The collapse of the August non-farm payroll data was like a massive stone thrown into a calm lake, stirring a vigorous reaction in global capital markets. This data has fundamentally altered market expectations—significantly increasing the probability of an interest rate cut in September.

Furthermore, Jerome Powell's remarks at the 2025 Jackson Hole Global Central Banking Conference signaled a clear dovish shift, further fueling market sentiment towards interest rate cuts. Currently, the market estimates the probability of a rate cut in September to exceed 87%.

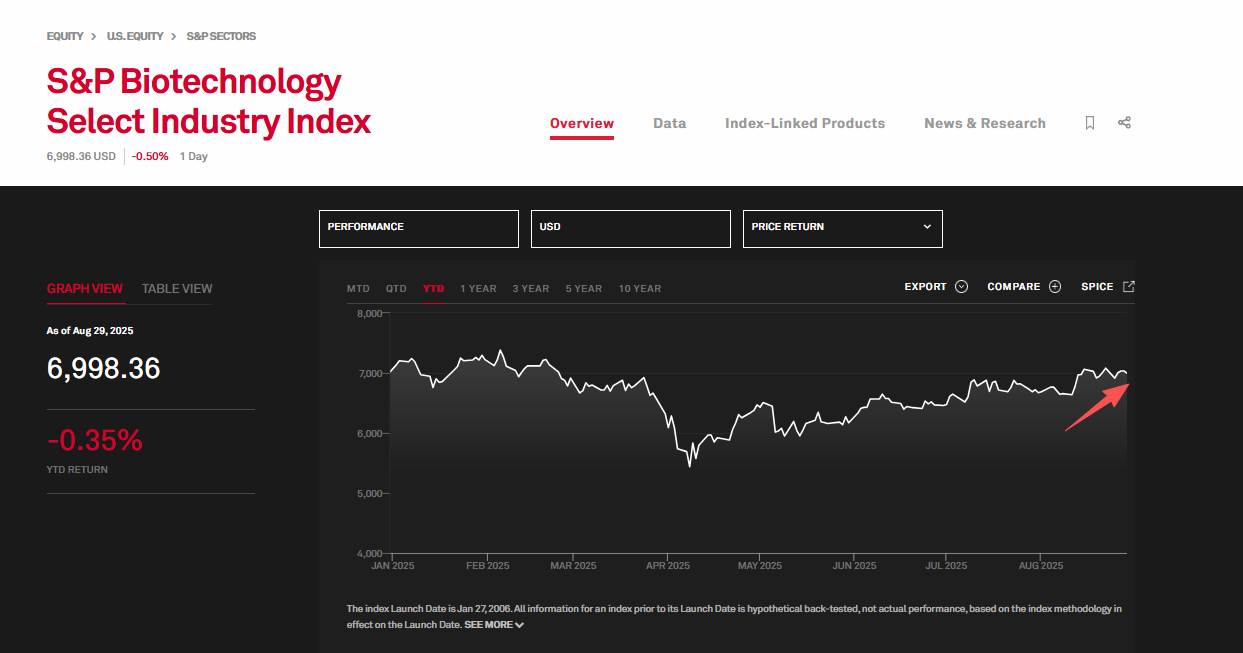

Against this backdrop, capital has begun to flow en masse into risk asset sectors. In August, the S&P Biotechnology Index (SPSIBI) performed exceptionally well, achieving the best single-month gain of the year. As of the market close on August 29, the index had risen by 5.41% for the month, fully reflecting the market's positive reaction to the expectations of an interest rate cut.

The ETF tracking this index $SPDR S&P Biotech ETF (XBI.US)$ also demonstrated strong momentum in August.

The ETF tracking this index $SPDR S&P Biotech ETF (XBI.US)$ also demonstrated strong momentum in August.

The biotechnology sector is sensitive to interest rates.

The biotechnology industry is extremely sensitive to changes in interest rates, primarily due to its industry characteristics: high financing needs and high future value.

Firstly, the research and development in biotechnology is a long and expensive process. Prolonged timelines, substantial capital expenditure, and high failure rates are common characteristics of the industry. During this period, biotechnology companies often remain unprofitable for extended durations, heavily relying on venture capital or IPOs for financial support.

Taking innovative drugs as an example, the average cost of drug development is approximately $2.284 billion, with an average development time exceeding 7 years. Biotechnology firms need to rely on external financing to support their cash flow. In a low-interest-rate environment, these companies face reduced difficulties in financing and lower costs of capital, allowing for easier replenishment of cash flow to support the advancement of more R&D pipelines.

