In the first half of 2025, despite the macro impacts of tariffs and geopolitical issues, the US stock market still resiliently reached new highs.

Looking ahead to the second half of the year, driven by the wave of technological innovation, some specific sectors are expected to maintain high growth, while the US will re-enter a rate-cutting cycle, and lower interest costs will help boost small-cap stock EPS growth. Long-duration growth stock valuations will also receive more support, thus mid-cap and more growth-oriented sectors may yield excess returns.

This article focuses on the discussion of five sectors: AI, Blockchain, Healthcare, Quantum Computing, and Space; everyone is welcome to vote for the sector you are most optimistic about.

1. AI Mainline: Reshaping the Global Economy, Alpha Still Significant.

The AI wave was initiated by OpenAI's release of ChatGPT at the end of 2022. By 2025, in two years, the leap in generative AI's reasoning and multimodal capabilities has repeatedly amazed the world, but the value space brought by future technologies such as video, universal Agents, and embodied intelligence far exceeds what exists now. In the second half of the year, OpenAI GPT-5 is expected to be released, reaching the 5 trillion parameter level with full multimodal native support. If China's DeepSeek R2 overcomes computing power constraints, it is also expected to launch, leading to further expansion of the open-source ecosystem.

The AI wave was initiated by OpenAI's release of ChatGPT at the end of 2022. By 2025, in two years, the leap in generative AI's reasoning and multimodal capabilities has repeatedly amazed the world, but the value space brought by future technologies such as video, universal Agents, and embodied intelligence far exceeds what exists now. In the second half of the year, OpenAI GPT-5 is expected to be released, reaching the 5 trillion parameter level with full multimodal native support. If China's DeepSeek R2 overcomes computing power constraints, it is also expected to launch, leading to further expansion of the open-source ecosystem.

Blackrock's stock team continues to recommend maintaining or increasing investments in AI-driven stocks, even amid global trade fluctuations. They believe that "AI Alpha" still exists. In other words, AI is not just a tech story; it is also a structural investment theme. Recently, Musk posted on X stating that "AI and Robotics technology will lead to budget surpluses and large-scale economic growth within 10 years."

