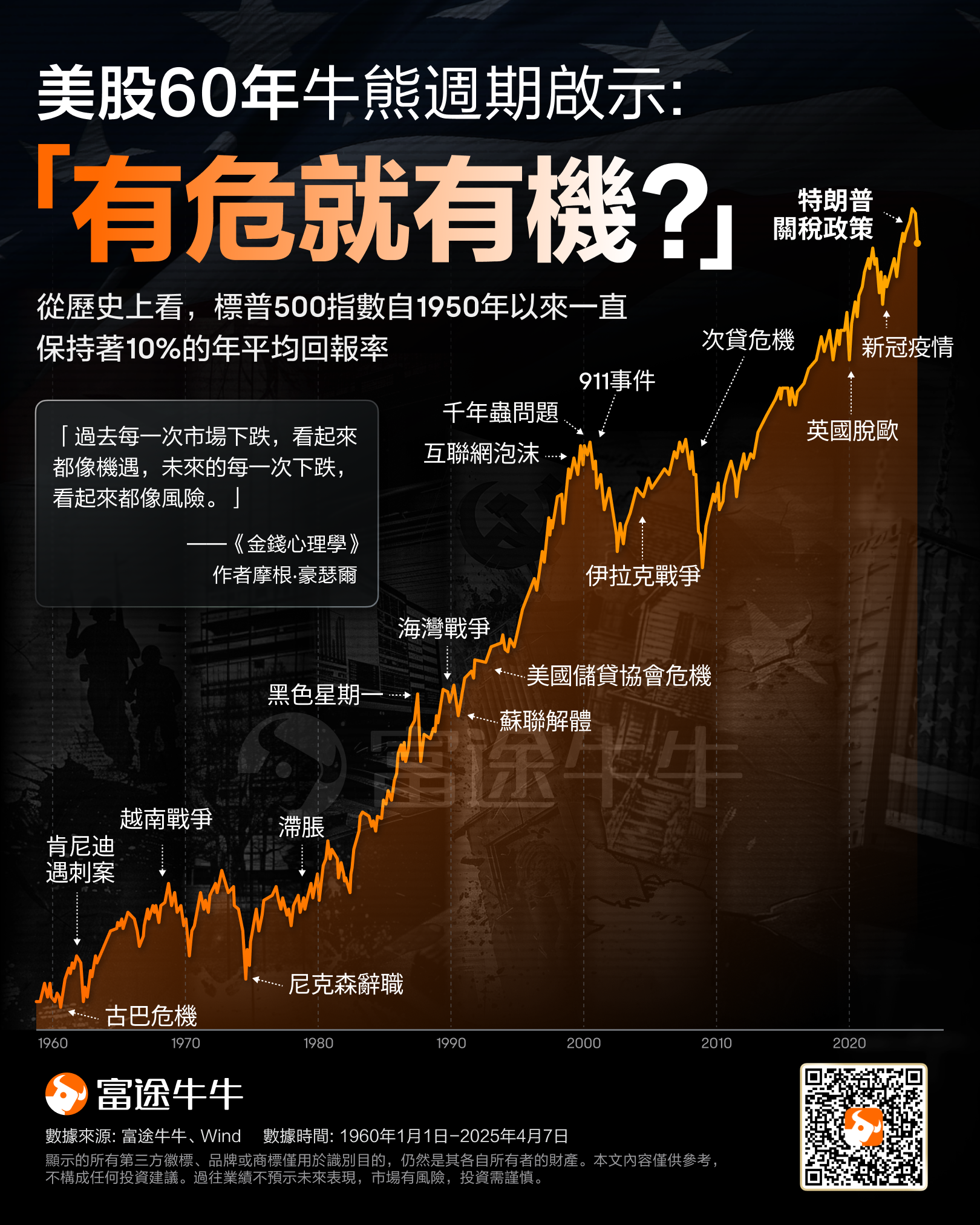

Every past market decline has looked like an opportunity, while every future decline seems like a risk.

— Morgan Housel, author of "The Psychology of Money".

