Driven by the dual forces of global energy transition and geopolitical competition, rare earth elements have become the focal point of a new round of resource contention. On October 20, US President Trump and Australian Prime Minister Anthony met at the White House to sign a critical minerals project agreement valued at approximately $8.5 billion, strengthening cooperation in critical minerals and rare earths. The mining agreement once again pushed up the rare earth sector.

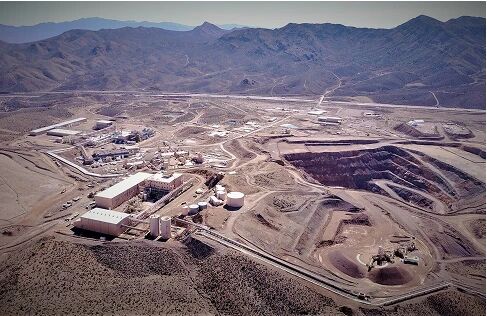

As the leading player in rare earth mining and processing within the U.S., $MP Materials (MP.US)$ MP Materials operates the only active rare earth mine in the United States—the Mountain Pass Mine in California. In 2024, the mine produced 45,400 tons of rare earth concentrate and 1,294 tons of neodymium-praseodymium oxide (NdPr).

The share price of MP Materials surged from less than $20 to a historic high of $100.25 in October 2025, marking an increase of over fivefold. Its market capitalization exceeded $14 billion, far surpassing other US rare earth companies and ranking it at the top of the US rare earth industry.

This is not merely a stock market rally but a microcosm of the reshaping of the US supply chain. The rise of MP Materials stems from strategic opportunities amid US-China trade frictions and the surge in downstream demand. However, the risks associated with holding positions at elevated levels also follow—volatile stock prices expose investors to potential pullback risks.

This is not merely a stock market rally but a microcosm of the reshaping of the US supply chain. The rise of MP Materials stems from strategic opportunities amid US-China trade frictions and the surge in downstream demand. However, the risks associated with holding positions at elevated levels also follow—volatile stock prices expose investors to potential pullback risks.

This article will analyze the turnaround journey of MP Materials and exploreOptions Strategyhow to help investors avoid potential pitfalls of holding shares at high levels, achieving risk hedging and balanced returns.

MP Materials' Low Point: From Mine Restart to Market Challenges

The predecessor of MP Materials was the Mountain Pass rare earth mine (formerly owned by Molycorp), located in the California desert. This mine was once a giant in global rare earth production during the 1990s, accounting for more than 80% of global annual output at its peak.

However, with the rise of China's rare earth industry, US domestic companies struggled to compete, leading to the closure of Mountain Pass mine in 2002. Due to geopolitical considerations and supply chain security concerns, Mountain Pass made several attempts to restart operations after 2010, but its journey was fraught with difficulties until Molycorp filed for bankruptcy in 2015.

This trough period lasted nearly 20 years, symbolizing the United States' strategic retreat in the critical minerals sector.

In 2017, MP Materials acquired Mountain Pass and resumed production. In 2020, MP Materials went public on the New York Stock Exchange through a SPAC(Special Purpose Acquisition Company), with its stock price initially at a historic low of just $9.78 at the time of listing.

At the time, MP Materials faced multiple challenges: high production costs and reliance on China for processing; weak market demand and low rare earth prices; and geopolitical uncertainties, with China controlling over 90% of global rare earth refining capacity, leaving U.S. companies under immense pressure.

In its first year as a public company, MP Materials only achieved preliminary recovery in rare earth concentrate production, generating less than $100 million in annual revenue and posting a net loss. Investors remained cautious about this “resurrected” mining firm, with its stock price lingering in the $10-15 range for an extended period.

The turning point during this low period came in 2021 amid escalating U.S.-China trade tensions. Potential restrictions on China’s rare earth exports and the Biden administration's push for the Inflation Reduction Act injected vitality into MP Materials. The company received initial funding from the U.S. Department of Defense and began investing in processing facilities. By 2022, MP Materials announced the restart of the refining production line at the Mountain Pass mine, reaching record-high NdPr oxide output. The stock price also surged to a phase high of $60.19.

