After the results of the 30-year U.S. Treasury auction were announced, the market reacted positively, with the 10-year U.S. Treasury yield falling to a day's low of 4.34%. However, analysts pointed out that the U.S. still faces significant pressure from the supply of long-term government bonds—due to the massive financing support needed for the "big and beautiful" spending plan promoted by Trump.

On Thursday local time, the U.S. Treasury auctioned $22 billion of 30-year government bonds. Overall, the auction was impressive, especially with strong demand from overseas bidders.

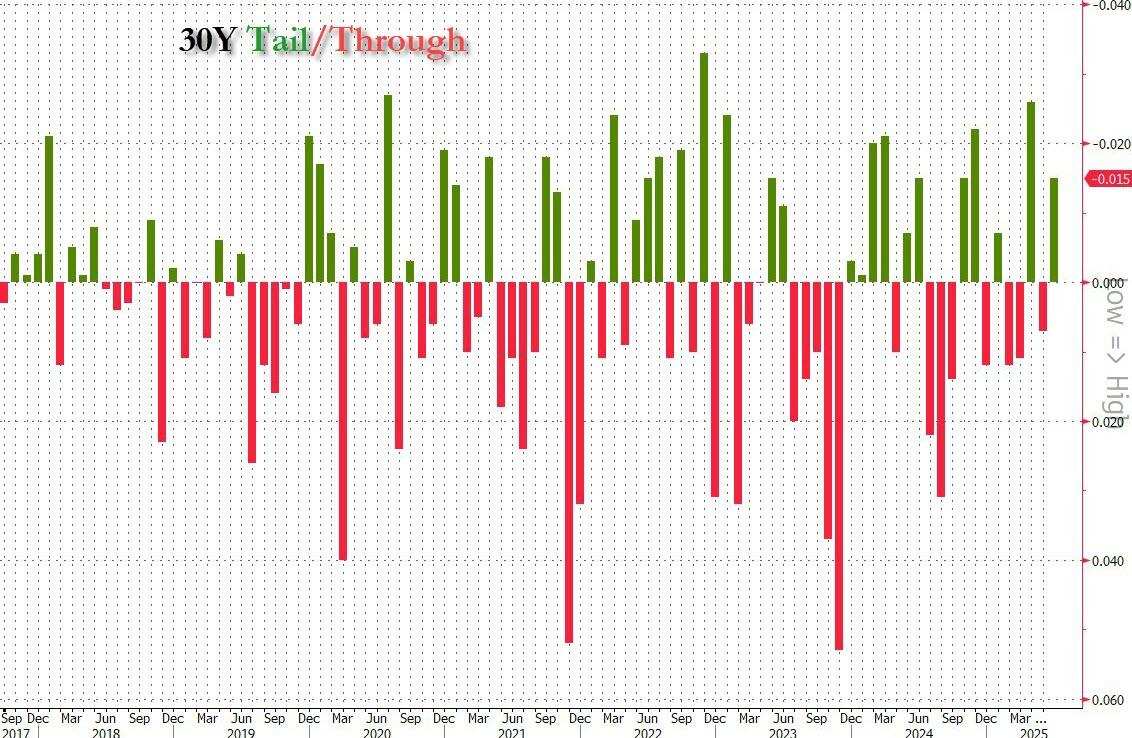

The winning bid rate for this 30-year U.S. Treasury auction was 4.844%, the highest since January of this year, compared to 4.819% on May 8. The winning bid rate was 1.5 basis points lower than the pre-issue rate of 4.859%, without producing a tail spread reflecting weak demand, whereas last month a tail spread of 2.6 basis points was produced. This auction's winning bid rate's difference from the pre-issue rate was also the second largest since November of last year.

