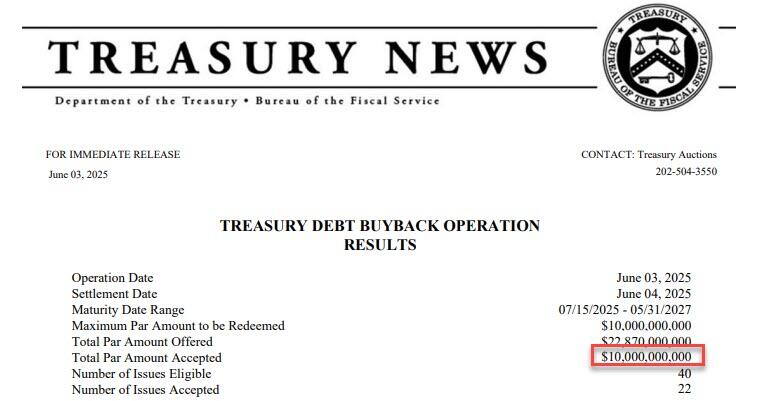

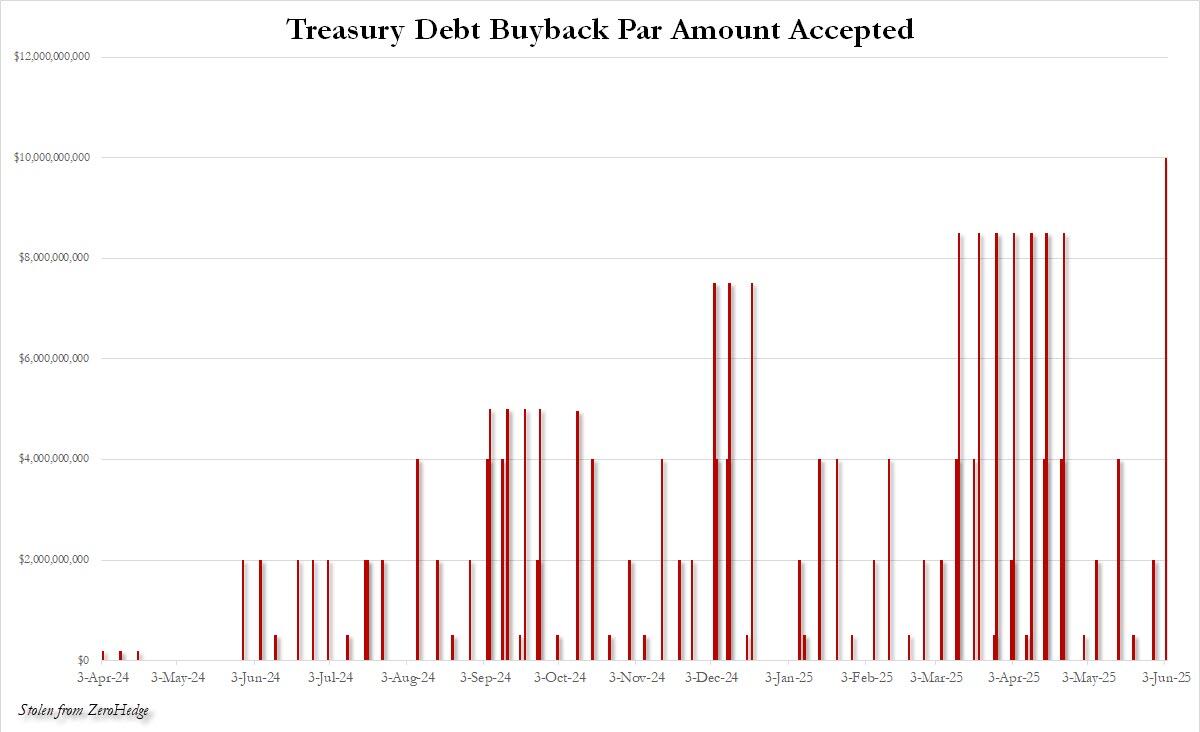

At 2 PM Eastern Time on Tuesday, the U.S. Treasury announced the results of its latest bond repurchase operation; although this operation itself is not surprising—this has been occurring almost weekly since April 2024—its scale reached unprecedented levels: up to 10 billion dollars, which is the largest single bond repurchase operation in the history of the U.S. Treasury.

According to Caixin News on June 4 (Editor: Xiaoxiang), as the Federal Reserve remains 'indifferent' in the face of the plummeting U.S. bonds, the U.S. Treasury seems to have no choice but to 'rescue' U.S. bonds on its own...

Let's turn the clock back six weeks: back on April 14, when U.S. bond yields soared after Trump's 'Liberation Day' tariff declaration—at that time, the market speculated that some overseas 'creditors' of the U.S. were dumping portions of their holdings of U.S. bonds to stabilize their national currencies, and this sell-off was exacerbated by a 2 trillion dollar basis trade being simultaneously closed out, Treasury Secretary Besant delivered a speech that was quite profound.

