On Thursday, the three major indices of the Hong Kong stock market all rose,$Hang Seng TECH Index (800700.HK)$closing up 2.66%,$Hang Seng Index (800000.HK)$up 2.06%, closing at 20,681.78 points, reaching a high of 21,211.13 points and a low of 20,530.43 points during the session. At night,$HSI Futures Current Contract (HSIcurrent.HK)$ it closed at 20,601 points, down 95 points or 0.46%, 81 points lower.

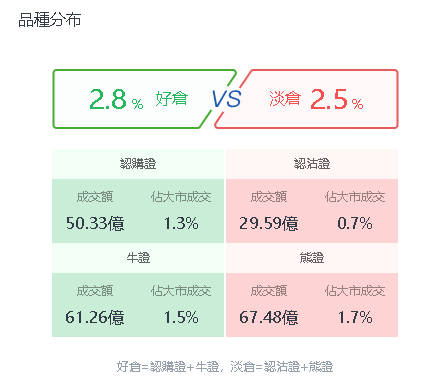

As of yesterday's close, the market's turnover was 395.534 billion Hong Kong dollars, with all warrants.bull and bear certificatesThe total traded amount was 20.866 billion HKD, accounting for 5.3% of the market turnover, with long positions making up 2.8% and short positions 2.5%. There was a net outflow of 0.501 billion HKD for all warrants.

Yesterday, the turnover for call warrants was 5.033 billion HKD, and for put warrants, it was 2.959 billion HKD; the turnover for bull warrants was 6.126 billion HKD, and for bear warrants, it was 6.748 billion HKD.

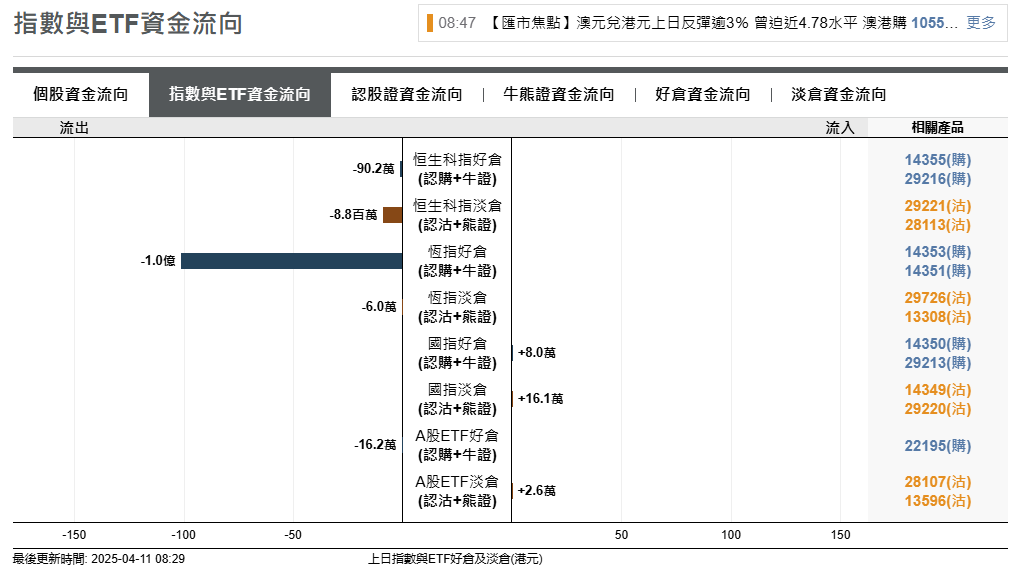

In terms of capital trend for the Hang Seng Index, there was a net outflow of 100 million HKD for long positions and a net outflow of 0.06 million HKD for short positions.

In terms of capital trend for the Hang Seng Index, there was a net outflow of 100 million HKD for long positions and a net outflow of 0.06 million HKD for short positions.