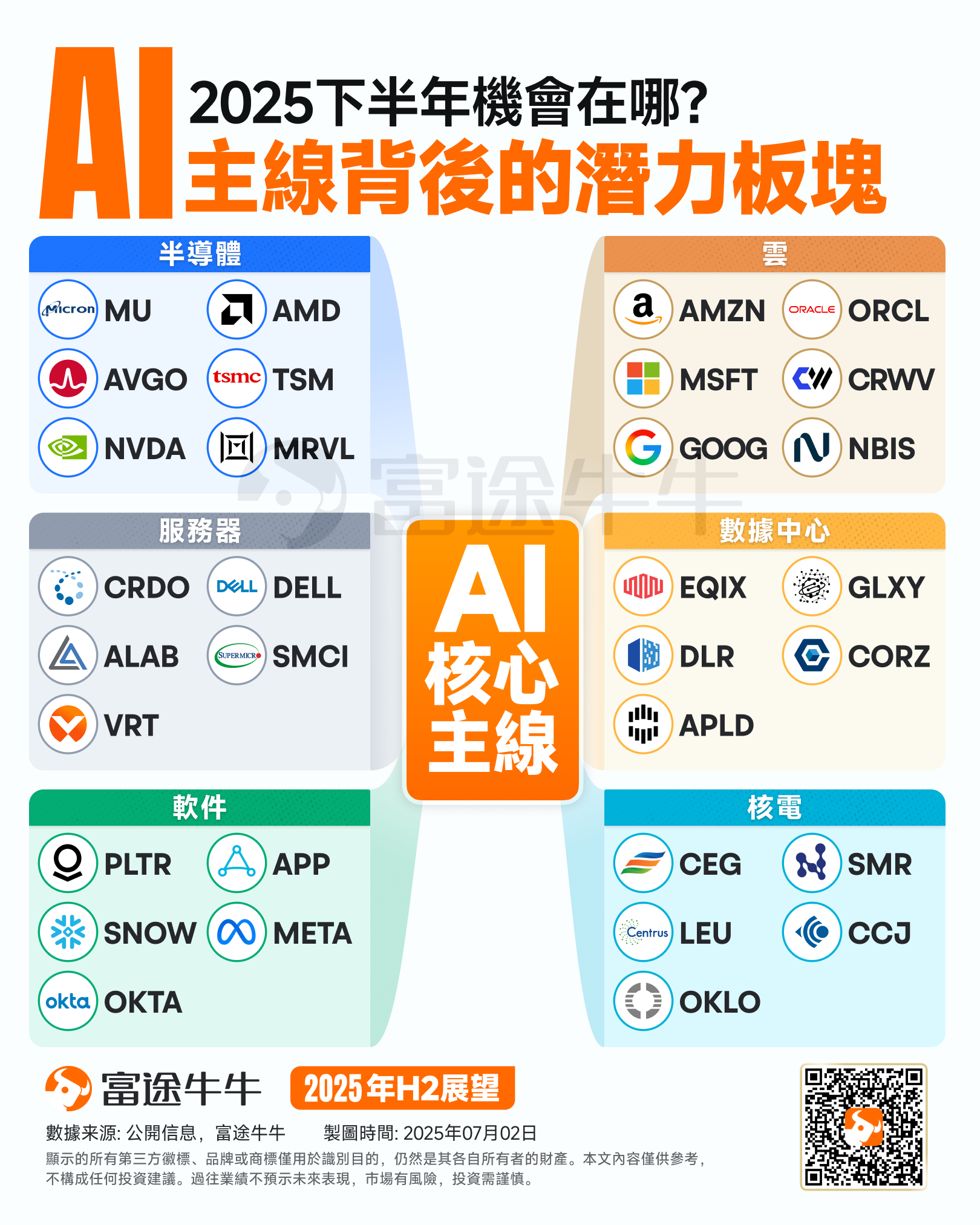

Given the strong growth momentum in the AI sector, investors may focus on the following core mainlines:

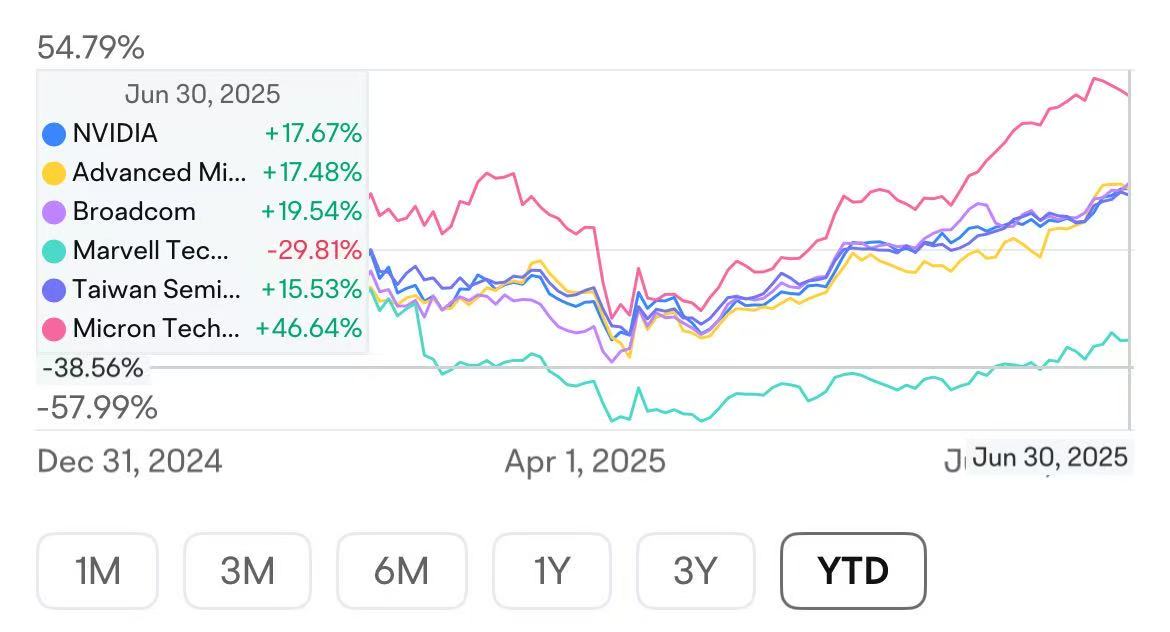

AI Infrastructure: As AI applications and model scales continue to grow, the demand for computing power and storage will remain strong. At the recently concluded Advancing AI conference in June, AMD projected global GPU revenue to increase from $45 billion in 2024 to $500 billion in 2028, with a compound growth rate of 60%. The directly benefiting companies include$NVIDIA (NVDA.US)$、 $Advanced Micro Devices (AMD.US)$ 、$Broadcom(AVGO.US)$、 $Marvell Technology (MRVL.US)$ And $Micron Technology (MU.US)$ A few chip designers, as well as those that are nearly monopolizing the manufacturing and COWOS advanced packaging segments.$Taiwan Semiconductor(TSM.US)$。

Cloud computing service providers: including those offering AI computing power support.$Amazon(AMZN.US)$ AWS,$Microsoft (MSFT.US)$Azure, Google Cloud, $Oracle (ORCL.US)$Cloud, as well as emerging $CoreWeave(CRWV.US)$、$NEBIUS(NBIS.US)$ GPU cloud, and data center solution providers, such as relatively mature Equinix, Digital Realty, and those specialized in Digital Currency mining or AI data center hosting.$Applied Digital(APLD.US)$、$Galaxy Digital(GLXY.US)$Wait.

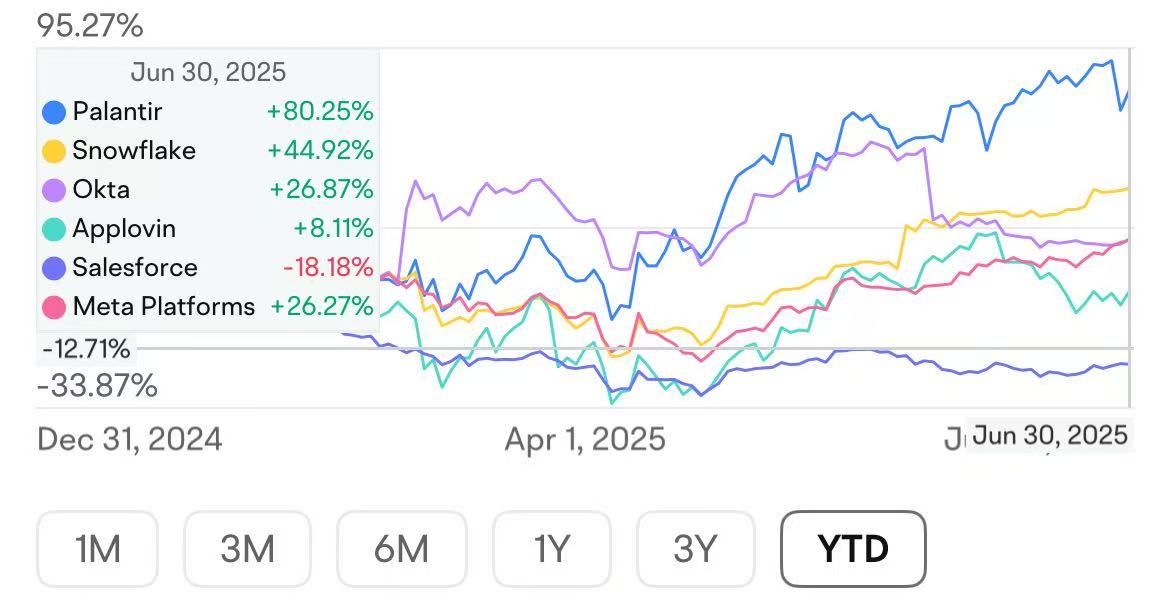

The upgraded "SaaS" - Agent track: Agentic computing disrupts the assumption that traditional software development is primarily based on humans playing a core role in executing tasks, workflows, and business processes, suggesting that intelligent agents will gradually become the main bodies for task execution and decision-making. As agent applications gradually penetrate the application software market valued at over 630 billion dollars, this will create huge value opportunities.

