The first half of 2025 has been monumental, with opportunities and risks coexisting in the global investment market — DeepSeek emerging, Trump's tariff policies, and conflicts in the Middle East... mooers are both participants in the Capital Markets and witnesses to a great era.

Looking back, consolidating experience, feel free to subscribe to the special topic.2025 Exclusive Mid-Year Review, may all our efforts in the first half of the year lay the groundwork for surprises in the second half.

In the first half of 2025, the U.S. stock market staged a dramatic 'V-shaped' reversal amidst the backdrop of DeepSeek, Trump's tariffs, and geopolitical conflicts.

At the beginning of this year, China's AI model DeepSeek made waves in the U.S. market. After the "reciprocal tariff" policy caused a sharp decline in U.S. stocks in early April, with some tariffs paused and a China-U.S. trade agreement reached, the U.S. stock market has continually rebounded, and as of now, the three major Indexes have basically recovered their declines for the year. $Dow Jones Industrial Average (.DJI.US)$ Increased by 1.28%, $Nasdaq Composite Index (.IXIC.US)$ Increased by 3.12%,$S&P 500 Index (.SPX.US)$Increased by 3.58%.

At the beginning of this year, China's AI model DeepSeek made waves in the U.S. market. After the "reciprocal tariff" policy caused a sharp decline in U.S. stocks in early April, with some tariffs paused and a China-U.S. trade agreement reached, the U.S. stock market has continually rebounded, and as of now, the three major Indexes have basically recovered their declines for the year. $Dow Jones Industrial Average (.DJI.US)$ Increased by 1.28%, $Nasdaq Composite Index (.IXIC.US)$ Increased by 3.12%,$S&P 500 Index (.SPX.US)$Increased by 3.58%.

