The Fed resumes rate cuts: What are the implications for global markets?

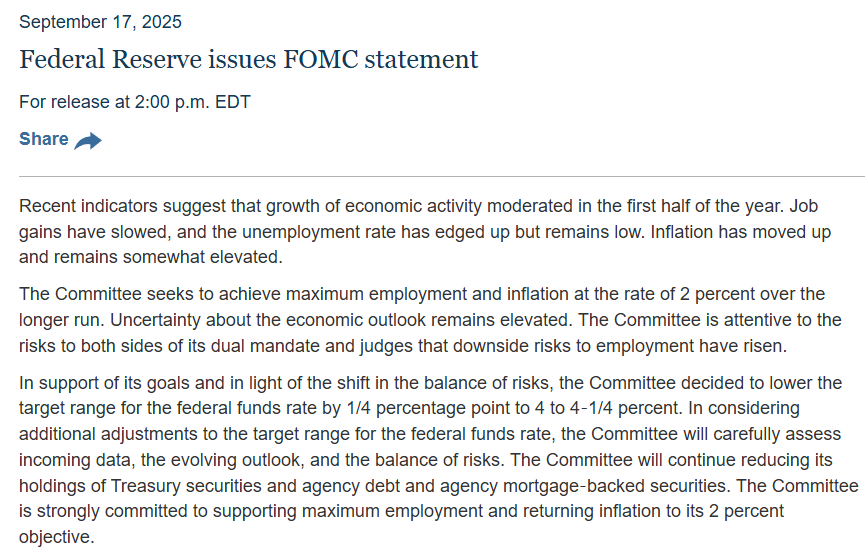

The Federal Reserve announces a 25-basis-point interest rate cut.

According to CCTV News, the latest minutes of the Federal Reserve'sFederal Open Market Committee(FOMC) monetary policy meeting revealed that the Federal Reserve has decided to cut the target range for the federal funds rate by 25 basis points to between 4.00% and 4.25%. This marks the Fed's first rate cut since December 2024.

Although the U.S. inflation rate has risen and remains at a slightly higher level, significantly weaker-than-expected job growth in recent months prompted the Fed to finally implement the rate cut. Recent indicators suggest that economic activity growth slowed in the first half of the year, and job growth decelerated. Uncertainty about the economic outlook persists, with downside risks to employment increasing.

Stephen Millan, newly appointed Fed governor and currently still serving as chairman of the White House Council of Economic Advisers, was the sole dissenter, advocating for a 50-basis-point rate cut.

Stephen Millan, newly appointed Fed governor and currently still serving as chairman of the White House Council of Economic Advisers, was the sole dissenter, advocating for a 50-basis-point rate cut.

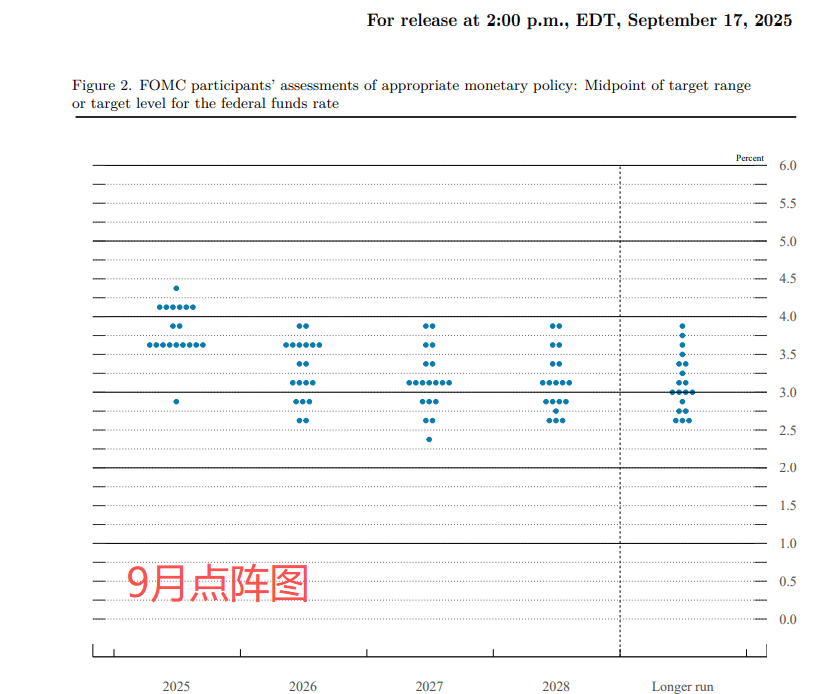

The Fed's forecasts indicate that an additional 50-basis-point cut will be made by the end of the year, followed by another 25-basis-point cut annually over the next two years.

