Hong Kong stocks have completely exploded.

Today, Hong Kong stocks continued to rise throughout the day, $Hang Seng Index (800000.HK)$ 、 $Hang Seng TECH Index (800700.HK)$ hitting new highs in this phase, with gains of 3.27% and 4.47% respectively, the Hang Seng Index rose 750 points, and market bullish sentiment has reignited.

The Financial Secretary of the Hong Kong SAR, Paul Chan Mo-po, stated today that the government will continue to enhance offshore RMB liquidity, improve related infrastructure, and provide more investment products and risk management tools. The Hong Kong SAR government will optimize the interconnection mechanism with the mainland, including launching offshore government bond futures in Hong Kong.

It is worth noting that since January 14, the Hang Seng Index has risen over 26% cumulatively, while the Hang Seng TECH Index has seen a cumulative increase of as much as 41%.

It is worth noting that since January 14, the Hang Seng Index has risen over 26% cumulatively, while the Hang Seng TECH Index has seen a cumulative increase of as much as 41%.

Technology Stocks are in full swing, becoming the core driving force of the market. Today, $MEITUAN-W (03690.HK)$ surged nearly 10%, $JD-SW (09618.HK)$ Increased by over 8%. $SMIC (00981.HK)$ 、 $XIAOMI-W (01810.HK)$ Both rose by more than 5%, setting historic highs. $BABA-W (09988.HK)$ Up nearly 5%.

Additionally, today, Brokerage stocks, Mainland Real Estate stocks, Dining stocks, and others surged violently one after another. $NAYUKI (02150.HK)$ rising over 33%, $SHIMAO GROUP (00813.HK)$ Increased by nearly 26%. $CICC (03908.HK)$ 、 $CGS (06881.HK)$ Increased by over 19% and 17% respectively.

According to market news, China Galaxy and China International Capital Corporation plan to merge through a stock swap, expected to be announced in the coming weeks. Both parties' public relations departments stated they were unaware of this. Such rumors have surfaced multiple times in 2024, but both companies have denied them.