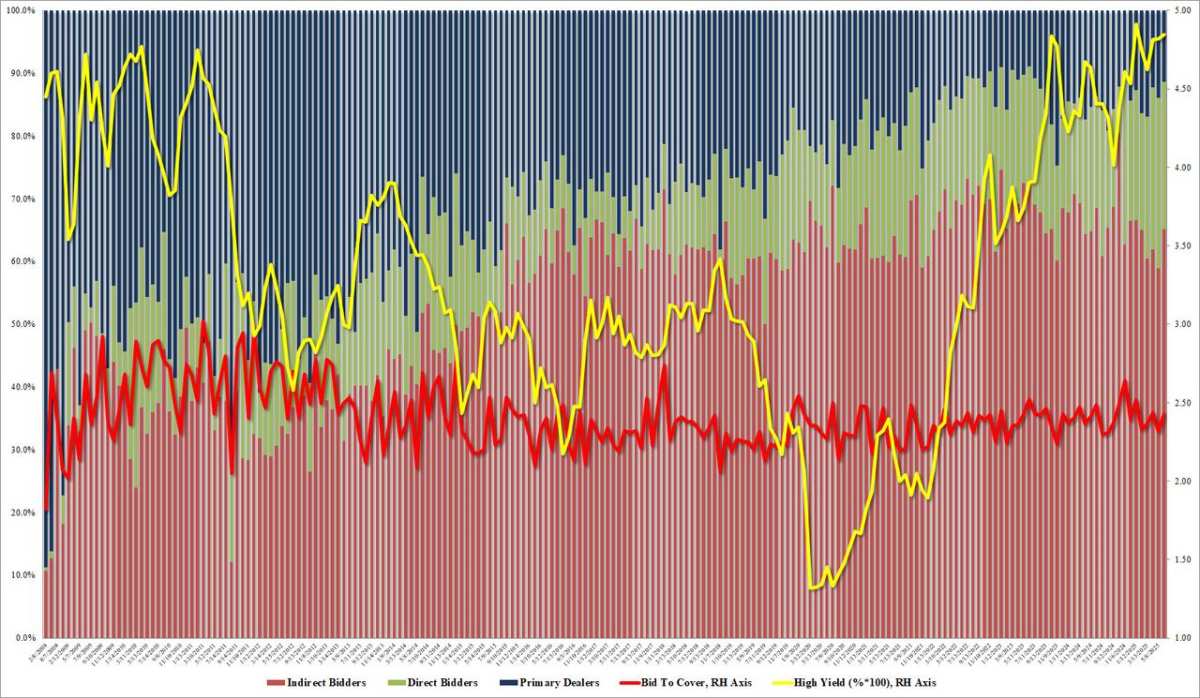

The bid-to-cover ratio for this auction was 2.43, the second highest since January, with the previous being 2.31. The average of the past six auctions was 2.392.

The bid-to-cover ratio for this auction was 2.43, the second highest since January, with the previous being 2.31. The average of the past six auctions was 2.392.

The market is most concerned about the internal data of the auction:

The indirect bid ratio was 65.2%, the highest since January, compared to last month's 58.9%. Indirect bidders typically include foreign central banks and other institutions participating through primary dealers or brokers, serving as a measure of overseas demand.

The direct bid ratio was 23.4%, lower than last month's 27.2% but higher than the recent average of 22.3%. Direct bidders include hedge funds, pension funds, mutual funds, insurance companies, banks, government institutions, and individuals, serving as a measure of domestic demand in the U.S.

As the "backstop" for all unsold supplies, primary dealers' allocation ratio for this auction was 11.4%, the lowest since November of last year, indicating that this auction had sufficient bids and did not require the primary dealers to provide support.

This week's U.S. Treasury auctions began with a modest 3-year Treasury auction, followed by a robust 10-year Treasury auction yesterday, and the 30-year long-term Treasury auction on Thursday is the last and most challenging auction of the week. The final auction results alleviated market concerns.

After the results of the 30-year Treasury auction were released, the market reacted positively, $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ which briefly dipped to an intraday low of 4.34%, lower than the levels prior to last week's strong non-farm payroll report, although it subsequently rebounded.

However, analysts pointed out that despite the excellent performance of this auction, the U.S. still faces a significant pressure of long-term Treasury supply—because the "big and beautiful" spending plan promoted by Trump still requires substantial financing support.

Is investing always stepping on a landmine?Futubull AI is now online!Providing precise answers, comprehensive insights, and grasping key opportunities!

Editor/Rocky