Unlike previous instances where retail investors flocked into the market, this round of A-share increases has seen a more restrained performance from retail investors. This relatively rational approach to participation helps to mitigate the risks of significant market fluctuations and may contribute to a more sustainable upward trend, with the Chinese stock market displaying characteristics of a 'slow bull' market.

The recent bullish trend in the Chinese stock market may prove to be more sustainable than in the past, as retail investors have not yet exhibited exuberance, which helps mitigate the risks associated with herd behavior in chasing prices.

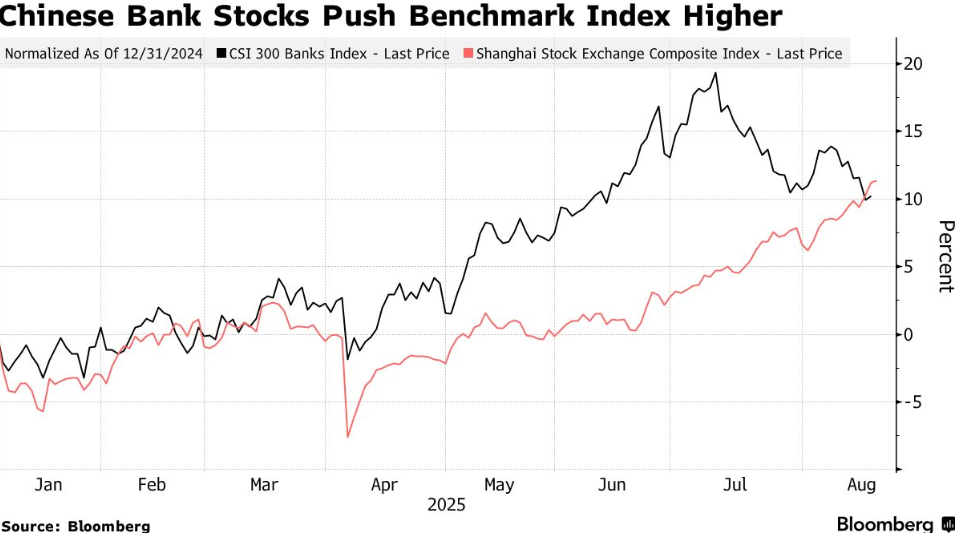

Analysts indicate that while the Shanghai Composite Index rose to a ten-year high on Monday, partly due to well-capitalized investors seeking higher returns than bonds, their pace of building positions has been more cautious compared to previous stock market rallies.

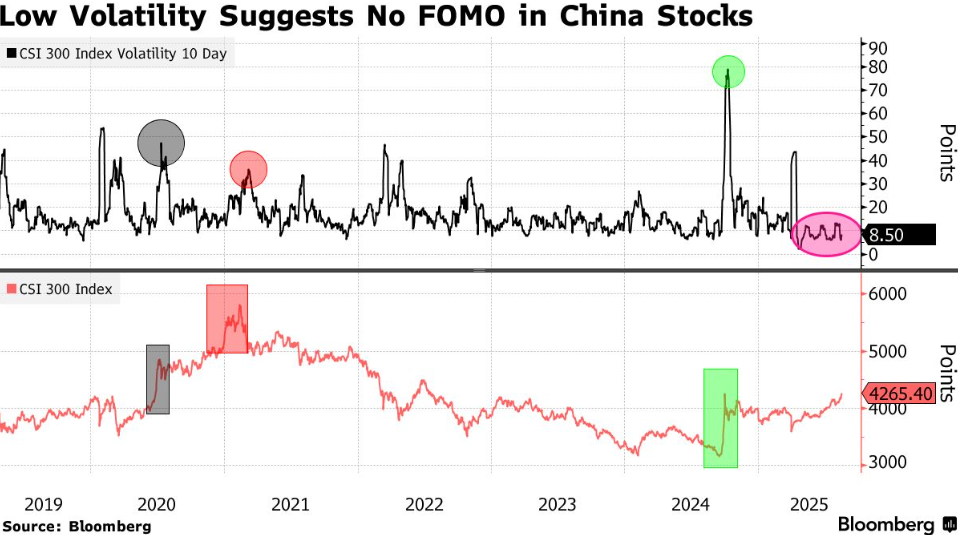

The 10-day historical volatility of the CSI 300 Index, which measures market volatility, is only slightly above this year's low and well below last October's peak. This trend raises hopes for a more sustainable rise in the stock market, which could help restore investor confidence.

The 10-day historical volatility of the CSI 300 Index, which measures market volatility, is only slightly above this year's low and well below last October's peak. This trend raises hopes for a more sustainable rise in the stock market, which could help restore investor confidence.

