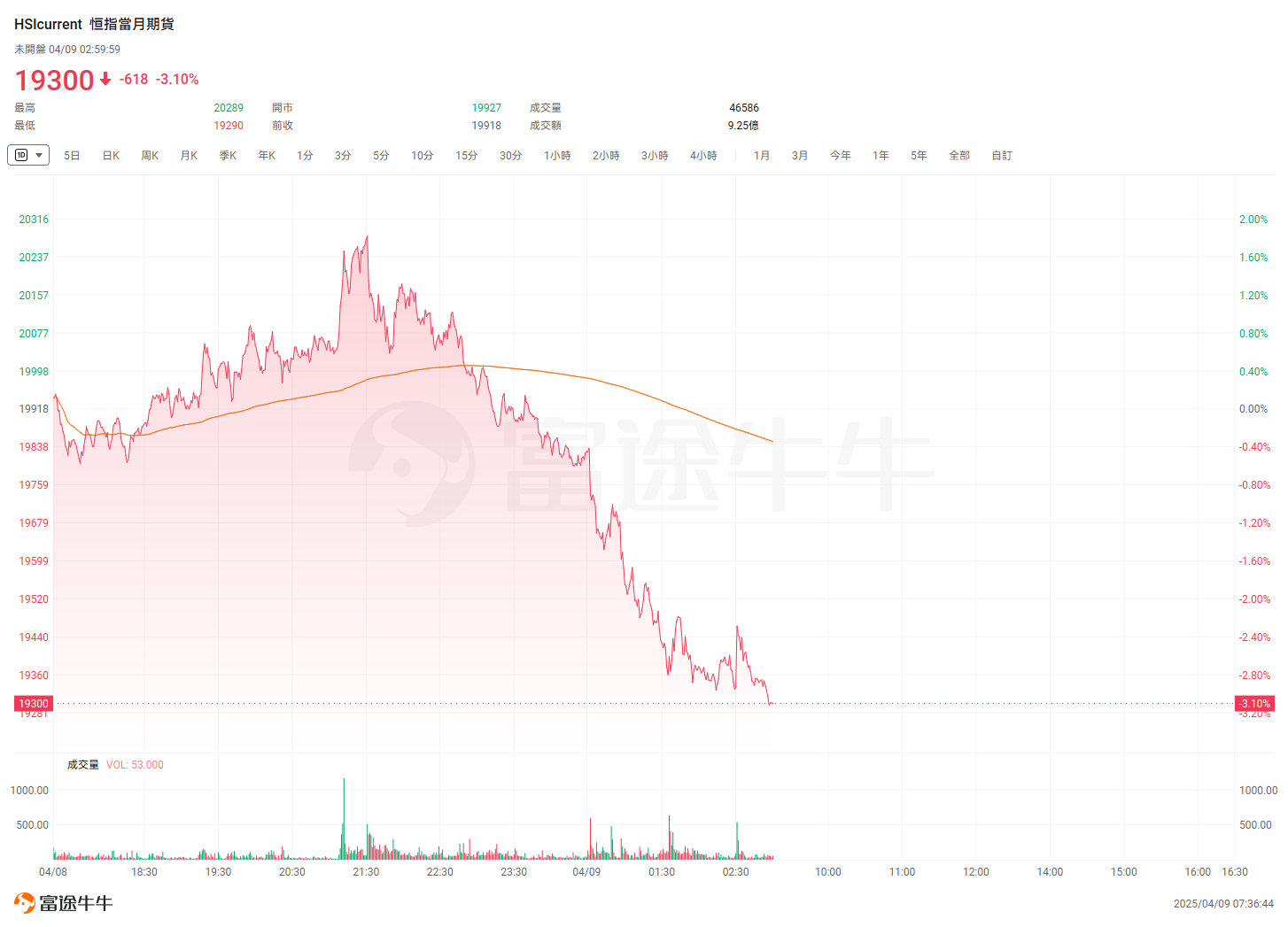

On Tuesday, the Hong Kong stock market rebounded under bullish conditions,$Hang Seng TECH Index (800700.HK)$rising nearly 4%,$Hang Seng Index (800000.HK)$rising 1.5%, closing at 20127.68 points, reaching a high of 20454.26 points and a low of 19745.14 points during the day. At night,$HSI Futures Current Contract (HSIcurrent.HK)$ it closed at 19300 points, down 618 points or 3.1%, 828 points lower.

