On May 8th, Beijing time (Thursday) at 2 AM, the Federal Reserve will announce the May interest rate decision; at 2:30 AM, Federal Reserve Chair Powell will hold a press conference to explain the monetary policy decision and answer questions from reporters.

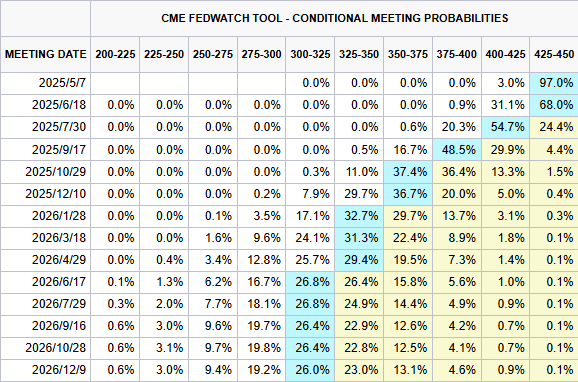

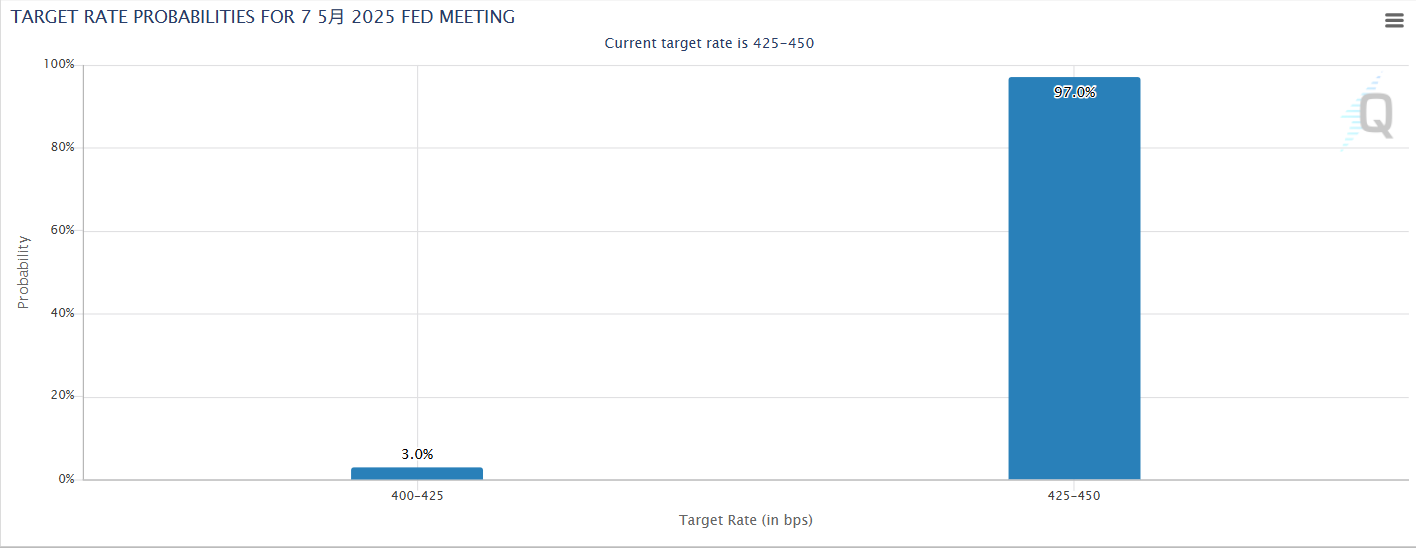

According to the CME's FedWatch tool, the current market is highly pricing in no rate cut in May, maintaining the interest rate range at 4.25%-4.5%. The unexpectedly strong non-farm data released last Friday in April provided room for the Fed to remain unchanged.

Nevertheless, investors and Trump will closely monitor the outcome of this meeting and Powell's speech, with Trump likely to comment on Powell's remarks afterward.

Since the interest rate policy itself is not suspenseful, Wednesday's market fluctuations will completely depend on what Powell says. From the perspective of monetary policy makers, if Powell makes dovish remarks leaning towards a rate cut, it may not help prevent cost increases or economic slowdown caused by tariffs; conversely, if he appears more "hawkish", it could suppress market inflation expectations.