Low volatility indicates that there is no fear of missing out (FOMO) in the Chinese stock market.

Cao Liulong, Chief Strategy Analyst at Western Securities, and others wrote in a report: 'While some investors are discussing the accelerated flow of deposits into the stock market, our observations show that high-net-worth investors are indeed entering the market, but most individual investors are opting for wealth management products rather than directly purchasing stocks or mutual funds.'

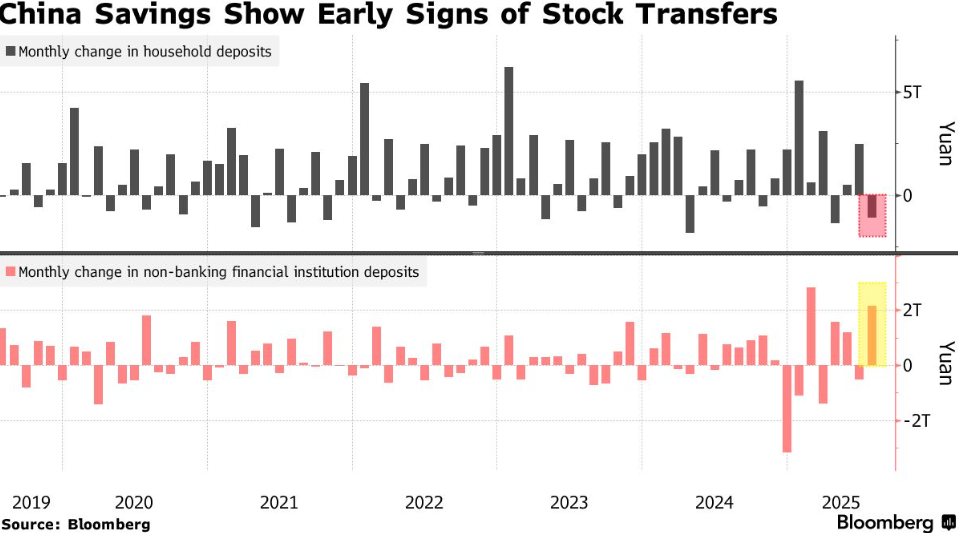

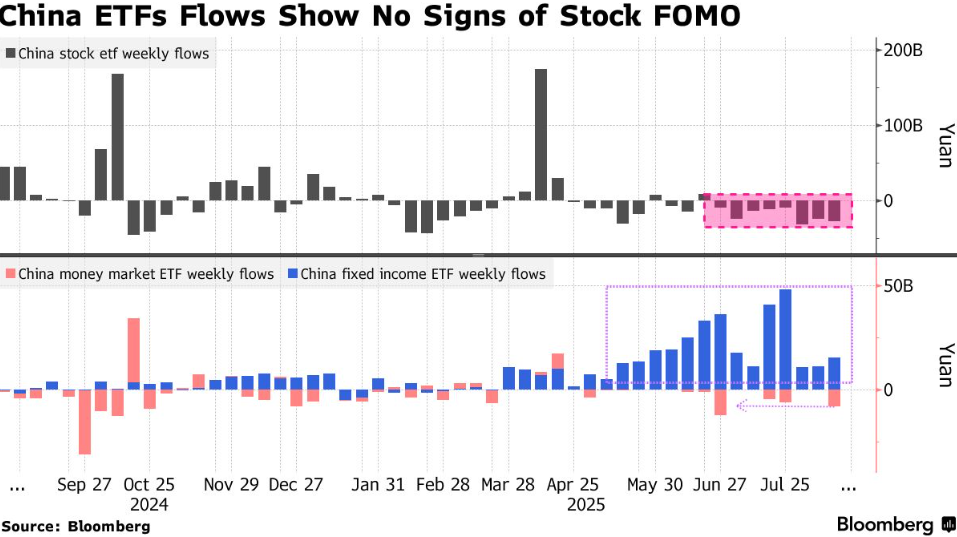

They added that small transactions also indicate low participation among retail investors. Some households are turning to the stock market in search of higher returns, but retail investors have not been rushing to buy stocks. Data compiled by Bloomberg shows that as of August 15, China-focused equity exchange-traded funds (ETFs) have experienced eight consecutive weeks of outflows, despite the CSI 300 Index rising over 9% during this period. Meanwhile, fixed-income ETFs continue to attract inflows, and redemptions from money market funds have been minimal.

There are initial signs of a shift in household savings towards the stock market.

