The Federal Reserve is scheduled to hold its interest rate meeting on September 16 and 17, with Wall Street widely expecting the meeting to result in a rate cut, likely by 25 basis points.

However, a small number of market participants anticipate a 50-basis-point rate cut, as the latest economic and employment data in the U.S. have been less than ideal. Meanwhile, the cost effects triggered by Trump's tariffs are gradually becoming apparent, with signs of upward pressure on U.S. consumer prices.

Thus, this Federal Reserve interest rate decision has drawn significant attention: the focus is not on whether rates will be cut, but rather on the Federal Open Market Committee’s (FOMC) view of the U.S. economic outlook, as it will provide insight into the committee's future rate-cutting trajectory.

What capital markets love and fear most is the same thing: uncertainty.

What capital markets love and fear most is the same thing: uncertainty.

The Fed’s assessment of the economic outlook and Powell’s post-meeting statement after the rate decision may help clarify short-term uncertainties, thereby providing more clarity for capital markets.

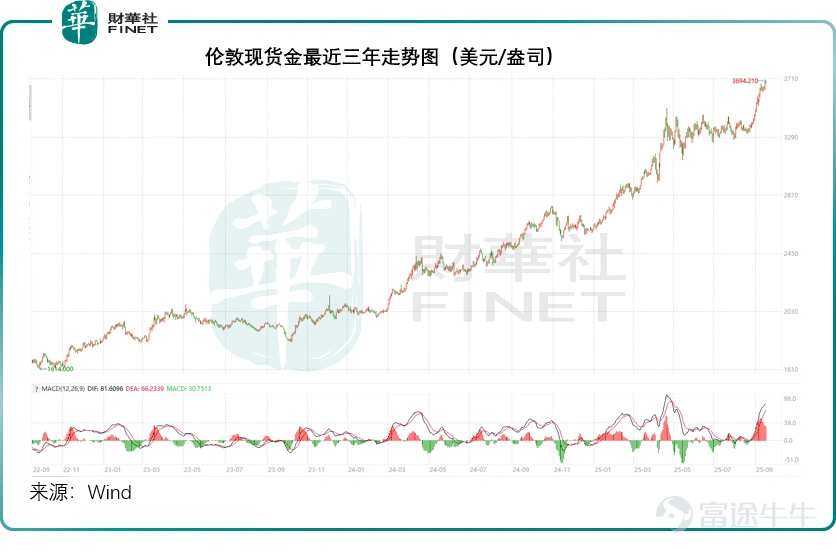

Before the interest rate meeting, gold prices became volatile first.

Data from Wind shows that London spot gold briefly surpassed USD 3,690 per ounce during the Asian trading session, hitting another record high at USD 3,694.21, and is currently trading at USD 3,688.21.

The record high in gold prices can be attributed to both fundamental supply-demand dynamics and short-term triggers, specifically the U.S. dollar.

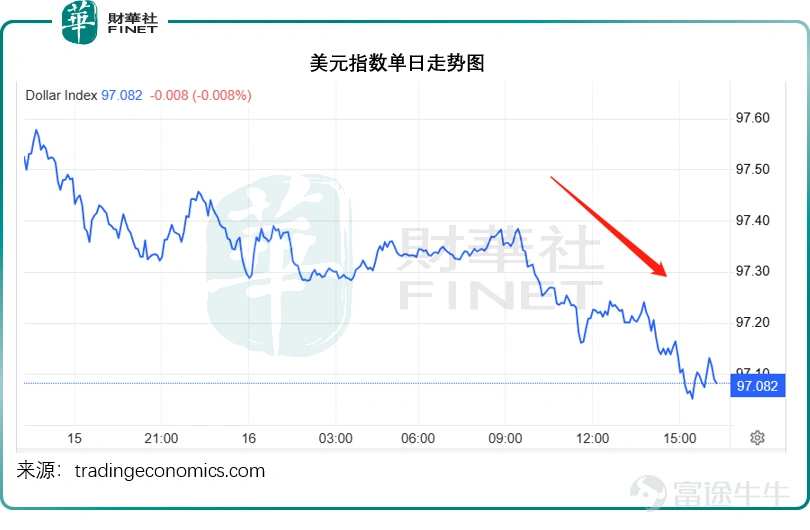

Ahead of the Fed’s interest rate decision, the weakening of the U.S. dollar reflected widespread market expectations of a probable rate cut by the Fed, which would mark the first rate cut since December 2024.

