On Tuesday, the three major indices of the Hong Kong stock market collectively fell,$Hang Seng Index (800000.HK)$down 1.87%, closing at 23,108.27 points, with an intraday high of 23,494.44 points and a low of 23,070.4 points. $Hang Seng TECH Index (800700.HK)$ Down 3.26%. At night,$HSI Futures Current Contract (HSIcurrent.HK)$ closed at 23,288 points, up 261 points or 1.13%, at a premium of 180 points.

As of Tuesday's close, the market turnover was 219.845 billion Hong Kong dollars, with all warrants.bull and bear certificatesThe total Trade was 19.171 billion Hong Kong dollars, accounting for 8.7% of the market's total Trade, with long positions taking up 5.9% and short positions 2.8%. There was a net Outflow of 0.937 billion Hong Kong dollars for all warrants.

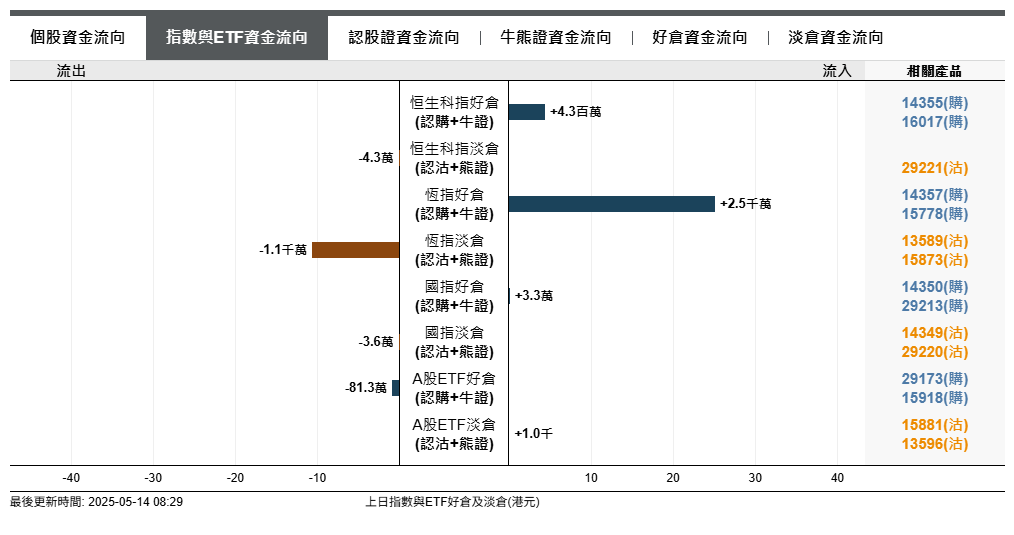

In terms of Capital Trend for the Hang Seng Index, there was a net Inflow of 25 million Hong Kong dollars for long positions and a net Outflow of 11 million Hong Kong dollars for short positions.

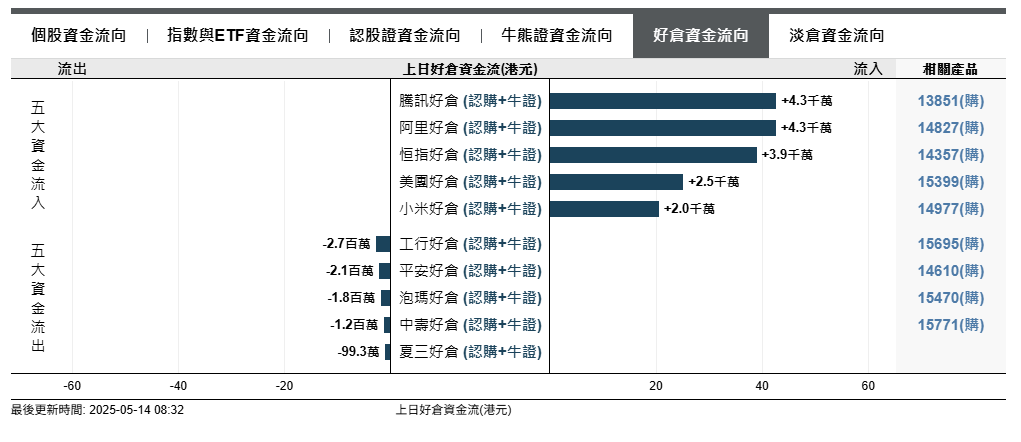

The top five stocks with capital inflow for long positions are: $TENCENT (00700.HK)$ 、 $BABA-W (09988.HK)$ 、 $Hang Seng Index (800000.HK)$ 、 $MEITUAN-W (03690.HK)$ 、 $XIAOMI-W (01810.HK)$ 。