However, a slowdown in the global economy and fluctuations in EV demand still drove the company’s stock price below $20 in 2023. Data showed that while the company’s revenue grew to $204 million in 2023, it still recorded losses, underscoring persistent bottlenecks in the supply chain.

Throughout 2024, the company’s stock price remained subdued with minimal trading volume. Investors witnessed the transformation from a “ghost mine” to a “strategic asset,” but also bore the brunt of uncertainty. Companies overly reliant on resource prices are vulnerable to macroeconomic cycles; only policy support and industrial chain upgrades can ignite a recovery.

The Road to Surge: Dual Drivers of Geopolitics and Market Demand

Starting June 2025, MP Materials’ stock price began accelerating, climbing from below $20 to over $30. In July, the stock surged by 50%, followed by another 100% gain in August. On October 14, it closed at $98.65, representing a more than fivefold increase from its 2020 low. Its market capitalization soared from $2 billion to $13 billion, elevating it to large-cap status.

This “surge feast” was no accident but rather the result of multiple factors converging catalytically.

First, geopolitics is the primary driver. The escalation of Sino-US trade tensions has led the US government to view rare earth as a cornerstone of national security. In April 2025, MP Materials announced the cessation of rare earth concentrate exports to foreign countries. The company explicitly stated that, at current tariff levels, exporting rare earth minerals lacks commercial viability and does not align with US national interests. Instead, it will focus on 're-industrializing' the rare earth supply chain domestically within the United States.

In July 2025, the US Department of Defense announced a $400 million acquisition of convertible preferred shares in MP Materials, becoming its largest shareholder (with a 15% stake), supporting MP Materials’ “10X Facility” expansion project. This initiative aims to increase NdPr production tenfold, breaking China Rareearth's monopoly. Simultaneously, the Department of Defense set a floor price of $110 per kilogram for its core product NdPr (neodymium-praseodymium), significantly higher than the current market price of $77 per kilogram.

During the same period, the Trump administration threatened to impose tariffs on China Rareearth, further stimulating the recovery of domestic production capacity. Analysis firm Kharon noted, “Sino-US tensions will continue to expand government support for rare earth enterprises, and MP Materials is benefiting from this.”

The backing of Wall Street capital has further bolstered market confidence. In addition to the Department of Defense, Goldman Sachs and JPMorgan will jointly provide $1 billion in financing to support MP’s production expansion and magnet manufacturing projects. Capital markets have viewed this as a strong endorsement. This combination strengthens MP’s growth trajectory under the dual drivers of policy support and financial resources.

Secondly, there has been an explosive growth in market demand. Rare earths are critical materials for smartphones, electric vehicles (EVs), wind power, and defense equipment. NdPr is used to manufacture high-performance magnets, with demand surging alongside EV sales. Global EV sales are projected to exceed 20 million units by 2025, with giants like BYD and Tesla increasing local procurement.

At the business level, the company has signed long-term supply agreements with industry giants such as Apple and General Motors (GM), effectively locking in downstream demand. Notably, the $500 million agreement with Apple includes a $200 million advance payment, strongly supporting its magnet material capacity construction and recycling business expansion.

Internal operations within the enterprise have also played a significant role. In Q2 2025, MP Materials reported revenue of $57.39 million, a year-on-year increase of 85%. The company processed more concentrate internally, driving a 226% year-on-year surge in high-value NdPr oxide sales, while achieving a near 10% price increase, narrowing losses, and gradually clarifying its path to profitability. Morgan Stanley and BMO Capital successively upgraded the company’s ratings.

TechnicallyLook, the company's stock price has broken through multiple moving averages,MACDshows a strong golden cross signal, with trading volume increasing fourfold, indicating capital inflow.

Options Strategy: How to avoid the risk of being stuck at a high position?