See the chart below,$USD (USDindex.FX)$Currently hovering around the 97 level.

If the Federal Reserve anticipates that the outlook for the U.S. economy and employment is less optimistic, while inflation remains under control, the likelihood of further interest rate cuts will increase significantly, potentially benefiting asset prices, including gold and U.S. equities.

Conversely, if the Federal Reserve remains ambiguous, indicating it will observe more data before deciding on future interest rate directions, and its stance on inflation remains unclear, asset prices that surged due to expectations of a Fed pivot to 'dovish' policies may see profit-taking.

Recently,$S&P 500 Index (.SPX.US)$and$Nasdaq Composite Index (.IXIC.US)$Hitting a new high, with significant constituent stocks $Alphabet-C (GOOG.US)$breaking through a market capitalization of 3 trillion USD, becoming the fourth publicly listed company globally to surpass a 3 trillion USD market cap, following $NVIDIA (NVDA.US)$、$Microsoft (MSFT.US)$and$Apple (AAPL.US)$. We have observed that over the past five trading days, the cumulative increase of Alphabet Inc. Class C (Google-C) has reached 7.52%.

Meanwhile, another key constituent stock$Tesla (TSLA.US)$Recently, there have been frequent good news: the German factory has increased production, which may indicate that the company is optimistic about future demand in Europe; at the same time, the new models launched in China have shown strong order performance; additionally, Musk has spent $1 billion to increase his stake in Tesla stock, and Tesla's stock price has surged 18.37% in the last five trading days, recovering losses incurred this year, with the price change from the beginning of the year shifting from negative to a positive 1.54%.

On the other hand, the expectation of interest rate cuts means that the cost of funds will decrease, attracting capital to flow into high-risk, high-return assets, such as emerging markets. During the Asian trading session on September 16, Japanese stocks reached a new high again.$Nikkei 225 (.N225.JP)$The index once soared to a record high of 45,055.38 points, closing at 44,902.27 points.$Hang Seng TECH Index (800700.HK)$Increased by 0.56%, the smooth progress of China-U.S. trade negotiations may also be one of the driving factors.

Epilogue:

In the current global economic situation, which is full of uncertainties, the capital market is like a startled bird, highly sensitive to every move of the Federal Reserve's interest rate meetings. Every fluctuation in data and every wording of statements can trigger a significant market reaction. After all, from the surge in gold prices to the weakening of the dollar, from the new highs in U.S. stocks to the inflow of funds into emerging markets, the core of all these fluctuations points to a "thirst for certainty."

Compared to the US stock market, the Hong Kong stock market is still at a low valuation, and it is precisely this uncertainty that makes it the most noteworthy value pit: as an important part of the global capital market, it not only benefits from the expectation of interest rate cuts leading to "lower capital costs and a flow towards high cost-performance assets," but its investment value is becoming increasingly prominent at this current juncture.

It is at this critical juncture that the preparatory work for the 12th "Top 100 Hong Kong Stocks" selection activity has officially commenced. This selection has never strayed from the essence of the market, with its core mission being to provide a reliable anchor point for "confused capital." Unlike ordinary rankings, it not only uses "representativeness, growth potential, and resilience" as key criteria, but also aligns closely with current market logic: paying attention to the margin of safety for companies in undervalued conditions, their ability to absorb capital during a rate-cutting cycle, and their long-term potential amid trade dividends and industrial upgrades. This authoritative and impartial ranking essentially helps investors navigate through the fog of "Fed policy swings and asset price volatility," accurately identifying high-quality investment targets in the Hong Kong stock market that combine risk resistance with room for growth.

From the Federal Reserve’s interest rate decisions shaping capital flows to the Top 100 Hong Kong Stocks anchoring value directions, this synergy bridging global markets and regional opportunities will ultimately assist capital in finding clear allocation paths. The concentration of high-quality enterprises represented by the list will further solidify the resilience of the Hong Kong stock market, injecting sustained momentum into the prosperity of Hong Kong's and even the global capital markets. So, which companies will stand out in this authoritative selection? Let us wait and see.

Editor/Melody