The Hong Kong stock market has been fluctuating around 22,000 points for five consecutive trading days, with market trading cooling down. As of Tuesday's closing, $Hang Seng Index (800000.HK)$ it rose by 0.16%, closing at 22,008.11 points, with an intraday high of 22,213.51 points and a low of 21,918.1 points. At night, $HSI Futures Current Contract (HSIcurrent.HK)$ it closed at 21,927 points, unchanged from the previous day or 0.00%, with a low of 81 points.

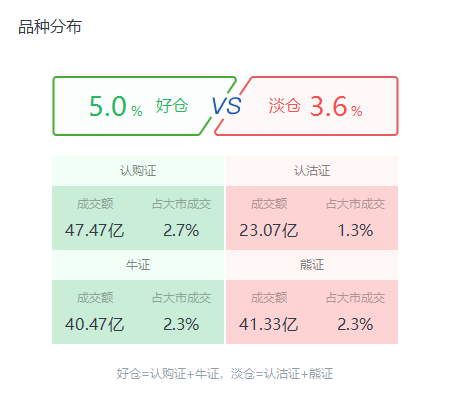

As of yesterday's market close, the total market turnover was 117.658 billion HKD, with all warrants bull and bear certificatestotaling 15.234 billion HKD, accounting for 8.6% of the total market turnover, of which the ratio of favorable positions is 5% and the ratio of unfavorable positions is 3.6%. All warrants saw a net capital outflow of 0.528 billion HKD.

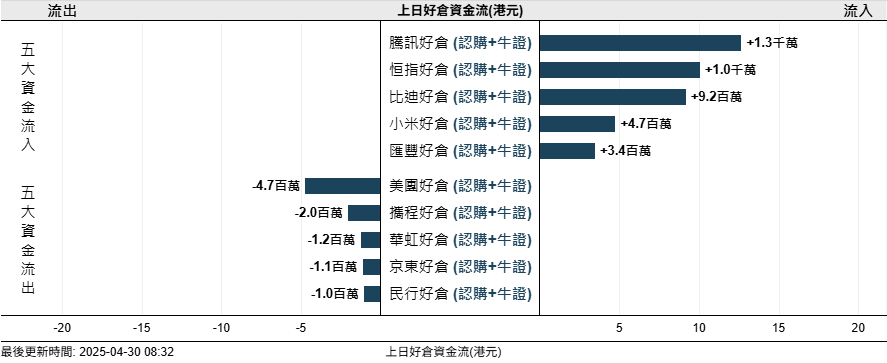

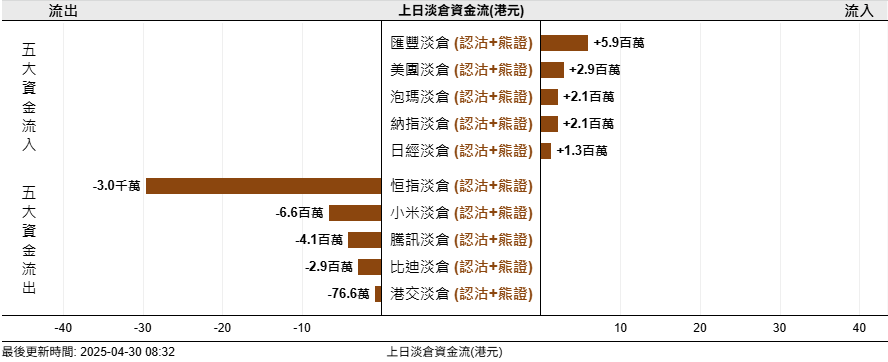

In terms of Capital Trend for the Hang Seng Index, there was a net Inflow of 10 million HKD for long positions and a net Outflow of 30 million HKD for short positions.

The top five indices and underlying stocks for the inflow of long positions are: $TENCENT (00700.HK)$ 、 $Hang Seng Index (800000.HK)$ 、 $BYD COMPANY (01211.HK)$ 、 $XIAOMI-W (01810.HK)$ 、 $HSBC HOLDINGS (00005.HK)$ 。

The top five indices and underlying stocks for the inflow of long positions are: $TENCENT (00700.HK)$ 、 $Hang Seng Index (800000.HK)$ 、 $BYD COMPANY (01211.HK)$ 、 $XIAOMI-W (01810.HK)$ 、 $HSBC HOLDINGS (00005.HK)$ 。

The top five indices and their corresponding stocks for Inflow in the light position are: $HSBC HOLDINGS (00005.HK)$ 、 $MEITUAN-W (03690.HK)$ 、 $POP MART (09992.HK)$ 、 $NASDAQ 100 Index (.NDX.US)$ 、 $Nikkei 225 (.N225.JP)$ 。