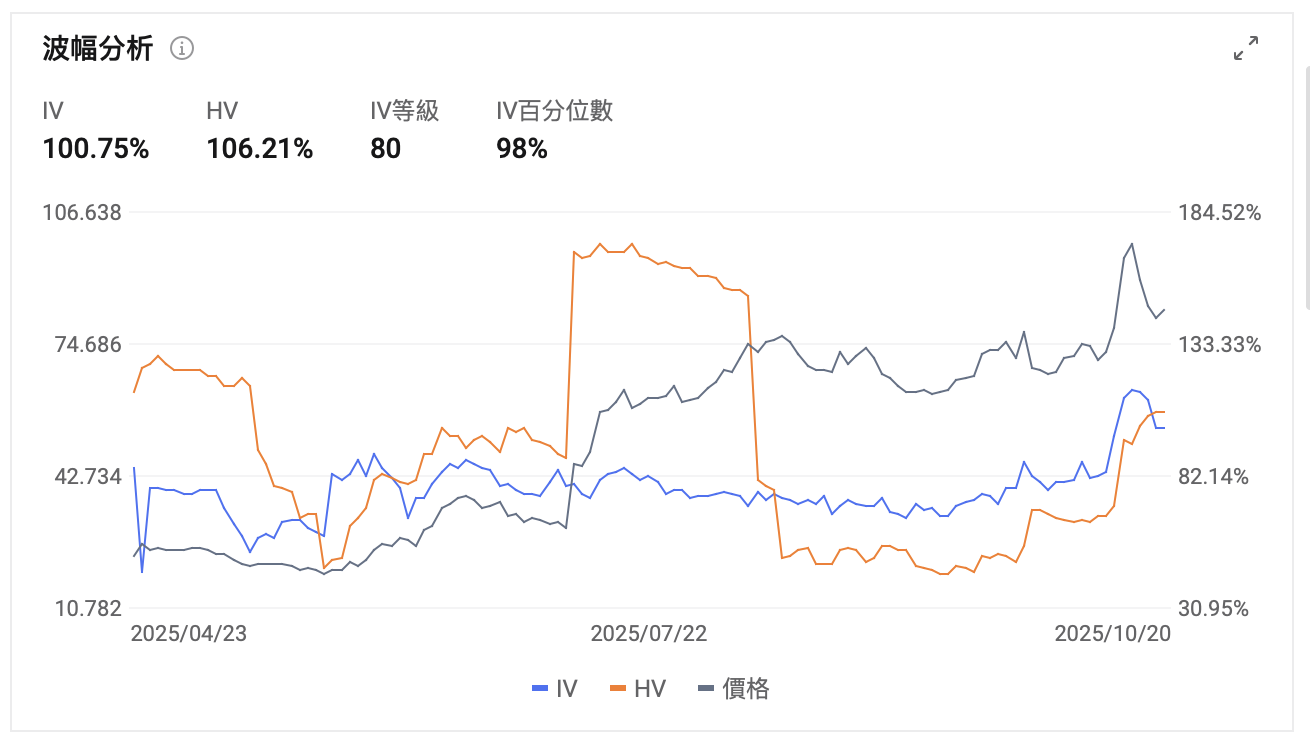

As of October 21, MP Materials' share price had retreated somewhat from its peak of $100 but still maintained a price-to-sales ratio of 60, far above the industry average. While investors have flocked in, the risk of being left holding the bag at a high price cannot be overlooked.

Geopolitical easing, slowing downstream demand, or capacity expansion falling short of expectations may expose the stock to the risk of a pullback.

In October 2025, the implied volatility of MP options expanded from around 80% to over 100%, reflecting the market's expectation of significant stock price volatility.

For investors currently holding MP Materials' spot shares, sticking to the physical position may subject them to the “winner’s curse” risk, while selling after a stock price correction may lead to concerns about missing out on greater future investment opportunities.

At this point, using derivative tools such as options allows investors to hedge against downside risks while retaining upside potential.