Secondly, biotechnology companies possess a high long-term value. The market typically employs the weighted average cost of capital (WACC) as the discount rate to estimate the present value of a company's future cash flows. A reduction in benchmark interest rates will lower the discount rate, thereby increasing the valuation of biotechnology companies.

Therefore, interest rate cuts generally benefit the biotech industry through two avenues:

Lowering the capital costs of R&D activities

Enhancing the attractiveness of future earnings potential in valuation models

Moreover, interest rate cuts often increase investors' risk appetite, making capital more willing to flow into high-potential asset classes such as biotech, further providing biotech firms with a liquidity premium.

Historical data shows that interest rate cut cycles perform exceptionally well.

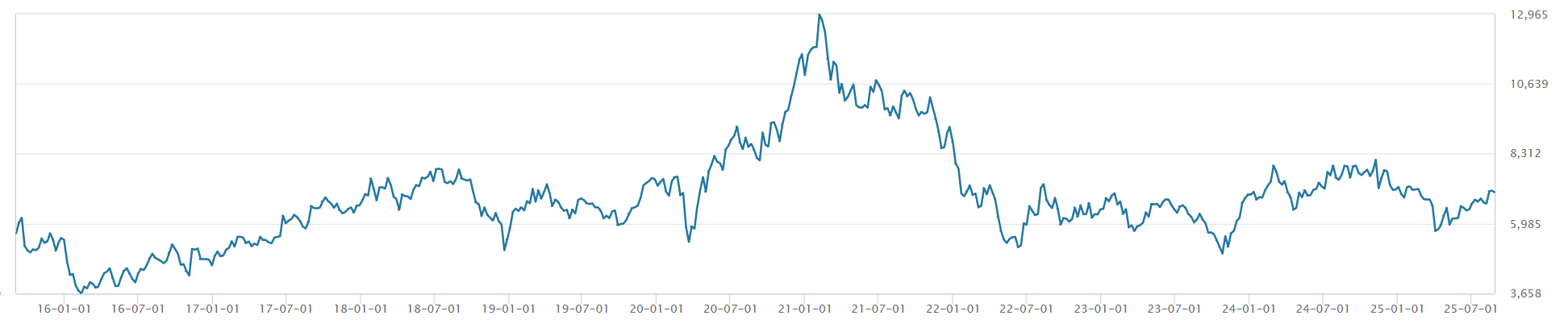

Looking back at history, we can see a clear correlation between the Nasdaq Biotechnology Index and the trends in the Federal Reserve's interest rates.

From mid-2019 to the end of 2021, the Federal Reserve was in a rate-cutting cycle, with liquidity being eased, resulting in the SPSIBI index soaring to historical highs.

During the rate-hiking cycle from mid-2015 to mid-2019, although the biopharmaceutical sector experienced historic breakthroughs, the SPSIBI index was volatile.

In the rapid rate-hiking phase from the end of 2021 to September 2022, the index subsequently declined.

During the period of rising expectations for the Federal Reserve's rate cuts in 2024 (with a total of 75 basis points cut throughout the year), the SPSIBI index also experienced a rapid rebound.

Currently, the valuation of the biotechnology sector is at a historical low. Several major companies have undergone deep adjustments, with most pharmaceutical giants having price-to-earnings ratios of less than 20 times.$Pfizer (PFE.US)$、$Merck & Co (MRK.US)$The current price-to-earnings ratio of traditional giants is only around 13 times. The overall price-to-earnings ratio of the healthcare sector is only $S&P 500 Index (.SPX.US)$ 70% of that, indicating that the valuation of healthcare stocks is at its lowest range since 1992, demonstrating significant investment value.

M&AThe industry is experiencing a surge, and consolidation is accelerating.

The expectations of interest rate cuts not only bring about an increase in valuations but may also accelerate industry mergers and consolidations.