Since the interest rate policy itself is not suspenseful, Wednesday's market fluctuations will completely depend on what Powell says. From the perspective of monetary policy makers, if Powell makes dovish remarks leaning towards a rate cut, it may not help prevent cost increases or economic slowdown caused by tariffs; conversely, if he appears more "hawkish", it could suppress market inflation expectations.

Now Powell is in a dilemma, as macro reporter Nick Timiraos, known as the "voice of the Fed", stated that the Fed will not "give up the fight against inflation prematurely", while also pointing out that under the impact of tariff policies, whether or not a rate cut is implemented, the Fed will ultimately face a predicament: either confront economic recession or wait for more troublesome stagflation.

Bloomberg Economic Review predicts that Powell will push back against market pricing and hint at refocusing on price stability. Other analysts warn that in this week's press conference, Powell may continue to rebut the claim that the Fed will be influenced by the White House with a "hawkish" tone, which could lead to an escalation of conflict between Trump and Powell.

Many market participants expect that Federal Reserve Chairman Powell may hint at this week's press conference that the impact of Trump's tariffs could lead to rising inflation and unemployment, and concerns about an economic recession are not unfounded.

In a recent research report led by Michael Gapen, Chief US Economist at Morgan Stanley, the analysis team wrote, "Given the strong inflation expectations and the potential for lasting inflation effects from tariff impacts, it is unlikely that the Federal Reserve will take preemptive actions."

Trump and Powell engage in a "remote duel".

In the past month, the conflict between Trump and Powell has made investors worried, as it calls into question the independence of the Federal Reserve.

