The first half of 2025 is considered one of the most challenging periods for investors.

The market has been fluctuating violently amidst historic declines, sharp rebounds, and news-driven shocks —$S&P 500 Index (.SPX.US)$which once plunged 12% within two days. $CBOE Volatility S&P 500 Index (.VIX.US)$ soared above 45. Panic trading was triggered, then reversed within days.

Behind what seems to be systemic risk lies a brand new volatility mechanism — its driving force stems more from political maneuvering than from fundamentals. The core of this mechanism is the political 'shock-reversal', particularly the aggressive tariff increases based on the International Emergency Economic Powers Act (IEEPA) during the period when Trump declared the fentanyl issue a 'national emergency'.

Over the past six months, events such as escalating trade frictions, regulatory relaxations, power struggles among tech giants, and shifts in cryptocurrency policy have consecutively impacted the market, each time causing short-term chaos followed by equal force rebounds. Now, investors succinctly summarize this pattern with an acronym: 'TACO' — Trump Always Chickens Out, and the market is increasingly pricing in this expectation.

Over the past six months, events such as escalating trade frictions, regulatory relaxations, power struggles among tech giants, and shifts in cryptocurrency policy have consecutively impacted the market, each time causing short-term chaos followed by equal force rebounds. Now, investors succinctly summarize this pattern with an acronym: 'TACO' — Trump Always Chickens Out, and the market is increasingly pricing in this expectation.

From tariff shocks to the relaxation of Cryptos, from AI subsidies to private grievances with Musk: the past six months have redefined the market's way of digesting policy noise. Below we break down four key events that frequently fluctuate, rebound closely, and repeat patterns.

Tariffs: initial shock, followed by rebound.

Trump's trade strategy was rapid and tough: starting from February 4, the U.S. imposed a 25% tariff on goods from Canada and Mexico under the pretext of a fentanyl emergency, and a 10% tariff on Chinese goods; on February 13, the White House issued a memorandum requiring the establishment of 'reciprocal tariffs' by nation; by March 2, the tariff scope expanded to imports of steel and Aluminum; on March 4, the tariff on Chinese goods doubled from 10% to 20%.

On March 27, Trump imposed a 25% tariff on all imported cars, shocking the automotive market, leading to a sharp drop in European and Japanese car stocks, a sell-off of the yen and euro, while domestic U.S. car stocks briefly rose. From March 29 to April 1, analysts from Morgan Stanley and Citigroup lowered global automotive industry profit expectations by 7-10%.

This tariff war peaked on April 2 (referred to as 'Liberation Day') — the U.S. announced a uniform 10% tariff on all imported goods. On April 3. $S&P 500 Index (.SPX.US)$ A drop of 6.65%, followed by another drop of 5.97% on April 4, erasing a decline of 12.2% which wiped out more than 6.6 trillion dollars in global market cap. $CBOE Volatility S&P 500 Index (.VIX.US)$ Soared to 45.31, the highest since March 2020.

Then the first "TACO moment" arrives: on April 9, the Trump administration announced a 90-day suspension of tariffs, overturning the previously promised tariff escalation plan. The market welcomed a record rebound: the S&P 500 Index surged 9.5% in a single day, marking one of the strongest rebounds since the war; on April 12, with Chinese trade officials arriving in the U.S. to start ceasefire negotiations, the market's upward momentum continued.

On May 12, China and the U.S. reached a 90-day temporary ceasefire agreement; however, on May 28, the U.S. International Trade Court ruled that tariffs based on IEEPA were illegal, opening another "TACO chapter" - although the government vowed to appeal, no new tariff escalation measures were introduced. On June 4, tariffs on steel and aluminum doubled to 50%, causing market fluctuations once again, but many fund managers took the opportunity to buy at low prices.

On June 13, officials from the U.S. Trade Representative's Office hinted that there might be exemptions for rare earth and semiconductor inputs to "protect domestic innovation capabilities", which the market viewed as a signal for the de facto cancellation of tariffs - another "TACO" was unfolding.

Core conclusion: Trump's tariff actions are destructive, but only temporary. Once he retracts his orders (which he often does), the market will rebound rapidly.

Musk vs. Trump: a private feud impacting the market.

At the beginning of Trump's term, Musk was a prominent ally: he attended the inauguration on January 20 and was appointed to lead the newly established Department of Government Efficiency (DOGE). Investors expected that Musk's relationship with Trump would bring about Bullish policies, causing Tesla's stock price to soar, and by January 25, its Market Cap exceeded 1 trillion dollars.

On February 5, Musk began internal audits across federal departments; on February 11, he appeared at the White House, defending the layoffs and restructuring plans while standing next to Trump; on February 22, the U.S. Department of Justice launched an investigation into employment lawsuits related to DOGE.

