Looking back at the first half of the year, the experience of the U.S. stock market can be described as tumultuous: at the beginning of the year, the impact of DeepSeek on tech stock valuations, the disturbance of market liquidity by the "Eastern Rise and Western Fall Theory," along with escalating geopolitical conflicts and the economic recession and stagflation risks triggered by the trade war, led to severe fluctuations, once resulting in the "triple kill" of stocks, bonds, and currencies.

However, the market has shown remarkable resilience amidst a series of black swan events, with the Nasdaq hitting a year-low on April 7 and quickly rebounding. By June 30, in just over two months, $Nasdaq Composite Index (.IXIC.US)$it had risen by 30.55%, $S&P 500 Index (.SPX.US)$ also recording a 22.57% increase. Such a rapid recovery momentum has led even Bessent to remark that it is one of the fastest rebound markets in U.S. stock market history.

So which companies are driving the Nasdaq and S&P 500 Index to new highs?

Futu News has compiled a list of "constituent stocks that have propelled the Nasdaq Composite Index and S&P 500 Index to new heights" for mooer reference.

Futu News has compiled a list of "constituent stocks that have propelled the Nasdaq Composite Index and S&P 500 Index to new heights" for mooer reference.

Specifically, within the components of the Nasdaq Composite Index, the companies "with a Market Cap over 10 billion USD and have ranked in the top 10 for growth since April 7" are as follows:

$CoreWeave (CRWV.US)$、$Credo Technology (CRDO.US)$、$NEBIUS (NBIS.US)$、$Robinhood (HOOD.US)$、$AeroVironment (AVAV.US)$ 、$AST SpaceMobile (ASTS.US)$、$Symbotic (SYM.US)$、$Rocket Lab (RKLB.US)$、$Coinbase (COIN.US)$、$Seagate Technology (STX.US)$。

$CoreWeave (CRWV.US)$: A deep integrator of NVIDIA GPU resources, one of the earliest cloud service providers to deploy Blackwell architecture chips, has signed long-term contracts with giants such as OpenAI, Microsoft, and META, ensuring significant revenue visibility. The company's revenue in the first quarter increased by 420% year-on-year, thanks to the robust capital expenditure by hyperscale computing firms.

$Robinhood (HOOD.US)$ Since April 7, the increase has been 171.31%. The company recently launched a series of major cryptocurrency product offerings, including: providing tokenized US stock and ETF trading; opening cryptocurrency perpetual contract trading functionality with up to 3x leverage; and launching $Ethereum (ETH.CC)$ 和$Solana (SOL.CC)$staking services. In addition, there are plans to develop a brand new Layer 2 blockchain network, specifically designed for the settlement of tokenized assets and 24/7 trading.

$AeroVironment (AVAV.US)$ AeroVironment: the largest drone supplier to the US military, specializing in the manufacturing of drone systems, is likened by CNBC commentator Jim Cramer to be the next "Palantir of hardware." Jim Cramer pointed out that NATO allies agreed to raise the defense spending target to 5% of GDP, and AVAV is expected to be the biggest beneficiary. Previously, the company announced its fourth fiscal quarter and full-year earnings report, where revenue, order volume, and profits all reached new highs, mainly benefiting from the surge in demand for unmanned systems and loitering munitions.

Among the S&P 500 Index constituents, the companies with a "Market Cap of over 10 billion USD and the top 10 increases since April 7" are as follows:

$Coinbase (COIN.US)$、$Seagate Technology (STX.US)$、$Western Digital (WDC.US)$、$Vistra Energy (VST.US)$、$Microchip Technology (MCHP.US)$、$GE Vernova (GEV.US)$、$NRG Energy (NRG.US)$、$Micron Technology (MU.US)$、$Constellation Energy (CEG.US)$、$Broadcom (AVGO.US)$。

$Broadcom (AVGO.US)$ The company has core advantages in custom AI chips and high-speed data exchange chips. The latest earnings report shows that sales of custom AI chips are expected to account for 70% of total AI semiconductor revenue in the second quarter. JPMorgan considers this its top choice in the semiconductor coverage field, mainly bullish on its leading position in AI infrastructure, diversified terminal market layout, industry-leading gross margin, operating profit margin, and free cash flow profit margin.

$Micron Technology (MU.US)$ The largest storage chip manufacturer in the United States, the company's recently announced fourth quarter results and profits exceeded market expectations, mainly due to the surge in demand for high-performance storage driven by AI development tools. In addition to expanding revenue in the AI sector, Micron is also actively laying out its storage business in emerging markets such as electric vehicles and gaming chips.

$GE Vernova (GEV.US)$ The American electric power giant is an energy technology company completely spun off from the industrial giant General Electric in April 2024, focusing on three main sectors: energy, wind power, and grid systems. Currently, the U.S. government is promoting the upgrade of the AI industry's power supply system, emphasizing the acceleration of nuclear power and supporting grid system construction.

Outlook for the future: How will the U.S. stock market perform in the second half of 2025?

CITIC Research believes that the shift in fiscal policy and the easing of tariffs are continuously enhancing the medium-term visibility of the U.S. economy, combined with the operating cycle of the Technology sector, which is still in an upward phase, as well as the current low holdings of domestic investment institutions in U.S. tech stocks, looking at the performance of U.S. tech stocks in the next 6 to 12 months.

