Amid tariff panic, a "Copper Rush" is unfolding in the USA.

According to Bloomberg, Trump may implement copper import tariffs within weeks. Stimulated by this news, COMEX copper futures have continued to surge, breaking through the historic high set in May of last year.

In the US stock market, overnight copper concept stocks also rose across the board, $Freeport-McMoRan (FCX.US)$ with a rise of more than 3%. $Teck Resources (TECK.US)$ 、 $Southern Copper (SCCO.US)$ Increased by nearly 2%, $Rio Tinto (RIO.US)$ rose over 1%.

In the Hong Kong stock market, some copper mining stocks are also performing strongly. $CHINFMINING (01258.HK)$ Since March, they have cumulatively risen over 25%. $ZIJIN MINING (02899.HK)$ Increased by over 18%.

In the Hong Kong stock market, some copper mining stocks are also performing strongly. $CHINFMINING (01258.HK)$ Since March, they have cumulatively risen over 25%. $ZIJIN MINING (02899.HK)$ Increased by over 18%.

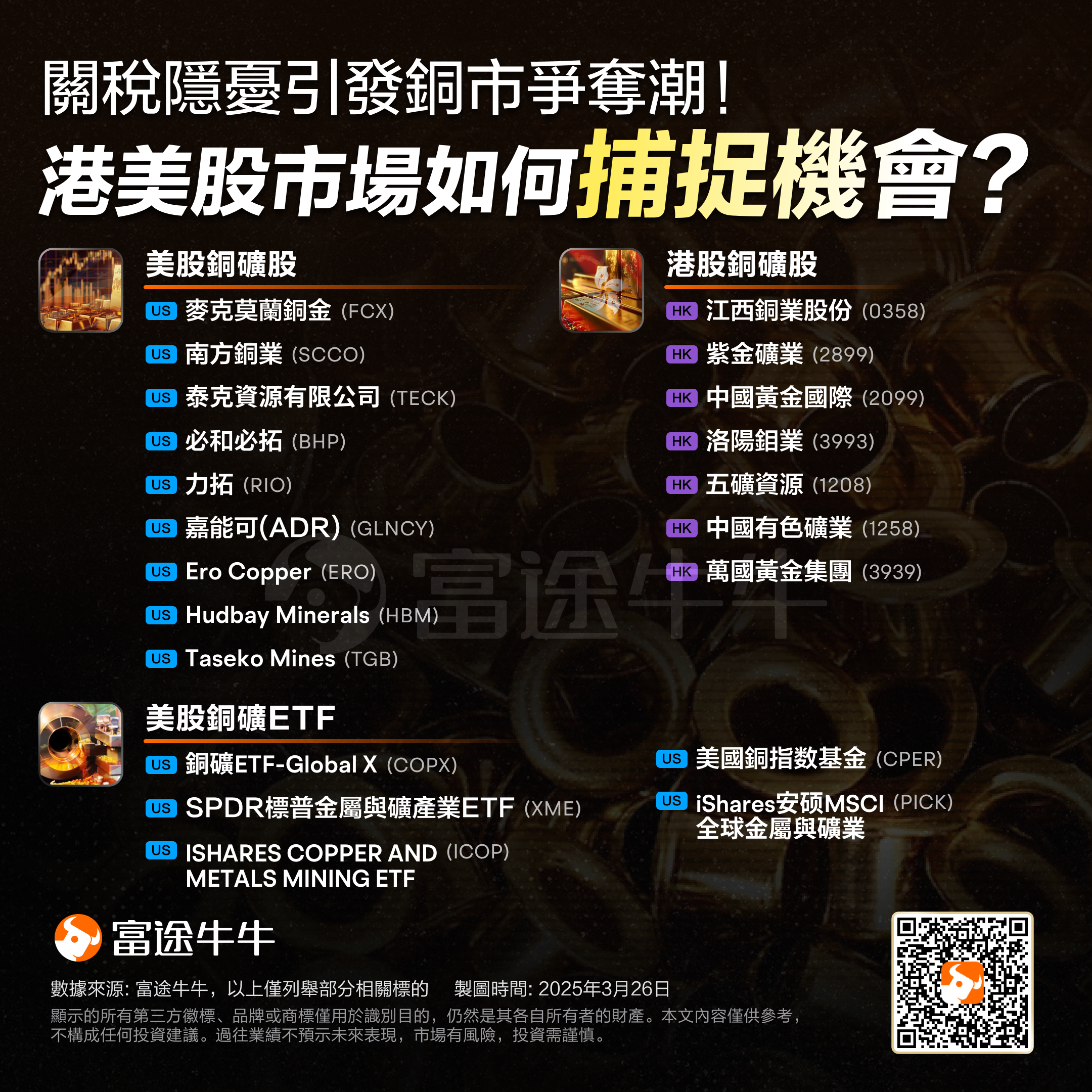

Concerns over tariffs have sparked a scramble in the Copper market! How can opportunities be captured in the Hong Kong and US stock markets?

Bloomberg previously reported that a large wave of Copper shipments is coming to the USA, with an estimated 100,000 to 150,000 tons of refined Copper expected to arrive in the coming weeks. If all arrives within the same month, it will exceed the historical record of 136,951 tons set in January 2022.

Goldman Sachs and Citigroup pointed out that the core driver of copper price volatility comes from expectations regarding the tariff policy of the Trump administration — the market widely anticipates that the USA will implement a 25% import tax on April 2, leading traders to rush to ship about 0.5 million tons of copper to US ports before the taxes take effect, causing regional supply imbalance.

Futu has sorted out some Hong Kong and US stock Copper Concept stocks and ETFs for mooers to reference:

Among them, the Hong Kong stocks include $JIANGXI COPPER (00358.HK)$ 、 $ZIJIN MINING (02899.HK)$ 、 $CHINAGOLDINTL (02099.HK)$ 、 $CMOC (03993.HK)$ 、 $MMG (01208.HK)$ 、 $CHINFMINING (01258.HK)$ 、 $WANGUO GOLD GP (03939.HK)$ ;