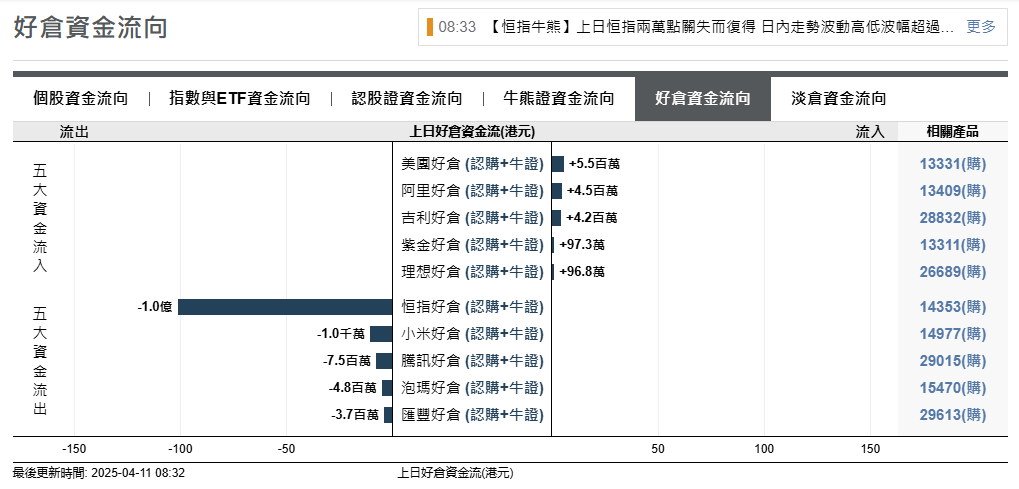

The top five indices and underlying stocks with fund outflows from good positions are: $Hang Seng Index (800000.HK)$、 $XIAOMI-W (01810.HK)$、 $TENCENT (00700.HK)$、 $POP MART (09992.HK)$、 $HSBC HOLDINGS (00005.HK)$ 。

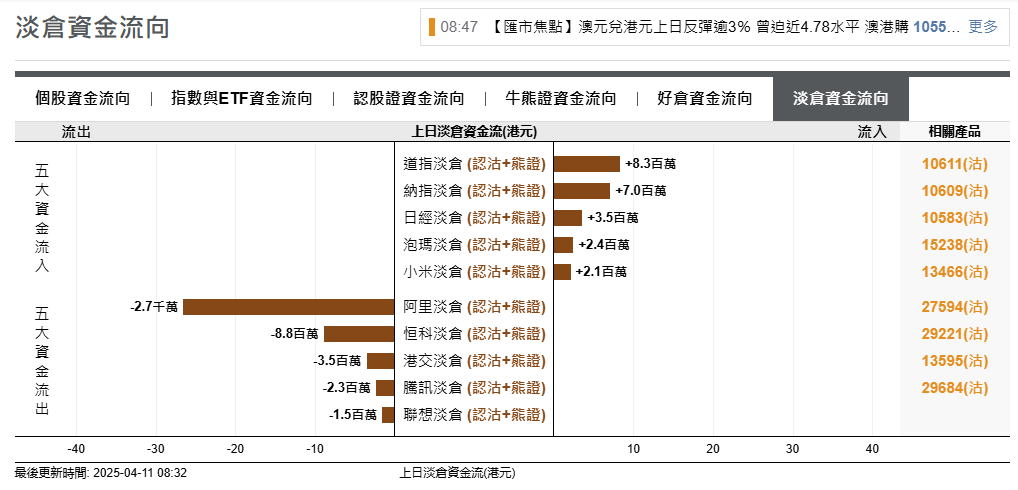

The top five indices with Bearish Capital Outflow and their related stocks are: $BABA-W (09988.HK)$ 、 $Hang Seng TECH Index (800700.HK)$ 、 $HKEX (00388.HK)$ 、 $TENCENT (00700.HK)$ 、 $LENOVO GROUP (00992.HK)$ 。