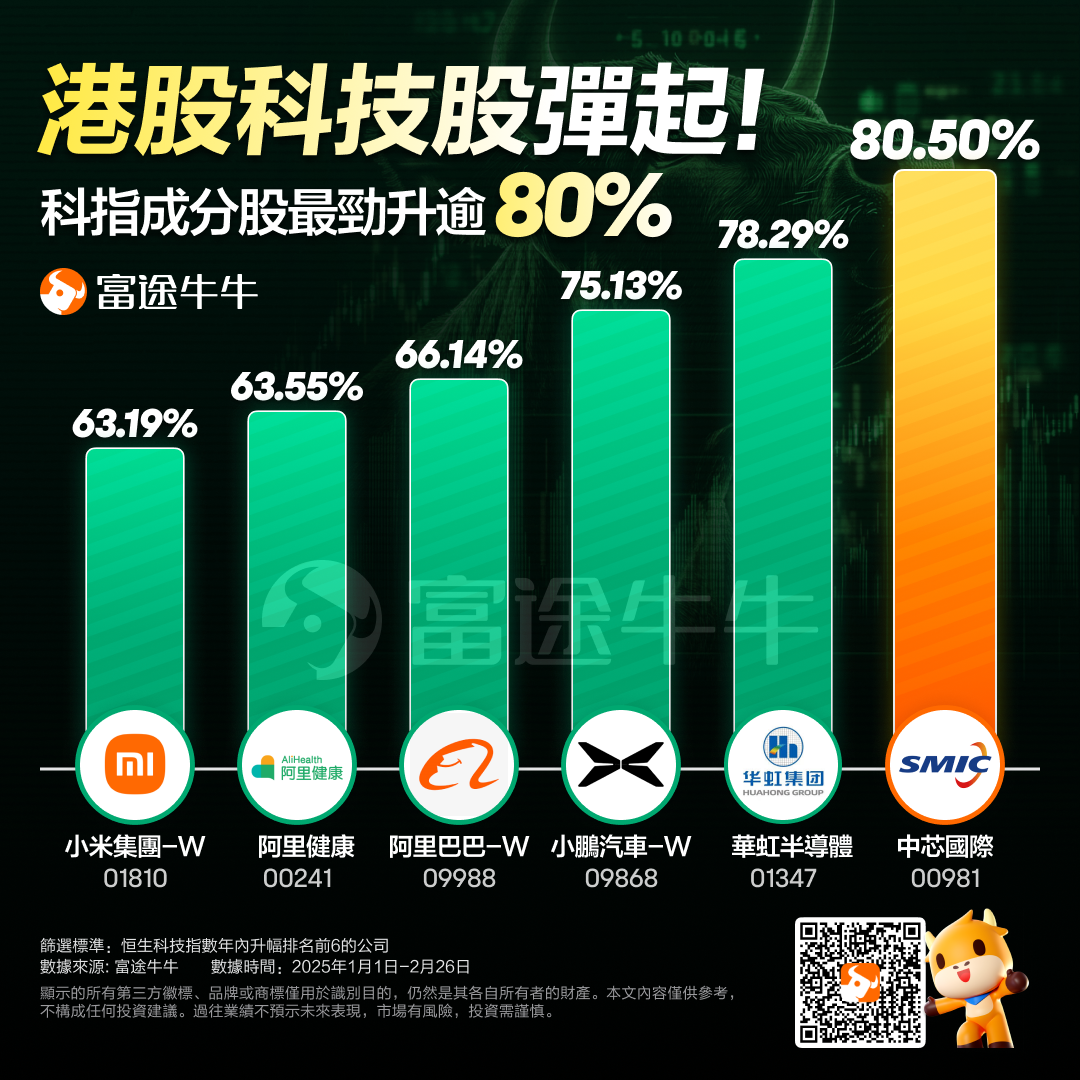

Looking at this year's increase, Technology stocks are the driving force of this bull market, with constituent stocks of the index. $SMIC (00981.HK)$ Increased by over 80%. $HUA HONG SEMI (01347.HK)$ Increased by over 78%, $XPENG-W (09868.HK)$ Increased by over 75%, $BABA-W (09988.HK)$ Increased by over 66%, $ALI HEALTH (00241.HK)$ 、 $XIAOMI-W (01810.HK)$ An increase of over 63%.

Southbound funds and foreign capital are entering the market in large numbers.

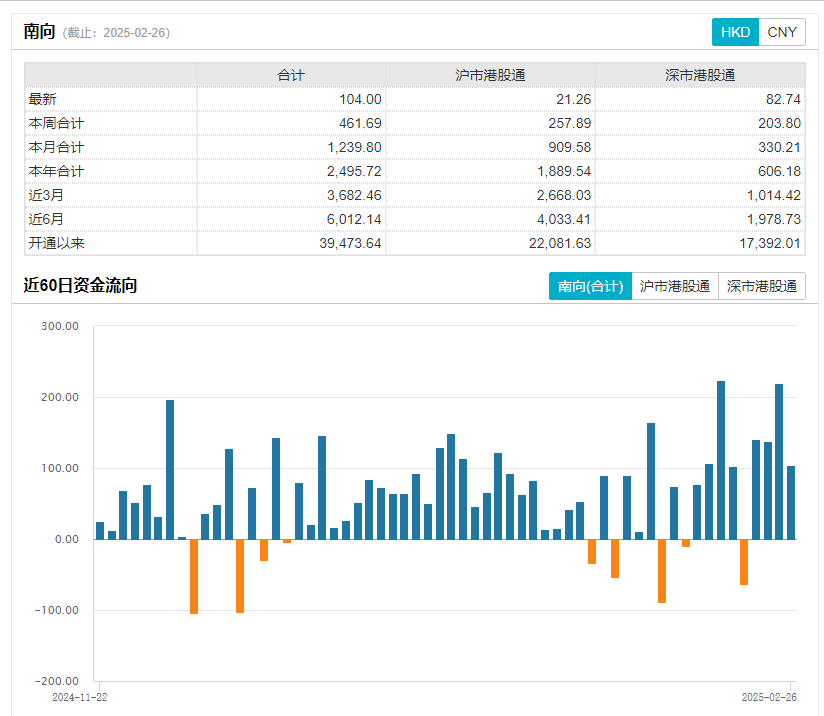

Since the beginning of this year, enthusiasm for Southbound funds in Hong Kong stocks has been continuously rising.

According to Wind data, the cumulative net buy scale reached approximately 250 billion yuan from the beginning of 2025 to date, with only 5 trading days recording net outflow.

As of today, Southbound funds have net bought over 10 billion Hong Kong dollars for 4 consecutive days, with over 22 billion Hong Kong dollars in purchases yesterday, marking the third highest in history and the second highest this year.

According to statistics, Alibaba and Tencent have become the 'darlings' of Southbound funds, with net inflows of 48.4 billion and 40.3 billion Hong Kong dollars this year, respectively, indicating that mainland investors favor these two Internet giants.

Morgan Stanley Fund expects that the significant rise in Hong Kong stocks this year is due to the inflow of Southbound funds and foreign capital.

