$Opendoor Technologies (OPEN.US)$ The stock price has continued to rebound in recent weeks, with a sharp jump during Thursday's trading session. This rally comes against the backdrop of an impending management change within the company.

In August this year, Carrie Wheeler, the former CEO of Opendoor Technologies, announced her resignation. Subsequently, the company announced that Kaz Nejatian, the former $Shopify (SHOP.US)$ Chief Operating Officer of Shopify, would take over as CEO. At the same time, Opendoor Technologies launched a private placement, raising $40 million, and invited co-founders Keith Rabois and Eric Wu to rejoin the board of directors.

Throughout the summer, discussions and various meme images about Opendoor Technologies on social media were rampant. However, Thursday’s announcement provided OPEN shareholders with a tangible reason for optimism rather than mere speculation or rumors. From this perspective, the appointment of a new CEO and the addition of board members are positive signals that may help improve the company’s development trajectory.

However, former hedge fund analyst Ian Bezek pointed out that the new management team might struggle to address Opendoor Technologies’ core issues, which are structural in nature rather than stemming from mismanagement.

However, former hedge fund analyst Ian Bezek pointed out that the new management team might struggle to address Opendoor Technologies’ core issues, which are structural in nature rather than stemming from mismanagement.

Instant Home-Buying and Reselling Model: A 'Dead End' in the U.S. Stock Market

Simply put, the “instant home-buying and reselling” (iBuying, where companies quickly purchase homes and then resell them) model has yet to see a successful case in the U.S. stock market. Previously, $Zillow-C (Z.US)$ Competitors such as Redfin have completely exited this space — even during more robust periods in the real estate market, these well-known property enterprises failed to make the iBuying model profitable.

Opendoor’s most direct competitor currently, $Offerpad Solutions (OPAD.US)$ has also seen dismal performance in its home flipping business in recent years. Structurally speaking, iBuying itself is a 'fundamentally flawed' business model.

A reality check for 'rate cut trading'

The current enthusiasm for OPEN stock largely stems from high expectations of subsequent rate cuts. The Federal Reserve appears ready to initiate rate cuts at its next meeting, with markets even speculating on a 'aggressive 50 basis-point cut,' and some analysts suggesting the possibility of a 75 basis-point reduction.

Recent U.S. employment data has taken a sharp downturn, with rising unemployment giving the Fed even more reason to act to 'stabilize the labor market.' However, the problem lies in the fact that inflationary pressures remain unresolved — Thursday's inflation data showed signs of accelerating consumer price increases.

If the economy falls into 'stagflation' (high inflation coupled with high unemployment), the Federal Reserve’s rate cuts are unlikely to meet the expectations of real estate bulls. More importantly, even if the Fed cuts rates, mortgage rates may not decline significantly.

The core logic behind this judgment is that a reduction in the Federal Reserve’s benchmark interest rate does not necessarily mean banks will adjust mortgage rates accordingly. In reality, when setting mortgage rates, banks focus more on the trend of long-term U.S. Treasury yields — the key influencing factors being the 10-year and 30-year Treasury yields, rather than the Fed’s benchmark rate.

Typically, after the Fed cuts rates, the yields on 10-year and 30-year Treasuries tend to fall in tandem, but this is not an inevitable rule. Current concerns over inflation persist; if the Fed cuts rates, markets may fear that 'policy stimulus will exacerbate future inflation,' which could instead push long-term Treasury yields higher. The recent surge in precious metals prices is a direct reflection of these inflation concerns.

Given the current risk of stagflation, market sentiment suggests that the Fed’s rate cuts in the short term will have limited impact on mortgage rates. As such, the rationale behind “betting on rate cuts to boost OPEN’s stock price” is unlikely to persist.

Opendoor Technologies continues to exhibit weak performance.

Opendoor Technologies’ Q2 2025 results announced in August were disappointing: The company continued to report a net loss, with a per-share loss of 4 cents, missing market expectations by an additional cent. Its forward-looking guidance was also notably weak. More critically, as of the end of Q2, the company had only 393 homes under contract for purchase — a staggering 78% drop from Q2 2024 and a 63% decline from Q1 2025.

For a company whose core business revolves around “home resale,” a year-on-year plunge of 78% in homes under contract is far from a positive signal. Following the earnings release, OPEN shares initially fell by approximately 20%, a reaction that came as no surprise. Over recent months, the U.S. real estate market has remained under pressure, with high mortgage rates combined with economic slowdown creating headwinds for the entire industry. Moreover, the iBuying model has never achieved sustained profitability, and during market downturns, performance naturally worsens further.

Unless the market believes that “Fed rate cuts will immediately revive the real estate market,” Opendoor Technologies’ operating results are likely to remain lackluster for at least the next few quarters. However, for OPEN shareholders, the recent stock price has severely diverged from the company’s continuously deteriorating fundamentals.

What can the new management team do?

The arrival of new leadership at Opendoor Technologies is undoubtedly a positive sign — Shopify is a highly successful company, and its former executives may possess the ability to turn things around. However, the market widely views Opendoor’s significant losses not as a “management issue,” but as a “model issue”: The iBuying model has yet to prove viable on a national scale.

