Yesterday, the three major indices of the Hong Kong stock market slightly closed lower.$Hang Seng Index (800000.HK)$It fell 0.05%, closing at 23,332.72 points, with an intraday high of 23,402.20 points and a low of 23,059.89 points. $Hang Seng TECH Index (800700.HK)$ It fell 0.5%. At night,$HSI Futures Current Contract (HSIcurrent.HK)$ it closed at 23,378 points, up 110 points or 0.47%, a premium of 45 points.

As of yesterday's market close, the total market turnover was 184.704 billion Hong Kong dollars, with the total turnover of all warrant bull and bear certificates at 17.901 billion Hong Kong dollars, accounting for 9.7% of the market turnover, of which good positions accounted for 5.8% and short positions accounted for 3.9%. The net Outflow of all warrants was 0.367 billion Hong Kong dollars.

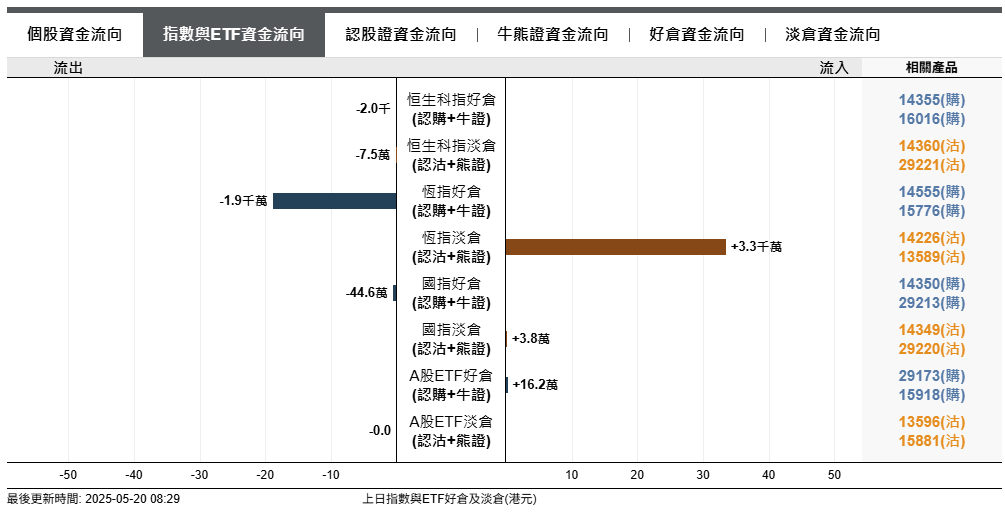

In terms of Capital Trend of the Hang Seng Index, there was a net Outflow of 19 million HKD from long positions and a net Inflow of 33 million HKD into short positions.

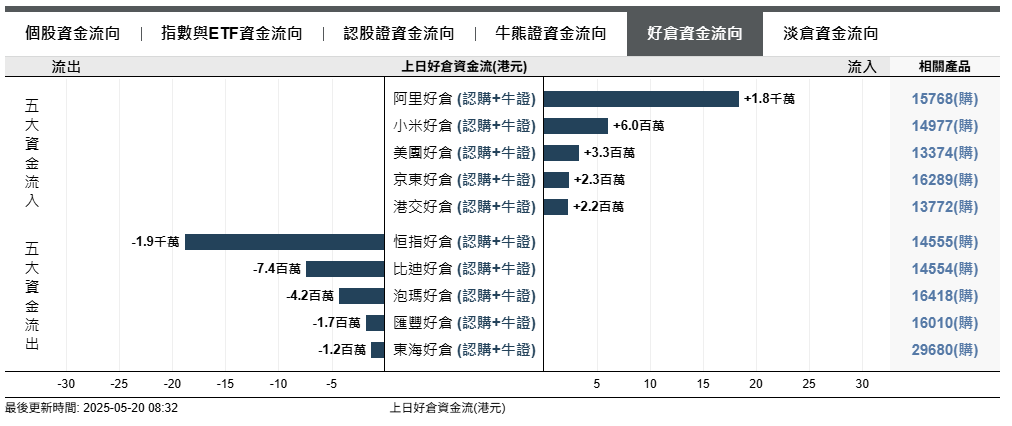

The top five indices and their underlying stocks that experienced Outflow for long positions are:$Hang Seng Index (800000.HK)$、 $BYD COMPANY (01211.HK)$ 、 $POP MART (09992.HK)$ 、 $HSBC HOLDINGS (00005.HK)$ 、 $OOIL (00316.HK)$ 。

