On Wednesday, Hong Kong stocks opened low and rose high, with southbound funds buying a record nearly 35.6 billion Hong Kong dollars.$Hang Seng TECH Index (800700.HK)$Increased trading volume rose by 2.6%.$Hang Seng Index (800000.HK)$It rose by 0.68%, closing at 20,264.49 points, with a high of 20,441.14 points and a low of 19,260.21 points during the session.$HSI Futures Current Contract (HSIcurrent.HK)$ At night, it closed at 20,180 points, a slight decline of 8 points or 0.04%, with a discount of 84 points.

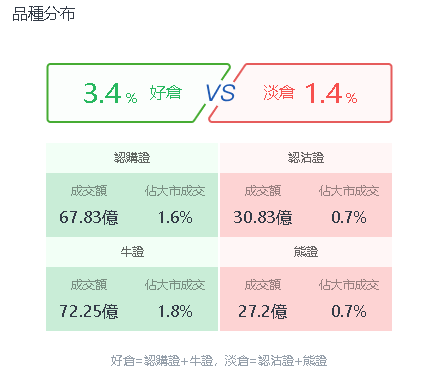

As of yesterday's close, the total market turnover was 412.385 billion Hong Kong dollars, and all warrants...bull and bear certificatesThe total transaction was 19.811 billion HKD, accounting for 4.8% of the market's total transactions, with long positions accounting for 3.4% and short positions accounting for 1.4%. The net Outflow for all structured products was 0.975 billion HKD.

Yesterday, the turnover of call warrants was 6.783 billion HKD, the turnover of put warrants was 3.083 billion HKD; the turnover of bull warrants was 7.225 billion HKD, and the turnover of bear warrants was 2.72 billion HKD.

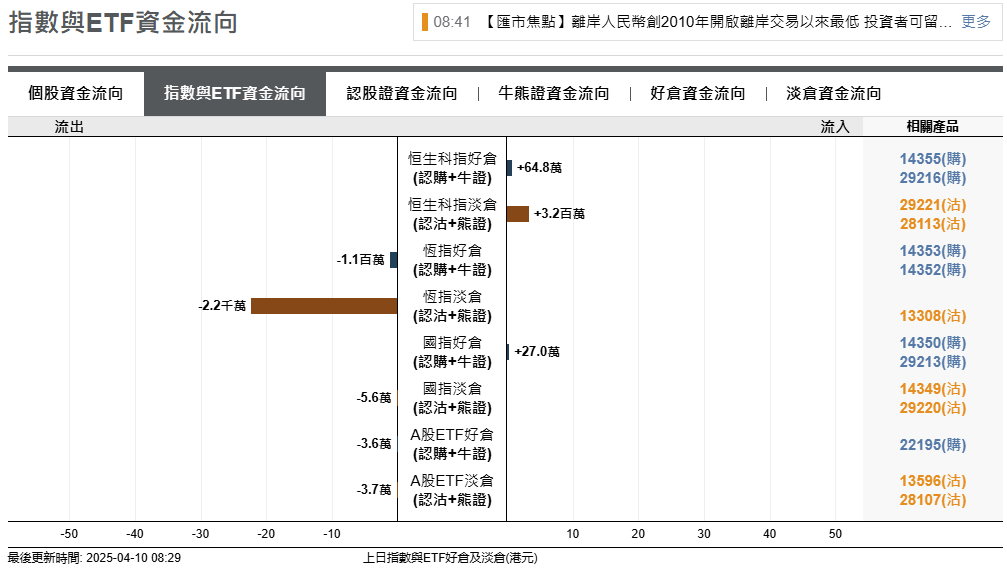

In terms of the Capital Trend of the Hang Seng Index, there was a net Outflow of 1.1 million HKD for long positions and a net Outflow of 22 million HKD for short positions.

In terms of the Capital Trend of the Hang Seng Index, there was a net Outflow of 1.1 million HKD for long positions and a net Outflow of 22 million HKD for short positions.

