① Market concerns that the Federal Reserve, which is "loyal to the President," might cut interest rates too aggressively and too quickly—thereby jeopardizing the central bank's credibility in combating inflation; ② Long-term interest rates may ultimately be higher than current levels, which will squeeze the economy and potentially trigger other market turmoil.

On August 27, the Financial Associated Press reported (editor: Xiao Xiang) that as Trump announced this week his intention to dismiss Federal Reserve Governor Cook, potentially allowing him to control the Federal Reserve Board, increasing numbers of industry insiders are concerned that the unprecedented and escalating attacks and interventions from the President may instead drive up long-term borrowing costs, adversely affecting the U.S. economy and financial markets.

In recent months, Trump has continuously criticized Federal Reserve Chairman Powell for not significantly lowering interest rates to stimulate the economy—in Trump's view, lowering rates could also reduce the government's interest expenses on debt. Earlier this month, Trump nominated his Economic Council Chairman, Milan, to serve as a Federal Reserve Governor, and is now attempting to remove Governor Cook, further complicating the legal battle over the political independence of the institution.

While the Federal Reserve has substantial control over short-term interest rates, the 10-year U.S. Treasury yield, primarily determined in real-time by global traders, largely dictates how much Americans need to pay in interest on trillions of dollars in mortgages, commercial loans, and other debts.

While the Federal Reserve has substantial control over short-term interest rates, the 10-year U.S. Treasury yield, primarily determined in real-time by global traders, largely dictates how much Americans need to pay in interest on trillions of dollars in mortgages, commercial loans, and other debts.

Currently, although Powell has hinted that interest rate cuts may resume as early as next month, many other factors are keeping long-term yields elevated: tariffs may exacerbate already high inflation; the fiscal deficit will continue to inject new Treasury bonds into the market; and Trump's tax cuts may even bring about new stimulus shocks next year...

Many industry insiders state that if market concerns about the Federal Reserve being "loyal to the President" leading to overly aggressive and rapid interest rate cuts persist—thereby jeopardizing the central bank's credibility in combating inflation—long-term interest rates may ultimately be higher than current levels, which would squeeze the economy and potentially trigger other market turmoil.

Could U.S. inflation spiral out of control?

David Roberts, Head of Fixed Income at Nedgroup Investments, pointed out: "Weak job growth in the U.S., coupled with ongoing pressure from the White House on the Federal Reserve as an institution and on individuals, is causing substantial concern for U.S. Treasury bond investors."

He predicts that even if short-term interest rates decline, long-term rates will continue to rise. "Current inflation far exceeds the Federal Reserve's target. Cheaper capital may spur economic prosperity, weaken the dollar, and significantly raise inflation."

In fact, the upward pressure facing long-term interest rates is not unique to the United States. In the UK, France, and other countries, long-term rates have remained high due to investor concerns about the combination of high government debt burdens and increasingly unpredictable political situations.

However, the complex effects of Trump's return to the White House have clearly introduced unique challenges.

Although the U.S. inflation rate has been on a downward trend in recent years after reaching a 40-year high in 2022, it still exceeds the Federal Reserve's 2% inflation target, which undermines the Fed's ability to significantly cut interest rates in the face of a weak labor market. This also suggests that any excessive interest rate cuts by the Fed during Trump's tenure could provoke a reaction in the bond market, as investors may lose confidence in the central bank's anti-inflation mission.

Tim Urbanowicz, Chief Investment Strategist at Innovator Capital Management, stated: "The bond market may penalize interest rate cuts at the wrong time."

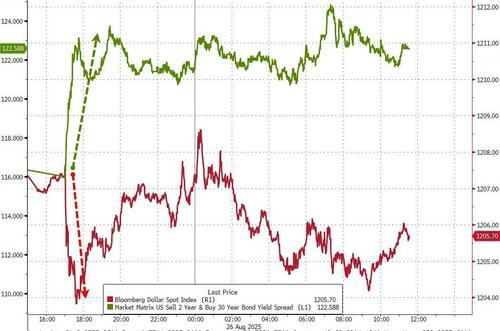

Due to uncertainty over whether Trump's efforts to dismiss Federal Reserve Board Governor Cook will succeed, the overall reaction to the news of Cook's potential dismissal on Tuesday was relatively subdued. However, key parts of the U.S. Treasury yield curve continue to steepen—short-term Treasury yields have declined on heightened expectations of an impending easing of monetary policy, while long-term Treasury yields have risen due to concerns that significant interest rate cuts could lead to higher long-term inflation.

On Tuesday, the closely watched 2-year and 10-year U.S. Treasury yield curve rose to its highest level since April, while the premium between the 30-year and 2-year Treasury yields surged to its highest level since early 2022.

Jamie Cox, Managing Partner at Harris Financial Group, pointed out: "The president will reshape the Federal Reserve Board over the next year and will employ unconventional methods." He added that this move "essentially deprives the Fed of its current forward guidance function," signaling to the market a potential for interest rate cuts.

Loss of Independence of the Federal Reserve

Many industry insiders have indicated that Trump's efforts to reshape the Federal Reserve are increasingly intensifying, which will almost certainly keep the bond market tense—and further push up long-term bond yields.

For decades, the market has become accustomed to the independence maintained by the Federal Reserve, and successive presidents have deliberately avoided being seen as interfering with the central bank's policies.

Since the Nixon administration's attempt in the early 1970s to pressure then-Federal Reserve Chairman Arthur Burns to maintain low interest rates, the separation of the Federal Reserve from electoral politics has never posed an issue for investors. In fact, that experience has remained a cautionary tale throughout subsequent history, as the inflation spike at that time was attributed by many to the central bank's capitulation to the president.

"The Federal Reserve's implicit mission is not to become Arthur Burns," said Steve Sosnick, Chief Strategist at Interactive Brokers. "Do not yield to political pressure."

However, Sarah Binder, a political science professor at George Washington University, pointed out that Trump's dismissal of Cook "reminds us once again that no institution in Washington is immune from Trump's bullying." "The so-called declaration of independence cannot protect the Federal Reserve from the encroachment of Trump's ambitions. The Federal Reserve needs guardians, particularly bond traders."

Analysts at the Bank of Montreal Capital Markets stated in a report on Tuesday: "We believe Trump will further challenge the independence of the Federal Reserve, driving up term premiums and steepening the yield curve."

S&P Global Ratings recently warned that while affirming the United States' AA+ credit rating, if political developments affect the strength of U.S. institutions, the effectiveness of long-term policy-making, or the independence of the Federal Reserve, the U.S. rating may further face pressure.

AXA's Chief Economist Gilles Moec stated: "If public debt is high, the government may use its influence over the central bank to revive economic growth and generate more inflation, thereby eroding the real value of its debt. In the long run, this will be counterproductive as it will lead to an increase in long-term interest rates."

Apart from U.S. Treasuries, the dollar is undoubtedly walking on thin ice due to the threats to the independence of the Federal Reserve. After a significant decline in the first half of the year, the dollar has basically stabilized since June. However, the new doubts regarding the Fed's independence may test its recent resilience. On Tuesday, the Bloomberg Dollar Spot Index fell slightly by 0.2%.

Goldman Sachs strategist Stuart Jenkins and others pointed out in a report: "We believe that the challenges to the independence of the Federal Reserve pose a clear downside risk to the dollar, stemming both from concerns about the U.S. system and from its transmission effect on the decline of U.S. short-term yields."

编辑/wendey