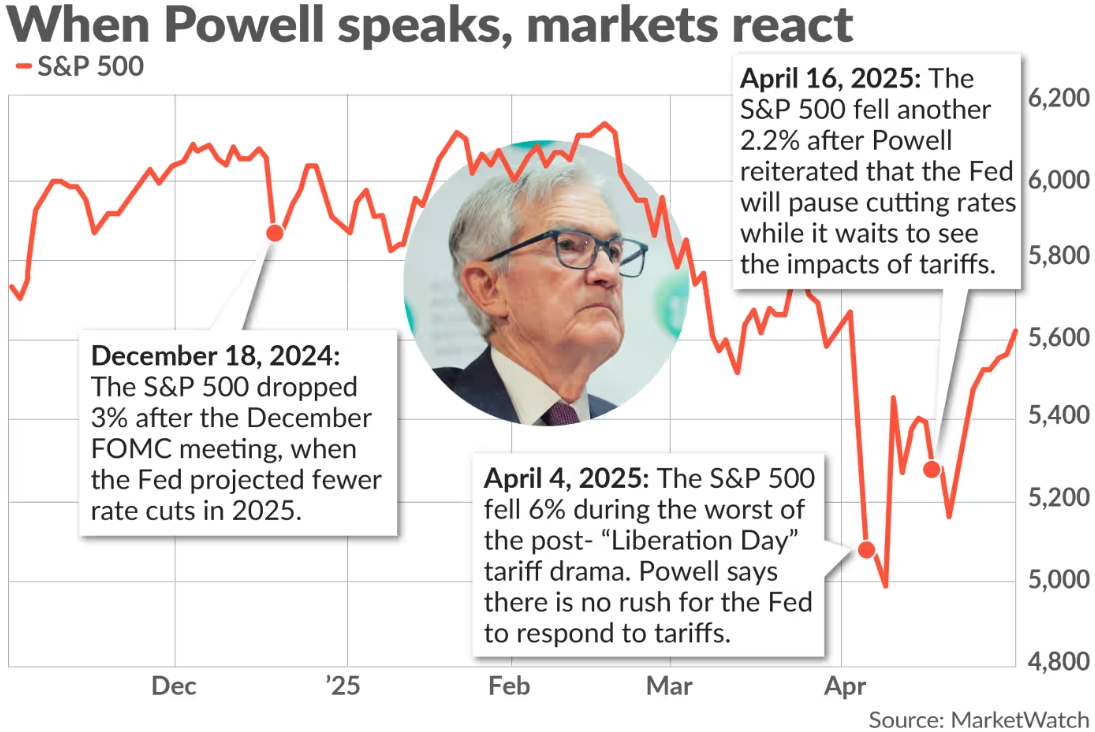

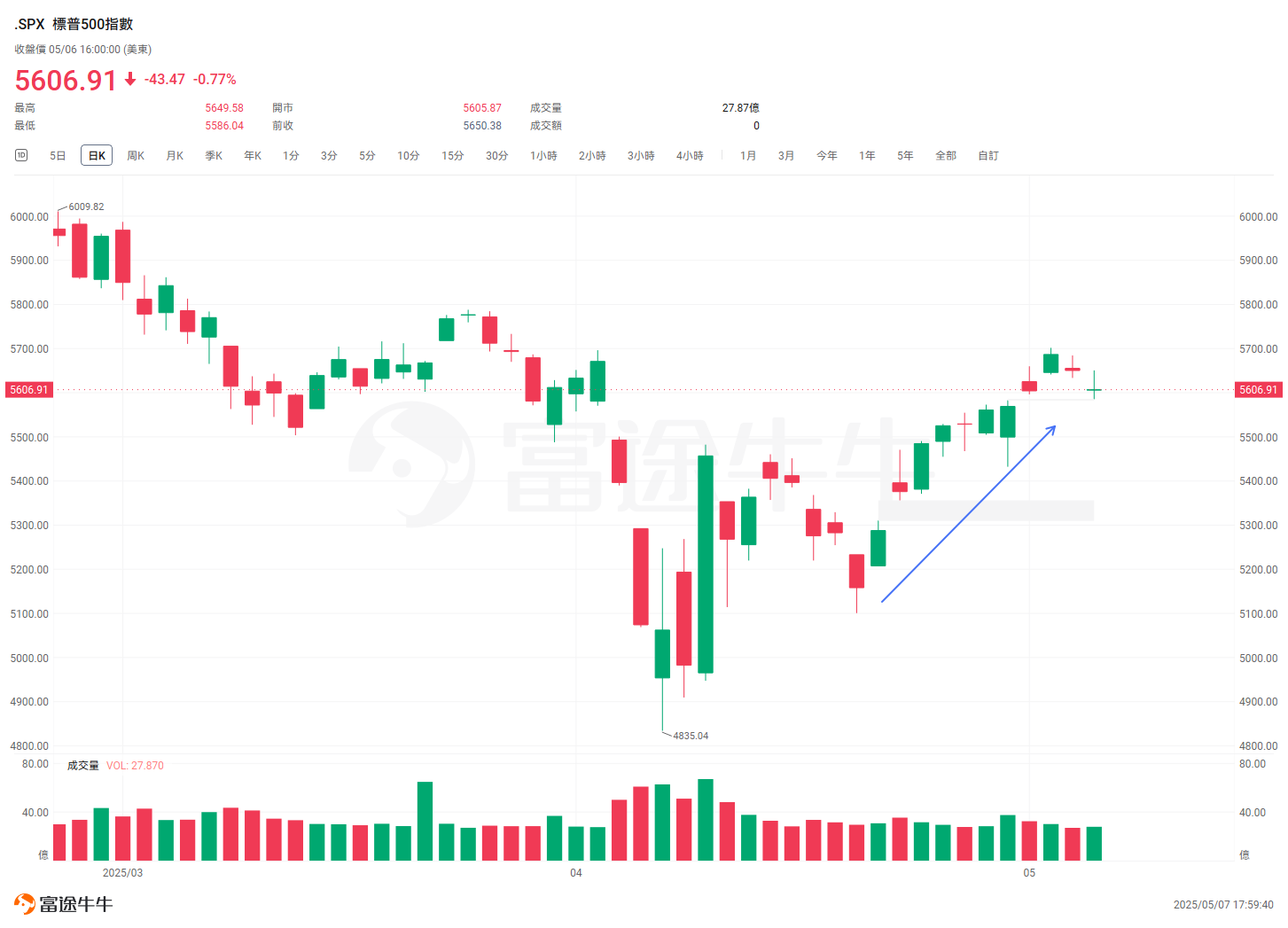

On April 4, 2025, the S&P 500 Index fell over 6% on "Tariff Liberation Day", with Powell stating that the Federal Reserve is not in a hurry to respond to tariffs.

In a subsequent speech on April 16, Powell reiterated his position. "Tariffs are very likely to lead to inflation rising at least temporarily. The inflation effects may also be more lasting," Powell added, saying, "At present, we are fully capable of waiting for clearer signals before considering adjusting our policy stance." That day, the stock market fell again, with the S&P 500 Index down by 2.2%.

