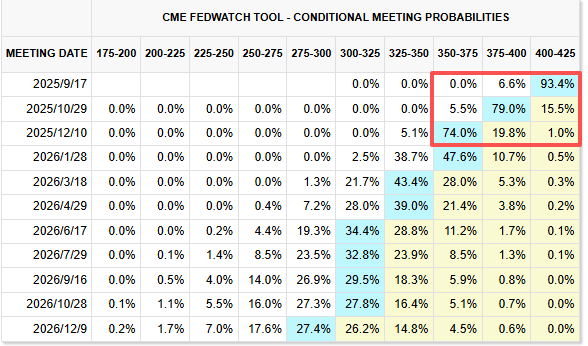

As the September Federal Reserve meeting approaches, market expectations for a restart of interest rate cuts continue to rise, creating favorable conditions for the rebound of cryptocurrencies and related stocks. According to data from the CME FedWatch tool, the probability of a 25-basis-point rate cut currently exceeds 90%, with some discussion around a more aggressive 50-basis-point cut. This signal of policy easing typically boosts market preference for risk assets.

Historical experience shows that Federal Reserve rate-cutting cycles often provide long-term support to the cryptocurrency market: In 2019, before the rate cut was implemented, Bitcoin had already doubled in value from about $4,000 at the beginning of the year to $8,000. Similarly, in 2020, when rates were slashed significantly to address the pandemic, Bitcoin's price surpassed the $60,000 mark in 2021.

The wave of new cryptocurrency-related stock listings in 2025 has become a market focus, but $Circle (CRCL.US)$ and $Bullish (BLSH.US)$ newly listed coins, such as , have entered a correction phase after experiencing a sharp price surge. If the Federal Reserve proceeds to initiate another rate-cutting cycle as expected, it could inject momentum into these recently adjusted coins, serving as a key catalyst for their return to an upward trajectory.

Fed Rate Cut Restart Provides Rebound Opportunity for Cryptocurrency Stocks

The Federal Reserve's monetary policy has always been a barometer for global financial markets. In September 2025, amid cooling labor markets and persistent inflationary pressures in the United States, the Federal Reserve is expected to reopen the rate-cut window during this week’s Federal Open Market Committee (FOMC) meeting (early morning on September 18, Beijing time). Economists widely predict a 25-basis-point rate cut, adjusting the federal funds rate target range to 4%-4.25%.

The Federal Reserve's monetary policy has always been a barometer for global financial markets. In September 2025, amid cooling labor markets and persistent inflationary pressures in the United States, the Federal Reserve is expected to reopen the rate-cut window during this week’s Federal Open Market Committee (FOMC) meeting (early morning on September 18, Beijing time). Economists widely predict a 25-basis-point rate cut, adjusting the federal funds rate target range to 4%-4.25%.

This expectation is not unfounded: August’s U.S. Consumer Price Index (CPI) data indicates that inflation has stabilized at around 2.5%, while the unemployment rate rose to 4.2%. These figures provide sufficient justification for the Federal Reserve to initiate easing policies.

In their latest reports, institutions such as Morgan Stanley and Deutsche Bank stated that the Federal Reserve is expected to implement three 25-basis-point interest rate cuts in 2025 to address the risks of slowing economic growth.

The positive impact of interest rate cuts on the cryptocurrency market is evident. A low-interest-rate environment reduces borrowing costs and increases market liquidity, thereby encouraging investors to shift towards high-risk assets such as $Bitcoin (BTC.CC)$ and $Ethereum (ETH.CC)$ . Historical data shows that during the interest rate cut cycle from 2019 to 2020, the price of Bitcoin surged from less than $10,000 to $30,000, and by 2021 it had risen above $60,000.

From another perspective, the options data of the world's largest Bitcoin ETF, $iShares Bitcoin Trust (IBIT.US)$ , further confirms the market's optimism. Recently, the Put/Call Ratio of IBIT has significantly decreased, falling from 0.6 in July to below 0.5, indicating that investors are betting more on a rise in Bitcoin rather than a decline.