Covered Call: Already held, generate additional income, and protect against minor pullbacks.

For MP Materials’ spot shareholders, a covered call strategy can be employed. The covered call is the simplest income-generating tool. Investors can sell call options with expiration dates of 1-3 months ahead and strike prices higher than the current price, collecting corresponding premiums.

If the stock price does not exceed the strike price, the investor can retain the shares while earning premium income, effectively hedging against minor pullback risks. If the stock price rises above the strike price, the shares can be sold at the strike price, and together with the premium, profits can be locked in. However, this strategy has limited upside potential, making it suitable for neutral-to-bullish investors looking to hedge against minor stock price corrections.

Protective Put: Hold shares and buy puts to hedge against downside risks and avoid being left ‘holding the bag.’

For MP Materials’ spot shareholders concerned about a sharp stock price pullback, a protective put strategy can be adopted. This offers unlimited downside protection by purchasing put options expiring in 2-3 months with strike prices slightly below the current price, akin to buying 'insurance' for existing holdings. This approach retains the upside potential of current spot positions while hedging against significant downside risks. However, the cost of premiums increases the overall holding costs, making it suitable for investors wishing to mitigate short-term downside risks but unwilling to sell their shares.

Collar: Achieve low-cost hedging.

More sophisticated investors may consider a Collar strategy to achieve costless hedging. This combines buying put options (to protect against downside risk) and selling call options (to offset costs). Investors can purchase puts with strike prices slightly below the current price and expiring in 2-3 months, while simultaneously selling call options with higher strike prices above the current level.

If the stock price falls, gains from the put option can offset losses; if the stock price rises beyond the call option's strike price, investors can sell the underlying asset to lock in profits. The Collar strategy can significantly reduce the volatility of the currently held spot position and also enable low-cost hedging against risks associated with holding high-priced stocks.

Additionally, for MP Materials, the current options chain indicates that implied volatility is favorable for sellers, making it advantageous for investors to prioritize put-selling strategies.

(The images displayed on the screen are for illustrative purposes only and do not constitute any investment advice or guarantee.)

*AboveOptions Strategyis for educational purposes only and does not constitute any investment advice.

![]() Market conditions are complex and volatile,Options StrategyOverwhelmed by too many choices? Futubull helps you build an options strategy in three simple steps, making investing easy and efficient!

Market conditions are complex and volatile,Options StrategyOverwhelmed by too many choices? Futubull helps you build an options strategy in three simple steps, making investing easy and efficient!

Risk Factors

An option is a contract that gives the holder the right, but not the obligation, to buy or sell an asset at a fixed price on or before a specified date. The price of an option is influenced by various factors, including the current price of the underlying asset, the strike price, the time to expiration, andImplied Volatility。

Implied VolatilityIt reflects the market's expectation of future volatility over a period, derived from the Black-Scholes (BS) option pricing model. It is generally considered an indicator of market sentiment. When investors anticipate higher volatility, they may be willing to pay higher prices for options to help hedge risks, leading to higher implied volatilities.Implied Volatility。

Traders and investors useImplied Volatilityto evaluateoption pricesthe attractiveness, identify potential mispricing, and manage risk exposure.

Disclaimer

This content does not constitute an offer, solicitation, recommendation, opinion, or any guarantee for any securities, financial products, or tools. The risks of loss from trading options can be significant. In some cases, the losses you incur may exceed the initial margin amount deposited. Even if you set up contingency orders, such as 'stop-loss' or 'limit' orders, these may not necessarily prevent losses. Market conditions may make it impossible to execute these orders. You may be required to deposit additional margin within a short period. If you fail to provide the required amount by the specified time, your open positions may be liquidated. However, you will still be responsible for any resulting deficit in your account. Therefore, before trading, you should research and understand options, and carefully consider whether this type of trading is suitable for you based on your financial situation and investment objectives. If you trade options, you should familiarize yourself with the procedures for exercising options and the rights and obligations at the expiration of options.

Editor/Doris