Last Friday, the three major indices of Hong Kong stocks rose together,$Hang Seng Index (800000.HK)$increased by 1.74%, closing at 22,504.68 points, with an intraday high of 22,532.54 points and a low of 22,058.3 points. $Hang Seng TECH Index (800700.HK)$ experienced a significant increase of 3.08%. In the evening$HSI Futures Current Contract (HSIcurrent.HK)$ it closed at 22,597 points, up 174 points or 0.78%, with a premium of 92 points.

As of last Friday's close, the total market turnover was 133.728 billion Hong Kong dollars, with all warrants.bull and bear certificatesThe total trading volume reached 15.868 billion HKD, accounting for 11.9% of the overall market trading, with long positions representing 6% and short positions 5.9%. There was a net outflow of 0.723 billion HKD in all warrants.

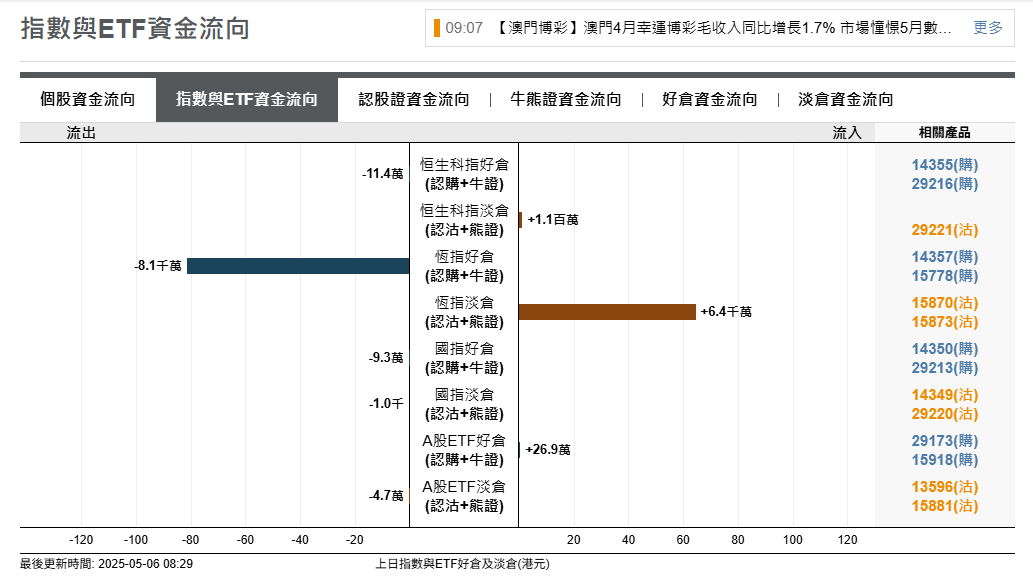

Regarding the Capital Trend of the Hang Seng Index, there was a net outflow of 81 million HKD in long positions and a net inflow of 64 million HKD in short positions.

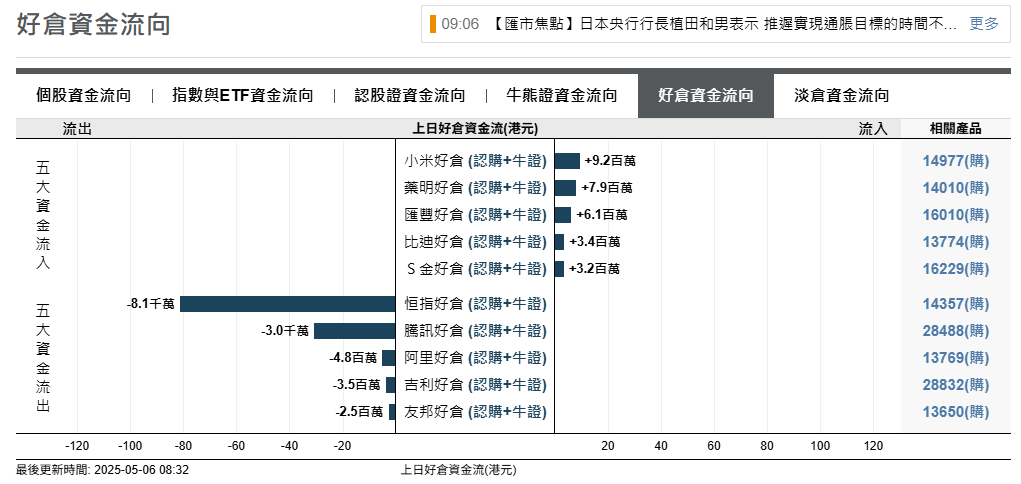

The top five indices and underlying stocks with fund outflows from good positions are: $Hang Seng Index (800000.HK)$ 、 $TENCENT (00700.HK)$ 、 $BABA-W (09988.HK)$ 、 $GEELY AUTO (00175.HK)$ 、 $AIA (01299.HK)$ 。