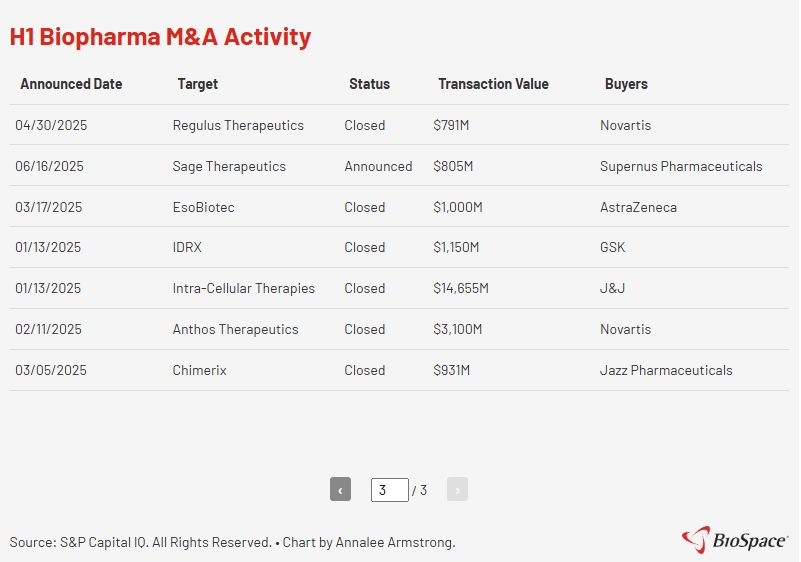

Since the beginning of this year, the global biopharmaceutical market has continued to maintain a frenzy of mergers and acquisitions. According to BioSpace statistics, in the first half of 2025, there were 32 pharmaceutical mergers and acquisitions globally, with a total amount exceeding 48 billion USD. Several significant acquisition events have attracted considerable market attention, such as $Johnson & Johnson (JNJ.US)$ acquiring Intra-Cellular Therapies for 14.7 billion USD, $Sanofi (SNY.US)$ acquiring Blueprint Medicines for 9.9 billion USD, $Merck & Co (MRK.US)$ acquiring for 10 billion USD.$Verona Pharma (VRNA.US)$and so on.

The main driving factor behind this wave of mergers and acquisitions is the approaching "patent cliff." In the next five years, the global pharmaceutical market is expected to lose approximately $192 billion in drug sales due to patent expirations. In particular, major pharmaceutical companies will continue to pursue mergers and acquisitions to replenish their pipelines in response to the "patent cliff" issue.

Additionally, the interest rate reduction environment will lower financing costs, which is conducive to further encouraging large pharmaceutical companies to acquire innovative small and medium-sized enterprises. Historical data indicates that merger and acquisition announcements often lead to a single-day increase of 30% to 100% in the stock prices of target companies.

Investment opportunities coexist with risks.

Despite facing multiple challenges in the first half of the year such as the patent cliff, drug pricing policy pressures, and a slowdown in FDA approvals, the SPSIBI index performed overall weaker than the S&P 500 index. However, since August, several constituent stocks have shown strong rebound momentum.

With the Federal Reserve's interest rate cut cycle about to commence, the biotechnology sector is entering its best investment environment in recent years. The combination of declining capital costs, active merger and acquisition activities, and signals of valuation bottoms collectively constitute the driving forces behind the sector's rise.

So, which biotechnology companies should be focused on next? After the interest rate decline, companies with four specific characteristics are worth paying attention to:

Biotechnology companies with clinical trial catalysts in the short term may gain favor in the market due to positive trial results.

Companies with significant differentiated technological advantages may see their fundamentals rapidly released following an improvement in the financing environment.

Existing businesses with additional value catalysts can further realize their value on a stable foundational basis.

Potential acquisition targets, particularly small innovative biotechnology companies in currently popular fields such as obesity, oncology, neuroscience, and immunology.

For investors, there are indeed investment opportunities in the biotechnology sector during the Federal Reserve's interest rate cut cycle, such as $SPDR S&P Biotech ETF (XBI.US)$ 、 $Direxion Daily S&P Biotech Bull 3x Shares ETF (LABU.US)$ $iShares Biotechnology ETF (IBB.US)$ However, it is also necessary to pay attention to risk control. For instance, there are risks in areas such as interest rate reduction progress, clinical advancements in innovative drugs, cancellations of product and technology licensing transactions, technological iterations, as well as international registration and commercialization that may fall below expectations.

![]() Looking for your ideal ETF?The Niu Niu U.S. Stock ETF Zone can help you!Open the market > ETF > United States > Choose from different types of ETFs!

Looking for your ideal ETF?The Niu Niu U.S. Stock ETF Zone can help you!Open the market > ETF > United States > Choose from different types of ETFs!

Editor/jason, rocky