Focus on key points.

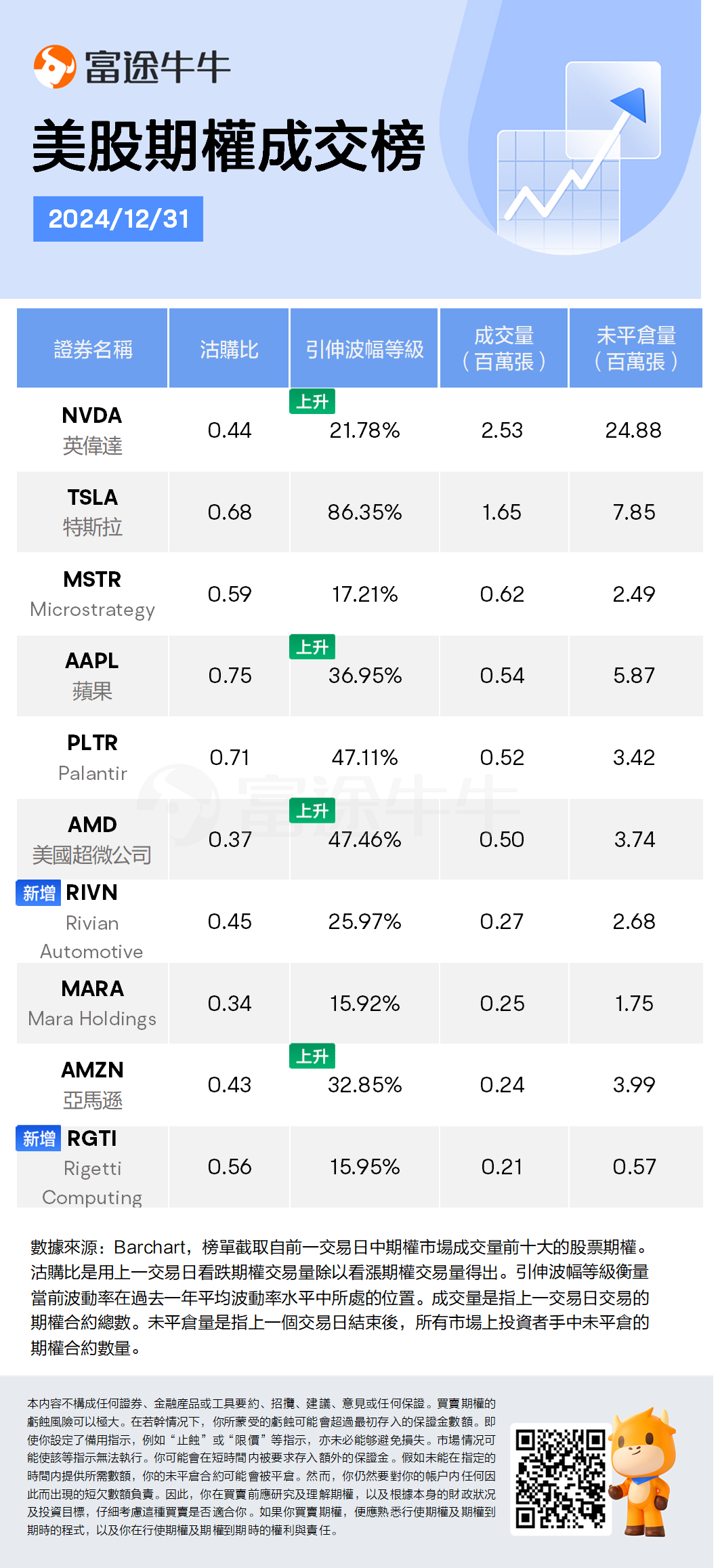

On the last trading day of 2024, $NVIDIA (NVDA.US)$ fell by 2.33%, with Options Trading volume at 2.5332 million contracts, still ranking first in individual stocks, with a Call ratio of 69.4% and an implied volatility level of 21.78%, which is an increase compared to the last trading day.

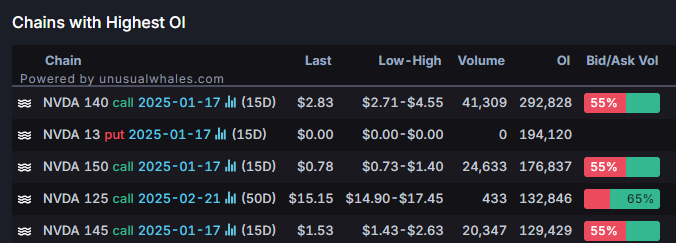

On the Options Chain, the call options with a strike price of $140 expiring this Friday had the highest transaction volume, reaching 0.1293 million contracts, while the call options expiring on January 17, 2025, with a strike price of $140 had the highest open interest, with 0.2928 million contracts outstanding, suggesting the market may be betting on NVIDIA continuing to rise before Trump's inauguration.