Last week, Trump raised the import tariffs in the USA to the highest level since the 1930s, causing a sharp decline in the U.S. stock market and triggering investors' fears about the market outlook.

At the beginning of trading on Monday, $S&P 500 Index (.SPX.US)$ Once down 20% from its recent peak, entering a technical bear market. However, driven by rumors of "tariff delays" during the session, US stocks also experienced a roller coaster market, with the S&P ultimately only slightly down. Today, the S&P saw a strong rebound, rising over 4% at one point, and as of this writing, the S&P 500 Index is up 3.82%, returning above 5200 points.

At the beginning of trading on Monday, $S&P 500 Index (.SPX.US)$ Once down 20% from its recent peak, entering a technical bear market. However, driven by rumors of "tariff delays" during the session, US stocks also experienced a roller coaster market, with the S&P ultimately only slightly down. Today, the S&P saw a strong rebound, rising over 4% at one point, and as of this writing, the S&P 500 Index is up 3.82%, returning above 5200 points.

However, as the result of this "tariff war" remains uncertain, Wall Street strategists are considering how much more the stock market can withstand. At the same time, they have been intensively lowering the target price for the S&P 500 Index.

Oppenheimer significantly lowered the target level for the S&P 500 Index from 7100 points to 5950 points.

Bank of America lowered its Target Price from 6666 points to 5600 points, making it one of the lowest Target Prices on Wall Street.

JPMorgan cut its end-of-year expectation for the S&P 500 Index from 6500 points to 5200 points, while lowering the total EPS expectation for the Index's constituent stocks from $270 to $250.

However, some analysts pointed out that although the overnight gains ultimately receded, the brief rebound revealed many signals and served as a 'field test' of market bottom conditions.

Have U.S. stocks reached the bottom.

Market analysis indicates that the market quickly rebounded due to fake news, and despite the White House refuting it and Trump further escalating tariffs, it did not trigger a further market decline. This asymmetric reaction reveals a key fact: buyers are ready to make large purchases at any sign of tariff easing, while sellers are no longer panic selling even in the face of worse tariff conditions. This suggests that the market may be ready for a rebound.

However, The Wall Street Journal warns that this rebound may not necessarily be sustainable. Analysts point out that a real market reversal requires a change in the narrative that tariffs will trigger an economic recession, which would need at least one of three potential triggering factors to appear.

Trump concedes on trade stance, as he has ample reason to lessen the impact of tariffs and can package it as reasonable or even a victory;

Other countries concede on trade stance, reducing the intensity of the global trade war;

The Federal Reserve intervenes, boosting the market and economy through rate cuts or purchasing risk assets.

However, some market opinions believe that every decline in the US stock market is an opportunity.

Looking back at history, since 1950, despite experiencing major events such as Black Monday, the Internet bubble, the 9/11 terrorist attacks, the financial crisis, and the COVID-19 pandemic, the overall trend of the S&P 500 Index has remained upward, with an average annual ROI of around 10%.