The top five indices and their underlying stocks that experienced Outflow for long positions are:$Hang Seng Index (800000.HK)$、 $BYD COMPANY (01211.HK)$ 、 $POP MART (09992.HK)$ 、 $HSBC HOLDINGS (00005.HK)$ 、 $OOIL (00316.HK)$ 。

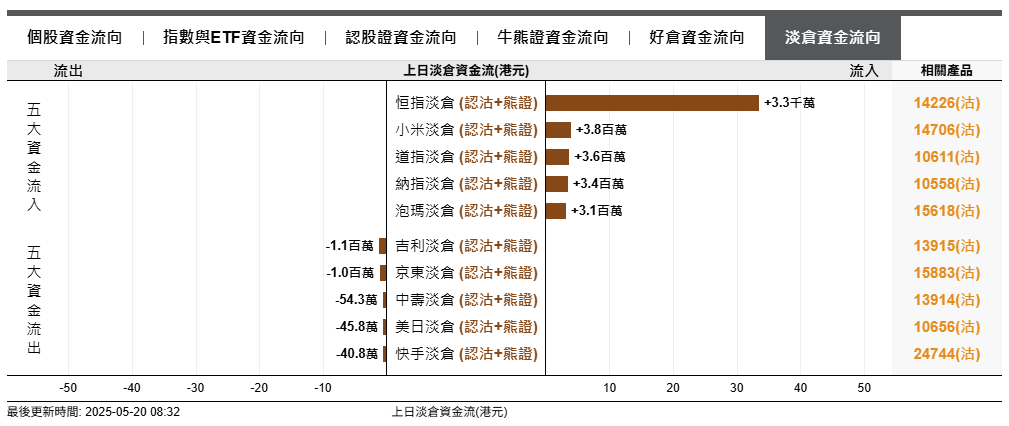

The top five indices and underlying stocks for Inflow of light positions are:$Hang Seng Index (800000.HK)$ 、 $XIAOMI-W (01810.HK)$ 、 $E-mini Dow Futures (JUN5) (YMmain.US)$ 、 $E-mini NASDAQ 100 Futures (JUN5) (NQmain.US)$ 、 $POP MART (09992.HK)$ 。