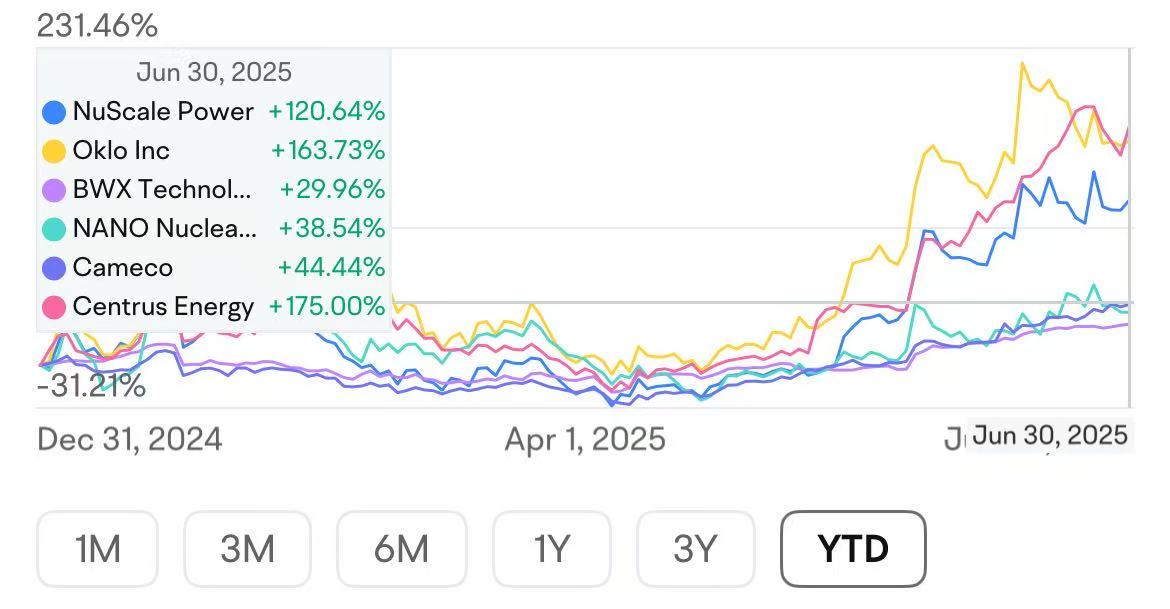

Energy support amid the surge in AI power consumption: The International Energy Agency (IEA) report shows that by 2030, global data center electricity consumption will more than double. Nuclear energy, with its high energy density and low carbon emissions, plays an increasingly important role in the global energy transition, while the IRA Act tax credits promote investment in small modular nuclear reactors. $NuScale Power(SMR.US)$ 、 $Oklo Inc(OKLO.US)$ As startup companies gain capital favor, uranium mining and processing as fuel also seem to possess high certainty.

2. Blockchain and Fintech: Regulatory relaxation and innovation explosion, the grand narrative of RWA unfolds.

At the beginning of this year, Trump's signing of the executive order 'Strengthening the United States' Leadership in Digital Financial Technologies' and the repeal of Biden's Executive Order No. 14067 marks a significant regulatory shift in the U.S. blockchain field.

Its core logic is to stimulate private sector innovation by reducing regulatory barriers, consolidating the United States' leadership position in global digital finance.

The combination of blockchain and fintech will continue to create tremendous value; investors can focus on the following core lines:

Stablecoins: With characteristics of short settlement time and low costs, stablecoins are reshaping the global cross-border payment landscape. The recent introduction of the U.S. 'GENIUS Act' and Hong Kong's 'Stablecoin Regulation Draft' will accelerate the development of stablecoins as a key bridge between legal currency and the digital asset ecosystem. According to defillama data, as of June 23, 2025, there are a total of 264 types of stablecoins globally, with a total market cap exceeding 250 billion USD. Standard Chartered Bank predicts that the scale of stablecoins will reach 2 trillion USD within three years.

