① Trump once again urged the Federal Reserve to cut interest rates during a cabinet meeting, emphasizing that prices and Energy prices are decreasing, and he hopes the Federal Reserve can lower rates; ② Last week, the Federal Reserve maintained the target Range for the federal funds rate unchanged, with Chairman Powell stating there is no need to rush to adjust policies.

US President Trump reiterated his call for the Federal Reserve to cut interest rates during a cabinet meeting on Monday (March 24), continuing to pressure the central bank to adjust its MMF policy.

Trump stated, "Overall, prices are falling, and Energy prices are also falling. I hope the Federal Reserve can lower interest rates, and you will see rates drop."

Last Wednesday (March 19), the Federal Reserve announced that it would maintain the federal funds rate target Range between 4.25% and 4.50%, a decision to keep rates unchanged for the second time since the meeting at the end of January, with the last rate cut occurring in December of last year.

Last Wednesday (March 19), the Federal Reserve announced that it would maintain the federal funds rate target Range between 4.25% and 4.50%, a decision to keep rates unchanged for the second time since the meeting at the end of January, with the last rate cut occurring in December of last year.

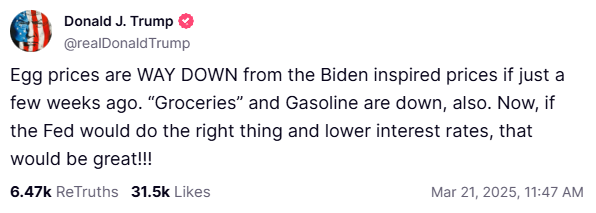

Later that day, Trump published a Post on the social platform Truth Social urging the Federal Reserve to "do the right thing." Trump added, "The Federal Reserve should better cut rates, as the impact of US tariffs is starting to seep into the economy."

The next day, Trump posted again, "Egg prices are much lower than the prices boosted by Biden a few weeks ago, and grocery and RBOB Gasoline prices have also decreased. Now, if the Federal Reserve can do the right thing and lower rates, that would be great!!!"

But it should be noted that official US data has not yet shown signs that would indicate a need to cut rates. The consumer price index (CPI) for February, published two weeks ago, rose by 2.8% year-on-year, with the core CPI growth for food and Energy at 3.1%, both above the central bank's target of 2%.

This Friday, the US Bureau of Economic Analysis will release the February personal income and expenditure report, which includes the inflation Indicators favored by the Federal Reserve—the PCE (personal consumption expenditures) inflation data. Currently, the market expects the year-on-year growth of PCE to be 2.5%, with the core Index at 2.7%.

Federal Reserve Chairman Powell stated at the press conference following the decision that the Fed does not need to rush to adjust its policy stance, as the current uncertainty is exceptionally high. Powell also pointed out that central bank officials expect the tariffs imposed by Trump will exert upward pressure on prices.

Shortly before the release, Atlanta Fed President Raphael Bostic told the media that concerns about the direction of the economy are increasing, but the data has not yet shown this. He also emphasized that the impact of these tariffs on price increases may not be a one-time event.

![]() Is investing always stepping on a landmine?Futubull AI is officially launched!Providing precise answers, comprehensive insights, and grasping key opportunities!

Is investing always stepping on a landmine?Futubull AI is officially launched!Providing precise answers, comprehensive insights, and grasping key opportunities!

Editor/lambor