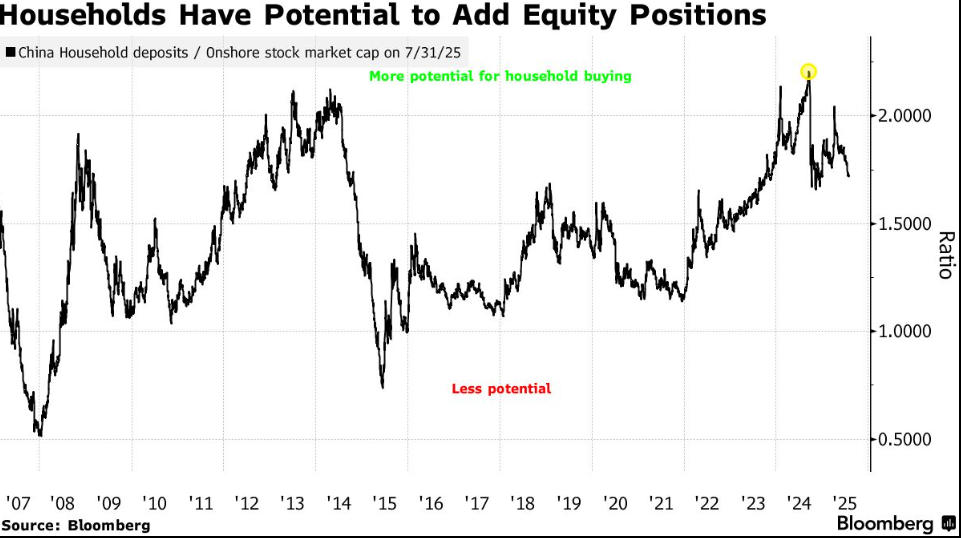

Notably, local investors are more cautious than before. The outlook for corporate earnings has not yet shown substantial improvement. However, retail investors, holding record savings, remain a potential force driving the market. Analysts are closely monitoring the ratio of household savings (which exceeded 160 trillion yuan as of July) to the market capitalization of the Chinese stock market to assess the potential funds available for purchasing stocks.

Chinese households have significant potential to increase their investments in the stock market.

Zhejiang Securities estimates that approximately 4.25 trillion yuan of excess savings could flow into the stock market, while Citic Construction Investment Securities predicts an even higher figure of 6 trillion yuan. As the stock risk premium hovers near record highs, these funds may be released.

The liquidity of Chinese ETFs indicates that there is no fear of missing out (FOMO) in the A-share market.

Cao Liulong from Western Securities pointed out that institutional investors are also providing support for further increases in the stock market. This group is opening accounts at an accelerated pace, and the assets under management of private equity funds and leveraged funds are climbing to record levels, indicating that more experienced investors are participating.

Niu Chunbao, a fund manager at Shanghai Wanjia Asset Management, stated: 'Although the recent rise may be related to the transfer of deposits, there is still a significant amount of capital on the sidelines, and there is a general expectation of further increases. Given the current low savings yield, this rise is likely to stimulate more funds flowing into the stock market.'

JPMorgan is optimistic about Chinese bank stocks.

JPMorgan analysts believe that Chinese bank stocks will see an upward trend in the second half of the year, with stable net interest margins and growing fee income making this sector an ideal choice for dividend-seeking investors.

Analyst Katherine Lei at the bank expects that A-share listed banks could have a maximum upside of 15%, while H-share listed banks may see an increase of up to 8%. She predicts that the average dividend yield for A-share bank stocks covered by JPMorgan this year will be approximately 4.3%.

'We still hold a positive view on the Chinese banking sector,' she stated.

This judgment further corroborates the increasingly optimistic sentiment surrounding Chinese bank stocks. Bank stocks are increasingly viewed by investors as a safe haven for yield. Driven by institutional investors, such as insurance funds, seeking higher returns amid declining bond yields, key indices tracking Hong Kong-listed Chinese bank stocks have risen by about 25% this year. The Shanghai Composite Index has climbed to a ten-year high, with the banking sector playing a significant role as an important weighted component of this benchmark index.

Lei added that with the improvement in net interest margin and a moderate recovery in fee income, the revenue and profit growth of the banking industry is expected to gradually improve in the second half of the year.

The report has upgraded the ratings of several bank stocks, including raising the ratings of Bank of Communications A-shares and H-shares from 'Neutral' to 'Overweight', and upgrading Ping An Bank's rating from 'Underweight' to 'Neutral'. China Merchants Bank has been listed as a preferred A-share bank stock due to its 'considerable dividend yield and higher earnings sensitivity to the capital market.'

Editor/Melody