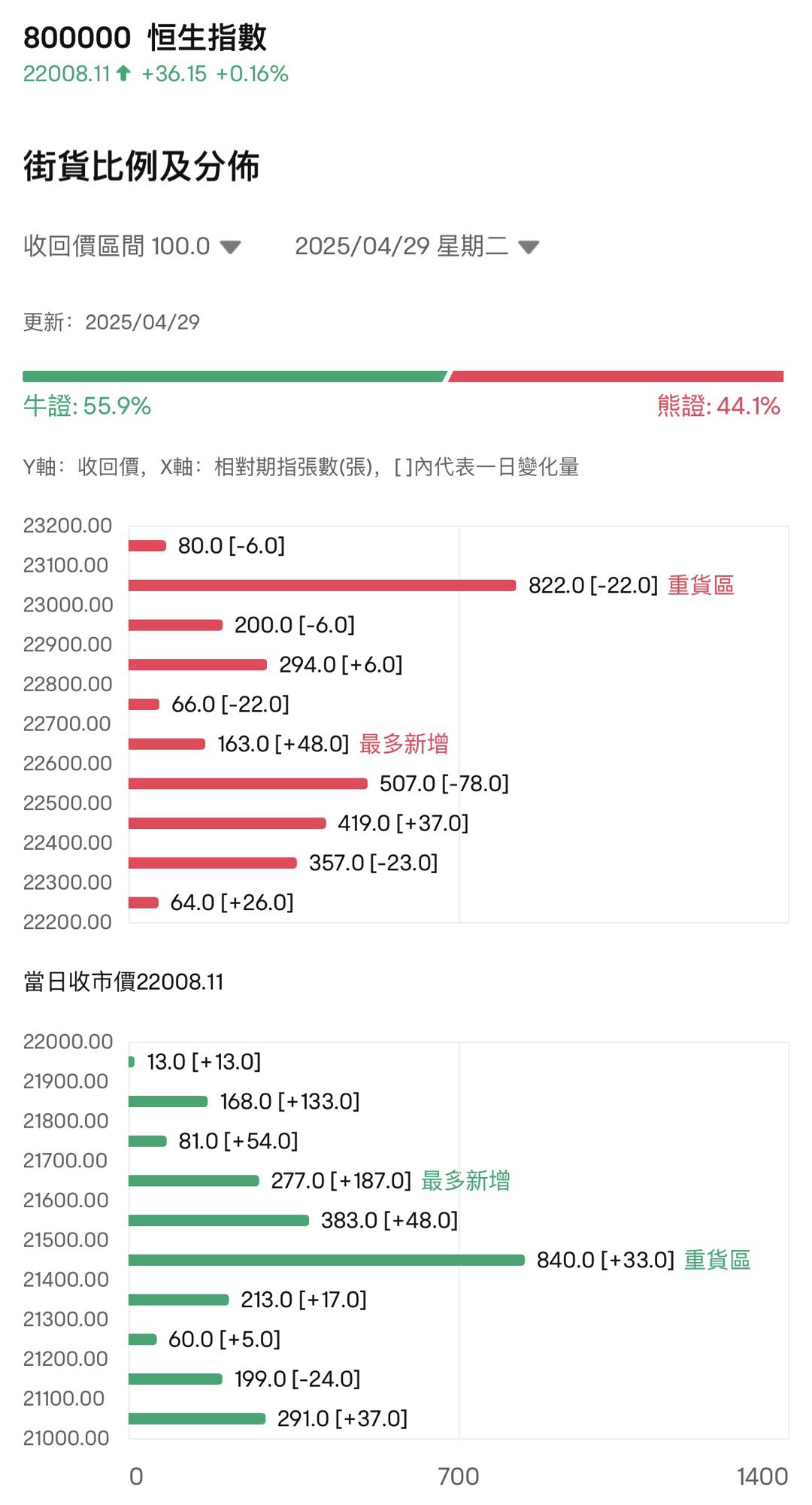

Bull-Bear Street Position Ratio

As of April 29, the latest bull-bear ratio of the Hang Seng Index is 56:44.

Data from the bull-bear certificate street distribution chart shows that the heavy area for bear certificates is in the Range of 23000-23099, with the latest number of bear certificates being 822, a decrease of 22 from the previous trading day; the most bear certificates were newly added in the Range of 22600-22699, with the latest number of bear certificates being 163, an increase of 48 from the previous trading day.

The heavy area for bull certificates is in the Range of 21400-21499, with the latest number of bull certificates being 840, an increase of 33 from the previous trading day; the most bull certificates were newly added in the Range of 21600-21699, with the latest number of bull certificates being 277, an increase of 187 from the previous trading day.

Warrant analysis

$Hang Seng Index (800000.HK)$ After several days of volatility, the difficulty in making a profit with bull-bear certificates has increased. $HSBC HOLDINGS (00005.HK)$ At noon, it announced an unexpectedly strong Q1 performance and declared a stock buyback of up to 3 billion dollars, with multiple warrants showing significant gains.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

JPMorgan: $HKEX (00388.HK)$ 将于今日公布2025年第一季度业绩。根据港交所数据,证券市场市值于3月底达到40 trillion元,较去年同期上升32%。首三个月平均每日成交金额达到280.2 billion元,同比增长152%。在衍生产品市场方面,衍生权证和牛熊证的平均每日成交金额分别较去年上升51%和83%。新股市场回暖,2025年首三个月共有17家新上市公司,首次公开招股集资金额达到17.7 billion元,同比增长269%。

轮证资金流方面,港交好仓前日录得约2.79 million港元净流入,至于淡仓前日录0.7 million港元净流出。部署业绩可留意港交购 $JP-HKEX@EC2508C.C (15623.HK)$ /Short Sale $JP-HKEX@EP2508A.P (13595.HK)$ 。

HSBC Holdings: With the Golden Week in mainland China approaching, good and bad setups can be considered for purchases. $HS-TRIP@EC2512A.C (15157.HK)$ / Bull $HS#TRIP RC2510A.C (67807.HK)$ 。

Editor/Rocky