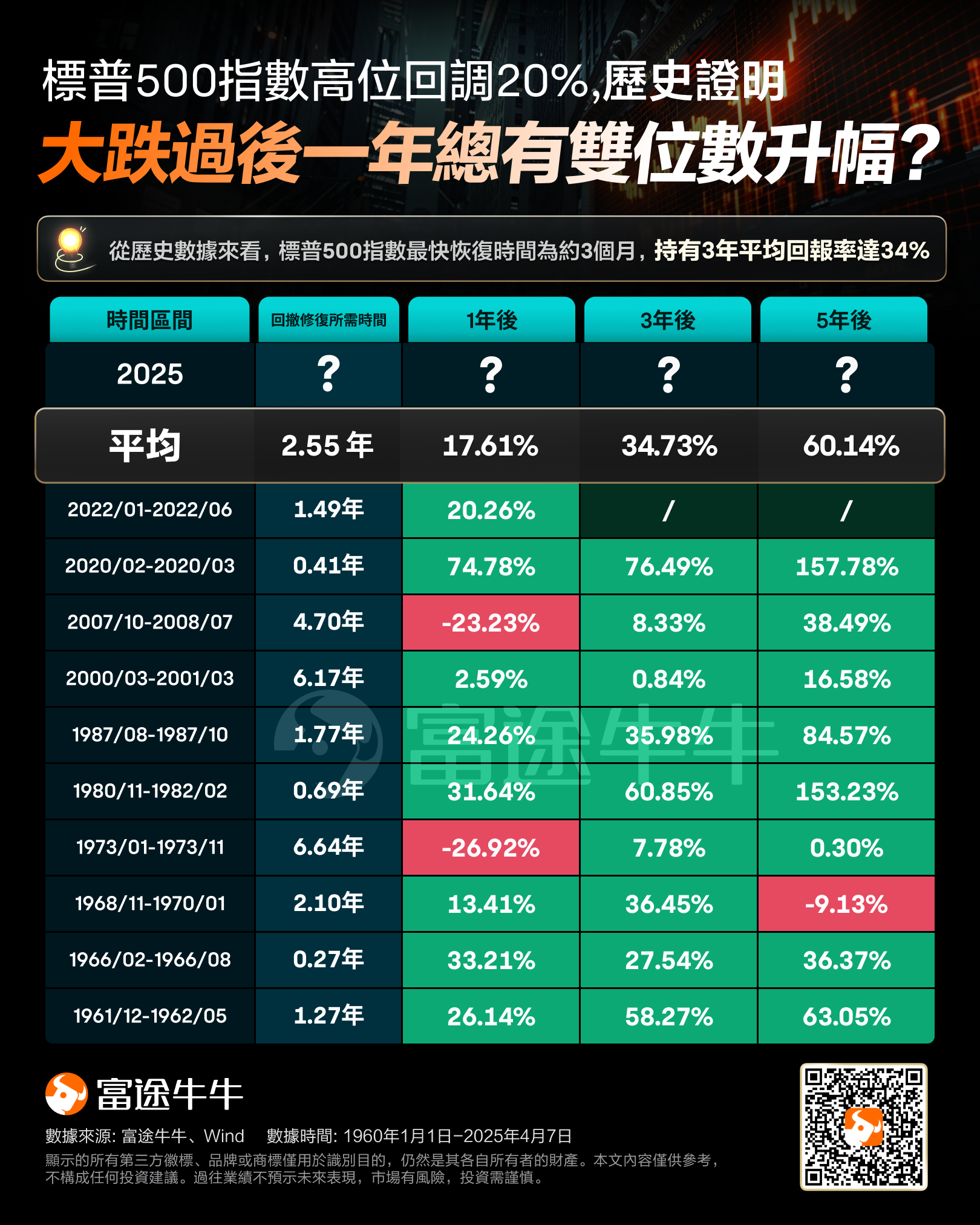

In addition, looking back over the past 60 years, $S&P 500 Index (.SPX.US)$ there have been 10 instances of a decline of more than 20%, but the index has recovered in as fast as 3 months, and holding it for 3 years results in an average ROI of up to 34%.

There is a saying in the financial markets: every substantial market decline is a chance to invest in high-quality companies. Many investors are likely wondering if now is a good time to invest in the seven giants that have attracted market attention.

Market analysis indicates that in the short term, the valuation adjustments of technology stocks have absorbed some negative news, and the revenue growth and stable cash flow shown in the latest earnings reports indicate that their core business is resilient. However, medium to long-term risks remain to be observed. Tariff policies may force companies to restructure their supply chains, and due to intensified competition, the capital expenditure cycle in the AI sector may slow down.

How will Trump's tariffs affect the seven giants? Which companies are least affected?

In fact, the extent to which these seven tech giants are affected by tariff policies varies significantly. From stock price performance, it can be seen that Tesla, Apple, and NVIDIA are more impacted by tariffs, while companies like Microsoft and Meta are relatively less affected.