Fed Chair Jerome Powell subsequently held a press conference, emphasizing that monetary policy is not on a predetermined path and that the Fed retains the ability to respond promptly. Today’s rate cut is a 'risk mitigation' measure; the rationale for cutting rates by 25 basis points lies in slowing economic growth and rising employment risks, rather than widespread support for a 50-basis-point reduction. Changes in the balance of risks have led the Fed to adopt a more neutral stance on rates. Monetary policy has remained tight this year, and future decisions will be made meeting by meeting based on incoming data. Powell reiterated that the interest rate path is not pre-set, and the impact of policy adjustments on the economy remains uncertain.

Shortly after the announcement, major U.S. stock indexes experienced a slight uptick. $Dow Jones Industrial Average (.DJI.US)$ The highest increase was 1.1%, $Nasdaq (NDAQ.US)$ Turned positive, $S&P 500 Index (.SPX.US)$ The highest increase was 0.27%. During Powell's speech, U.S. stock indices collectively pulled back. By the close, the Dow Jones Industrial Average rose by 0.57%, the Nasdaq Composite fell by 0.33%, and the S&P 500 dropped by 0.1%.

$USD (USDindex.FX)$ High volatility during trading saw a maximum decline of 0.44% to 96.2179, followed by a rapid recovery, reaching a maximum increase of 0.37% to 96.999 within an hour; at the close, it was up by 0.4%, at 97.0307.

Commodities closed collectively lower, with spot gold in London falling over $60 from its peak to trough, closing at $3,658.89 per ounce, down 0.83%. Spot silver in London once fell by 3.39%, closing down 2.14% at $41.638 per ounce. Among base metals, LME copper and LME zinc, as well as crude oil benchmarks WTI crude and ICE Brent crude, all experienced intraday declines exceeding 1%.

Review of the Federal Reserve's past rate cuts

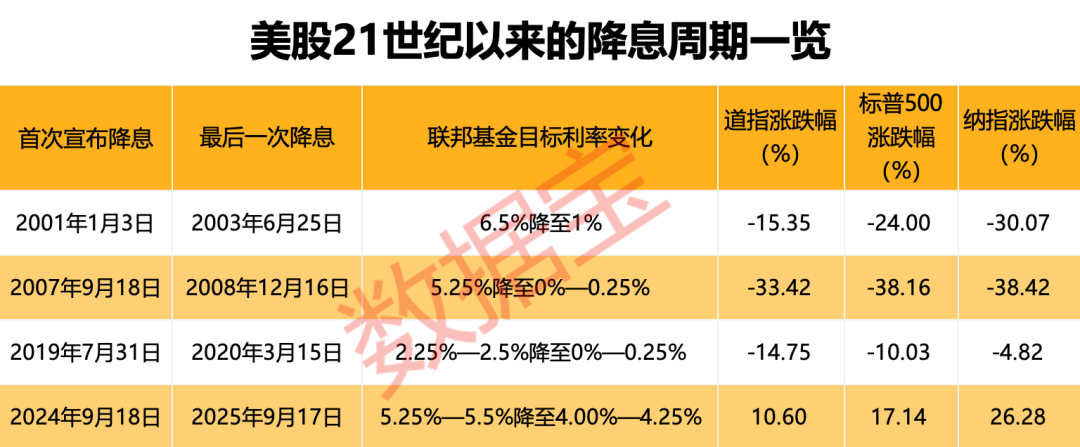

Looking back at history, since 2000, the Federal Reserve has experienced four interest rate cut cycles: January 3, 2001 to June 25, 2003; September 18, 2007 to December 16, 2008; August 1, 2019 to March 16, 2020; and from September 19, 2024 to the present. These four rounds of rate cuts were all in response to signals of economic slowdown or easing inflationary pressures, with each cycle having its unique triggering factors.

The first interest rate cut cycle of the 21st century occurred between 2001 and 2003. Affected by the bursting of the internet bubble and the impact of terrorist attacks, the U.S. stock market suffered heavy losses. In response to downward economic pressure, the Federal Reserve continuously lowered interest rates, reducing the federal funds rate from 6.5% to a final level of 1%. The rate-cutting policy ultimately helped stabilize and revive the economy. From June 2003 to June 2004, the federal funds target rate remained at a historic low of 1%. The accommodative monetary environment significantly boosted economic vitality, with U.S. GDP growth rising from 1.7% in 2001 to 3.9% in 2004.