US stocks include $Freeport-McMoRan (FCX.US)$ 、 $Southern Copper (SCCO.US)$ 、 $Teck Resources (TECK.US)$ 、 $BHP Group Ltd (BHP.US)$ 、 $Rio Tinto (RIO.US)$ 、 $GLENCORE PLC (GLNCY.US)$ 、 $Ero Copper (ERO.US)$ 、 $Hudbay Minerals (HBM.US)$ 、 $Taseko Mines (TGB.US)$ ;

The Copper Mining ETFs in the US include $Global X Copper Miners ETF (COPX.US)$ 、 $SPDR S&P Metals & Mining ETF (XME.US)$ 、 $ISHARES COPPER AND METALS MINING ETF (ICOP.US)$ 、 $United Sts Commodity Index Fd Com Unit Repstg U S Copper Index Fd (CPER.US)$ 、 $Ishares Inc Msci Glbl Mtl&Mng Produ Etf (PICK.US)$ 。

Analysts believe that the global copper trade landscape is being reshaped, with rising premiums in the USA leading to price distortions. China may face supply shortages, all originating from the tariff policies that the Trump administration might implement, a situation that supports copper prices in the short term.

Guosheng Securities indicated that Trump has classified copper as a "National Security lifeline resource" and is attempting to rebuild the domestic supply chain through tariffs, which gives copper prices a geopolitical risk premium similar to that of crude oil.

However, Morgan Stanley believes that while Copper prices may continue to rise in the short term, investors must closely monitor the progress of U.S. tariff policies. The demand for Copper in the USA is closely related to tariff expectations, so any changes could lead to a market reversal, especially as the USA may be hoarding large amounts of materials it does not need.

In addition, Morgan Stanley pointed out that current copper stocks are generally lagging behind the rise in copper prices, which may indicate market concerns about future demand due to the uncertainty brought about by tariffs. It is worth noting that current positions are rising, especially at the London Metal Exchange.

ING analysis indicates that in the short term, as the investigation into Copper imports continues in the USA, and with more metals entering the USA before potential taxation, Copper prices may continue to be supported. In the future, if tariffs are imposed, the risk of further increases in U.S. Copper prices remains; however, if any potential tariffs are lower than expected, the spread may pull back.

Is investing always stepping on a landmine?Futubull AI is now online!Providing precise answers, comprehensive insights, and grasping key opportunities!

Editor/Somer