Laura Wang, Chief Stock Strategist at Morgan Stanley China, stated that despite significant increases in A-shares and Hong Kong stocks since the end of January, foreign capital has not yet truly participated in this round of rebound, indicating there is still substantial allocation space. Morgan Stanley recently predicted that the MSCI Chinese Index is expected to rise another 4%.

Morgan Stanley continues to express an optimistic outlook on the Chinese stock market after abandoning its bearish stance.

Laura Wang, Morgan Stanley's Chief Equity Strategist for China, stated in an interview with Bloomberg on the 21st that, although A-shares and Hong Kong stocks have significantly risen since the end of January, foreign capital has not yet truly participated in this round of rebound, indicating there is still considerable room for allocation.

"Investors are still significantly under-allocated to China. Therefore, there is ample space for them to increase allocations from now on."

According to Morgan Stanley's analysis and data, the main incremental funds driving this round of rebound come from "southbound trading," which refers to mainland funds flowing into the Hong Kong market through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect. So far this year, as much as $25 billion has flowed into Hong Kong. Additionally, some regional and China-focused funds have also actively participated in this rebound.

However, it is noteworthy that actively managed or passive funds headquartered in the USA or Europe have not yet truly participated in this round of rebound. This means that a significant amount of potential foreign capital is still on the sidelines.

"If you look at active or passive funds in the USA or Europe, they have not really participated in the geopolitical changes, breakthroughs in Chinese technology innovations, or the market rebound triggered by Monday's symposium."

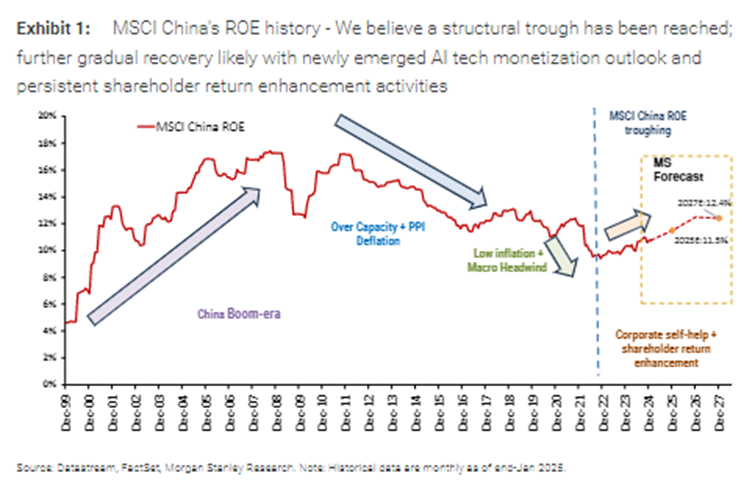

On the 20th, Laura Wang's team published an article indicating a shift to a bullish stance on the Chinese stock market, expecting the MSCI Chinese Index to rise another 4%. The report stated that the Chinese stock market (especially the offshore market) has finally undergone a structural qualitative change, making one more confident than during the rebound in September of last year that the recent improvement in the MSCI Chinese Index can be sustained.

Previously, Morgan Stanley maintained a cautious attitude towards Chinese Stocks. Some opinions point out that Morgan Stanley's upgrade of the rating is a significant shift, indicating that global investors' attitudes towards the Chinese market may be undergoing a fundamental change. Even in October, when China's MMF stimulus measures led to a surge in the stock market, Morgan Stanley hardly changed its stance — it only reduced its underweight position.

Morgan Stanley believes that several key changes are enhancing the attractiveness of the Chinese market. Firstly, the easing of geopolitical tensions has injected confidence into the market. Secondly, breakthroughs in China's technological innovation, particularly the strong signals released during the private enterprise symposium held on February 17, have further strengthened the market's long-term growth potential.

Laura emphasized that these positive changes are happening very rapidly, and many investors still have significantly insufficient allocations to the Chinese market. Therefore, foreign capital has a substantial opportunity to increase its allocation to the Chinese stock market in the future.

Editor/Rocky