Exchanges:$Robinhood(HOOD.US)$The recently announced focus on RWA Layer 2 and stock tokenization services marks the acceleration of the digital reconstruction of the traditional financial market worth trillions of dollars (bonds, Futures, insurance, Real Estate, etc.). Although by June, the RWA market had soared to over 24 billion dollars, driven mainly by private credit and U.S. Treasury securities, the wave of tokenized stocks, backed by the 50 trillion dollar public equity market and more RWA assets (Michael Saylor predicted in February that excluding BTC, the total scale of new on-chain digital economic assets could reach 590 trillion dollars), presents huge TAM growth potential for cryptocurrency exchanges.

MicroStrategy: represented by $Bitcoin (BTC.CC)$ The long-term value of leading digital currencies represented by is continuously rising, but the direct purchasing channels for Institutions, such as Binance, are not only cumbersome but also involve tax issues and risks of fraud and illegal funds. Therefore, the demand for indirect allocation of digital currencies through U.S. stock market listed companies is increasingly strong. Currently, in addition to BTC holders, $Strategy(MSTR.US)$ there has also emerged $Ethereum (ETH.CC)$ 、 $XRP(Cryptos)$ 、 $Binance Coin (BNB.CC)$ 、 $TRON(Cryptos)$ Pay attention to the unique flywheel effect, which can amplify both returns and risks. If cryptocurrency prices fall, the prices of such stocks may plummet.

Three, Healthcare: A dual dividend driven by AI innovation and aging population.

Although healthcare stocks may not perform as well as other high-growth sectors recently, drug innovation and relatively low valuations may present an attractive outlook. The application of AI in the medical field is deepening, covering multiple aspects from drug development, disease diagnosis, personalized treatment plan formulation to hospital operation, becoming an important force driving industry development.

Under the trend of interest rate cuts, the valuation of pharmaceutical research and development companies benefits the most, especially those focused on innovative drug research and development, gene therapy, and cellular therapy in cutting-edge fields. Goldman Sachs predicts that the market size for GLP-1 weight loss drugs will exceed 100 billion USD by 2025.$Novo-Nordisk A/S(NVO.US)$、$Eli Lilly and Co (LLY.US)$Market share exceeds 70%. Several Alzheimer’s drugs are entering phase III clinical trials, with a potential market size of 50 billion USD.

Musk's Brain-computer Interface company Neuralink's press conference has once again attracted the attention of Capital Markets towards advanced Medical Devices, such as those positioned in the neural modulation sector.$Medtronic (MDT.US)$、$Abbott Laboratories(ABT.US)$、$Boston Scientific(BSX.US)$、$LivaNova(LIVN.US)$Wait.

$Hims & Hers Health(HIMS.US)$ The termination of the partnership with Novo-Nordisk on Wegory does not seem to affect its long-term growth logic, as telemedicine will still be favored by users due to its better privacy, convenience, data personalization, and price advantages.

IV. Quantum Computing - From Experiment to Commercialization

Currently, the international academic community generally believes that commercial implementation of quantum computing will gradually be realized in the next 5-10 years. In the first half of 2025, breakthroughs in scale and stability of quantum computing will be achieved, IBM will launch a 2000 physical qubit processor and announce the 'Starling project,' aiming to realize a 200 logical qubit system by 2029, supporting 0.1 billion error-free calculations. $Microsoft (MSFT.US)$ And the atomic computing company will achieve entanglement of 24 logical qubits for the first time. $Alphabet-C (GOOG.US)$ The Willow chip is launched to overcome the quantum error correction challenge, reducing the error rate by 300%. Jensen Huang stated in June that quantum computing is reaching a turning point, while announcing that CUDA-Q has already been integrated into Blackwell, using GPU to accelerate quantum computing and achieve synergy between quantum and classical accelerated computing.

NVIDIA expects the number of logical qubits to increase tenfold in five years and one hundredfold in ten years, similar to Moore's Law. Morgan Stanley estimates that by 2030, revenue from quantum processors will account for 4% of high-performance computing expenses, approaching the trillion-dollar level by 2035.