Morgan Stanley's Chief Investment Officer Mike Wilson expects that the performance of the U.S. stock market in the second half of this year will be more stable than in the first half. The firm has set a year-end target price of 6500 points for the S&P 500 Index, approximately 5% higher than the current level. It believes that the reduction in tariff rates has significantly lowered the risk of recession, the market bottomed during the "Liberation Day sell-off," and more and more companies are raising their profit forecasts, which is a major sign of market optimism.

Hussein Malik, Global Research Head at JPMorgan, expects the U.S. economy to slow down in the second half of the year; however, with the deepest concerns related to the trade war dissipating, a recession is unlikely. As inflation remains high, interest rates will stay elevated for a longer period, with expectations that the Federal Reserve will cut rates by 100 basis points between December and Spring 2026, bringing the final rate down to 3.5%. The firm’s year-end target price for the S&P 500 Index is set at 6000 points.

Wells Fargo & Co's Chief Investment Officer Darrell Cronk believes that multiple bullish factors may drive U.S. stocks to achieve new highs before the end of the year. The market should not be overly concerned about the economic outlook, as inflation is moving toward normalization, and the easing of regulatory policies will benefit businesses, particularly small and medium enterprises. The firm predicts that the S&P 500 Index will end the year between 5900 and 6100 points.

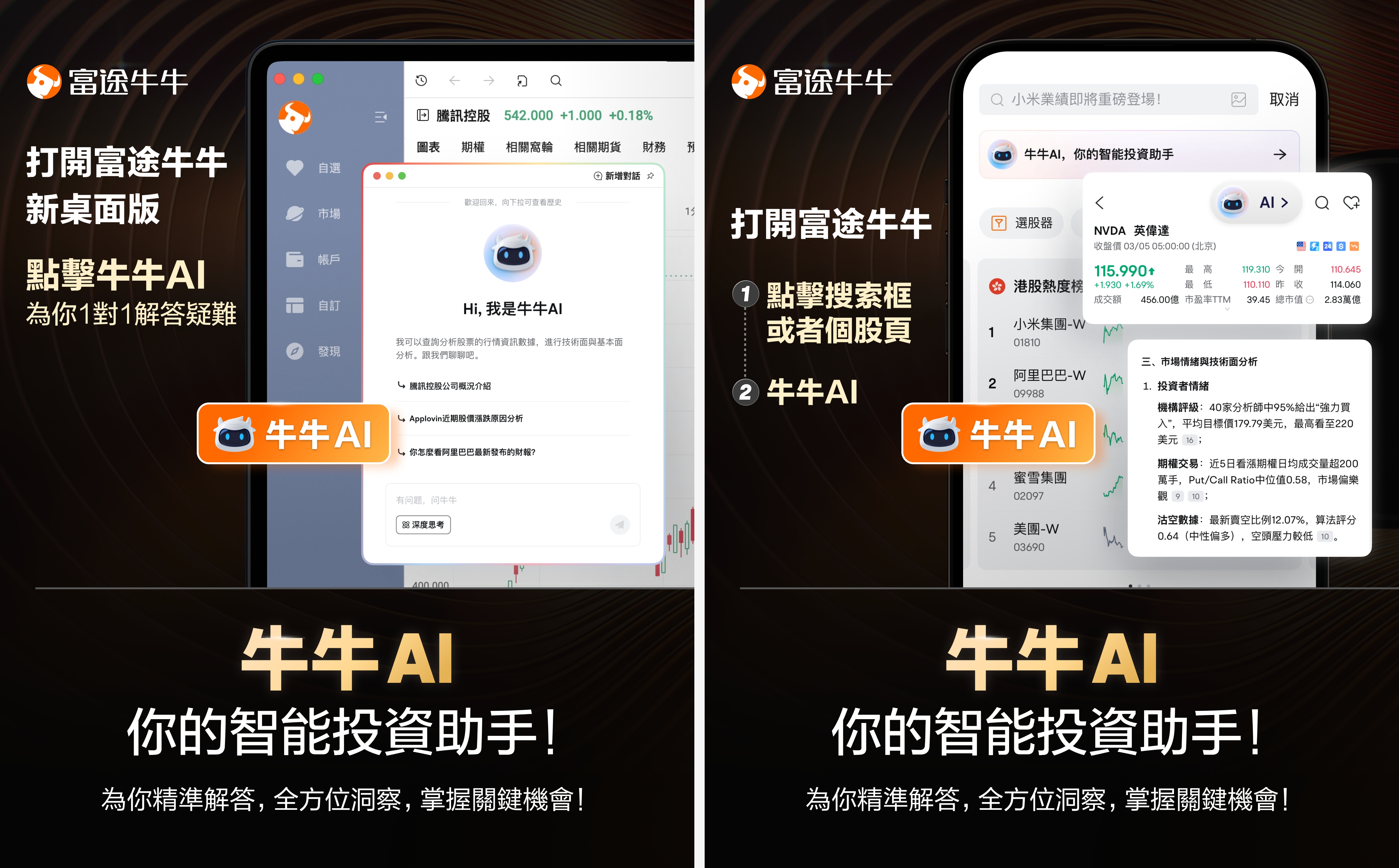

Is investing always stepping on a landmine?Futubull AI is now online!Accurate answers, comprehensive insights, seize key opportunities!

Editor/joryn