On March 6, Trump informed Cabinet members that DOGE would "take over" non-compliant departments, escalating tensions between the two; on March 11, Trump held a media event on the South Lawn, showcasing Tesla's Cybertruck, claiming he had bought the vehicle, and the next day. $Tesla (TSLA.US)$ the stock price rose by 4.3%.

In April, cracks began to appear in the alliance: Musk's close relationship with Trump drew criticism from consumers and progressive lawmakers, and on April 1, an organized protest erupted outside Tesla stores; from April 10 to 20, Tesla's stock price fell by 21%, driven by market sentiment rather than performance.

On May 18, Tesla's first quarter Earnings Reports revealed a slowdown in market growth in Europe and California, exacerbating market concerns; it wasn't until May 27 that Musk broke his silence in an interview with CBS, criticizing Trump’s financial plan as "reckless," and on May 29, he resigned from his White House position; on June 3, he called on Congress to "veto the bill" on X.

On June 4, Trump retaliated by calling Musk a "traitor," threatening to cancel government subsidies and terminate federal contracts; on June 5, Tesla's stock price plummeted by 14%, evaporating 150 billion dollars in Market Cap, and reports surfaced that NASA had paused new SpaceX missions due to "budget adjustments," adding to the impact.

From June 6 to 9, Trump continued to escalate conflicts, while Musk responded that SpaceX would retire the "Dragon" spaceship fleet ahead of schedule; however, on June 10, another "TACO moment" occurred: Trump spoke with Musk, praising his "vision" and hinting at resolving differences; on June 14, Musk stated at a technology conference, "I never bet against the resilience of America," leading to a stabilization in Tesla's stock price.

Core conclusion: The Musk incident reveals how Trump's personal and political unpredictability shakes the market, but likewise, reversals always occur. In the "TACO world", even private grudges are rarely permanent.

Cryptos: Potential opportunities in the undercurrents.

Trump's second term unexpectedly favors digital assets: On January 23, Executive Order No. 14178 prohibited central bank digital currency in the U.S. and reaffirmed the digital autonomy of the private sector. $Bitcoin (BTC.CC)$ It surged by 3%.

On March 6, Executive Order No. 14233 announced the establishment of a strategic Bitcoin reserve, halting government auctions of seized Bitcoins, which drove up Bitcoin by 4.2%.

On March 7, the Department of Justice disbanded the cryptocurrency enforcement task force, and the SEC suspended enforcement actions not related to fraud, leading to a nearly 13% increase in the total market cap of cryptocurrencies since the beginning of the year by April 10.

On April 21, Trump appointed the famous liberal and market deregulator Paul S. Atkins as the SEC chairman, and the news of a "crypto-friendly" chairman drove$Coinbase (COIN.US)$stock prices soaring.

On May 27, the Trump Media and Technology Group announced that Bitcoin would be included on its balance sheet and supported the launch of a Currency ETF, further boosting bullish sentiment; on June 17, the import duties on mining machines raised concerns among American miners, but Bitcoin remained resilient.

Core conclusion: Although Trump speaks harshly, the policies benefit from deregulation measures for Cryptos, even the tariffs on mining hardware couldn't stop the upward trend.

Artificial Intelligence and Technology: Navigating between subsidies and tariffs.

On January 21, Trump announced the "Stargate AI Initiative," a $500 billion public-private partnership aimed at building domestic AI infrastructure in the U.S. The first $100 billion of funding was provided by$Oracle (ORCL.US)$, OpenAI, $Metagenomi Technologies (MGX.US)$ And $SoftBank Group (ADR) (SFTBY.US)$Support from enterprises for data centers, training clusters, and federal AI procurement pipelines. Overall, this announcement pertains to industrial technology andReal Estate Investment Trust(REIT) The sectors bring positive sentiment, involving AI infrastructure and large-scale data construction.

However, clarity in policy quickly gave way to protectionist pressures: In mid-February, Commerce Secretary Howard Lutnick announced the impending imposition of Section 232 tariffs on electronics and semiconductors; on March 15, the tariffs officially took effect, including taxes on rare earth components and GPUs. $NVIDIA (NVDA.US)$ , Super Micro Semiconductor and$Super Micro Computer (SMCI.US)$Wait for Stocks to drop by 7-10% within two weeks. $NASDAQ 100 Index (.NDX.US)$ Drop by approximately 3.5%.

In April, the market stabilized: with delays in law enforcement and discussions on exemptions, Technology stocks rebounded; on May 13, Trump secured a joint investment commitment of 600 billion dollars from Saudi Arabia, with 20 billion dollars allocated for domestic AI data centers and 80 billion dollars for chip manufacturing, AI modeling centers, and cloud infrastructure, from May 14 to 17. $NASDAQ 100 Index (.NDX.US)$ Rose by 2.2%, led by AI-related Stocks.

