UBS Group maintains a positive view on Hong Kong and Chinese stock markets, believing that given the attractive valuations (especially for Technology stocks related to artificial intelligence), "Buy on dips" will receive strong support, which may attract southbound Inflow (although lower than in the first half of the year) and potential foreign capital Inflow.

UBS Group stated that due to the competitive pressure in industries such as delivery, it believes that the Hong Kong stock market is under certain pressure in the short term. Nevertheless, with the advancement of the "anti-involution" movement, policy adjustments seem to be brewing, while southbound capital and international investors may provide financial support, as the valuation of Hong Kong stocks remains attractive compared to other domestic assets and global markets. In the current macro environment, UBS Group still believes that a barbell strategy is the most suitable industry allocation method. UBS Group maintains a positive outlook on the Hong Kong and Chinese stock markets overall, and believes that given the attractive valuations (especially technology stocks related to artificial intelligence), "buying on dips" will receive strong support, which may attract southbound capital inflows (albeit lower than in the first half of the year) and potential foreign capital inflows.

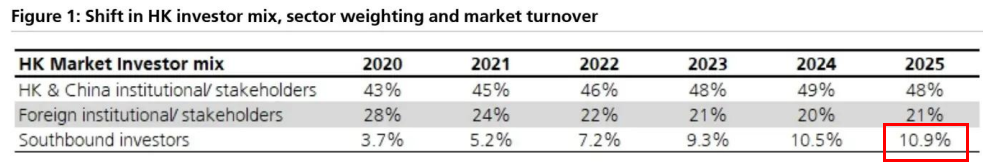

As the allocation ratio of southbound investors in Hong Kong stocks has risen to 21% of the free float market capitalization of Hong Kong stocks, on July 23, UBS Group reassessed the investment framework of the Hong Kong stock market. The key factors driving Hong Kong stocks identified by UBS Group (ranked by importance from high to low) are:

1) Policy and regulation;

1) Policy and regulation;

2) Earnings (especially earnings revision trends);

3) Innovation;

4) Capital flow (especially southbound capital) and interest rates;

5) Valuation;

6) Macroeconomic conditions;

7) Geopolitics.

I. What changes have occurred in Hong Kong stock investments?

With the rising proportion of Southbound Hold Positions, UBS Group has found the following changes in Hong Kong stock investments compared to the past:

1) The market's sensitivity to geopolitics has decreased;

2) The impact of capital flows (especially Southbound capital) and local liquidity (such as Hong Kong interbank lending rates) on Index performance has significantly increased;

3) The correlation with global stock markets has decreased;

4) Due to the increasing proportion of Technology Stocks in the Index, the impact of economic factors has weakened. What remains unchanged is that policy and regulatory changes are still very important to overall market sentiment and valuation levels, while EPS revision remains the most significant single factor driving stock prices.

Figure 1: Changes in the structure of Hong Kong stock investors, industry weights, and market transaction volume.

2. What insights does the updated framework provide for the second half of the year?

Under the updated framework, UBS Group sees the following potential adverse factors in the short term:

1) Predictions from UBS Group analysts indicate that the consensus earnings for the Hang Seng H-Share Index ETF may have a 4% downside potential (particularly affected by competition in the takeaway industry);

2) The Hong Kong interbank borrowing rate has significantly decreased, which may result in a slight rebound;

3) UBS Group maintains a positive outlook on Hong Kong stocks and the overall Chinese stock market, believing that due to attractive valuations (especially for technology stocks related to artificial intelligence), "buying on dips" will receive strong support, which may attract southbound fund inflow (although lower than in the first half) and potential foreign capital inflow.

Catalysts for further significant re-evaluation of the market may come from the following factors:

1) Progress of the "anti-involution" actions;

2) New innovations, particularly in the field of artificial intelligence (such as new versions of deep exploration models);

3) With the economic growth slowing down, the government's policy response in the fourth quarter. Currently, UBS Group has no strong preference for A-shares and H-shares.