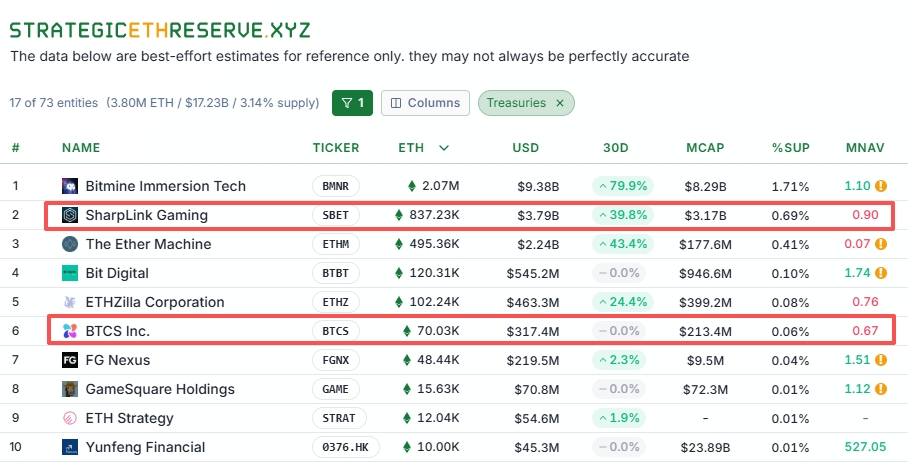

In 2025, this trend in the crypto market is expected to repeat, with the increase further driving the performance of coin-related stocks, such as mining companies and blockchain enterprises whose share prices often correlate positively with the price of Bitcoin. Specifically, for certain companies, some $Ethereum (ETH.CC)$ The current Market Net Asset Value (MNAV) of the crypto reserve company has fallen below 1, indicating that its stock price is undervalued.

to$SharpLink Gaming (SBET.US)$ For instance, as one of the largest ETH reserve companies globally, it holds approximately USD 3.6 billion worth of ETH, with nearly 100% of its ETH staked. Its MNAV recently dropped below 1, but the company has initiated a USD 1.5 billion stock repurchase program to enhance shareholder value. These repurchases not only reduce the outstanding shares but also signal confidence in the company's valuation. In a declining interest rate environment, these cryptocurrency-related stocks are expected to rebound.

Similarly, competitor $Bitmine Immersion Technologies (BMNR.US)$ is also facing an MNAV below 1; however, its holdings of nearly USD 9 billion in ETH reserves provide a solid foundation for future rebounds.

Observing the performance of newly issued AI stocks over the past two years: post-decline opportunities may arise for recent cryptocurrency stocks.

In 2025, the wave of new cryptocurrency IPOs became a market highlight, but many stocks entered a correction phase after surging. For example, $Circle (CRCL.US)$ and $Bullish (BLSH.US)$ For example, after their IPOs in the first half of the year, the share prices of these companies surged by more than 50% but then experienced a sustained pullback, with cumulative declines ranging from 30% to 50%.

This trend is similar to that of U.S. recent IPOs over the past two years, such as $Arm Holdings (ARM.US)$ 、$Reddit (RDDT.US)$ and $Astera Labs (ALAB.US)$ post-listing performance.

ARM formed a descending wedge pattern within six months of its listing in 2023. As a semiconductor stock, it benefited from the AI wave post-listing, with its share price doubling from the IPO price. Similarly, Astera Labs (ALAB), dubbed the 'mini NVIDIA,' also capitalized on the AI boom. The company, which provides semiconductor connectivity solutions, saw its stock fall more than 40% in the six months following the IPO but rebounded over two-fold from its low within a year. Reddit (RDDT), which went public in March 2024, experienced a similar pullback; however, leveraging its social platform data advantage, it delivered impressive earnings, with a half-year gain of 450%.