On April 17, the day after Powell spoke at the Chicago Economic Club, Trump criticized the Federal Reserve Chairman on Truth Social. "The ECB is expected to cut rates for the 7th time, however, ‘it’s too late’ for Jerome Powell of the Federal Reserve, who is always too late and wrong. A report was released yesterday, which is another typical, complete ‘mess’!" Trump wrote, "Powell's dismissal is not coming fast enough!"

In the following days, Trump even told reporters, "If I wanted him out, he would be gone quickly, believe me." The S&P 500 Index dropped about 2.4% on the day Trump made these remarks to reporters.

After April 21, the S&P 500 Index rose for nine consecutive days, the longest streak in over 20 years. This is partly related to progress in trade negotiations, but analysts stated that during this period, Trump's softening stance towards Powell also played a role.

Trump retracted his remarks about Powell, which may have eased investors' concerns, making them feel that Trump was actually listening to the market's voice, and the timing of this rebound coincided perfectly with the next Federal Reserve meeting.

Analyst Sosnick stated: "Clearly, the recent significant rise in the stock market largely reflects the market's optimistic outlook on the comments Powell might make. Otherwise, such a rebound would not occur."

However, this optimism may be somewhat unrealistic. According to the CME's FedWatch Tool, the market currently expects a 97% chance that the Federal Reserve will maintain the target interest rate at its May meeting, but it also anticipates three rate cuts by the end of 2025.

If the Federal Reserve does not cut rates in May, investors may pay attention to whether Powell mentions a rate cut in June. However, if the Federal Reserve wants to wait to see the impact of tariffs, it may have to wait until the end of the current 90-day tariff suspension period in July, further delaying a rate cut.

How to use Options Trading for this speech?

Overall, the market leans towards Powell's "hawkish remarks" to stabilize inflation expectations. Powell needs to balance the dual pressures of "Trump's tariff policy boosting inflation" and "slowing economic growth," while being cautious of its suppressive effect on market sentiment.

If Powell hints that "the impact of tariffs is limited" or that "economic resilience requires a rate cut," it could trigger a rebound in the stock market, but the probability is relatively low (the current market probability for maintaining the interest rate in May is 97%).

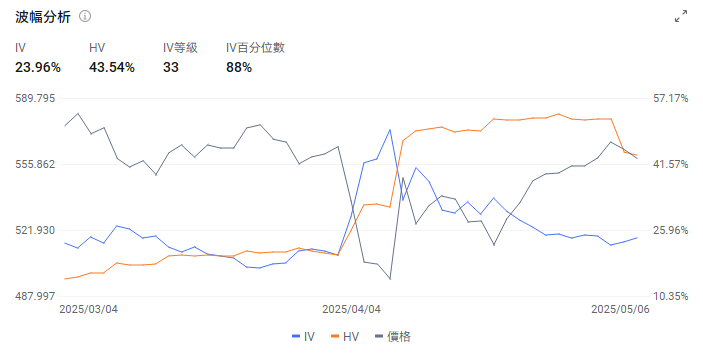

From $SPDR S&P 500 ETF (SPY.US)$ According to the Options data, the current implied volatility of the Options has dropped to 23.96%, with an implied volatility level of 33.

$CBOE Volatility S&P 500 Index (.VIX.US)$ Currently, it is at 24.41, dropping back to the level before Trump announced tariffs on April 2.

Overall, the current $S&P 500 Index (.SPX.US)$ And $SPDR S&P 500 ETF (SPY.US)$ Options reflect a low market pricing for volatility after the interest rate decision, but if actual volatility exceeds expectations, there are still trading opportunities.

The optimal short-term strategy is a straddle or a wide straddle, focusing on betting that volatility will increase after the interest rate decision; if holding positions that require risk hedging, then choose protective Put Options.

1. Buy a straddle to speculate on significant bidirectional volatility.

Operation: simultaneously buy Call and Put Options with the same expiration date and strike price (for example, a strike price of 5650 points for the S&P 500 ETF).

Logic: betting that Powell's speech will trigger severe market volatility (in either direction), covering the potential breakout of resistance (5700) and support (5300) levels.

Risk: with high volatility, the cost of premiums is relatively high, requiring the volatility to exceed the breakeven point (the S&P needs to move more than 2% in a single day).