The top five stocks with capital inflow for long positions are: $TENCENT (00700.HK)$ 、 $BABA-W (09988.HK)$ 、 $Hang Seng Index (800000.HK)$ 、 $MEITUAN-W (03690.HK)$ 、 $XIAOMI-W (01810.HK)$ 。

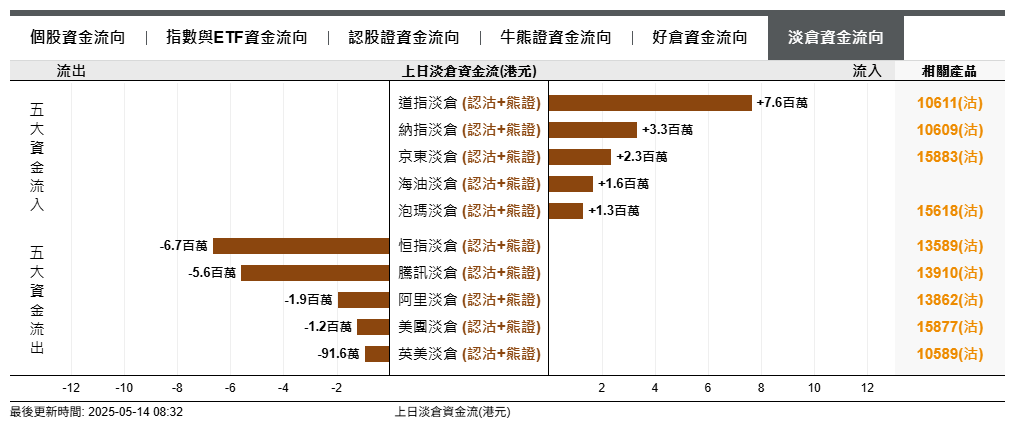

The top five indices and their corresponding stocks for Inflow in the light position are: $E-mini Dow Futures(JUN5) (YMmain.US)$ 、 $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ 、 $JD-SW (09618.HK)$ 、 $CNOOC (00883.HK)$、 $POP MART (09992.HK)$ 。