Among the large orders for NVIDIA options, there are two transactions worth over ten million dollars. One involved selling 9,875 call options expiring on January 31, 2025, with a strike price of $110, worth $25.8231 million, with a bearish outlook; the other involved selling 4,000 put options expiring on January 16, 2026, with a strike price of $140, worth $10.66 million, with a bullish outlook.

Learn more.Click to view the nvidia options chain >>

Learn more.Click to view the nvidia options chain >>

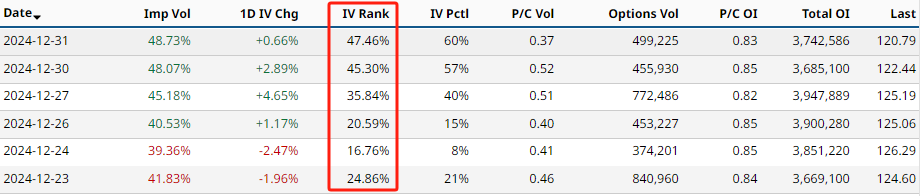

The Global Consumer Electronics Show (CES) in 2025 is approaching. $Advanced Micro Devices (AMD.US)$ The implied volatility level of Options has been climbing for consecutive days to 47.46%, while the Call ratio has risen to 73%. On Tuesday, AMD fell by 1.35%, and nearly 0.5 million Options were traded.

On the Options Chain, the Call contracts with a strike price of $125 expiring this Friday had the highest trading volume, reaching 0.0211 million contracts; for the January 17, 2025 expiration, the Call contracts with a strike price of $150 had the highest open interest, with nearly 0.06 million contracts outstanding.

On the last trading day of 2024, there were five large Orders on AMD Options, each over $10 million, including two bullish and three bearish. The largest single order involved $25 million, selling 5,910 put contracts expiring on January 17, 2025, with a strike price of $165, indicating a bullish direction.

AMD will hold a press conference at CES 2025 to announce the new generation RDNA 4 architecture GPU, corresponding to the Navi 4x series of chips. This time, AMD changed the naming convention for new graphics cards, skipping the Radeon RX 8000 series and moving to the Radeon RX 9000 series, with a combination style more similar to NVIDIA GeForce RTX, where the first two digits represent the GPU architecture series and the last two indicate the product level.

Learn more.Click to view the AMD Options Chain >>

3. "Crypto-Stock" Options Trading is booming! Last trading day of 2024. $MicroStrategy (MSTR.US)$ Dropped over 4%, Options Trading volume of 0.619 million contracts ranked third.$MARA Holdings (MARA.US)$Dropped 3%, Options Trading volume of 0.248 million contracts ranked 8th. Among them, the Call ratio for MicroStrategy is 63.0%, with an implied volatility level of 17.21%; the Call ratio for MARA Holding is 74.5%, with an implied volatility level of 15.92%.

MicroStrategy had two significant trades totaling tens of millions of dollars on the last trading day. One was a Buy of 3,500 contracts of the call option expiring on February 21, 2025, with a strike price of $315, involving $11.76 million, bullish in direction; the other was a Sell of a call option expiring on January 10, 2025, with a strike price of $330, involving $11.7531 million, bearish in direction.

In the recently concluded 2024, Bitcoin surged over 120%. Investors and industry executives expect Bitcoin to reach new highs in 2025; potential policy support from Trump and the anticipated improvement in the USA regulatory environment have become the main driving forces for Bitcoin prices; Wall Street Analysts predict the price of Bitcoin will range from $80,000 to $200,000 in 2025, with some views even bullish up to $250,000.