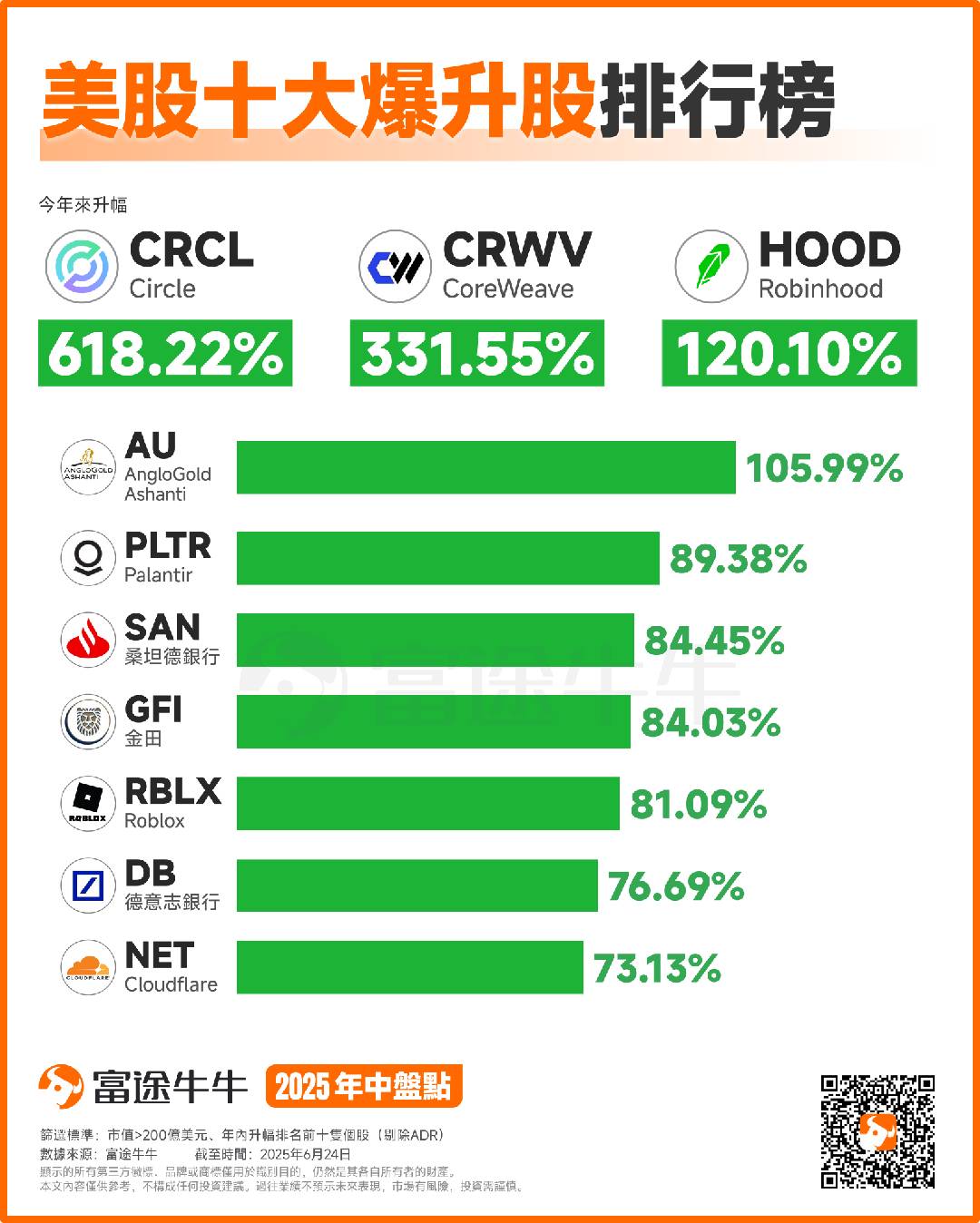

Among the top ten explosive stocks this year, U.S. newly listed stocks have performed outstandingly, with the first stock of stablecoins listed in June. $Circle (CRCL.US)$ The stock price surged ahead, skyrocketing from $31 to nearly $300 at one point, an increase of over 618% since its debut. In June, the U.S. Senate passed the GENIUS Act, which is analyzed to be a milestone victory for stablecoins and even crypto assets, marking the entry of the digital assets industry into a new era. "NVIDIA's darling" $CoreWeave (CRWV.US)$ The stock price has surged astonishingly, having increased by 331.55% since its listing.

Amid geopolitical risks and Trump's tariff policies causing severe fluctuations in global markets, Gold prices broke through $3,500 to reach a historic high, and have so far increased by approximately 27%. As a result, Gold stocks in the US have strengthened. $AngloGold Ashanti (AU.US)$ 、 $Gold Fields (GFI.US)$ Since the beginning of the year, they have accumulated gains of over 105% and 84%.

AI Industry Chain stocks continue to rise, with "AI + military" stocks.$Palantir (PLTR.US)$ With an increase of nearly 90% this year, the ongoing escalation of geopolitical tensions further drives up global military spending, benefiting from the increase in global defense expenditures and the application of AI technology in the military field. "AI + Cybersecurity" stocks. $Cloudflare (NET.US)$ Increased by over 73% this year.

The European Central Bank continues a loose monetary policy in the first half of the year, having lowered interest rates eight times since starting rate cuts in June of last year. $Banco Santander (SAN.US)$ And $Deutsche Bank (DB.US)$ Increased by 84% and 76% respectively.

In addition, providing JIAOYIHUOBI services for Cryptos. $Robinhood (HOOD.US)$ The stock price surged 120% this year for the social gaming platform. $Roblox (RBLX.US)$ It has accumulated over 81% increase this year.

It is noteworthy that the ‘Seven Giants’ in the US stock market, which performed brilliantly last year, have shown divergence this year. $Meta Platforms (META.US)$ In the first half of this year, it continued its upward trend with an increase of nearly 22%; $Microsoft (MSFT.US)$ 、 $NVIDIA (NVDA.US)$ Both have risen by over 16% and 10% respectively this year, still competing for the title of the "top company" by Market Cap. $Apple (AAPL.US)$ This year, it has dropped nearly 20%, becoming the worst-performing company among the "seven giants."

In addition, there are other companies among the "seven giants" that have significantly lagged behind. $Tesla (TSLA.US)$ Due to Musk's enthusiasm for political and stance issues, there have been many instances of boycotts and vandalism against Tesla, causing the company's stock price to suffer, with a drop of over 40% at one point in the year. Since Musk's 'return' to the company, Tesla's stock price has significantly rebounded, especially after the recent debut of Robotaxi, where the stock surged over 8% on the first day. As of now, Tesla's decline for the year has narrowed to over 15%.

$Netflix (NFLX.US)$The stock price constantly sets new historical highs, rising over 43% during the year; the semiconductor giant. $Broadcom (AVGO.US)$ 、 $Taiwan Semiconductor (TSM.US)$ Bottom-out rebound, rising over 14% and 12% respectively during the year.

Morgan Stanley's U.S. stock strategy report published in June 2025 indicates that despite policy tightening pressures in the first half of 2025, the U.S. stock market will enter a relatively more optimistic scenario in the second half of 2025 and through 2026, reaffirming the 12-month target for the S&P 500 Index at 6,500 points. The firm noted that at the beginning of the year, the market was expected to be challenged by a "risk-averse" policy tone in the first half, and although tariff-related growth resistance exceeded expectations, a market price low may have already been reached. In terms of investment recommendations, Morgan Stanley advises sticking to a "high-quality curve" in cyclical industries; defensive hedges should remain selective, focusing on low-leverage, low-valuation stocks.

Finally, Futu News brings you a benefit for fans!Just pick up > >