On one hand, Southbound funds have continuously inflowed into Hong Kong stocks this year, while on the other hand, overseas capital is rebalancing in the Global asset allocation by flowing back to Hong Kong stocks from other Emerging Markets.

According to data, from January 24 to February 14, foreign capital net inflow into Hong Kong stocks reached 17.7 billion Hong Kong dollars, mainly increasing positions in Technology and Consumer sectors.

Market analysis indicates that the weakening of US consumer confidence and service PMI data, combined with Walmart's poor performance, may accelerate the shift of funds from high-valued US stocks to undervalued Hong Kong stocks.

How much room is there for the revaluation of Hong Kong's Technology?

So far this year, the continuous surge of Hong Kong stocks has made it one of the best stock markets globally.

The trend of Hong Kong stocks, especially in the Internet and Technology sectors, has become the market focus, with Changjiang Securities looking ahead from two perspectives on how much more revaluation space is left.

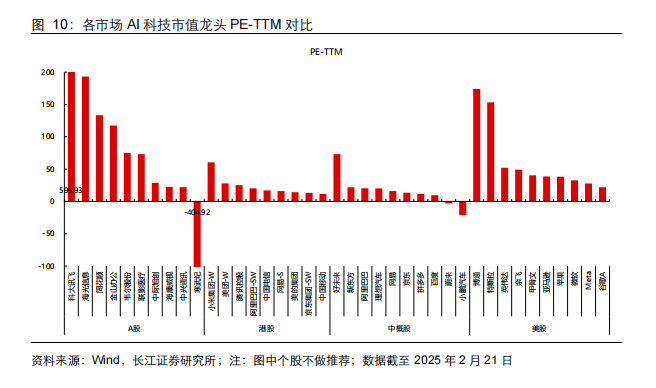

Firstly, the firm explores the revaluation space of Chinese Technology based on the benchmark of leading US tech stocks, theoretically still allowing for significant repair space in Hong Kong’s Technology sector.

The firm conducts comparative statistics using different valuation methods such as PE, PS, and PEG.

1) As of February 21, 2025, the average PE-TTM, PS-TTM, and PEG of the top ten AI-related stocks in the USA market are lower than those of the top ten AI-related stocks in the A-share market. The average PE-TTM of the top ten AI stocks in the A-share market (hereinafter referred to as A-share major AI stocks) is 83.22x, which is 24.49% higher than the average PE-TTM of the top ten AI stocks in the USA market (hereinafter referred to as USA major AI stocks); the average PS-TTM of A-share major AI stocks has a gap of 33.41% compared to USA major AI stocks; the average PEG of A-share major AI stocks has a distance of 1.28% from USA major AI stocks.

2) The Hong Kong stock market and Chinese concept stock market are significantly lower than the USA market. Among them, the PE-TTM (31.92x) and PS-TTM (3.13x) of the top ten AI-related stocks in the market capitalization ranking in Hong Kong show theoretical upward space of 96.8% and 286.3% compared to the USA market, while the PEG gap is 35.2%.

The firm believes that an important condition for Hong Kong technology stocks to converge towards the valuation system of leading USA stocks is the switch from overseas AI trends to domestic industrial prosperity realization, which is gradually being validated. The recent significant inflow of foreign capital into Hong Kong's technology stocks indicates that, to some extent, foreign capital has begun to accept this logic.

