On Wednesday local time, the U.S. Treasury Department released the highly anticipated International Capital Flow Report (TIC) for April 2025. In this month when U.S. government bonds experienced rare fluctuations, the movements of U.S. overseas "creditors" were also revealed...

The TIC report shows that in April, the scale of U.S. Treasury bonds held by foreign investors decreased slightly from the historical high level, indicating that despite the severe impact of Trump's erratic tariff policies on the market, overseas "creditors" of the U.S. had not yet engaged in massive selling that month...

Data shows that in April, the scale of U.S. Treasury bonds held by foreign investors fell from a historic high of $9.049 trillion in March to $9.013 trillion, marking the first decline in five months. Analysts pointed out that this decline mainly reflects foreign private investors net selling U.S. bonds, whereas foreign official institutions remained net buyers of long-term U.S. bonds.

Prior to this, some market participants had expected a significant decrease in the total holdings of U.S. bonds by foreign investors. The strategy team at JPMorgan, led by Jay Barry, had anticipated that the Shareholding would mainly come from foreign private investors rather than the official sector — which aligns closely with the situation ultimately revealed by the data.

Prior to this, some market participants had expected a significant decrease in the total holdings of U.S. bonds by foreign investors. The strategy team at JPMorgan, led by Jay Barry, had anticipated that the Shareholding would mainly come from foreign private investors rather than the official sector — which aligns closely with the situation ultimately revealed by the data.

Regarding whether people are truly concerned about a large-scale wave of selling U.S. bonds, CreditSights' investment-grade and macro strategy head, Zachary Griffiths, stated, "What we see from the data does not actually support that," noting that "the overall wave of selling remains relatively mild."

After Trump announced the "liberation day" tariffs on April 2, the U.S. stock market experienced a significant decline — such turmoil typically raises demand for U.S. Treasury bonds as a safe haven. However, the situation at that time was not as expected — in the week following the trade policy shock, U.S. Treasury bonds recorded the largest drop in over twenty years. Along with the sharp decline of the dollar, the triple hit in the U.S. stock, bond, and currency markets raised concerns about a massive withdrawal of foreign investors from U.S. assets.

U.S. Treasury Secretary Bessent downplayed the market's downward trend in April, attributing the volatility in Treasury bonds to a deleveraging wave among specific investors. He repeatedly stated that the data he was aware of indicated a continued demand from foreign investors for U.S. debt.

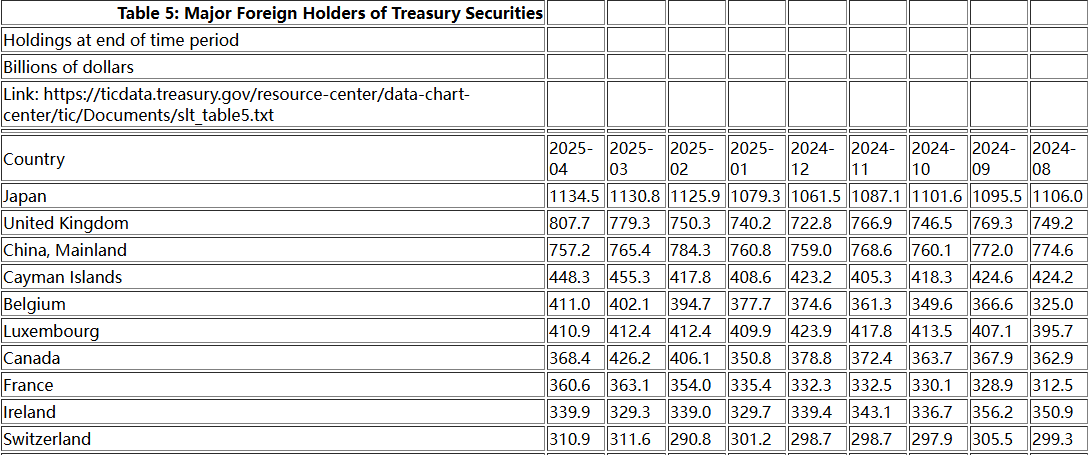

The movements of overseas 'creditors' of the United States.