The top five indices and underlying stocks with fund outflows from good positions are: $Hang Seng Index (800000.HK)$ 、 $TENCENT (00700.HK)$ 、 $BABA-W (09988.HK)$ 、 $GEELY AUTO (00175.HK)$ 、 $AIA (01299.HK)$ 。

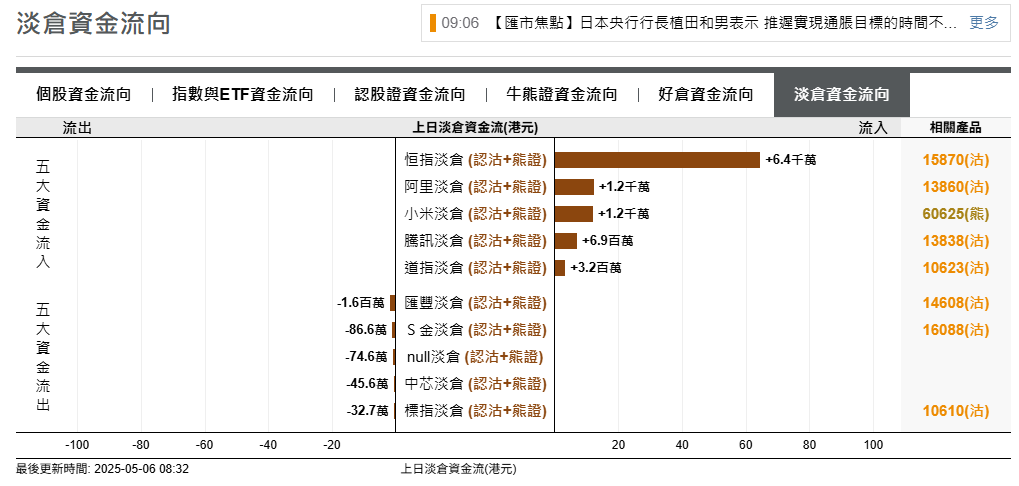

The top five indices and their corresponding stocks for Inflow in the light position are: $Hang Seng Index (800000.HK)$ 、 $BABA-W (09988.HK)$ 、 $XIAOMI-W (01810.HK)$ 、 $TENCENT (00700.HK)$ 、 $E-mini Dow Futures(JUN5) (YMmain.US)$ 。