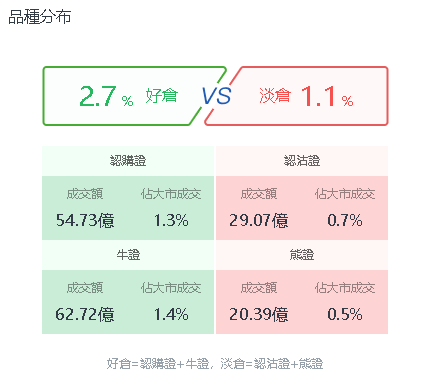

As of yesterday's close, the total market turnover was 433.157 billion HKD, all warrants.bull and bear certificatesThe total transaction was 16.691 billion HKD, accounting for 3.9% of the market's trading volume, with the long position accounting for 2.7% and the short position accounting for 1.1%. There was a net Outflow of 0.23 billion HKD from all warrants.

The transaction for call warrants yesterday was 5.473 billion HKD, while put warrants had a transaction of 2.907 billion HKD; bull certificates accounted for 6.272 billion HKD, and bear certificates accounted for 2.039 billion HKD.

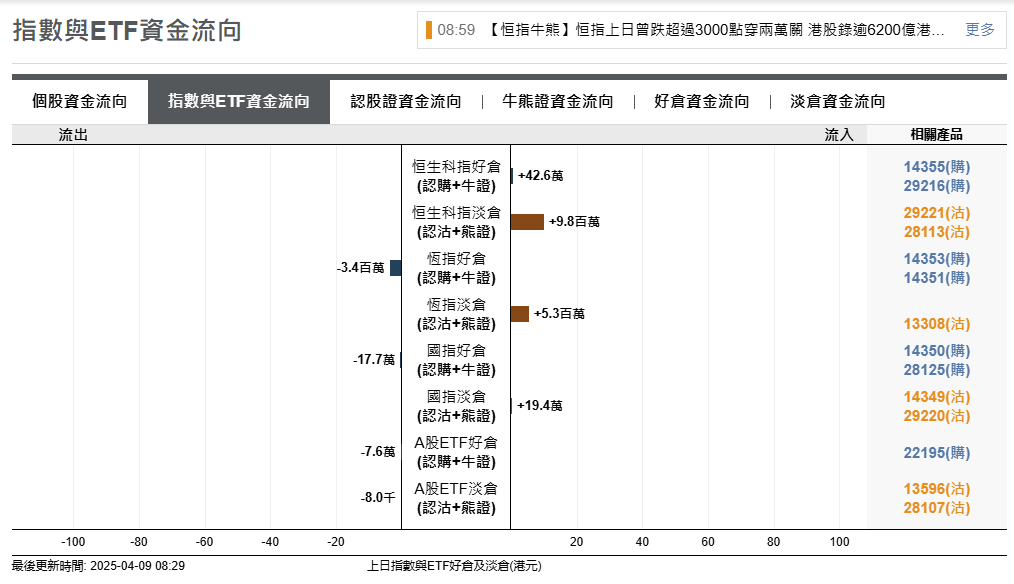

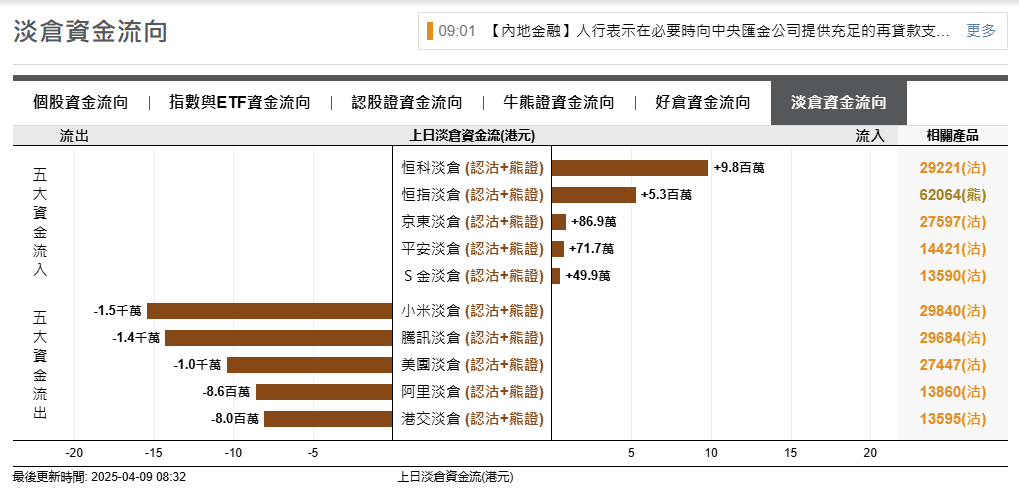

Regarding the Capital Trend of the Hang Seng Index, there was a net Outflow of 3.4 million HKD from long positions and a net Inflow of 5.3 million HKD into short positions.