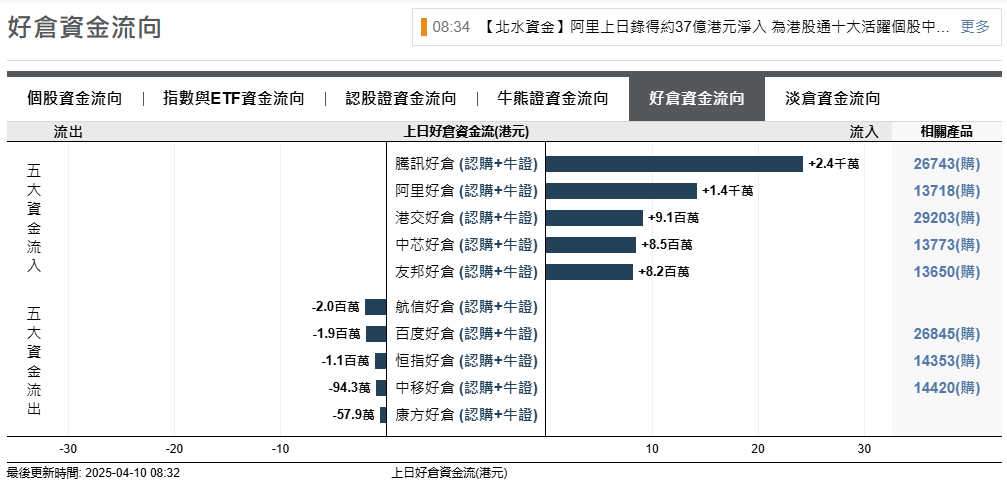

The top five stocks with capital inflow for long positions are: $TENCENT (00700.HK)$、 $BABA-W (09988.HK)$、 $HKEX (00388.HK)$、 $SMIC (00981.HK)$、 $AIA (01299.HK)$ 。

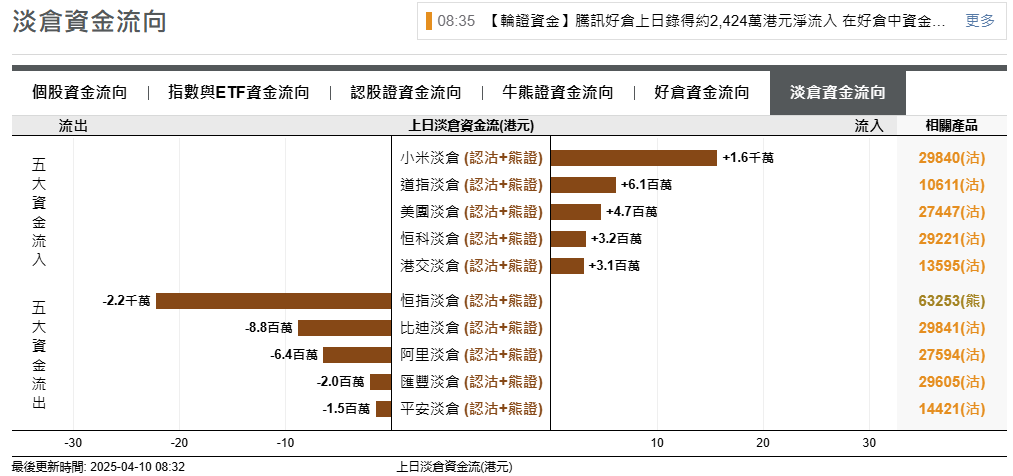

The top five indices with Bearish Capital Outflow and their related stocks are: $Hang Seng Index (800000.HK)$、 $BYD COMPANY (01211.HK)$、 $BABA-W (09988.HK)$、 $HSBC HOLDINGS (00005.HK)$、 $PING AN (02318.HK)$ 。