To learn more, click to view.microstrategy、MARA HoldingOptions Chain >>

1. US stock options trading list

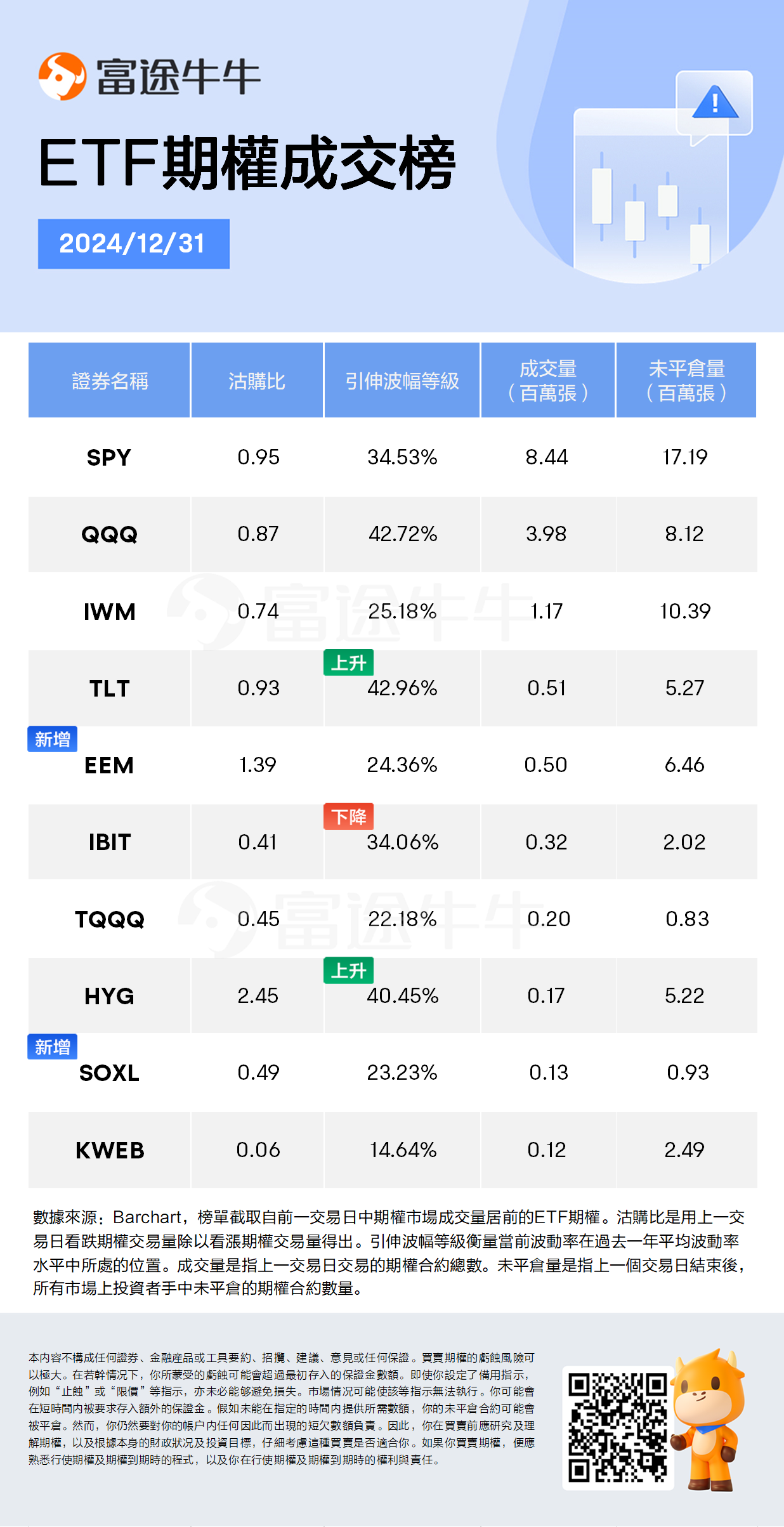

2. ETF options trading list.

Track using Unusual Options Activity,View L in US stock Options Trading!

Stock Quote Page > Options Unusual Options Activity > Filter > Custom filter conditions can be used to obtain target Options Unusual Activity information!

Risk Warning

Options are contracts that give the holder the right, but not the obligation, to buy or sell an asset at a fixed price on or before a specific date. The price of options is influenced by various factors, including the current price of the underlying asset, the strike price, the expiration date, andImplied Volatility。

Implied VolatilityReflecting the market's expectations for the future volatility of options over a period of time, it is data derived from the option BS pricing model, generally considered as an indicator of market sentiment. When investors anticipate greater volatility, they may be more willing to pay higher prices for options to help hedge risks, thereby leading to higher.Implied Volatility。

Traders and investors use Implied Volatilityto evaluateoption pricesAttractiveness, identifying potential mispricing, and managing risk exposure.

Disclaimer

This content does not constitute an offer, solicitation, recommendation, opinion, or guarantee of any securities, financial products or instruments. The loss risk of buying and selling options could be substantial. In certain circumstances, you may suffer losses exceeding the amount initially deposited as margin. Even if you set up backup instructions, such as stop loss or limit instructions, losses may not be avoided. Market conditions may render such orders impossible to execute. You may be required to deposit additional margin in a very short period of time. If the required amount cannot be provided within the specified time, your open contracts may be closed. However, you are still responsible for any shortfalls in your account arising from this. Therefore, before buying or selling, you should research and understand the options, and consider carefully whether such trading is suitable for you based on your financial situation and investment objectives. If you buy or sell options, you should be familiar with the exercise of options and the procedures at expiration, as well as your rights and obligations when exercising an option or at expiration.

Editor/Rocky