① All developed economies face difficult deficit bills, with long-term Bonds yields rising on Monday across major economies from Japan, Germany, the United Kingdom, France to the United States; ② On the news front, Japan's fiscal spending commitments during the Senate election and U.S. President Trump's announced tariffs over the weekend are direct triggers for the global rise in Bonds yields.

On July 15th, financial news service reported (Editor: Xiaoxiang) that all developed economies face difficult deficit bills, with long-term Bonds yields rising on Monday across major economies from Japan, Germany, the United Kingdom, France to the United States due to concerns over expanding fiscal deficits hitting investor demand.

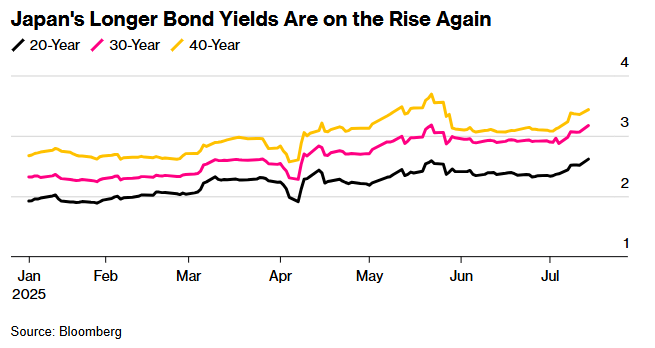

Market data shows that the yield on Japan's 30-year government bonds saw its largest increase in two months on Monday, while the yield on the same duration German bonds approached its highest level in 14 years. For these countries, fiscal issues are replacing interest rate policy as the primary focus of the market.

At the same time, although the selling pressure in the U.S. bond market was relatively small overnight, the yield on 30-year U.S. Treasuries is also nearing the sensitive 5% mark, reaching its highest level in a month.

At the same time, although the selling pressure in the U.S. bond market was relatively small overnight, the yield on 30-year U.S. Treasuries is also nearing the sensitive 5% mark, reaching its highest level in a month.

On the news front, Japan's fiscal spending commitments during the Senate election and U.S. President Trump's announced tariffs over the weekend are direct triggers for the global rise in Bonds yields. These factors exacerbate deep concerns in the market over excessive government debt, aggressive fiscal spending, surplus in Bonds supply, and persistently high inflation in developed countries.

"Monetary policy is no longer the main policy focus; instead, the dynamics of budgets and national debt have taken center stage," said Benoit Anne, Senior Managing Director and Head of Market Insights Group at MFS Investment Management.

Anne noted that while it’s fine if investors are willing to pay for it, past experience shows that investors often quickly develop serious doubts about fiscal extravagance.

Japanese bonds lead the decline.

Market data shows that the yield on Japan's 30-Year Treasury Bonds rose by more than 10 basis points on Monday, and is now approaching the record high set in May. $Japan 10-Year Treasury Notes Yield (JP10Y.BD)$On Tuesday, it further increased by 2.5 basis points, reaching 1.595%, marking the highest level since October 2008.

Japan will hold a Senate election on July 20. The Japanese National Diet's House of Councillors has 248 seats, with a term of six years and half of the members elected every three years. This election will contest 125 of those seats. As the Senate campaign intensifies, candidates are promising to increase spending and enhance tax cuts to attract voters.

Daiju Aoki, Chief Japan Economist at UBS SuMi Trust Wealth Management, stated, "There is a 50% chance that Japan's ruling coalition will lose its majority in the Senate, which may escalate the debate over lowering Japan's consumption tax rate, raising concerns about Japan's fiscal condition and pushing up long-term interest rates."

In addition to the imminent election, the decline in demand for Japan's ultra-long-term Bonds is also related to traditional buyers like life insurance companies reducing their purchases—mirroring recent similar dynamics in the United Kingdom. Meanwhile, after becoming the largest holder in Japan's Bonds market in recent years, the Bank of Japan is attempting to gradually exit the market.

Shinichiro Kadota, head of Forex and interest rate strategy at Barclays Securities Japan Ltd., said, "This situation is different from past environments; I believe this provides a rather unique context for this election."

The Bank of Japan ended its negative interest rate policy last year and subsequently raised rates twice. Officials generally expect that the Bank of Japan will maintain the benchmark interest rate at 0.5% during the interest rate meeting on July 31.

It is not difficult to see that as Japanese Bonds have been declining since the Asian session began on Monday, such selling sentiment has also created ripples in global markets. In European markets, the yield on 30-year German Bonds rose by 3 basis points overnight to 3.25%, reaching its highest level since 2023.

To bolster military and infrastructure, German authorities have abandoned decades of fiscal austerity this year. German Chancellor Merz also warned on Monday that the 30% tariff threat proposed by Trump would severely impact exporters in Europe's largest economy.

Calvin Yeoh, portfolio manager at Singapore hedge fund Blue Edge Advisors Pte., stated that the long end of the government bond market "will be fixed at current levels," and will only decrease in the event of an economic slowdown. He is currently positioning in what is known as a steepening trade in the U.S. Treasury market.

"Right now, everyone—the U.S., Japan, Europe—is on the fiscal bus, filled with RBOB Gasoline, heading towards inflation city," Yeoh said.

U.S. Treasuries are nearing 5%.

Regarding U.S. Treasuries, although the overnight selling pressure is not as pronounced as it is for Japanese bonds, the price of the U.S. 30-year Treasury has also fallen for a third consecutive day on Monday, with yields rising to the highest level in over a month ahead of the critical inflation report.

Market data shows that as of the end of the New York trading session, the 2-year U.S. Treasury yield rose by 0.99 basis points to 3.896%, the 5-year U.S. Treasury yield rose by 1.58 basis points to 3.985%, the 10-year U.S. Treasury yield rose by 2.40 basis points to 4.433%, and the 30-year U.S. Treasury yield rose by 3.21 basis points to 4.978%.

Currently, the 30-year U.S. Treasury yield has once again approached the sensitive 5% mark, last reached in early June. Last Friday, due to market concerns about inflation, the yield on this longest-term Treasury rose by 8 basis points, and since the beginning of this month, the yield has cumulatively increased by more than 20 basis points.

This trend is partly following the bond market movements of other countries, as global investors grow increasingly concerned about governments' ability to control budget deficits. However, in the United States, many investors are particularly focused on the U.S. June CPI data set to be released on Tuesday. Some Wall Street strategists expect that the data for this month may reflect the impact of Trump's global trade war for the first time.

Mark Cabana, head of U.S. interest rate strategy at Bank of America Securities, stated that rising inflation may force the market to reassess the Federal Reserve's policy path. Traders currently estimate the probability of a rate cut in September to be around 65%, whereas the market had previously fully priced in expectations for a cut at that meeting.

In an interview, he stated that the higher-than-expected inflation data "will cause the market to pause for a moment." "Can we find a reasonable basis for a rate cut of about 15 basis points, priced in for September, or nearly two full cuts before the end of the year? We believe the market will realize the answer is negative."

This data could become a topic of conversation during several officials' speeches at the Federal Reserve this week. Meanwhile, Trump has been increasingly intensifying his attacks on Federal Reserve Chairman Powell lately.

George Bory, Chief Investment Strategist for Fixed Income at Allspring Global Investments, stated on Monday: " $U.S. 30-Year Treasury Bonds Yield (US30Y.BD)$ Currently, it has returned to around 5%, and may rise further. The reality is that deficit spending by governments is very common worldwide, and the way to relieve the pressure is through the long end of the yield curve.

Want to learn more market analysis?Futubull AI is now online!Accurate answers, comprehensive insights, seize key opportunities!

Editor/rice