These historical cases indicate that the pullbacks of newly listed cryptocurrency stocks are often a process of short-term selling pressure being released, potentially leading to a trend reversal thereafter. $Circle (CRCL.US)$ Circle, a stablecoin issuer, experienced a surge in its share price after its IPO in August 2025, followed by a pullback due to market volatility. Currently, its market capitalization is approximately USD 2 billion, having declined 50% from its peak. Technical charts show that Circle is forming a descending wedge, a bullish reversal pattern. Once it breaks above the upper boundary, significant upside potential is expected.

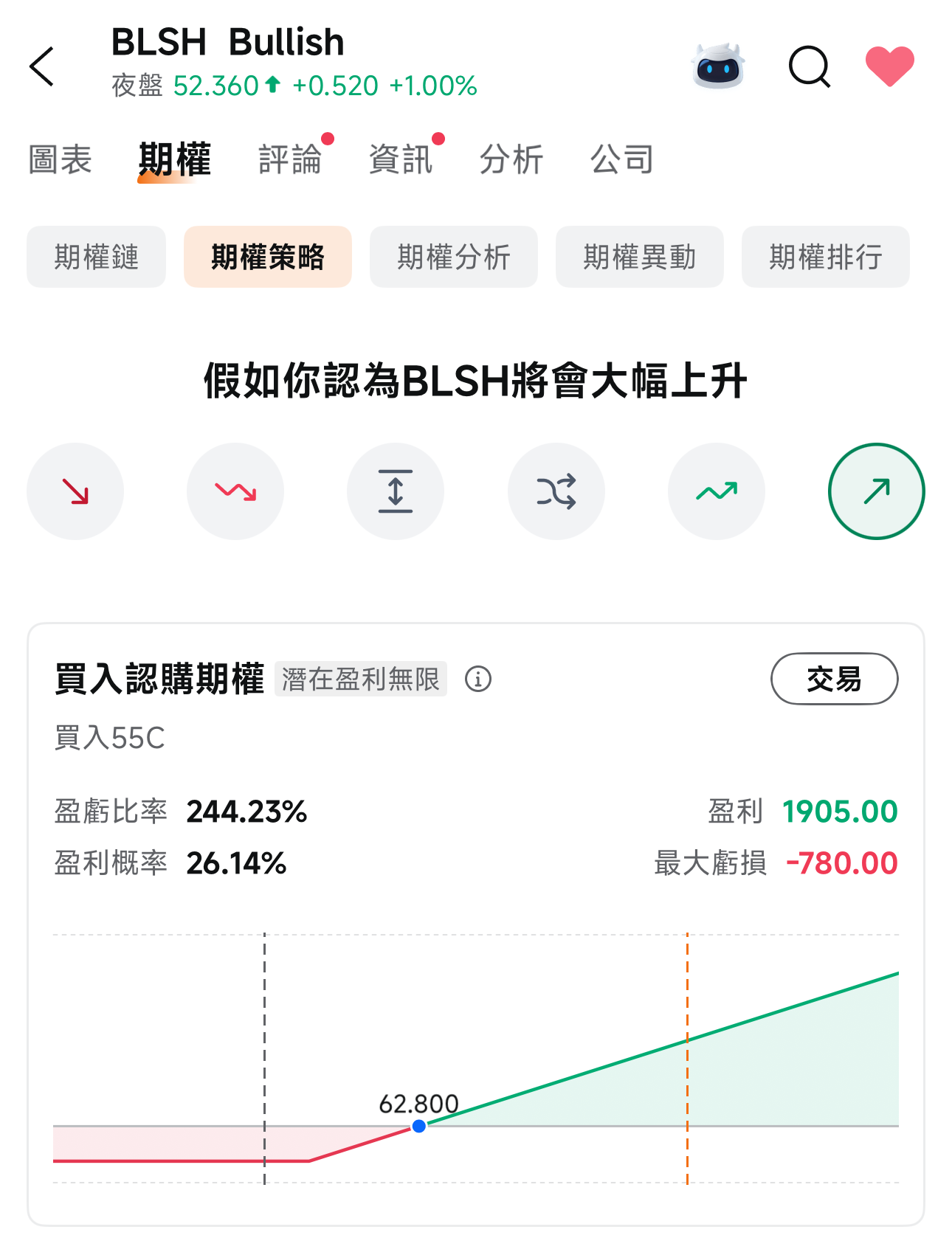

Similarly, as a cryptocurrency exchange, $Bullish (BLSH.US)$ BLSH delivered strong performance post-IPO, but has recently pulled back, with a current market cap of approximately USD 5.3 billion. However, BLSH's window of opportunity is particularly clear.

The company is set to release its Q2 2025 earnings report after the US stock market closes on Wednesday (September 17), right after the Federal Reserve's interest rate decision meeting. Institutional forecasts expect revenue of USD 56.3 million for Q2 2025, with earnings per share projected at USD 0.88. A dual catalyst—favorable interest rate cuts and positive earnings results—could drive a rebound in BLSH's stock price.

Cryptocurrency Stock Options Strategy: Balancing Offense and Defense

Investors holding a significant number of cryptocurrency-related stocks may utilize options as tools to hedge against potential volatility events.

Offensive Strategy

Buy at-the-money call options (Call) with one month until expiration. In a high implied volatility (IV) environment, this strategy captures short-term upside gains. Leverage volatility to profit from premium spreads. In volatile markets, buying longer-dated single-leg Call options is suitable for scenarios anticipating rebounds, such as the rise of Bitcoin after an interest rate cut.

Defensive Strategy

Buy at-the-money (same as current price) put options to protect holdings and lock in potential losses. If cryptocurrency or related stocks continue to decline, the Put option will generate profits to offset losses from the underlying stock, functioning effectively as insurance during periods of crypto volatility.

For investors with larger stock positions, selling Puts is a preferable choice.

