For well-known institutional investors in the U.S. bond market, such as DoubleLine Capital, there seem to be only two attitudes towards 30-year U.S. Treasuries at present: either to avoid them as much as possible or to short them directly... These companies are avoiding the longest-dated U.S. government bonds in favor of shorter-term bonds that have lower interest rate risk but can still provide considerable returns.

On June 3, Financial Alliance reported (Editor: Xiaoxiang) that for well-known institutions investors like DoubleLine Capital in the U.S. bond market, there are seemingly only two attitudes left: $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ either to avoid it as much as possible or to directly short it...

Due to concerns about the expansion of the U.S. government's budget deficit and the worsening debt burden, operations by this investment firm led by "new bond king" Gundlach and renowned fixed income market investment organizations such as Pimco and TCW Group Inc. are similar: They are avoiding the longest-dated U.S. government bonds and instead favoring shorter-term bonds that have lower interest rate risk but can still provide considerable returns.

As government spending increases globally—from Japan to the United Kingdom and the United States—confidence in long-term bonds has weakened, and this shift from long bonds to short bonds has performed well this year. Last month, after S&P and Fitch, the last of the three major global rating agencies—Moody's—also stripped the U.S. of its Aaa sovereign credit rating.

As government spending increases globally—from Japan to the United Kingdom and the United States—confidence in long-term bonds has weakened, and this shift from long bonds to short bonds has performed well this year. Last month, after S&P and Fitch, the last of the three major global rating agencies—Moody's—also stripped the U.S. of its Aaa sovereign credit rating.

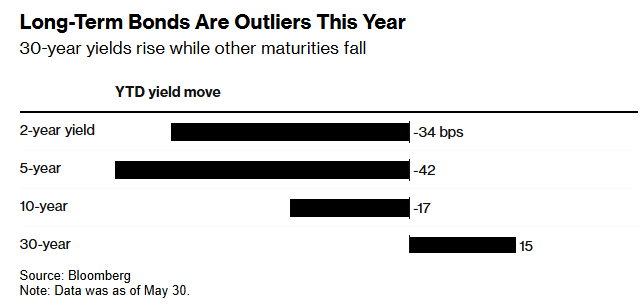

In fact, from the structure of the U.S. Treasury yield curve, the steepening phenomenon of the yield curve this year is becoming particularly obvious—30-year Treasury yields have continued to rise sharply, while yields on 2-year and 5-year Treasury bonds have actually declined.

As investors worry about the possibility of the U.S. government covering the deficit by issuing more bonds, the yield on 30-year U.S. Treasuries reached 5.15% last month, approaching the highest level since 2007. At the same time, the yield difference between 30-year U.S. Treasuries and 5-year U.S. Treasuries rose above 100 basis points for the first time since 2021.

This difference is extremely rare—the last full year in which this occurred was in 2001, which undoubtedly highlights the pressure faced by long-term bonds, as investors demand extra compensation to be willing to lend to the U.S. government for such long terms. The decline in long bonds is so severe that some have even begun to speculate that the U.S. Treasury might reduce or stop auctioning the longest-term bonds.

Avoid long bonds.

Richard McGuire, a strategist at the Dutch Cooperative Bank, stated, "We can certainly see why the long end of the U.S. Treasury yield curve is unpopular; the outlook for U.S. policy is too bleak to attract buyers for long-term U.S. Treasuries."

Bill Campbell, a portfolio manager at DoubleLine Capital, pointed out, "Where we can short directly, we are betting on a steepening yield curve, expecting long-term yields to rise relative to short-term yields. In other purely long strategies, we are essentially conducting a 'buyer strike' and shifting towards more investment in the intermediate part of the yield curve."

In fact, the fiscal situation in the U.S. prompted Pimco to call for caution regarding 30-year Treasuries as early as the end of last year, and the institution still holds an underweight stance on long-term bonds.

Mohit Mittal, Chief Investment Officer of the core strategy at the bond giant, stated that Pimco currently prefers the 5-year and 10-year areas of the U.S. Treasury yield curve and is focusing on non-U.S. bonds. "If there is a rebound in the bond market, we think it will be led by the 5-year to 10-year segment, rather than the long bonds," Mittal said.

Given that the U.S. Treasury has long sought stability in its debt auction plans, the increasing discussions on Wall Street about reducing 30-year Treasury auctions seem particularly unusual. Bob Michele, the global head of Fixed Income at JPMorgan Asset Management, stated last week that the way long-term bonds are currently traded is not seen by Wall Street as a risk-free asset, and the possibility of reducing or canceling auctions is very real.

"I don't want to be the person standing in front of the steamroller right now," Michele said in an interview. "I will let others help stabilize the long end. I worry that things will get worse before they get better."

A report from a strategist at TD Securities last week predicted that the U.S. Treasury might hint at a reduction in long-dated auctions as early as the refinancing announcement in August.

However, a spokesperson for the U.S. Treasury recently stated that the auction demand for bonds of all maturities is strong, and the government will adhere to its long-standing policy of issuing bonds in a "regular and predictable manner." In a statement on April 30, the U.S. Treasury also committed to maintaining stable auction sizes for long-term bonds and other maturities—at least for the next several quarters.

Looking ahead, it is foreseeable that a key test will arrive on June 12 — when the next 30-year U.S. Treasury auction will take place.

Recently, the auction days for long-term bonds of major economies have become an important "eye of the storm" for global markets. Last month in Japan, the long-term bond auction showed concerning signals regarding confidence in the country's longest-term government bonds, with the demand for a 40-year Japanese government bond issuance hitting the weakest level since last July, increasing the pressure on officials to reduce the issuance of such long-term bonds. Similarly, last month in the United States, the auction results for 20-year U.S. Treasuries were also sluggish, further intensifying concerns about the demand for long-term U.S. Treasuries.

Editor/rice