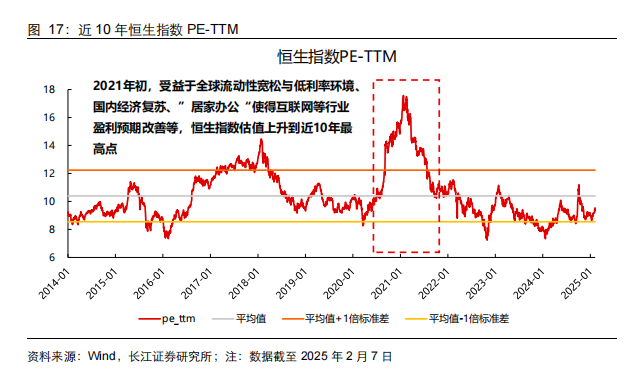

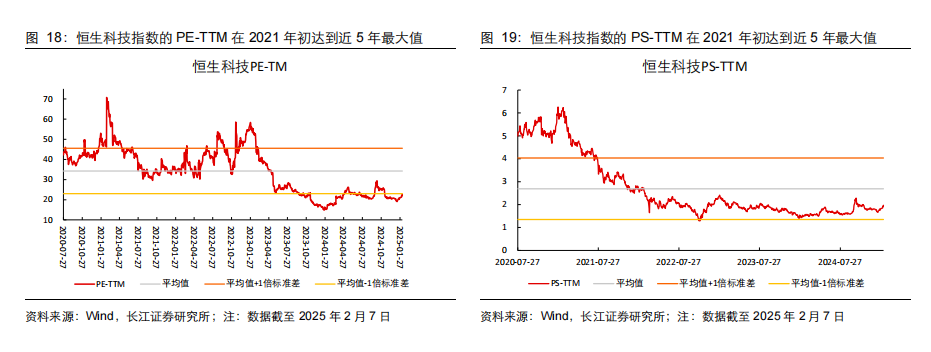

Secondly, referencing the historically high valuation of Hong Kong's Internet stocks, the focus is on whether Hong Kong's technology can replicate the bull market from 2020 to 2021.

The firm reviews history, noting that Hong Kong stocks were crowned the bull market leader globally from the end of 2020 to the beginning of 2021, thanks to the rise of technology-weighted stocks. In 2021, the valuation of the Hang Seng Index rose to nearly a ten-year high, while the PE and PS of the Hang Seng TECH Index also reached peaks, mainly driven by global liquidity easing, expectations of China's economic recovery, and performance recovery in industries such as Internet.

1) Global liquidity easing: Central banks like the Federal Reserve maintain ultra-low interest rates and large-scale asset purchases, leading to funds flowing into Hong Kong stocks and other emerging markets.

2) Expectations of China's economic recovery: With policy support, corporate earnings are gradually improving, boosting market confidence.

3) Performance recovery in industries such as Internet: Due to the demand for more Internet products spurred by remote work, the recovery of related sectors, combined with ongoing Internet dividends, drives up the valuation of Hong Kong stock indices.

Changjiang Securities believes that against the backdrop of the explosion of the "AI+" Industry Chain, the Hong Kong Stock Exchange is transitioning from a "Dividend Bull" to an "AI Bull." Over the past three years, the valuations of technology and Internet companies in Hong Kong stocks have been significantly affected by the macro environment.

On one hand, as the technology and Internet sectors mature, their performance fluctuates with domestic economic expectations, evolving from growth stocks into value stocks, with the valuation center continuously declining during this period.

On the other hand, the overall valuation of Hong Kong stocks is influenced by short-term overseas liquidity, with high U.S. Treasury rates and the strong dollar suppressing the performance of Hong Kong stocks, making companies with more stable cash flow and dividends more favored by investors.

With the changing landscape of AI, Hong Kong tech companies possessing numerous AI applications and underlying technologies may welcome a "second spring" in their industry lifecycle, transforming again from value stocks back into growth stocks; while performance realization may take some time, the reconstruction of valuations has already begun.

What should be focused on next?

Looking ahead, according to China Securities, the two sessions are about to commence. In the short term, China Merchants indicates that based on past experience, the market generally rises before the two sessions, while performance is slightly weaker during the meetings and the following week, especially for large-cap stocks. However, the market tends to strengthen again two weeks later, with major indices generally rising in the month following the meetings. Industries with stronger growth attributes, such as Computer, have a high probability of obtaining excess returns after the two sessions, while traditional industries perform poorly.

Hualong Securities believes that expectations for policy easing are strong, and fundamental expectations will further improve. Policies are guiding medium and long-term funds into the market, with trading volume also clearly recovering recently, which will generally stabilize market expectations. The recent phase of adjustment may provide a good opportunity for future layouts. Based on the historical trend of price fluctuations in the first five trading days before the Two Sessions, combined with recent market hotspots, the focus mainly revolves around new forms of productivity.

In addition, Paul Chan Mo-po, the Financial Secretary of the Hong Kong Special Administrative Region, today announced the government budget proposal for the fiscal year 2025 to 2026.

Paul Chan Mo-po stated that to promote more Stocks to be traded in Renminbi and enhance market liquidity, both regions are rapidly proceeding with technical preparations for the implementation of Renminbi trading counters to be included in the Hong Kong Stock Connect.

Morgan Stanley indicated that the Chinese stock market, particularly the offshore market, is undergoing a structural transformation that will lead to sustainable ROE and valuation recovery. CITIC SEC believes that the reversal of Hong Kong stocks is likely to continue.

![]() Hong Kong stocks continue to soar, making good use of "Monthly Payment Zone"Function to invest in a fixed amount at scheduled times, using Average Cost method to capture increases!"

Hong Kong stocks continue to soar, making good use of "Monthly Payment Zone"Function to invest in a fixed amount at scheduled times, using Average Cost method to capture increases!"

Editor/Somer