Due to the pressure on the European economy from USA tariffs and the risk of political turmoil in the region, traders are betting that the European Central Bank (ECB) will have to adopt a more aggressive approach to cut interest rates. The market expects the euro to weaken, potentially falling from the current exchange rate of about 1 euro to 1.04 USD to below 1 USD. As the ECB relaxes its interest rate policies, Bonds are expected to rise in the coming months. There is a widespread expectation in the market that the ECB will cut rates by 25 basis points on Thursday, and traders will closely monitor any changes in the policymakers' positions.

Currently, the market's baseline scenario predicts that the ECB will cut rates three more times by the end of this year, lowering the deposit rate to 2%. This has shown a divergence with the Federal Reserve, but some strategists have indicated that if USA President Donald Trump's punitive trade tariffs threats materialize, this gap will widen and accelerate.

Tariffs imposed by the USA on goods imported from Europe could force the ECB to further cut rates to support economic growth, which may damage the euro in the process. Meanwhile, the dollar will be supported as the Federal Reserve maintains high interest rates to offset the potential for tariffs to reignite inflation in the USA.

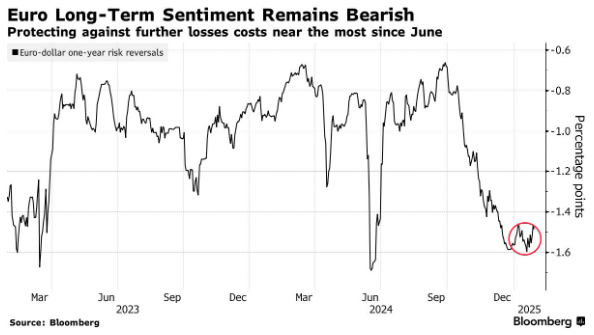

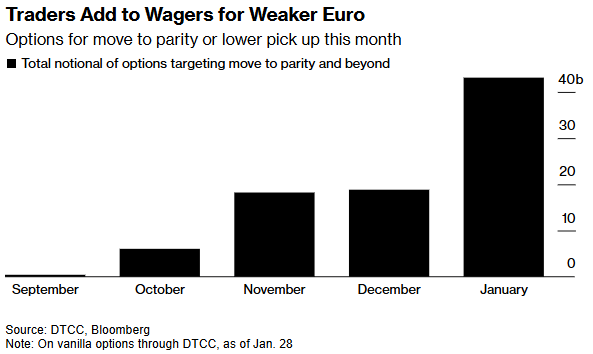

Tim Brooks, head of Forex Options Trading at Optiver, stated, "As long as a tariff against Europe is announced, the Exchange Rates will return to parity." In the long term, market participants are "seeking to hedge against the possibility of the euro weakening against the dollar and falling below parity."

Tim Brooks, head of Forex Options Trading at Optiver, stated, "As long as a tariff against Europe is announced, the Exchange Rates will return to parity." In the long term, market participants are "seeking to hedge against the possibility of the euro weakening against the dollar and falling below parity."

Risk reversals are a closely watched barometer reflecting positions and sentiment in the options market, and this Indicator shows that the cost of hedging against a weaken euro before the end of the year is approaching its highest level since June. Data from the Depository Trust & Clearing Corporation indicates that the demand for related Options for the euro to depreciate to parity or lower against the dollar has more than doubled this month compared to the trading volumes in November and December.

This cautious sentiment has also permeated the interest rate market. Traders have bet heavily on Options, believing that the European Central Bank will cut rates by at least 50 basis points before the middle of the year, accelerating from the current pace of 25 basis points. A market participant has purchased an Options strategy with the goal of reaching a deposit rate of 2% by mid-year.

Konstantin Veit, a portfolio manager at The Pacific Investment Management Company, wrote in a report: "We believe that after the US election, the Eurozone's economic growth will face more downside risks, and the final interest rates may be lower than currently expected."

Policy Shift

Moreover, one of the more Neutral policymakers at the European Central Bank, François Villeroy de Galhau, the Governor of the Bank of France, has downplayed the necessity for a significant rate cut. Data released last Friday showed that after two months of contraction, the Eurozone's private sector experienced growth in January, which surprised Analysts.

In addition, Trump's policy shift has triggered frenzied speculation in recent weeks, causing significant fluctuations in the Forex market. Since the election last November, Analysts have been predicting that the Euro will reach parity with the dollar.

Over the past two weeks, the Euro has soared more than 3% due to bets that tariffs will be delayed or softened. However, these gains were reversed on Tuesday after Trump vowed to impose taxes "far above" 2.5%.

There are still many uncertainties in Europe. In France, the newly formed government is attempting to pass a budget in a turbulent parliament, which is as difficult as walking a tightrope. In neighboring Germany, voters will go to the polls in February after the coalition government led by Chancellor Olaf Scholz collapsed in November.

A Bloomberg survey shows that on Thursday, the Eurozone's fourth quarter GDP will also be released a few hours before the European Central Bank policymakers announce their decision, with the data expected to grow only by 0.1%, down from the 0.4% in the third quarter.

Nicolas Jullien, the Global Head of Fixed Income at Candriam, stated that the European Central Bank's meeting in March will be 'particularly important, at which time the first measures from the US government and the results of the German election will have been revealed.'

However, Candriam maintains an overall optimistic stance on the Eurozone's core government Bonds, as the downtrend of inflation in the Eurozone is 'more solid' compared to the USA. The long-term inflation expectations indicator for the Eurozone remains stable around 2%, in sharp contrast to the corresponding indicator in the USA. The Fed is expected to keep interest rates unchanged later on Wednesday.

Salman Ahmed, Global Head of Macro and Strategic Asset Allocation at Fidelity International, and others expect the rate cut by the European Central Bank to exceed market expectations. He anticipates a total of 150 basis points this year, bringing the deposit rate to 1.5%, falling into what many consider a zone of easing policy.

"This is the only way to protect oneself from tariff risks, compelling the European Central Bank to take more aggressive measures," Ahmed stated. "What we question is not its direction, but its intensity."

Editor/ping