The second interest rate cut cycle occurred between 2007 and 2008. Impacted by the collapse of the real estate market and the worsening global financial crisis, the Federal Reserve reduced interest rates to near-zero levels and began implementing quantitative easing in dollars. During this period, the U.S. stock market experienced a sharp correction, with the S&P 500 falling 38.49% and the Dow Jones Industrial Average declining 33.84% in 2008. After interest rates were reduced to zero, the Federal Reserve did not raise rates for seven years, until the first rate hike in December 2015.

The third interest rate cut cycle began at the end of July 2019. Amid a robust economy and labor market, but low inflation and heightened trade tensions, the Federal Reserve implemented three consecutive rate cuts over three months, totaling 75 basis points. Then, in March 2020, to address the impact of the COVID-19 pandemic, the Federal Reserve held an emergency unscheduled meeting and announced two significant rate cuts in quick succession, ultimately reducing rates by 100 basis points and lowering the federal funds target range to 0%-0.25%. However, the market reacted negatively, with the New York Stock Exchange plummeting on March 16, triggering multiple circuit breakers, and all three major indices dropping more than 11% in a single day.

The most recent interest rate cut cycle began in September 2024. With inflation continuing to decline and approach the Federal Reserve's long-term target, coupled with a weakening labor market and rising unemployment, various economic indicators showed slowing growth momentum. Concerned that delayed action might exacerbate the risk of recession, the Federal Reserve implemented a 'preemptive rate cut.' On September 19, 2024, the Fed made an initial rate cut of 50 basis points, followed by 25-basis-point cuts in November and December. From January to August this year, the Federal Reserve kept interest rates unchanged at 4.25%-4.5%, until another rate cut was implemented this month.

U.S. Stocks: Major Indices Generally Decline During Rate Cut Cycles

Statistics show that since 2000, the Federal Reserve has cut interest rates 32 times, with the Dow Jones Industrial Average and the S&P 500 more likely to decline on the day of rate cut announcements, falling 18 out of 32 times. The Nasdaq Composite Index showed an equal probability of gains and losses.

In the short term following past rate cuts, there has been no clear pattern of gains or losses in the three major U.S. stock indices. The probability of achieving gains within five trading days and 20 trading days after the announcement was higher than the probability of declines. However, when extended to 60 trading days, the likelihood of declines in the Dow Jones Industrial Average and the S&P 500 exceeded that of gains, while the Nasdaq Composite Index still tended to rise. This suggests that technology growth stocks are more likely to outperform cyclical value stocks in the short term after the start of a rate cut cycle.

When viewed over the entire cycle, the three major U.S. stock indices experienced significant declines during the first three rate cut cycles, with the most pronounced declines occurring during the 2007-2008 cycle, where all indices fell more than 30%. In contrast, during the current rate cut cycle, U.S. stock valuations have not shown a significant decline, possibly due to the absence of a major economic crisis and the Federal Reserve's pursuit of a 'soft landing' for the economy.