In the current round of tariff policy impacts, among the seven giants in the USA stock market, $Tesla (TSLA.US)$ the decline this year has reached as high as 40%, $Apple (AAPL.US)$ 、 $NVIDIA (NVDA.US)$ 、 $Alphabet-A (GOOGL.US)$ Dropped over 20%, $Amazon (AMZN.US)$ Dropped over 17%, $Microsoft (MSFT.US)$Dropped over 12%, $Meta Platforms (META.US)$ the stock fell over 7%.

Eric Compton, the Global Technology Equity Research Director at investment research firm Morningstar, also shared his views on the potential impact of tariff policies on technology stocks. Eric Compton pointed out: "The Hardware in the Technology Industry is hit the hardest, with Semiconductors in the middle, and Software doing slightly better."

According to a general market analysis, the impact of this round of tariffs on the seven giants is as follows: Microsoft < Alphabet-A ≈ Meta Platforms < NVIDIA < Amazon < Tesla < Apple.

Apple.

According to a report from CCTV News citing Bloomberg, currently, 90% of Apple's phones are assembled in China. This means that Apple will have to face a tough choice: either absorb the tariff costs itself or pass them on to consumers.

According to the latest estimates from investment bank Morgan Stanley, the additional tariffs on China will increase Apple’s costs by about $8.5 billion annually. Reuters cited analysts saying that if Apple passes the entire tariff cost onto consumers, the retail price of the iPhone 16 Pro Max in the USA will rise from the current $1,599 to $2,300 (approximately ¥16,750).

Tesla

Currently, Tesla has a broad but decentralized global layout, with about 50% in the USA and 50% overseas, which diversifies its revenue sources and alleviates single market risk to some extent. However, it should not be overlooked that its supply chain's level of globalization far exceeds that of traditional automotive companies, and tariffs will directly impact the import of its key components.

Under the dual impact of Musk's political stance and Trump's tariff policy, analysts who were once firmly bullish on Tesla have finally surrendered and significantly lowered the Target Price. Daniel Ives from Wedbush Securities is concerned that Tesla will face retaliation against Trump's tariff policy, which will further impact Tesla's sales.

Amazon

According to Morningstar, although Amazon does not produce Hardware, it sells a large amount of Commodity, many of which are imported cost items (COGS, cost of goods sold). We estimate that about 60% of Amazon's product costs are imported, with approximately 30% coming from China. They have not directly disclosed this data, but this is our estimation. If the tariffs persist, they must consider how to restructure their supply chain, how to lower costs, and the impact on future gross margin and sales. They have restructured their supply chain in the past, but this time it may be more challenging.

NVIDIA

Trump recently stated that "chip tariffs" will soon be implemented. Earlier this year, Trump threatened to impose tariffs of 25%, 50%, or even 100% on advanced chips, but after Taiwan Semiconductor promised to invest 100 billion dollars in the USA, this matter was temporarily shelved.

Industry analysis believes that although $82 billion of U.S. imported chips are temporarily exempt, the true lifeblood of the chip industry—$521 billion in Machinery, $478 billion in Electronics, and $386 billion in Autos imports—will be hit by tariffs as high as 49%, ultimately passed on to consumers, and will harm the interests of global AI and chip giants such as NVIDIA, AMD, Intel, and Qualcomm.

In addition, industry insiders claim that chip tariffs will harm the interests of U.S. chip design firms. For example, if the price of an NVIDIA AI GPU is $50,000 with a gross margin of 75%, then if a 25% tariff is imposed, NVIDIA would have to declare $12,500 in tariffs and pay $3,125 in import taxes. This would lead to profit losses for NVIDIA or be passed on to consumers.

Meta Platforms

Market analysis shows that Meta's revenue mainly comes from advertising, with users spread across the globe. Meta's overseas income mainly comes from markets such as India, Southeast Asia, and Europe, where these services are provided locally and generate local revenue, without involving the export of USA goods to these countries.

However, it is worth noting that if the global trade war leads to an economic downturn, advertisers in these regions may cut budgets, which could indirectly affect Meta's advertising revenue.

Google

Google primarily relies on advertising and cloud revenue, with limited direct tariff costs, and relatively less market panic.

