Options traders are betting that the European Central Bank will cut interest rates by a total of 125 basis points over the next four policy meetings, which implies one reduction of 50 basis points.

Traders are betting that the European Central Bank will cut rates by at least 50 basis points before the middle of this year.

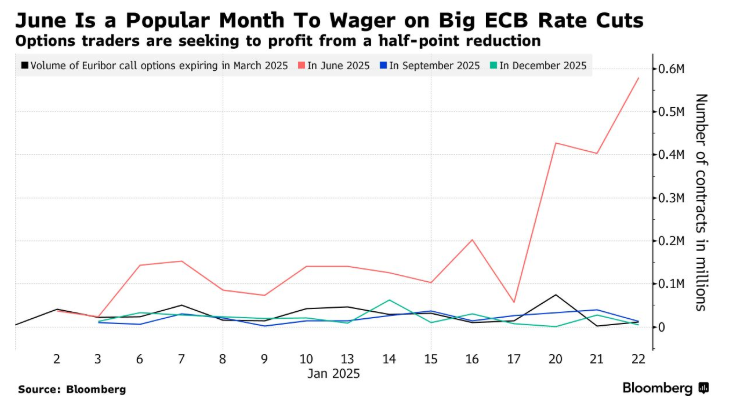

According to data compiled by Bloomberg, these bets are mainly concentrated on Options linked to the 3-month Euro Interbank Offered Rate (Euribor), which expire in June this year, and demand for them has surged since the beginning of this year.

Data shows that if policymakers cut the deposit rate by 125 basis points at the next four policy meetings, one of the bets could make a profit of over 11 million euros (11.46 million USD), which is 25 times its initial expenditure. Such an outcome would indicate that the European Central Bank is expected to cut rates by 50 basis points at one of those meetings, a scenario anticipated a month ago.

Data shows that if policymakers cut the deposit rate by 125 basis points at the next four policy meetings, one of the bets could make a profit of over 11 million euros (11.46 million USD), which is 25 times its initial expenditure. Such an outcome would indicate that the European Central Bank is expected to cut rates by 50 basis points at one of those meetings, a scenario anticipated a month ago.

European Central Bank policymakers stated this week at the Swiss Davos World Economic Forum that they intend to cut rates further, given that inflation is expected to remain at 2% this year, with possible cuts of 25 basis points at each meeting. According to swaps related to the policy meeting dates, the market expects the European Central Bank to cut rates by 25 basis points on January 30.

In the days leading up to Trump's inauguration as President of the USA earlier this week, bets on the European Central Bank cutting rates remained stable as traders assessed the outlook for US interest rates.

The swaps market expects the European Central Bank to have three cuts of 25 basis points before June, totaling four cuts by the end of the year. The next steps for the Federal Reserve remain unclear, and the market generally expects it to cut rates once or twice this year.

For strategists at ING Groep, the path of interest rates set by the European Central Bank largely depends on whether traders start betting that the Federal Reserve will further ease MMF, which they expect the Federal Reserve will do. In this case, a total rate cut of 100 basis points by the European Central Bank may not be sufficient.

ING Groep's senior European interest rate strategist, Michiel Tukker, wrote in a report to clients, 'The market is likely to start considering the idea of bringing the (Eurozone) terminal interest rate back close to 1.5% again.'

Data shows that on Wednesday, the Volume of Call Options for Euribor maturing in June reached nearly 0.6 million contracts. Similarly, since the beginning of this year, the related outstanding positions have surged by about 75%, reaching nearly 2 million contracts.