From the end of May to June, foreign capital surged into US AI Real Estate and Infrastructure Stocks; however, on June 21, the US initiated a national security review of foreign holdings in US cloud infrastructure, raising concerns among investors about the Gulf funds' ability to maintain control under new restrictions, resulting in a 1.9% intraday drop in the NASDAQ 100 Index.

Core conclusion: Despite facing intermittent tariff resistance, the strategic push for AI dominance in the U.S. and the capital support behind it remain powerful structural Bullish factors. Institutional investors believe that the 'Stargate AI Plan' is not only a political tool but also a capital-intensive national priority that may define America's technological leadership over the next decade.

TACO: A safety net for the market?

Although the acronym TACO (Trump Always Cuts Off) was initially trader slang, it has now become a market creed: investors are no longer as fearful of Trump's initial threats as they used to be when worried about actual actions—and he rarely follows through on those threats. From tariffs, technology grievances, Medical assaults to foreign policy impacts, the pattern remains clear: create maximum noise, cause brief disruptions, and ultimately back off.

The market does not need Trump to be dovish, just for him to concede—and he often does. From pausing tariffs to rescinding executive orders, and then suddenly calling for a ceasefire, the government has formed a rhythm of 'escalate-retreat.' As long as the TACO model persists, volatility is more noise than signal, and Institutions have adjusted their strategy accordingly.

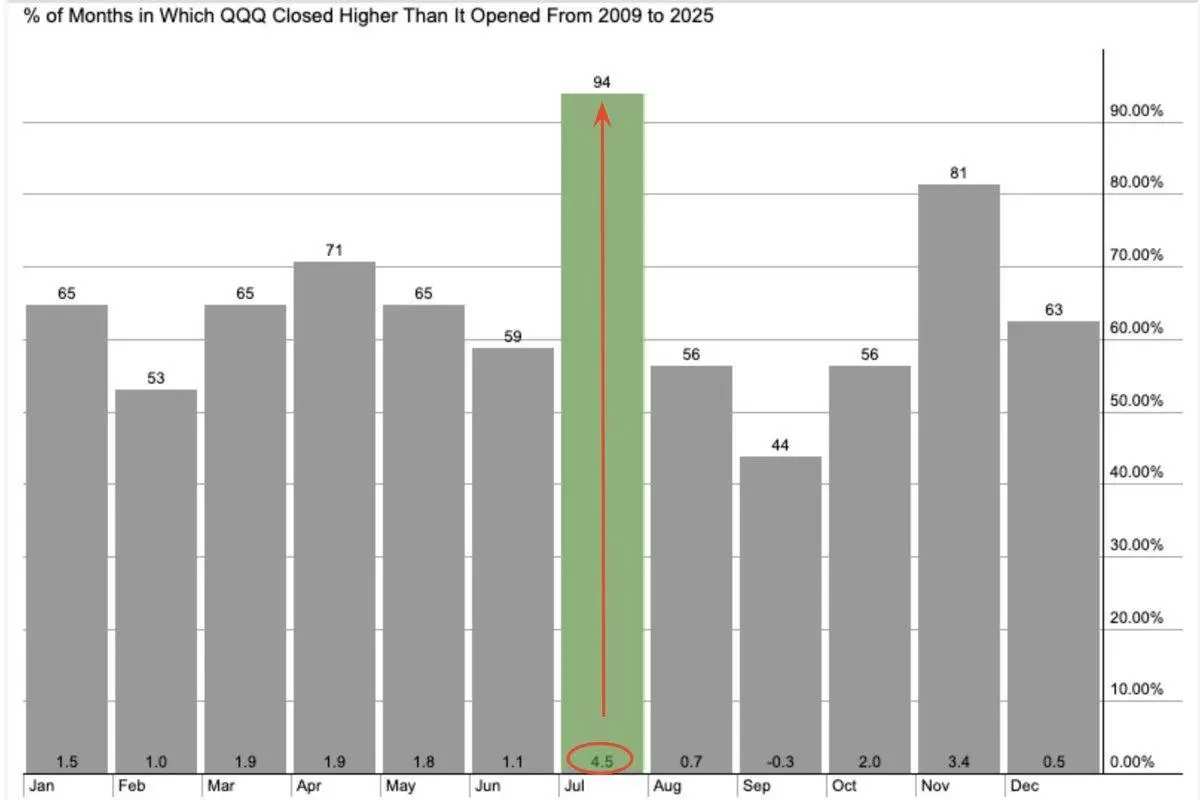

As Trump's strategy becomes increasingly predictable, the historical upward momentum from July is beginning to kick in, and market momentum seems to be gathering: the S&P 500 Index is just 1% away from its historical high, and seasonal factors suggest that the breakout window is not only open but also expanding.

The real question is not whether it can reach new highs, but how quickly it can hit those new highs.

![]() Finally, Futu News brings you a benefit for fans!Just pick up > >

Finally, Futu News brings you a benefit for fans!Just pick up > >

编辑/zhenyuyong、joryn