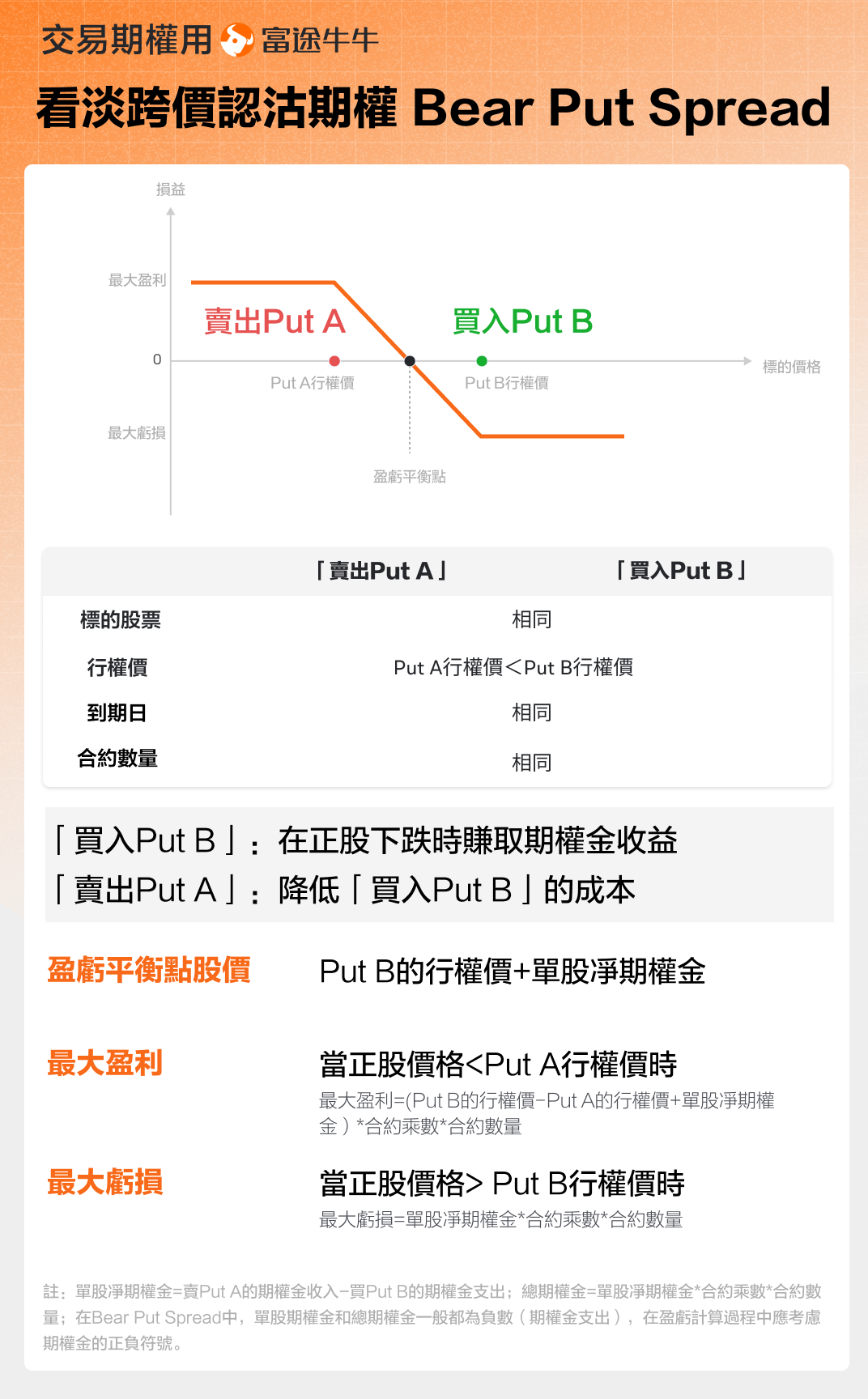

2. Bear Put Spread, betting on moderate market decline, reducing premium costs, and maintaining a controllable risk-reward ratio.

Operation: buy a Put Option (such as the S&P 5700 points) and sell a lower strike price Put Option (such as the S&P 5500 points).

Logic: the cost is lower than a straddle, suitable for scenarios with expected volatility, requiring the market to break through the recent consolidation Range.

Risk: If the market oscillates narrowly, time value erosion will be significant.