In that interview, in addition to revealing that he has breakfast with Powell every week and exchanges ideas, Besant also stated that if the Federal Reserve does nothing, he might take matters into his own hands—The U.S. Treasury has a 'large toolbox', one of which is to 'increase bond repurchase efforts'. At that time, Besant stated that this toolbox includes a government repurchase plan for old U.S. bonds in the market, and 'if necessary, we can significantly expand the scale of U.S. bond repurchases.'

In that interview, in addition to revealing that he has breakfast with Powell every week and exchanges ideas, Besant also stated that if the Federal Reserve does nothing, he might take matters into his own hands—The U.S. Treasury has a 'large toolbox', one of which is to 'increase bond repurchase efforts'. At that time, Besant stated that this toolbox includes a government repurchase plan for old U.S. bonds in the market, and 'if necessary, we can significantly expand the scale of U.S. bond repurchases.'

Now six weeks have passed: the Federal Reserve still remains "inactive," unwilling to take any measures to alleviate the predicament of U.S. Treasury Bonds, while the trading prices of U.S. Treasury Bonds continue to remain at dangerously high levels— $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ approaching the 5% level. It seems that the time for action, as believed by Basent, has arrived.

Sure enough, at 2 PM Eastern Time on Tuesday, the U.S. Treasury announced the results of its latest bond repurchase operation. Although this operation itself is not surprising—this has been occurring almost weekly since April 2024—its scale reached unprecedented levels: up to 10 billion dollars, which is the largest single bond repurchase operation in the history of the U.S. Treasury.

The U.S. Treasury initiated its first regular U.S. bond repurchase program since 2000-2002 in May last year, aimed at enhancing the liquidity of older bonds with lower trading activity. To date, similar operations have lasted for more than a year.

Historically, the Federal Reserve has usually been the main player in the U.S. Treasury bond market, conducting large-scale bond purchases in the secondary market as part of QE and other loose monetary policy operations. Many market participants have likened this bond repurchase action by the U.S. Treasury to 'light QE', as it essentially monetizes bonds in the open market, injecting funds into the market, similar to the Fed’s Permanent Open Market Operations (POMO), akin to stock buybacks.

It is worth mentioning that the last time the scale of U.S. Treasury bond repurchases approached Tuesday's amount was in mid to late April, when U.S. bonds also plummeted, and the Federal Reserve was reluctant to intervene, necessitating someone to step in to buffer the decline...

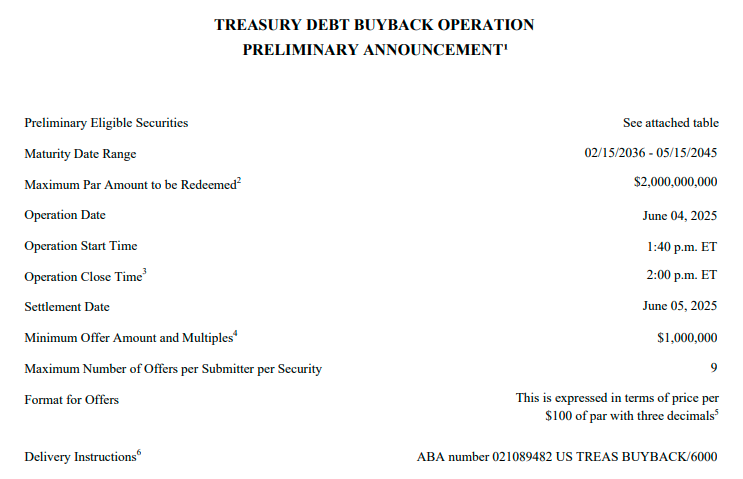

Although the bonds repurchased on Tuesday had a relatively short maturity range - maturing between July 15, 2025, and May 31, 2027, the repurchase operations for long-term bonds will also proceed vigorously.

What direction does the long-term bond repurchase represent?

On Tuesday, the U.S. Treasury also issued a preliminary announcement that a new round of long-term bond repurchases would be completed on Wednesday - focusing on U.S. Treasury bonds maturing between 2036 and 2045, which are 10-20 year bonds. The maximum repurchase amount is set at 2 billion dollars, consistent with the scale from last month.

Last month, the interest rate strategist at Industrial Bank predicted that the U.S. Treasury might further increase the scale of long-term bond repurchases, potentially up to 3 billion dollars, as a means to enhance liquidity. Barclays' U.S. interest rate research director Anshul Pradhan also anticipated that the repurchase plan might "become more flexible."

This action by the U.S. Treasury naturally raises significant speculation in the market: with the Federal Reserve "unhesitatingly lowering interest rates" two months before the election, but then "refusing to lower rates" as core personal consumption expenditures (PCE) fell to their lowest level since the COVID-19 crisis, will Bessenet ultimately intervene to control the bond market? Will the aggressive short-term bond issuance strategy of the Yellen era be replaced by Bessenet's active Treasury bond repurchase strategy until the Federal Reserve finally takes action...

Editor/rice