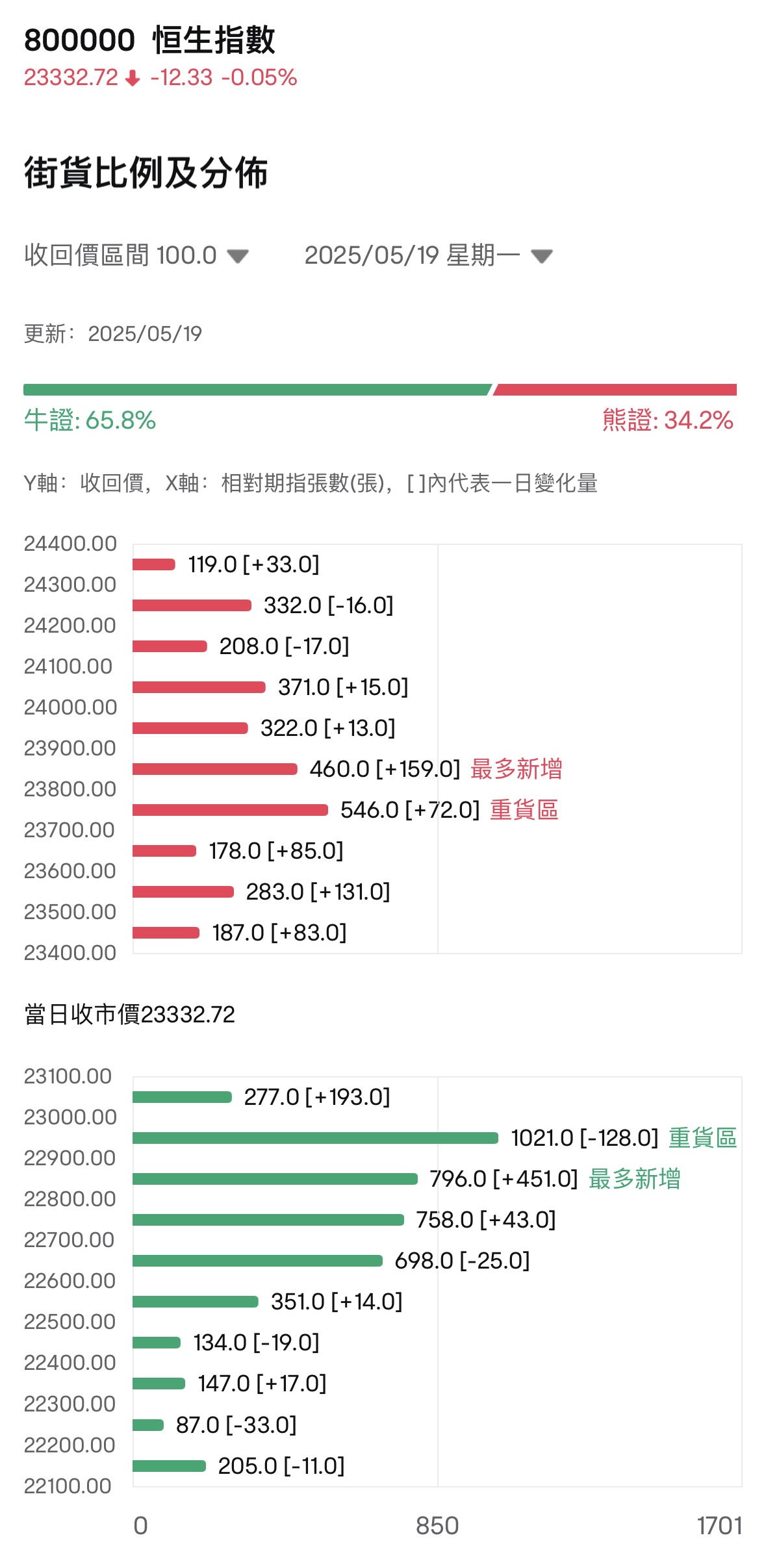

Bull-Bear Street Position Ratio

As of May 20, the latest bull-bear ratio for the Hang Seng Index is 65.8:34.2.

bull and bear certificatesThe data in the street goods distribution chart indicates that the heavy area for bear warrants is in the 23700-23799 Range, with the latest bear warrants totaling 546, an increase of 72 compared to the previous trading day; the most newly added bear warrants are in the 23800-23899 Range, with the latest bear warrants totaling 460, an increase of 159 compared to the previous trading day.

The heavy area for bull warrants is in the 22900-22999 Range, with the latest bull warrants totaling 1021, a decrease of 128 compared to the previous trading day; the most newly added bull warrants are in the 22800-22899 Range, with the latest bull warrants totaling 796, an increase of 451 compared to the previous trading day.

Warrant analysis

XIAOMI officially announced that YU7 and the玄戒o1 will be released on May 22. $XIAOMI-W (01810.HK)$ Responding to the rebound of over 2%, many bull certificates and call options rose significantly, among which $SG#XIAMIRC2512E.C (68702.HK)$ made a profit of over fifty percent.

On May 19th, Lei Jun, the founder, Director, and CEO of XIAOMI-W, announced through Weibo that on the 15th anniversary of Xiaomi's founding, the company officially launched its first self-developed flagship phone SoC Chip "XIAOMI玄戒O1", and revealed that a strategic new product launch event will be held on May 22nd at 7 PM, releasing multiple new products including the chip, phone, tablet, and the first SUV.

![]() Click to viewA beginner's guide to bull and bear certificates.>>

Click to viewA beginner's guide to bull and bear certificates.>>

Views from major banks.

HSBC: Continually reaching new highs. $POP MART (09992.HK)$ Not included in the Hang Seng Index, rebounded yesterday and broke the 200 Hong Kong dollar mark, both bullish and bearish can be noted. $HSPOMRT@EC2511B.C (16693.HK)$ / $HSPOMRT@EP2509A.P (16537.HK)$ 。

HSBC: Mobile device stocks have both dropped by about 3%. $SUNNY OPTICAL (02382.HK)$ And $AAC TECH (02018.HK)$ To seek a rebound, attention can be paid. $HS-SUNY@EC2509A.C (29883.HK)$ / $HS-AAC @EC2512B.C (14307.HK)$ 。

Editor/rice