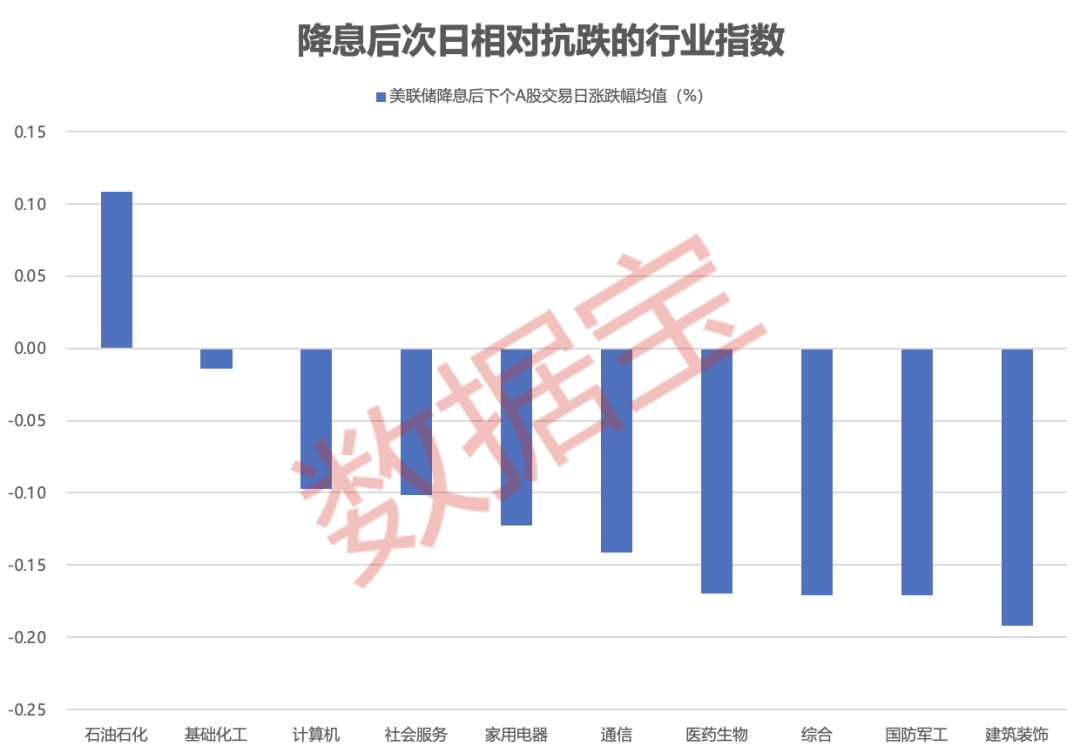

A-shares: The oil and petrochemicals sector demonstrated relative resilience against declines.

On the next trading day of the A-share market following the Federal Reserve's interest rate cut announcement, major A-share indices generally declined. Out of the previous 31 interest rate cuts, the Shanghai Composite Index fell 17 times with an average decline of 0.25%, while the Shenzhen Component Index dropped 17 times with an average decrease of 0.28%.

In terms of sectors, historically, after each interest rate cut, A-share industry indices have experienced more declines than gains on the next trading day. On average, only the petroleum and petrochemicals sector index showed a positive performance, rising by an average of 0.11%. Other relatively resilient industries included basic chemicals, computer technology, social services, home appliances, and telecommunications, with average declines within 0.15%; food and beverage, construction materials, and electronics performed poorly, with average declines exceeding 0.4%.

Commodities: Gold significantly rises during interest rate cut cycles.

In the commodities market, spot gold in London, representing precious metals, has seen significant increases during interest rate cut cycles. The most notable increase occurred from September 18, 2024, to date, with a rise of 48.94%.

In contrast, LME copper, representing industrial metals, and WTI crude oil, representing energy, have predominantly fallen.

Since 2000, Federal Reserve interest rate cuts have often been accompanied by economic recessions, with market risk aversion driving rapid increases in gold prices. For other commodities, the global economy typically experiences downturns during interest rate cut cycles, negatively affecting emerging market growth and weighing on the performance of commodities such as crude oil and industrial metals.

The movement of the US dollar tends to align closely with Federal Reserve interest rate cut cycles. During interest rate cut periods since 2000, the US Dollar Index has generally fallen or remained at lower levels.

A research report from BOC Securities noted that the Federal Reserve's initiation of an interest rate cut cycle indicates a decline in US interest rate levels, reducing the relative attractiveness of dollar-denominated assets (such as Treasury yields). This leads to capital outflows from dollar assets in search of higher returns in non-dollar assets, thereby directly pressuring the US dollar from the perspectives of interest rate parity and capital flows.

Institutions are optimistic about the performance of A-shares and Hong Kong stocks during this interest rate cut cycle.

Multiple institutions have issued research reports stating that this interest rate cut cycle differs from the past three cycles, and A-shares plus Hong Kong stocks may perform well.

Huaxin Securities' research report indicates that the Federal Reserve's resumption of interest rate cuts, against the backdrop of a weak economy, is expected to lead to a deeper and longer easing cycle. The combination of declining interest rates and the release of macro liquidity presents trend-based opportunities in rate-cut trading. Amidst the interest rate cuts, global liquidity is anticipated to remain abundant, driving the continued performance of risk assets, with both the A-share and H-share markets poised to benefit.

BOC Securities' research report suggests that under the Fed's interest rate cut cycle, Hong Kong stocks are likely to benefit in the short term from both the global liquidity shift and a domestic earnings inflection point. Scarce technology assets and high-dividend state-owned enterprises may emerge as key allocation themes. During the interest rate cut cycle, small-cap growth stocks in the A-share market typically exhibit structural-driven rallies, with technology stocks expected to be among the beneficiaries during the revaluation of renminbi-denominated assets amid this period of a weaker US dollar cycle.

Editor/KOKO