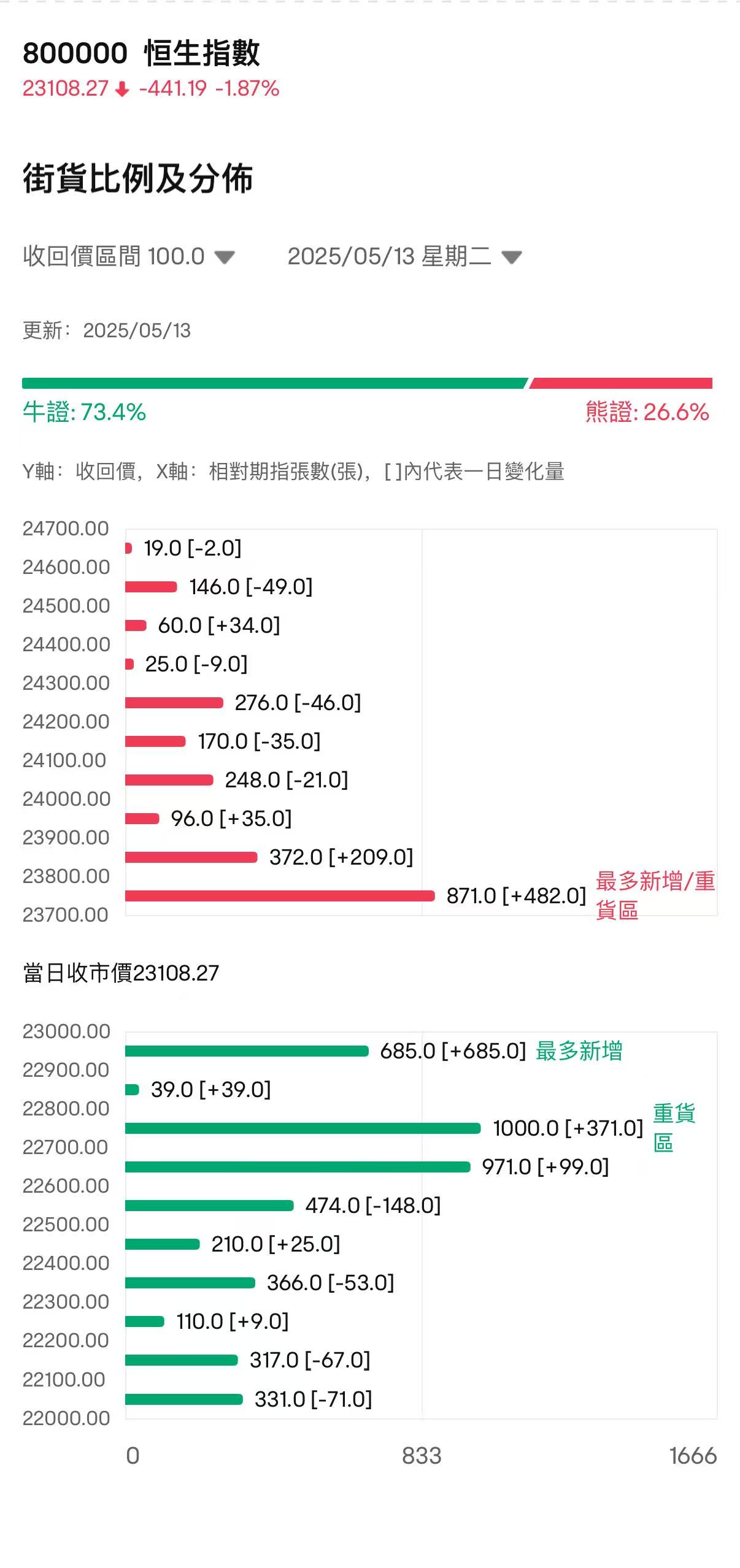

Bull-Bear Street Position Ratio

As of May 13, the latest bull-bear street ratio of the Hang Seng Index is 73:27.

The data in the bull-bear certificate street distribution map shows that the bear certificate heavy cargo zone and the most new additions are in the 23700-23799 Range, with the latest number of bear certificates in this Range being 871, an increase of 482 from the previous trading day.

The bear certificate heavy cargo zone is in the 22700-22799 Range, with the latest number of bear certificates in this Range being 1000, an increase of 371 from the previous trading day; the bull certificate street has the most new additions in the 22900-22999 Range, with the latest number of bull certificates in this Range being 685, an increase of 685 from the previous trading day.

Warrant analysis

On Tuesday, the Hang Seng Index fluctuated and fell, with multiple bear certificates soaring over 150%, among which $HS#HSI RP2711F.P (61672.HK)$ 、 $SG#HSI RP2710N.P (60795.HK)$ Profits increased by nearly 180%.

In terms of individual stocks, $BABA-W (09988.HK)$ After a pullback of nearly 4%, a bear certificate made over three times the profit; $BYD COMPANY (01211.HK)$ Dipped close to 5%, with several bear certificates rising over 170%.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

HSBC: Alibaba and TENCENT will announce their results, bullish on Alibaba options to pay attention to. $HSALIBA@EC2601A.C (14846.HK)$ / TENCENT Purchase $HSTENCT@EC2509G.C (15629.HK)$ ;

Morgan Stanley: Alibaba will announce its performance on Thursday, and the market is concerned about the impact of the mainland's small parcel cross-border restrictions on international e-commerce business, Alibaba Purchase $JPALIBA@EC2511A.C (14827.HK)$ /Short Sale $JPALIBA@EP2508B.P (13862.HK)$

Editor/Somer