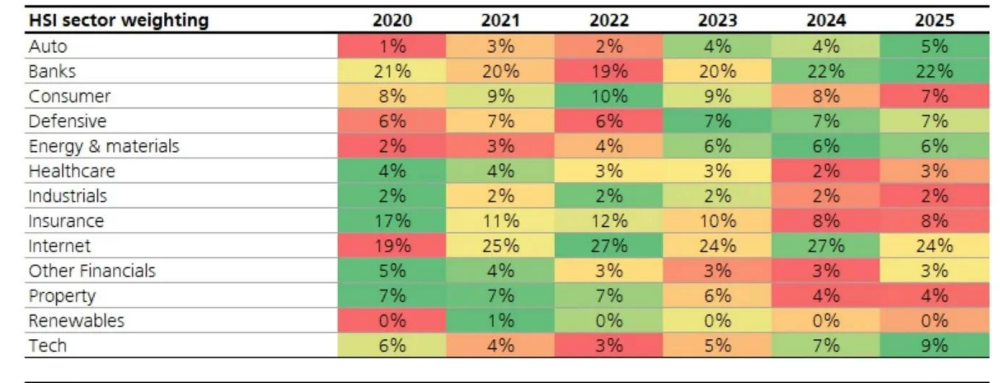

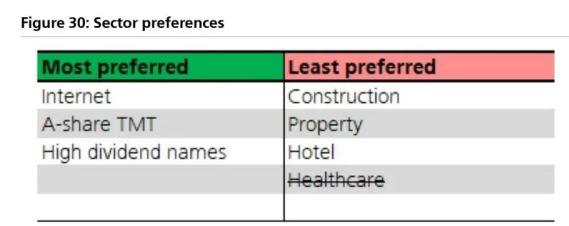

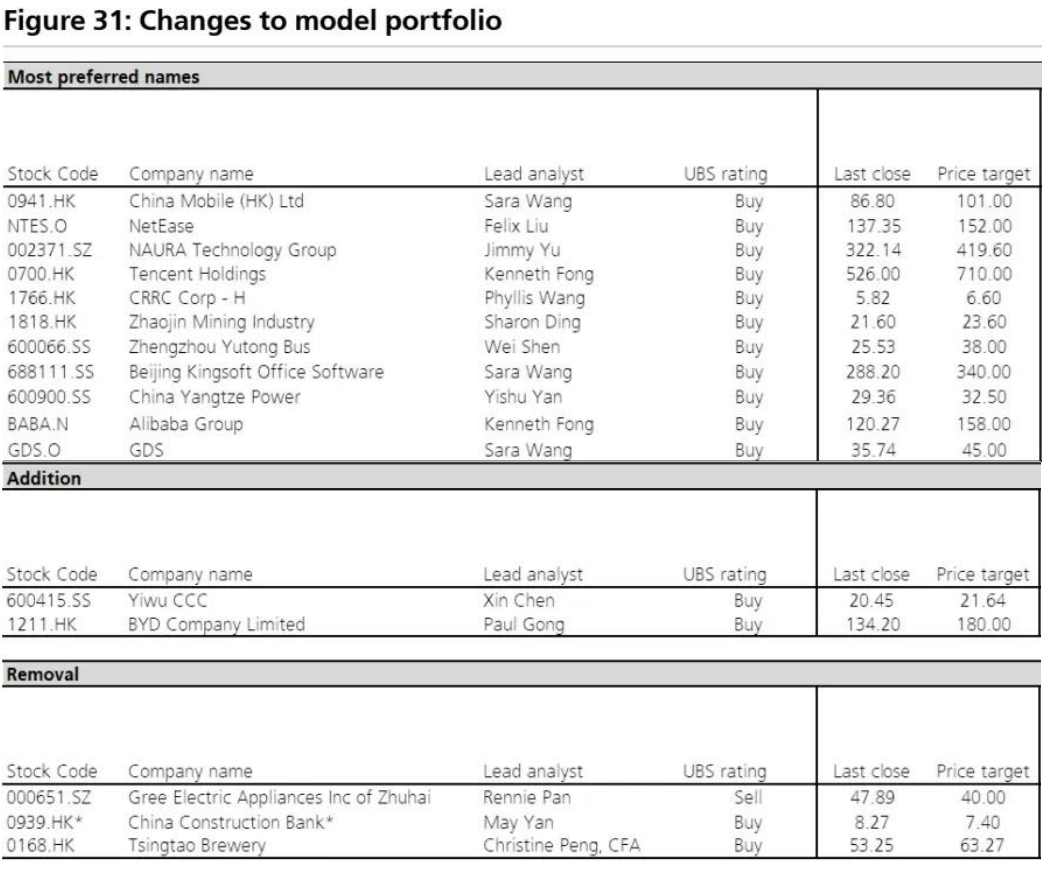

Three, Industry and Stocks Selection

In the current environment, capital flows and innovations may still be more important factors driving stock market performance in the short term. Therefore, UBS Group continues to adopt a barbell strategy in sector selection - favoring selected Internet and Technology stocks, as well as high-dividend stocks (Figures 30 and 31).

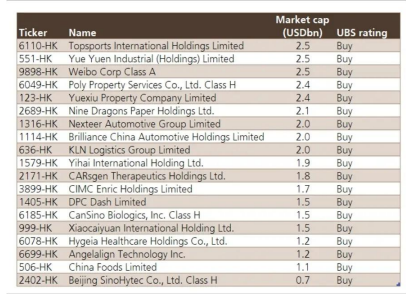

In the Hong Kong market, UBS Group also sees value in small-cap stocks, as southern investors have become more focused on them in recent months, and the performance of A-share small-cap stocks has significantly outperformed Hong Kong small-cap stocks over the past five years. UBS Group provides a list of small- and mid-cap stocks rated as Buy in Figure 72.

UBS Group provides a framework for industry and stock selection in the following diagram.

In the above diagram, UBS Group shows the key variables considered when configuring industries, the decisions made, and the types of industries used to express different views related to these variables. UBS Group emphasizes the key factors that may affect sector-specific performance:

Regulation and policy: have always been one of the most important drivers of industry performance, such as Internet regulation, the "three red lines" for real estate developers, and supply-side reforms;

Competition intensity: It will affect profit margins, as industry participants often compete for market share through discounts or increasing production capacity.