If there is any “bullish logic” for OPEN stock, the market believes the sole possibility lies in this: The new management, with its tech background, could potentially drive the company toward a “light-asset, technology-driven” transformation — for instance, expanding revenue streams through data sales, subscription services, or real estate brokerage fees. However, if Opendoor remains entrenched in its “asset-heavy, low-margin” model (buying properties and attempting to resell them at a slight markup), it is unlikely the company will achieve sustained profitability or true success.

Even transitioning into a “real estate platform” or “service provider” poses significant challenges: Proptech (property technology) has long been a focus area for venture capital, and Opendoor is not entering an untapped “blue ocean” market.

More importantly, Opendoor Technologies’ financial condition remains unstable: The company has accumulated substantial losses to date, with a significant portion of its balance sheet tied up in “homes held for sale,” the resale progress of which appears to be sluggish.

As of the last quarter, the company's tangible book value per share was 86 cents. However, as of now, the stock price has approached $9 per share — implying that investors are paying nearly 10 times the premium for “86 cents of intrinsic value per share.”

The bullish argument is that “the company will break away from its existing model and pivot to new businesses,” but the market questions: why pay 10 times the current intrinsic value for an uncertain expectation that “a more attractive new business might be found in the future?”

Options Strategy

Market analysis suggests that Opendoor Technologies’ stock price is significantly overvalued, but short selling at this point requires caution — a key risk for shorts is that the stock’s excessive premium over book value makes it highly feasible (and likely) for the company to conduct a large-scale secondary offering, substantially increasing the book value per share. If OPEN’s stock price continues to rise, the company could even issue shares at “double-digit prices,” which would compress short sellers’ profit margins by significantly boosting book value.

The situation has now changed: if the company initiates a large-scale secondary offering, it could raise substantial cash, significantly alleviating funding pressures for the next few years. If the new management can drive a “light-asset transformation,” the rate of cash burn will decrease, giving management more time to explore promising business directions.

Therefore, analyst Ian Bezek does not recommend “shorting OPEN stock directly,” as doing so could result in forced liquidation during a short squeeze. On the other hand, the stock’s excessive premium over book value and ongoing deep operational losses also lack a rational basis for holding the stock.

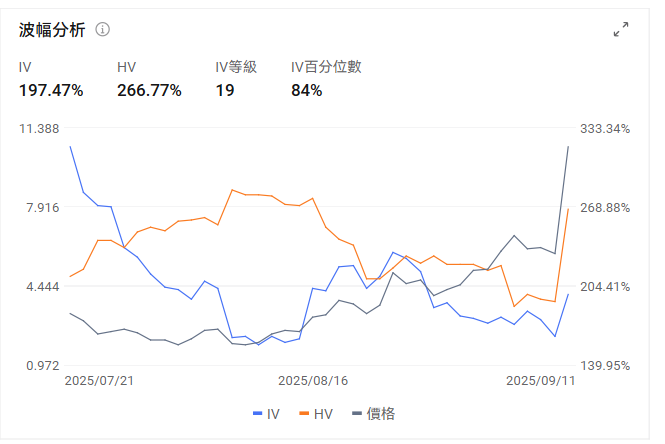

From a trading perspective, there is a potential opportunity: slightly shorting both OPEN’s call options and put options. This strategy essentially bets on a decline in OPEN’s implied volatility (IV) over time.

As the hype around “meme stocks” gradually fades, OPEN’s daily volatility will likely decrease, leading to a drop in the value of both call and put options. It should be noted that this is speculative trading, and investors need to evaluate the risks themselves.

![]() Finally, Futu News brings a small benefit to fellow investors, inviting them to claim it.Options Beginner Package

Finally, Futu News brings a small benefit to fellow investors, inviting them to claim it.Options Beginner Package

*This promotion is only available to invited HK users. Click to learn moreDetailed rules of the promotion >>

![]() With a multitude of options strategies, how can you navigate the earnings season with ease? The new Futubull desktop helps you build an options strategy in three steps, making your investments simple and efficient!

With a multitude of options strategies, how can you navigate the earnings season with ease? The new Futubull desktop helps you build an options strategy in three steps, making your investments simple and efficient!

Futu offers even more options tools to assist you! Navigate to the individual stock quote page > Options Movements > Filter > Customize your filter criteria to get the desired options movement information!

Disclaimer

This content does not constitute an offer, solicitation, recommendation, opinion, or any guarantee for any securities, financial products, or tools. The risks of loss from trading options can be significant. In some cases, the losses you incur may exceed the initial margin amount deposited. Even if you set up contingency orders, such as 'stop-loss' or 'limit' orders, these may not necessarily prevent losses. Market conditions may make it impossible to execute these orders. You may be required to deposit additional margin within a short period. If you fail to provide the required amount by the specified time, your open positions may be liquidated. However, you will still be responsible for any resulting deficit in your account. Therefore, before trading, you should research and understand options, and carefully consider whether this type of trading is suitable for you based on your financial situation and investment objectives. If you trade options, you should familiarize yourself with the procedures for exercising options and the rights and obligations at the expiration of options.

Editor/Rocky