Regarding the Capital Trend of the Hang Seng Index, there was a net Outflow of 3.4 million HKD from long positions and a net Inflow of 5.3 million HKD into short positions.

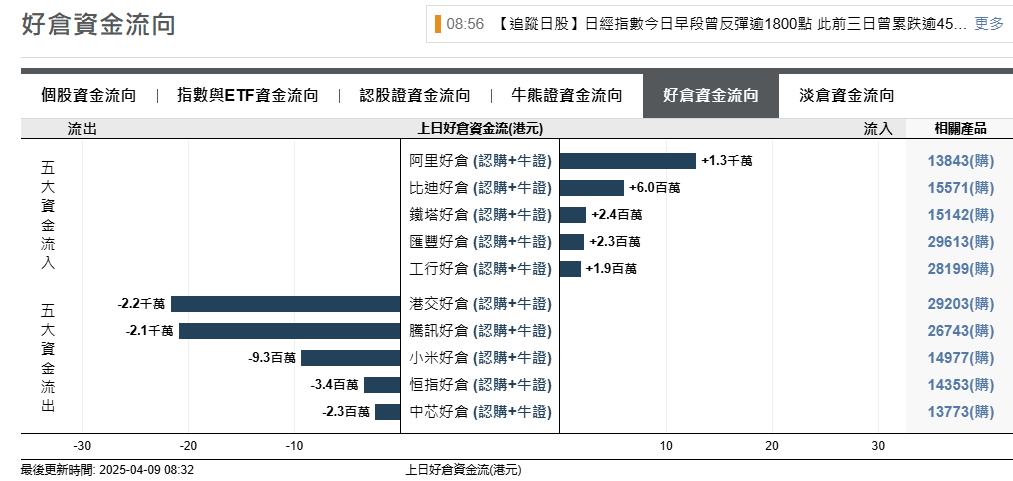

The top five stocks with capital outflow from bull positions are: $HKEX (00388.HK)$、 $TENCENT (00700.HK)$、 $XIAOMI-W (01810.HK)$、 $Hang Seng Index (800000.HK)$、 $SMIC (00981.HK)$ 。

The top five indices and their corresponding stocks for Inflow in the light position are: $Hang Seng TECH Index (800700.HK)$ 、 $Hang Seng Index (800000.HK)$ 、 $JD-SW (09618.HK)$ 、 $PING AN (02318.HK)$ 、 $SPDR Gold Trust (02840.HK)$ 。

