On Monday, after President Trump of the USA announced the implementation of new tariffs, the yen withstood the most intense pressure from the dollar, indicating that investors still view the yen as a safe asset during turbulent times.

On Monday, after President Trump of the USA announced the implementation of new tariffs, the yen withstood the most intense pressure from the dollar, indicating that investors still view the yen as a safe asset during turbulent times.

The Japanese Yen appreciated by 0.3% against the US Dollar. Meanwhile, the Euro fell by more than 1% against the US Dollar, and the Canadian Dollar, Australian Dollar, and New Zealand Dollar also declined.

The relative resilience demonstrated by the Japanese Yen on Monday was not coincidental. It is the only currency among the G10 that has maintained an appreciation against the US Dollar this year. In other markets, as Trump fulfilled his threat, announcing a 25% tariff on Canada and Mexico starting Tuesday, and a 10% tariff on Chinese Commodities, Asian stock markets broadly fell, indicating that investors are fleeing risk Assets.

The relative resilience demonstrated by the Japanese Yen on Monday was not coincidental. It is the only currency among the G10 that has maintained an appreciation against the US Dollar this year. In other markets, as Trump fulfilled his threat, announcing a 25% tariff on Canada and Mexico starting Tuesday, and a 10% tariff on Chinese Commodities, Asian stock markets broadly fell, indicating that investors are fleeing risk Assets.

Gareth Berry, a strategist at Macquarie Bank in Singapore, stated, "The Japanese Yen is re-displaying its safe-haven attributes." He pointed out that this is mainly due to the fact that the Bank of Japan is on a path of interest rate hikes, "while US Treasury yields are currently high and will fall during times of rising risk aversion, leading to a decline in the USD/JPY exchange rate."

The performance of the Japanese Yen in 2025 so far starkly contrasts with its weakness over the past four years. Previously, the Yen faced ongoing pressure due to the significant interest rate gap between Japan and the USA.

Bloomberg MLIV strategist Garfield Reynolds stated, "Amid the significant selling off of many currencies on Monday, the Japanese Yen appeared as a relatively calm oasis. Currently, it is the only currency in the G10 that has risen against the US Dollar. Traders may reference its performance during Trump's first presidential term, when the Yen climbed against most currencies that were declining, attracting widespread attention."

The strength of the Yen may provide the Bank of Japan with more room to act further, allowing it to take additional steps based on a series of recent interest rate hikes, thereby narrowing the interest rate gap with the USA. According to economists surveyed, following last month's rate hike, the Bank of Japan might wait until around July to September to take the next step.

Akira Takei, a fixed income manager at Tokyo Asset Management One Co., stated: "The Japanese Yen is a safe asset. So far, wages have been rising, but due to the depreciation of the yen, import prices remain high, making it difficult for the Bank of Japan to raise interest rates. With this factor disappearing, there is no rush for the central bank to raise rates."

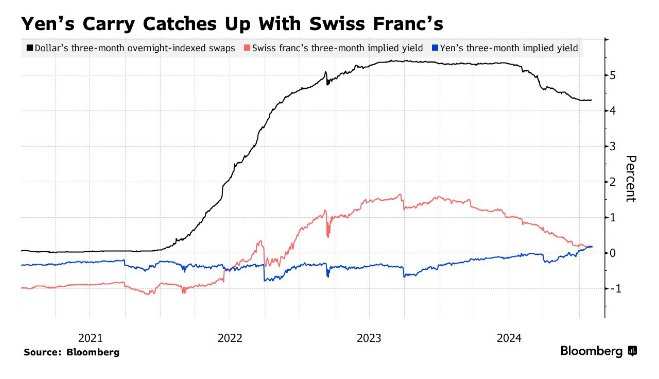

Despite the dollar maintaining a yield advantage over the yen, the yen as a safe-haven currency is appreciating against other currencies, even comparable to the Swiss Franc. The so-called "interest rate differential" of the yen (measured by three-month forward implied yields) climbed above zero in late December last year and has reached comparable levels to the Swiss Franc for the first time in over two years since then.

Berry noted, "The yen is so cheap, while the Swiss Franc is so strong, which makes the yen more favorable. The Bank of Japan is still in a tightening mode, which also supports the yen," while the Swiss National Bank is easing its policy.

Editor/Rocky