Specifically, among the top ten overseas 'creditors' of the United States, six (China, Cayman Islands, Luxembourg, Canada, France, Swiss Franc) experienced a decrease in their holdings, while four (Japan, United Kingdom, Belgium, Ireland) saw an increase.

As the largest overseas 'creditor' of the United States, Japan's holdings of U.S. Treasury bonds slightly increased by 3.7 billion USD in April, marking the fourth consecutive month of increase, reaching 1.1345 trillion USD. Since surpassing China in June 2019, Japan has been the largest overseas holder of U.S. Treasury bonds.

The second largest holder of U.S. Treasury bonds, the United Kingdom, also increased its holdings by 28.4 billion USD in April, reaching 807.7 billion USD. In March, the UK’s holdings of U.S. Treasury bonds first exceeded those of China since October 2000.

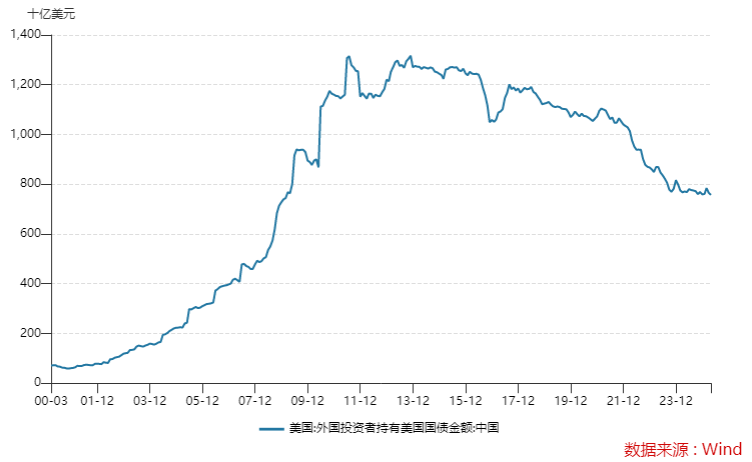

China's holdings of U.S. Treasury bonds decreased by 8.2 billion USD in April, down to 757 billion USD, further setting a new low since 2009. Since April 2022, mainland China's holdings of U.S. Treasury bonds have been below 1 trillion USD.

In April, the country that reduced its U.S. Treasury bond holdings the most among major overseas 'creditors' was Canada, whose holdings fell significantly by 57.8 billion USD, down to 368.4 billion USD. The Cayman Islands, regarded as a popular registration location for hedge funds and other leveraged investors, saw its holdings decreased by 7 billion USD.

In addition to U.S. Treasury bonds, the report on Wednesday also indicated that foreign investors were net sellers of long-term U.S. institutional bonds (including debt from Fannie Mae and Freddie Mac) and Stocks, while they were net buyers of long-term U.S. corporate bonds.

Overall, the changes in holdings of U.S. Treasury bonds by foreign investors in April were relatively stable, indicating that the motivation for investors to withdraw from long-term U.S. Treasury bonds that month likely came primarily from domestic U.S. investors rather than overseas investors.

However, regarding the US bond market, although yields have generally stabilized in recent weeks, the trend of the longest-term Bonds still shows concerns about the large-scale borrowing by the US government. Republican lawmakers have been pushing a tax-cut bill, which is expected to push federal government debt to a record high in the coming years. Issues of fiscal sustainability especially undermine the rationale for purchasing the longest-term government Bonds.

Meghan Swiber, a US interest rate strategist at the Bank of America, stated that according to the Federal Reserve's weekly custody data, there is still some evidence suggesting that foreign officials may have reduced their holdings of US Treasury Bonds.

Swiber noted that the custody data indicates that since late March, foreign official institutions have sold approximately $63 billion worth of US Treasury Bonds. The continued sell-off during May and June may mean that subsequent TIC data could show more capital outflows.

Editor/melody