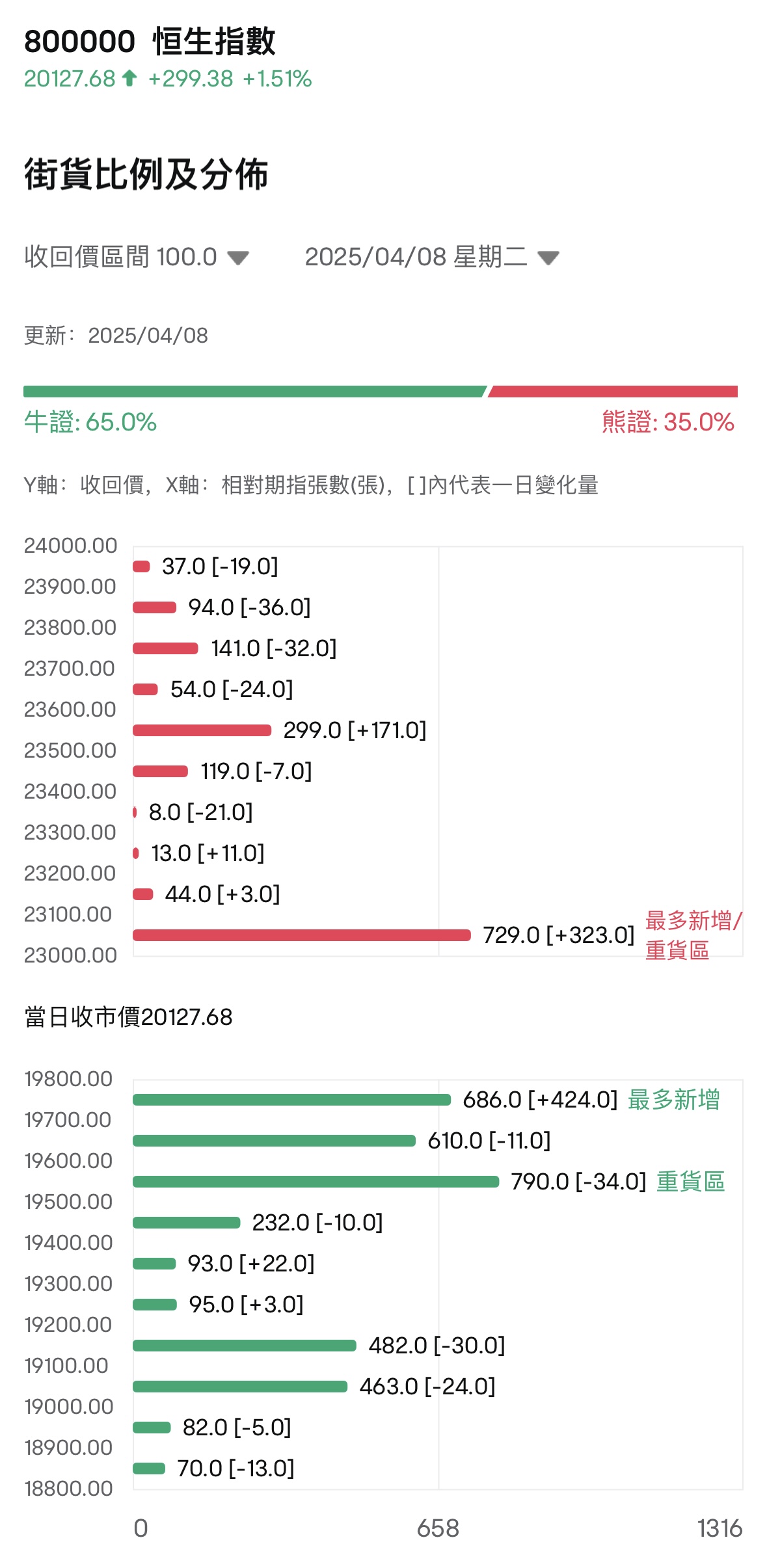

Bull-Bear Street Position Ratio

As of April 8, the latest bull-bear street merchandise ratio of the Hang Seng Index is 65:35.

bull and bear certificatesData from the street merchandise distribution map shows that the bear certificate heavy merchandise area and the highest new additions are in the range of 23000-23099. The latest number of bear certificates in this range is 729, which is an increase of 323 compared to the previous trading day.

The bull certificate heavy merchandise area is in the range of 19500-19599. The latest number of bull certificates in this range is 790, a decrease of 34 compared to the previous trading day. The highest new additions are in the range of 19700-19799, with the latest number of bull certificates in this range being 686, an increase of 424 compared to the previous trading day.

Warrant analysis

Yesterday, Hong Kong stocks collectively rebounded, with the Hang Seng Index rising by 1.51%. Many bull certificates around the recovery price of 19658-19700 points made over double profits, including $GJ#HSI RC2709E.C (68571.HK)$ made nearly triple profits, $HU#HSI RC27111.C (68173.HK)$ 、 $SG#HSI RC2709O.C (68474.HK)$ 、 $BP#HSI RC2811B.C (68466.HK)$ 、 $JP#HSI RC2711K.C (68252.HK)$ All earned more than double.

In terms of individual stocks, $JD-SW (09618.HK)$ Yesterday surged nearly 9%, multiple contracts with a recovery price of 125 made a large profit. $BP#JDCOMRC2704K.C (51398.HK)$ Profits increased more than four times.

$XIAOMI-W (01810.HK)$ Yesterday rebounded nearly 7%, bull certificate. $HS#XIAMIRC2511D.C (69317.HK)$ Earned nearly three times.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

HSBC: BYD is expected to see a year-on-year profit growth of 86% to 120% in the first quarter, with the stock price rising nearly 50% yesterday. Pay attention to bullish and bearish deployments.$HS-BYD @EC2602A.C (15626.HK)$ / $HS-BYD @EP2508B.P (13714.HK)$ 。

HSBC: Major banks expect Alibaba's fourth fiscal quarter performance to be below expectations, be prepared for both outcomes. $HSALIBA@EC2512B.C (29041.HK)$ / $HSALIBA@EP2604A.P (13233.HK)$ 。

Editor/rice