Some Analysts believe that Google is largely unaffected by any trade conflicts between the USA and other countries; with the continued expansion of the AI market, it is just a matter of time before Google's stock price rebounds.

Microsoft

In Microsoft's revenue composition, the domestic USA market is dominant. Previously, Microsoft focused on Software and Cloud Computing Service, with revenue mainly derived from providing digital products to businesses and consumers, and did not rely on large-scale cross-border flow of Commodities.

After the policy announcement, Microsoft's stock price decline was significantly smaller than that of other technology giants, far below the average level of the 'Seven Sisters.' This indicates that investor consensus believes tariffs have a minimal impact on Microsoft's profit outlook, while there are concerns regarding Apple, Tesla, and NVIDIA.

However, it should be noted that potential tariff increases or new digital service taxes may further suppress these companies' global profits.

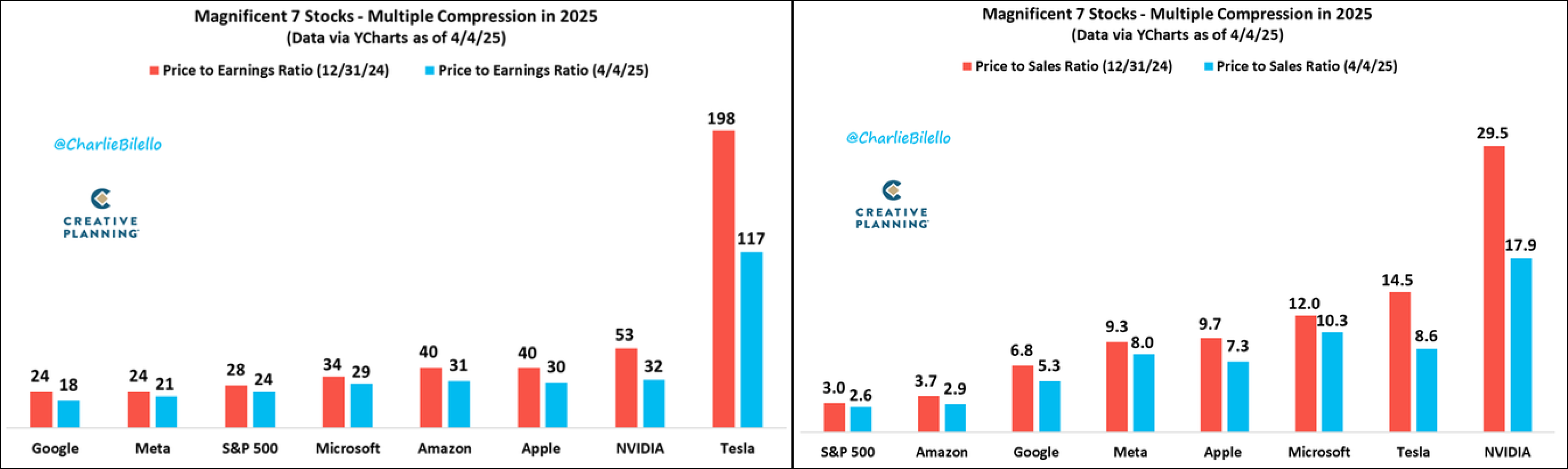

From a valuation perspective, with this round of decline, Alphabet-A and Meta Platforms' P/E ratios have fallen below the S&P 500 Index, but companies like NVIDIA and Tesla have also seen significant corrections. From the P/S perspective, the seven giants still exceed the S&P 500 Index.

Barclays US stock strategist Venu Krishna said: "We are bullish on large technology companies, but I think it is more of a mid to long-term optimism... In the short term, we hardly see any catalysts that would trigger a real recovery in tech stock trading."

![]() Want to understand how the market interprets it?Futubull AI is now online!Providing precise answers, comprehensive insights, and grasping key opportunities!

Want to understand how the market interprets it?Futubull AI is now online!Providing precise answers, comprehensive insights, and grasping key opportunities!

Editor/Somer