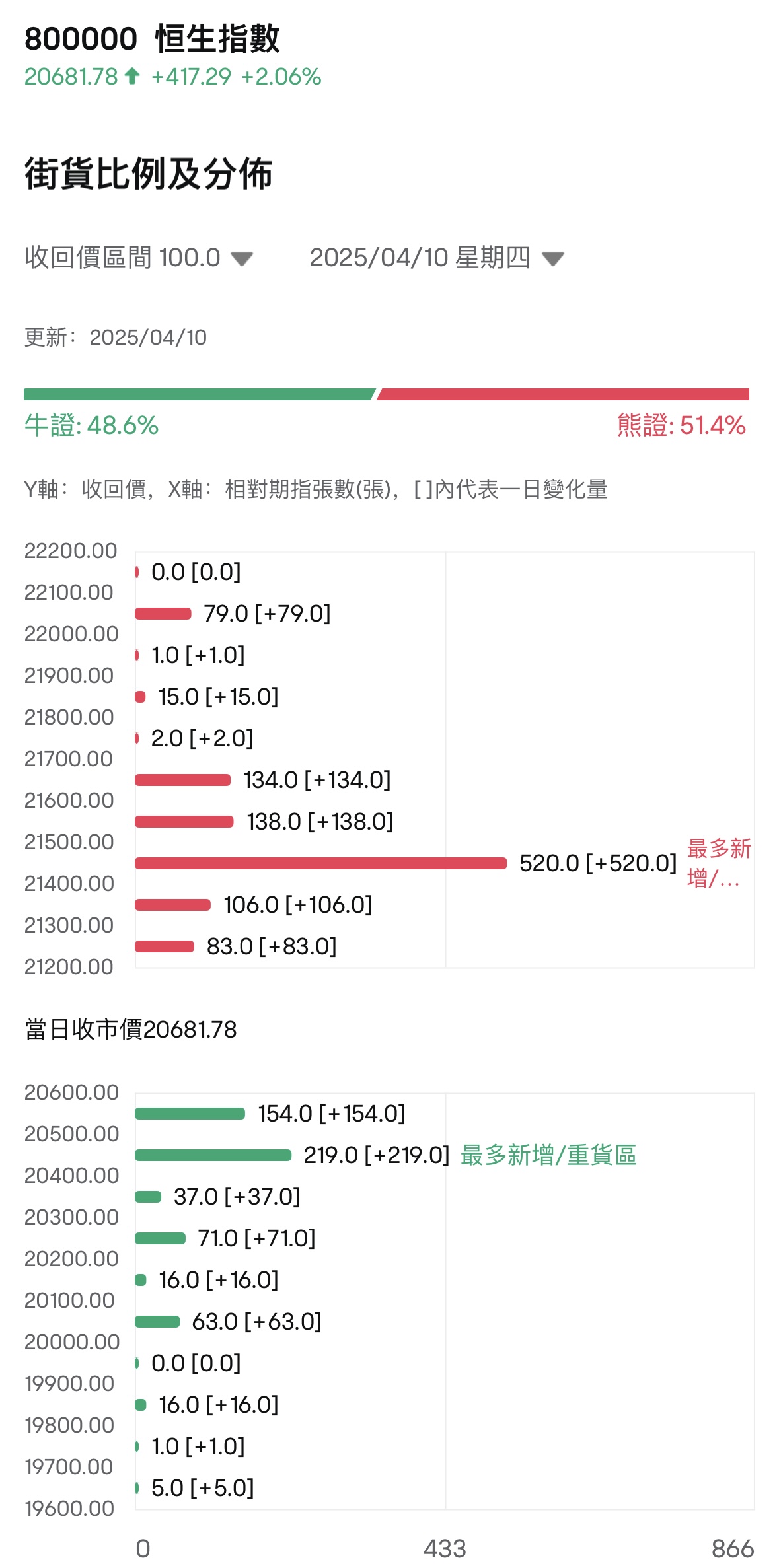

Bull-Bear Street Position Ratio

As of April 10, the latest bull-bear street positioning ratio of HSI is 48.6:51.4.

bull and bear certificatesThe data shown in the street position distribution chart indicates that the heavy load area for bear certificates and the most new additions are in the range of 21,400-21,499, with the latest number of bear certificates in this range being 520, an increase of 520 from the previous trading day.

The heavy load area for bull certificates and the most new additions are in the range of 20,400-20,499, with the latest number of bull certificates in this range being 219, an increase of 219 from the previous trading day.

Warrant analysis

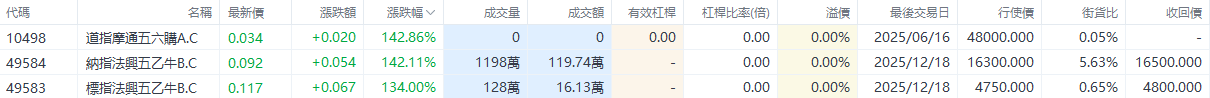

Recently, Trump's tariff threats have disturbed the Global market, causing a huge shock in the US stock market, where all indices surged on Wednesday, with the NASDAQ soaring over 12%. Several US stock index bull certificates and call options have made a profit. $JP-DJIA@EC2506A.C (10498.HK)$ 、 $SG#NQ100RC2512B.C (49584.HK)$ Profited over 140%. $SG#S&P RC2512B.C (49583.HK)$ Profited 134%.

In terms of individual stocks, $SMOORE INTL (06969.HK)$ Yesterday, there was a surge of over 10%, with multiple subscription warrants making significant profits, including $MBSMORE@EC2505A.C (25782.HK)$making over 120% profit.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

J.P. Morgan: The Nikkei 225 Index rebounded more than 9% yesterday, with short positions recording inflow for five consecutive days, pay attention. $JP-N225@EC2509A.C (10582.HK)$ / $JP-N225@EP2509A.P (10583.HK)$ 。

HSBC: The Hang Seng Index rebounded for the third consecutive day, pay attention to long and short deployment. $HS#HSI RC2707K.C (63116.HK)$ /$HS#HSI RP27041.P (63159.HK)$ 。

Editor/rice