①On Thursday, as expected, the European Central Bank (ECB) announced that, due to uncertainties related to tariffs and other factors, the three key interest rates will remain unchanged, halting the streak of eight consecutive meetings with rate cuts; ②Lagarde also warned that the risks to economic growth still skew to the downside, but supply chain disruptions and large-scale fiscal stimulus could potentially lead to a resurgence in inflation; ③In summary, the ECB has entered a 'wait-and-see' mode similar to that of the Federal Reserve.

Cailian News, July 24 (Editor Shi Zhengcheng) On Thursday evening, Beijing time, the European Central Bank, as expected, announced that it would maintain the current policy interest rates, with further actions pending greater clarity on tariffs and other developments.

(Source: ECB)

The official announcement stated that the deposit facility rate, the main refinancing operation rate, and the marginal lending facility rate will remain unchanged at 2.00%, 2.15%, and 2.40%, respectively. Unlike the Federal Reserve, the ECB has cut interest rates eight times since June 2024, reducing the deposit facility rate from 4% to 2%. Therefore, today's pause was within market expectations.

The official announcement stated that the deposit facility rate, the main refinancing operation rate, and the marginal lending facility rate will remain unchanged at 2.00%, 2.15%, and 2.40%, respectively. Unlike the Federal Reserve, the ECB has cut interest rates eight times since June 2024, reducing the deposit facility rate from 4% to 2%. Therefore, today's pause was within market expectations.

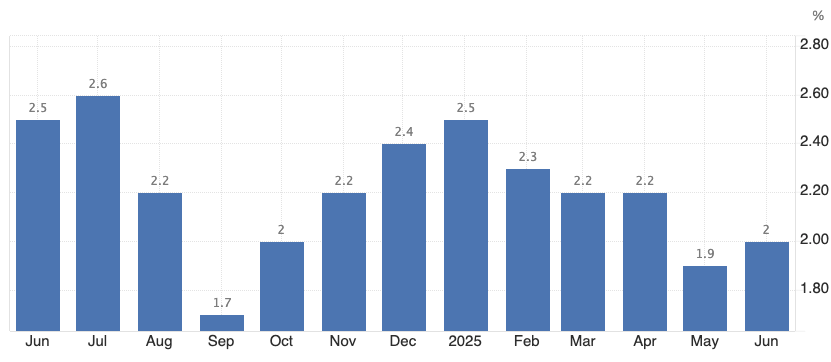

The ECB stated in its announcement: “The current inflation rate has reached the medium-term target of 2%. In a challenging global environment, the economy has so far shown resilience. However, the environment remains extremely uncertain, particularly due to trade disputes.”

(Inflation in the Eurozone has fallen to the 2% target, but the outlook remains quite unclear. Source: tradingeconomics)

According to CCTV News, U.S. President Donald Trump previously wrote to the EU, stating that he would impose a 30% tariff on most EU exports starting from August 1, up from the 20% announced in April. The EU member states also voted on Thursday to approve retaliatory tariffs on $93 billion worth of U.S. goods, which will take effect if no agreement is reached by August.

For the ECB, which has been cutting interest rates for a full year, the market's focus has shifted from whether to cut rates to whether the rate-cutting cycle has ended.

Traders still expect the European Central Bank (ECB) to cut interest rates at least once more this year, bringing the key lending rate down to 1.75%. Some investors believe the ECB will ultimately lower rates to 1.5% to address the risk of excessive disinflation.

In the press conference following the interest rate decision, ECB President Christine Lagarde stated in her opening remarks that the current inflation rate in the euro area is at the ECB's 2% medium-term target. The latest information largely aligns with the ECB's previous assessment of the inflation outlook, with price pressures continuing to ease and wage growth slowing.

Lagarde also emphasized that the risks to economic growth remain tilted to the downside. Key risks include further escalation of global trade tensions and related uncertainties, which could dampen exports, investment, and consumption. Conversely, if trade and geopolitical tensions are resolved quickly, it could boost market sentiment and stimulate economic activity.

ECB Vice President Luis de Guindos had previously warned that second and third-quarter economic growth would be 'almost flat' as European companies frontloaded their business activities to avoid higher tariffs starting in early 2025.

Thursday's decision also noted that the increase in actual and expected tariffs, a stronger euro, and ongoing geopolitical uncertainties have made businesses more cautious about investing.

This year, the euro has appreciated by over 13% against the US dollar, potentially causing a more significant decline in inflation than anticipated. Several members of the Governing Council, including Banque de France Governor François Villeroy de Galhau, have warned that inflation in the euro area may remain below target for an extended period.

Like most of her peers, Lagarde reiterated the commitment to a data-dependent, meeting-by-meeting approach to determining the appropriate monetary policy stance.

She also emphasized on Thursday that while a stronger euro could cause inflation to fall more than expected, the ECB is also monitoring another scenario where supply chain fragmentation could push up global prices. Higher fiscal spending and extreme weather events could also lead to a resurgence in inflation.

Mark Wall, Deutsche Bank's Chief European Economist, interprets that the European Central Bank (ECB) will keep all options open — this could even mean a potential future rate hike. Wall stated: 'If trade uncertainties dissipate, the combination of economic resilience and substantial fiscal easing will ultimately translate into upside inflation risks. The market is not far from shifting its focus from the last rate cut to the first rate hike.'

编辑/rice