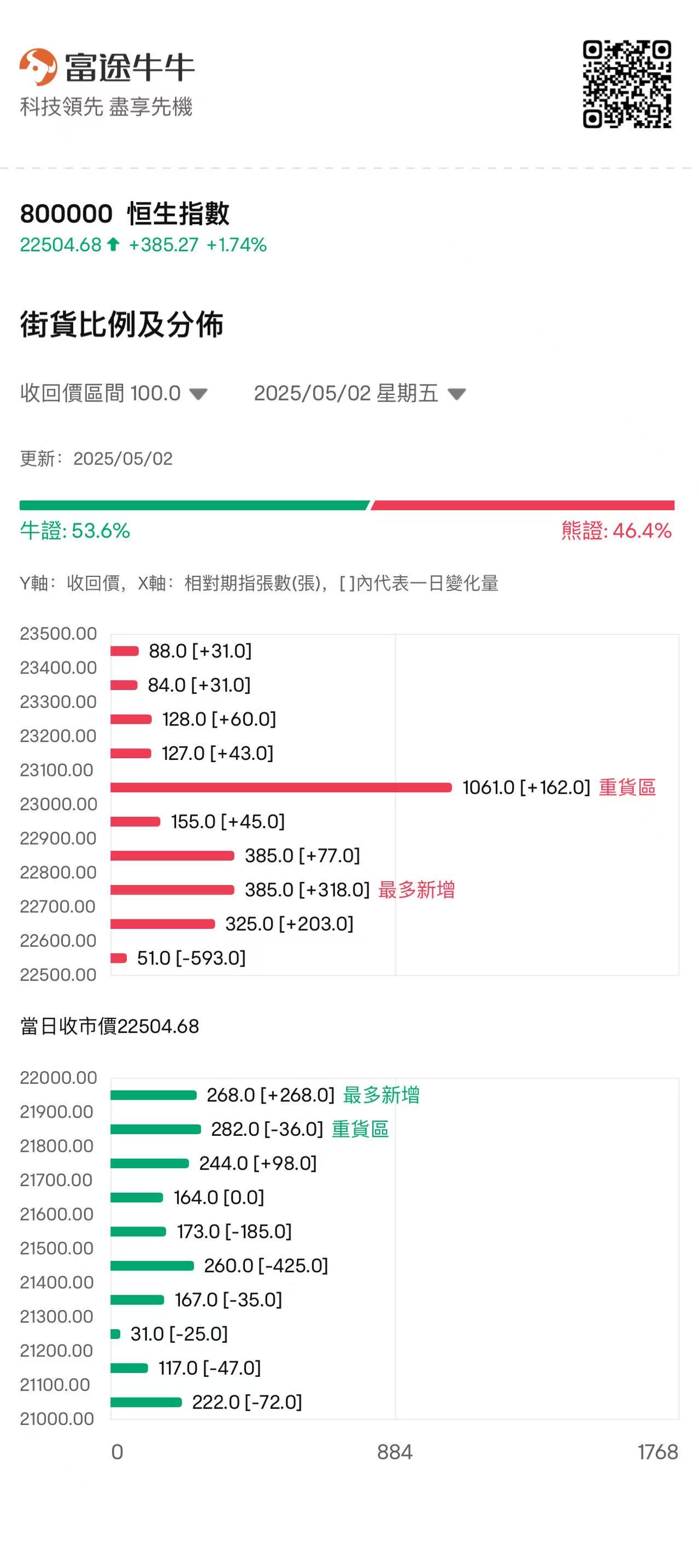

Bull-Bear Street Position Ratio

As of May 2, the latest bull-bear street merchandise ratio of the Hang Seng Index is 53.6:46.4.

bull and bear certificatesThe data from the street merchandise distribution map shows that the heavy zone for bear certificates is in the range of 23000-23099, with the latest number of bear certificates being 1,061, an increase of 162 compared to the previous trading day; the zone with the most new additions is in the range of 22700-22799, where the latest number of bear certificates is 385, an increase of 318 compared to the previous trading day.

The heavy zone for bull certificates is in the range of 21800-21899, with the latest number of bull certificates being 282, a decrease of 36 compared to the previous trading day; the zone with the most new additions is in the range of 21900-21999, where the latest number of bull certificates is 268, an increase of 268 compared to the previous trading day.

Warrant analysis

Last Friday, the Hong Kong stocks performed strongly, with the Hang Seng Index climbing steadily, closing up 1.74%. Several bull certificates surged over 65%, among which one bull certificate with a strike price of 21808. $SG#HSI RC27102.C (67349.HK)$ Soaring 75.56%, three bull certificates with a strike price of 21800 surged over 70%.

In terms of individual stocks, $YANKUANG ENERGY (01171.HK)$ One call warrant. $CIYKENR@EC2505A.C (27035.HK)$ Soaring 120%; $XPENG-W (09868.HK)$ Hong Kong stocks surged 6.66% last Friday, a subscription certificate. $CIXPENG@EC2505A.C (28054.HK)$ Doubling and making a big profit.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

Morgan Stanley: Macau's gross gambling revenue in April increased by 1.7% year-on-year, and the market anticipates that May data may continue to benefit from holiday factors, worth paying attention to. $JP-GEG @EC2510A.C (15913.HK)$ 、$JPSANDS@EC2511A.C (27360.HK)$。

HSBC: $HKEX (00388.HK)$ Performance has risen for two consecutive days, reaching a one-month high, worth noting in terms of bullish and bearish trends. $HS-HKEX@EC2508B.C (15522.HK)$ / $HS-HKEX@EP2506A.P (14444.HK)$ 。

Editor/lambor