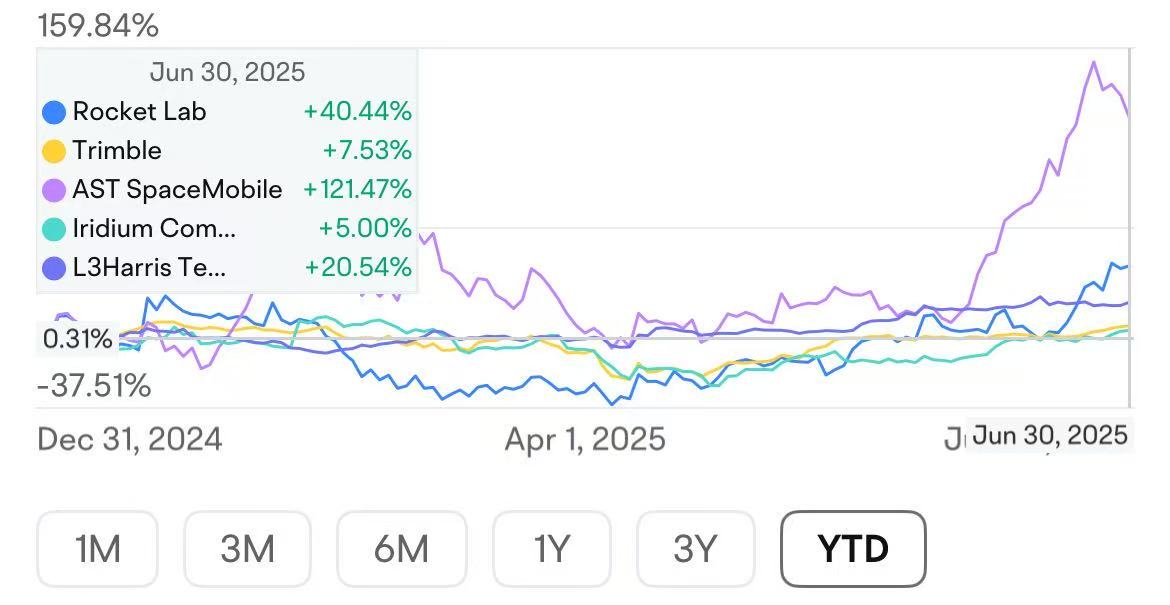

V. Space Economy: The Rise of a Trillion-Dollar New Economy

Investment opportunities in the Space Sector are extensive. In terms of Satellite launches, SpaceX completed 81 launches of the Falcon 9 rocket in the first half of the year, achieving a single launch cost of less than 5 million USD, and completed in-orbit propellant transfer tests to pave the way for crewed lunar landings.$Rocket Lab (RKLB.US)$The Electron rocket completed 67 successful launches in the first half of the year, setting a company record, making it the second highest in launch frequency in the United States. As the demand for satellite deployment increases, rocket manufacturing and launch service providers will continue to benefit.

In the field of satellite communication, the deployment and operation of Low Earth Orbit (LEO) satellite constellations is currently one of the hottest investment directions in the space sector. These constellations aim to provide global internet access, IoT connectivity, high-precision positioning, and other services, which will greatly change the global communication landscape. Related companies include satellite manufacturers, operators, and ground equipment providers. In June, SpaceX announced it had produced 10 million satellites, with Starlink subscription users surpassing 6 million; ASTS has launched 5 Block 1 BlueBird satellites and plans to deploy 100 satellites by the end of 2026 to achieve continuous coverage across the United States.

The emerging space tourism market, such as$Virgin Galactic(SPCE.US)$the suborbital flight experiences provided by Blue Origin, as well as the development and operation of commercial space stations, indicate that space will become a new destination for tourism and scientific research.

Morgan Stanley's "The New Space Economy" forecasts that the global space industry may exceed 1 trillion USD by 2040.

Risk Warning

The aforementioned individual leading Sectors face risks such as insufficient technological maturity, uncertain regulatory policies, and excessive bubble risks. The competitive advantages and market share changes of various companies still have considerable variability, and at the macro level, there are risks related to tariffs, US debt issues, and the current relatively high valuation of US Stocks.

Editor/Lee