Innovation: It is a major catalyst for the re-evaluation of the industry, such as the rise of AI-driven Internet Stocks.

Valuation: Indicators such as Price to Earnings Ratio (P/E) and Price/Earnings Growth Ratio (PEG) can be used to measure the relative attractiveness of different industries.

Overall market environment: It will also play a role due to industry-specific cyclicality, meaning in a bull market, growth industries usually outperform defensive industries.

Global themes: Stocks related to stablecoins are also traded synchronously in the Hong Kong market.

IV. Outlook for the remainder of 2025.

According to the revised framework, UBS Group has adjusted its outlook for Hong Kong stocks for the remainder of 2025 as follows.

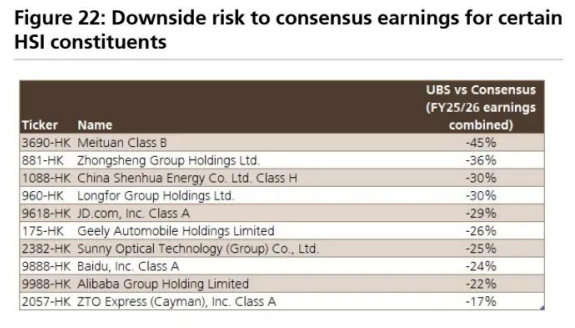

Earnings Adjustment: UBS Group believes that, due to intensified competition in the takeaway industry and the high base effect of consumer subsidies in the second half of 2025, there is downward risk to earnings. Overall, analysts' earnings forecasts for the Hang Seng H-Share Index constituents in 2025 are 4% lower than consensus.

Figure 22: There is a downside risk to the consensus earnings of some Hang Seng Index constituent stocks.

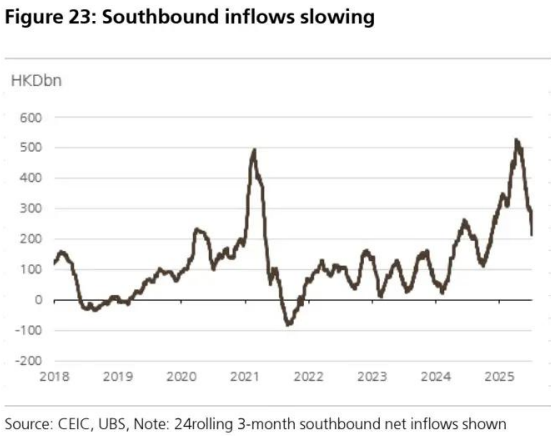

Capital flows: The inflow of Southbound funds may slow down from the rapid growth seen in the first half of this year, but the inflow of foreign capital may to some extent offset this impact, as the current allocation to Hong Kong stocks remains relatively low compared to recent historical levels;

Figure 23: The inflow of Southbound funds is slowing down.

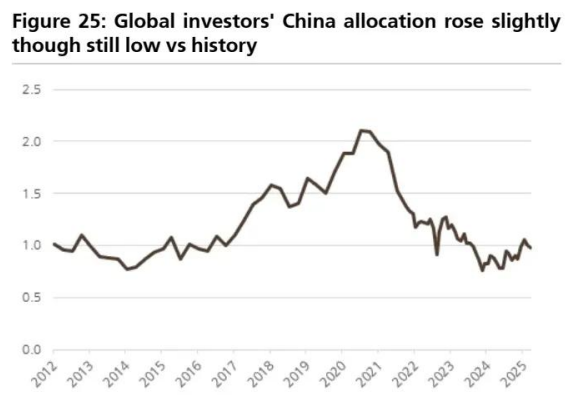

Figure 25: Global investors' allocation to China has slightly increased, but still remains below historical levels.

Source: FactSet, UBS Group, showing the positions of the top 40 global investors in Chinese stocks (as a percentage of the portfolio).

Liquidity: As Hong Kong's interbank lending rates may rebound from their current low levels (as noted in the report by Rohit), liquidity support may weaken. However, Rohit believes the rebound could be mild, and due to the diversification brought by IPOs and the high proportion of Southbound holdings, liquidity will remain ample;

Global interest rates: Given the expected decline in U.S. interest rates and the stability of the renminbi, global interest rates may still provide some support;

Policy: With the slowdown in economic growth, some fundamental economic policy support is expected, along with potentially stronger "anti-involution" reforms;

Geopolitical factors and tariffs: Although a temporary ceasefire has been reached on tariff issues, the related uncertainty is still expected to be a drag, though the impact will be significantly reduced compared to the past.

Therefore, in the short term, UBS Group believes that the driving factors are relatively balanced, and it is expected that the Hong Kong stock market will experience a consolidation while awaiting the following catalysts: normalization of competition among major food delivery platforms; implementation of more specific measures to curb vicious competition; development in the field of artificial intelligence, especially in terms of application and monetization; and government responses in the fourth quarter as economic growth begins to slow.

Editor/Lee.