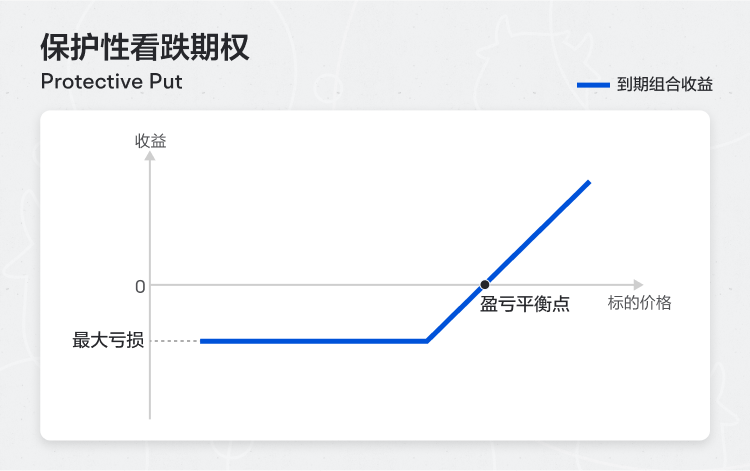

3. Protective Put, which involves holding Index ETF or component stock long positions while buying out-of-the-money Put Options (e.g., S&P 500 at 5500 points) to hedge against potential declines triggered by hawkish remarks, retaining upside profit potential, suitable for those looking to hedge in the short term.

Investors need to closely monitor Powell's wording on "inflation expectations management" and "tariff impacts". If unexpected signals are released, timely adjustments to the strategy direction should be made. Historical data shows that the S&P can drop by 2%-3% in a single day following hawkish comments from the Federal Reserve.

![]() Will the Federal Reserve adhere to the "data-dependent" principle amid contradictory economic data? If they choose to remain inactive, will Powell hint at future easing paths? How will the market react? Mooers are welcome to make an appointment to watch!

Will the Federal Reserve adhere to the "data-dependent" principle amid contradictory economic data? If they choose to remain inactive, will Powell hint at future easing paths? How will the market react? Mooers are welcome to make an appointment to watch!

![]() Finally, Futu News brings a little benefit to the mooers, welcoming mooers to claim it.Options Newbie Gift Package.

Finally, Futu News brings a little benefit to the mooers, welcoming mooers to claim it.Options Newbie Gift Package.

*This event is limited to specially invited users in HK. Click to learn more.Detailed rules of the event >>

![]() The market is complex and changing, with various Options Trading strategies available. Not sure how to choose? Futu's new desktop helps you establish Options Trading strategies in three steps, making investment simple and efficient from now on!Click to download the latest desktop version >>

The market is complex and changing, with various Options Trading strategies available. Not sure how to choose? Futu's new desktop helps you establish Options Trading strategies in three steps, making investment simple and efficient from now on!Click to download the latest desktop version >>

Risk Warning

Options are contracts that give the holder the right, but not the obligation, to buy or sell an asset at a fixed price on or before a specific date. The price of options is influenced by various factors, including the current price of the underlying asset, strike price, expiration time, and Implied volatility。

Implied volatilityreflecting the market's expectations of fluctuations in the options for a certain period. It is derived from the option's Black-Scholes pricing model and is generally regarded as an indicator of market sentiment. When investors expect greater volatility, they may be more willing to pay higher prices for options to help hedge risks, leading to higher Implied volatility。

Traders and investors useImplied volatilityTo assessOptions pricesThe appeal lies in identifying potential mispricings and managing risk exposure.

Disclaimer

This content does not constitute an offer, solicitation, recommendation, opinion, or any guarantee of any securities, financial products, or instruments. The risk of loss in trading Options can be substantial. In some cases, the losses incurred may exceed the amount of margin initially deposited. Even if you set backup instructions, such as "stop-loss" or "limit order" instructions, this does not necessarily avoid losses. Market conditions may make such instructions unexecuted. You may be required to deposit additional margin within a short period. If you fail to provide the required amount within the specified time, your open contracts may be liquidated. However, you will still be responsible for any shortfall that arises in your account as a result. Therefore, you should research and understand Options before trading, and carefully consider whether such trading is suitable for you based on your financial situation and investment objectives. If you trade Options, you should be familiar with the process of exercising Options and the rights and responsibilities you have at the time of exercising Options and Options expiration.

Editor/Rocky