①The European Central Bank (ECB) announced on Thursday evening that it would keep interest rates unchanged for the third consecutive time. Lagarde stated that the current interest rate level is in a “good position,” but subsequent actions will still depend on data; ②The market generally expects that the ECB's current rate-cutting cycle may be nearing its end; ③After the interest rate decision was released, the euro maintained its intraday decline, and traders' expectations for future rate cuts in the Eurozone remained largely unchanged.

On Thursday evening Beijing time, the European Central Bank released its October interest rate decision, maintaining the three key policy rates unchanged for the third consecutive meeting as expected. The last rate cut was in June. Policymakers still did not provide forward guidance, adhering to a data-dependent, meeting-by-meeting decision-making approach.

Specifically, the ECB maintained the deposit facility rate at 2%, while the main refinancing rate and the marginal lending rate were kept at 2.15% and 2.40%, respectively.

(Source: European Central Bank)

(Source: European Central Bank)

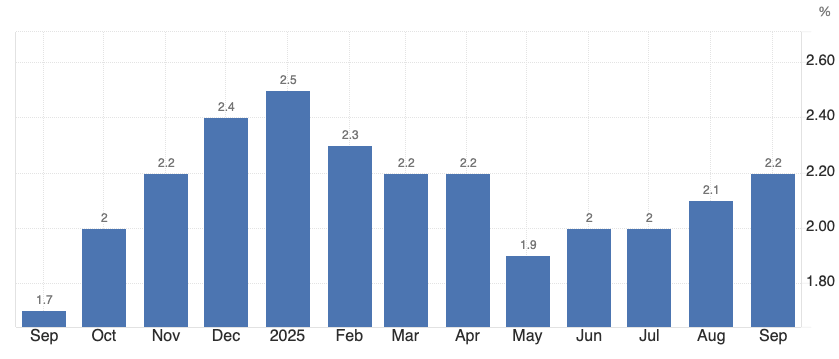

Underpinning this decision, the Eurozone inflation rate has hovered near the 2% target for several consecutive months. Meanwhile, data released by Eurostat on Thursday showed that GDP growth in the Eurozone during the third quarter exceeded expectations, with France providing the primary boost, delivering its strongest quarterly performance since 2023. Germany and Italy remained stagnant, narrowly avoiding recession. The next inflation report for the Eurozone is scheduled for release on Friday, with market expectations suggesting a further decline to 2.1%.

(Eurozone CPI, Source: tradingeconomics)

Unlike the Federal Reserve, which paused earlier today and has only cut rates twice this year, the ECB under Lagarde’s leadership has implemented eight rate cuts in this cycle. As a result, market focus has shifted to whether the ECB’s rate-cutting cycle has now come to an end.

In its policy statement, the ECB noted, “Despite a challenging global environment, the Eurozone economy continues to grow. A strong labor market, robust private sector balance sheets, and previous rate cuts remain key factors supporting economic resilience. However, uncertainties persist, particularly due to ongoing global trade disputes and geopolitical tensions.”

The statement also reiterated that “inflation remains close to the medium-term target of 2%, and the Governing Council’s overall assessment of the inflation outlook has not changed.”

At Thursday’s press conference, Lagarde also stated that the current monetary policy interest rate is in a “good position.” While the so-called “good position” is not fixed, the ECB will do everything possible to keep monetary policy within this “good position.”

The head of the European Central Bank also noted that the partial downside risks to economic growth have been mitigated by the EU-US trade agreement reached over the summer, the recent ceasefire announced in the Middle East, and today's latest developments. However, she warned: 'At the same time, the still volatile global trade environment could disrupt supply chains, further weigh on exports, and put pressure on consumption and investment.'

Regarding the ECB's latest decision, Mike Coop, Chief Investment Officer for Europe, Middle East, and Africa at Morningstar Wealth, remarked on Friday: 'What a boring statement. It really highlights the fact that inflation is now back to a fairly controlled state... so it’s not surprising that they are in no rush to change interest rates.'

Coop also stated: 'I think the bigger context is that Europe is still adapting to three major shocks: the loss of cheap energy, deteriorating trade terms with the United States, and the need to increase defense spending. Beyond these three areas, there is now the U.S. drawing investment away from the rest of the world, so Europe lacks the same level of stimulus as the U.S. to support growth.'

Following the release of the rate decision, traders' expectations for future rate cuts in the Eurozone remained largely unchanged, with swap markets pricing in only a 40% probability of another cut by June next year. The euro maintained its intraday decline against the dollar, primarily due to the hawkish remarks made earlier by Federal Reserve Chair Powell.

(EUR/USD Daily Chart)

The European Central Bank’s next policy meeting will take place in December, during which updated economic forecasts extending to 2028 will be released.

The full text of the European Central Bank interest rate decision:

The Governing Council of the European Central Bank decided today to keep the three key interest rates unchanged. Inflation remains close to the medium-term target of 2%, and the Governing Council's assessment of the inflation outlook has remained broadly unchanged. Despite a challenging global environment, the Eurozone economy continues to grow. A strong labor market, robust private sector balance sheets, and previous rate cuts remain key factors supporting economic resilience. Nevertheless, uncertainties persist, particularly due to ongoing global trade disputes and geopolitical tensions.

The Governing Council reaffirmed its steadfast commitment to ensuring that inflation stabilizes at the target level of 2% in the medium term. When determining the appropriate monetary policy stance, it will continue to adopt a data-dependent, meeting-by-meeting approach. Specifically, interest rate decisions will be based on an assessment of the inflation outlook and associated risks, combined with the latest economic and financial data, underlying inflation dynamics, and the strength of monetary policy transmission. The Governing Council will not pre-commit to a specific interest rate path.

Main interest rates

Deposit Facility Rate: 2.00%

Main Refinancing Operations Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

All three key interest rates remain unchanged.

Asset Purchase Programme (APP) and Pandemic Emergency Purchase Programme (PEPP)

The portfolios under the APP and PEPP are being reduced in an orderly and predictable manner, as the Eurosystem is no longer reinvesting the principal payments from maturing securities.

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilizes at the target level of 2% over the medium term and to safeguard the smooth transmission of monetary policy. Additionally, the Transmission Protection Instrument (TPI) remains available to counter unwarranted or disorderly market dynamics. If such volatility poses a serious threat to the transmission of monetary policy across euro area countries, the Governing Council will utilize the TPI to ensure that the policy effectively fulfills its price stability mandate.

Editor/Doris