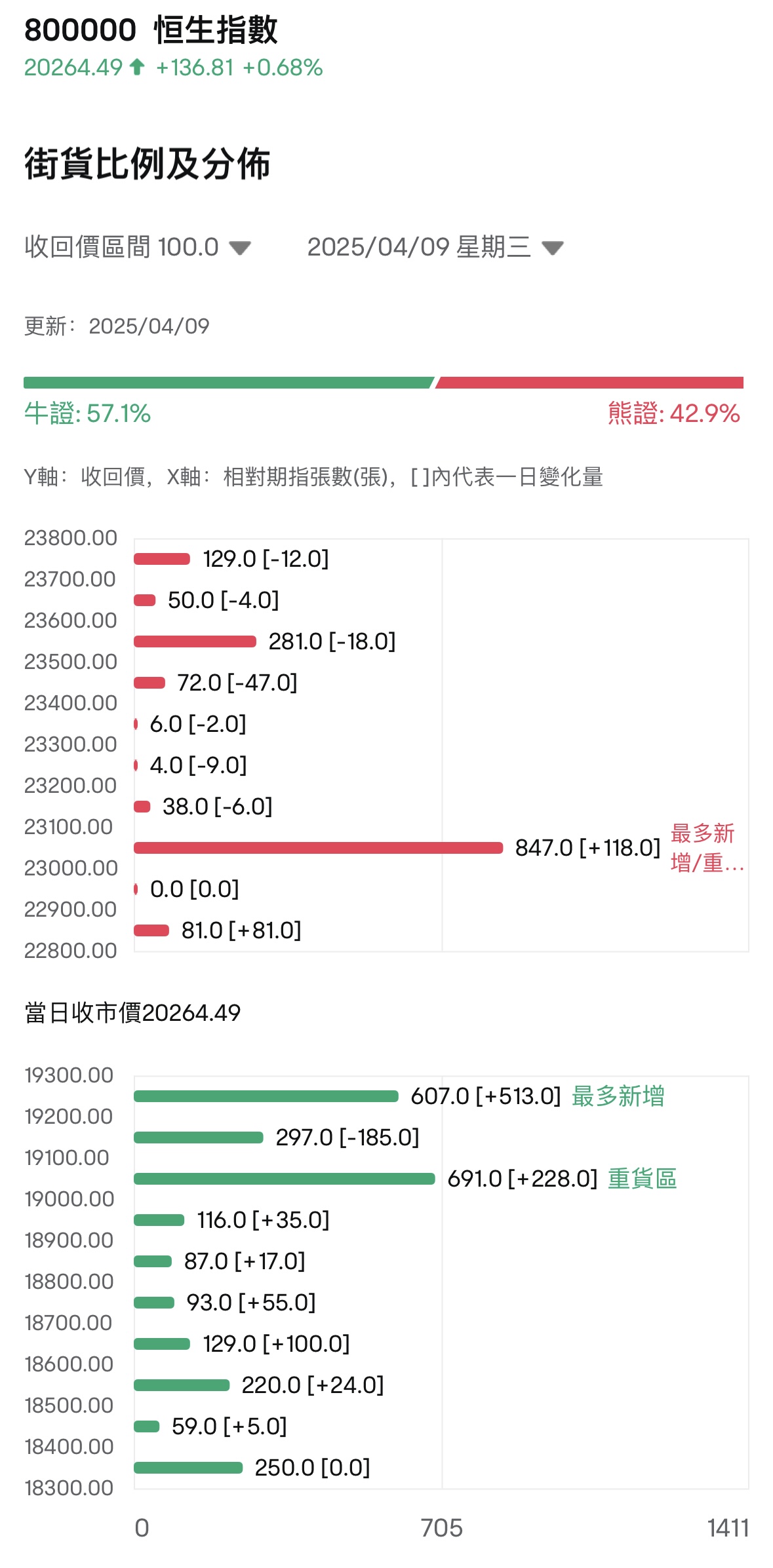

Bull-Bear Street Position Ratio

As of April 9, the latest bull-bear street货 ratio for the Hang Seng Index is 57.1:42.9.

bull and bear certificatesData in the street货 distribution map shows that the heavy zones for bear certificates and the most new additions are in the Range of 23000-23099, with the latest number of bear certificates in this Range being 847, an increase of 118 compared to the previous trading day.

The heavy zone for bull certificates is in the Range of 19000-19099, with the latest number of bull certificates in this Range being 691, an increase of 228 compared to the previous trading day; the most new additions for bull certificates are in the Range of 19200-19299, with the latest number of bull certificates in this Range being 607, an increase of 513 compared to the previous trading day.

Warrant analysis

Duty-free concept stocks$CTG DUTY-FREE (01880.HK)$ Soared nearly 24% yesterday, multiple call warrants made a big profit. $JPCTGDF@EC2506A.C (13131.HK)$ 、 $HSCTGDF@EC2511A.C (26988.HK)$ 、 $UBCTGDF@EC2506A.C (26948.HK)$ 、 $MBCTGDF@EC2511A.C (25881.HK)$ 、 $CTCTGDF@EC2506A.C (26241.HK)$ All made a profit of more than 1.5 times.

Semiconductor stocks collectively surged yesterday, $SMIC (00981.HK)$ A surge of over 10%, with multiple bull certificates and call options making significant profits, among them $UB#SMIC RC2510N.C (62635.HK)$ making 1.5 times the profit.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

HSBC: Domestic demand Concept stocks are collectively strong, China Tourism Group Duty Free Corporation stock price surges, good positions to watch. $HSCTGDF@EC2511A.C (26988.HK)$ / $HS-TRIP@EC2509A.C (28247.HK)$ 。

HSBC: Semiconductor Manufacturing International Corporation surges over 10%, good and bad deployments to watch. $HS-SMIC@EC2608A.C (13200.HK)$ / $HS-SMIC@EP2609A.P (13390.HK)$ 。

Editor/rice