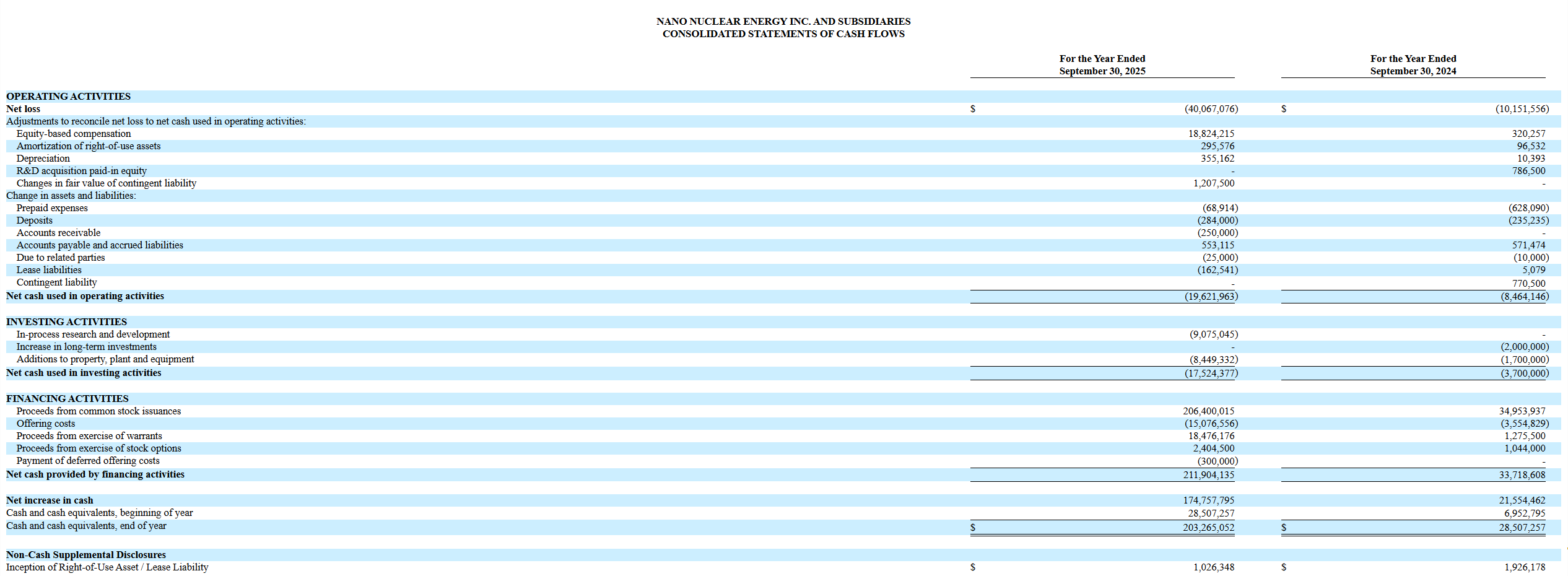

The company reported a net loss of $401 million for the fiscal year 2025, compared to $102 million in the previous year. The adjusted net loss per share was $1.06, compared to $0.39 last year.

The company stated that the increase in operating and R&D expenses, leading to a wider loss, was primarily to support the advancement of KRONOS MMR and related growth initiatives.

Financially, the company stated that it has raised over USD 600 million since its initial public offering (IPO) in May 2024, garnering backing from numerous renowned institutional investors. Additionally, it has been included in several indices and ETFs.

Financially, the company stated that it has raised over USD 600 million since its initial public offering (IPO) in May 2024, garnering backing from numerous renowned institutional investors. Additionally, it has been included in several indices and ETFs.

Equally important, the company has continued to make substantial commercial progress, including signing a feasibility study agreement with BaRupOn to evaluate the power generation capacity of up to 1 gigawatt for KRONOS MMR, as well as entering into a contract with AFWERX for direct progression to Phase II to assess the site selection for KRONOS MMR at Joint Base Anacostia Bolling. Additionally, there is a growing pool of potential customers from multiple diverse markets.