Given the current extremely high implied volatility (IV), investors aiming to bottom-fish while holding substantial stock positions can sell put options with lower strike prices to collect premiums, thereby reducing holding costs while maintaining upside potential. If the stock price falls below the strike price, investors may need to prepare margin to purchase the stock, but the collected premiums will have already lowered the cost basis.

![]() Finally, Futu News brings a small benefit to fellow investors, inviting them to claim it.Options Beginner Package

Finally, Futu News brings a small benefit to fellow investors, inviting them to claim it.Options Beginner Package

*This promotion is only available to invited HK users. Click to learn moreDetailed rules of the promotion >>

![]() With a multitude of options strategies, how can you navigate the earnings season with ease? The new Futubull desktop helps you build an options strategy in three steps, making your investments simple and efficient!

With a multitude of options strategies, how can you navigate the earnings season with ease? The new Futubull desktop helps you build an options strategy in three steps, making your investments simple and efficient!

Futu offers even more options tools to assist you! Navigate to the individual stock quote page > Options Movements > Filter > Customize your filter criteria to get the desired options movement information!

Disclaimer

This content does not constitute an offer, solicitation, recommendation, opinion, or any guarantee for any securities, financial products, or tools. The risks of loss from trading options can be significant. In some cases, the losses you incur may exceed the initial margin amount deposited. Even if you set up contingency orders, such as 'stop-loss' or 'limit' orders, these may not necessarily prevent losses. Market conditions may make it impossible to execute these orders. You may be required to deposit additional margin within a short period. If you fail to provide the required amount by the specified time, your open positions may be liquidated. However, you will still be responsible for any resulting deficit in your account. Therefore, before trading, you should research and understand options, and carefully consider whether this type of trading is suitable for you based on your financial situation and investment objectives. If you trade options, you should familiarize yourself with the procedures for exercising options and the rights and obligations at the expiration of options.

Editor/Rocky