The longer the government shutdown persists, the more data will be missing, and the more cautious the Federal Reserve's actions will become. Morgan Stanley believes that if the government shutdown extends beyond Thanksgiving (late November), there is a high likelihood that rate cuts will be paused in December. Citi, on the other hand, holds a more optimistic view, expecting the government to reopen within the next two weeks, allowing the Federal Reserve to receive multiple employment reports before the December meeting, thereby providing justification for another 25-basis-point rate cut.

The ongoing shutdown of the U.S. government is plunging the Federal Reserve into a 'data fog,' leaving its December interest rate decision hanging in the balance.

After the most recent interest rate meeting, Fed Chair Powell’s remarks reinforced cautious market expectations. According to TradingView, the latest reports from Citi and Morgan Stanley show that Powell, reversing his previous dovish stance, strongly stated that a December rate cut is 'far from certain.'

He likened the current lack of data to 'driving in fog' and frankly said, 'What do you do when driving in fog? You slow down.' This metaphor was interpreted by the market as a clear signal: missing data could lead to more caution in the Fed's actions.

He likened the current lack of data to 'driving in fog' and frankly said, 'What do you do when driving in fog? You slow down.' This metaphor was interpreted by the market as a clear signal: missing data could lead to more caution in the Fed's actions.

Due to the government shutdown preventing the timely release of key economic data, the data-dependent Federal Reserve is facing increasing uncertainty.

Currently, Wall Street remains divided. Morgan Stanley believes that the longer the shutdown lasts, the lower the probability of a rate cut. Meanwhile, Citi remains confident that the government shutdown will end within two weeks and expects the Fed to proceed with the rate cut as planned.

Driving in the Fog Amid Data Vacuum

Powell’s 'driving in fog' analogy underscores the policy dilemma faced by the Federal Reserve amid the data vacuum. According to a Morgan Stanley report, Powell emphasized at the press conference that monetary policy 'is not on a preset path' and will become 'increasingly data-dependent.' This shift in stance, occurring simultaneously with his announcement of a 25-basis-point rate cut, appeared particularly hawkish.

Citi analyst Andrew Hollenhorst's team believes that Powell’s hawkish remarks may be aimed at seeking consensus within a divided Federal Reserve. Nevertheless, Powell’s warning was clear: under conditions of extreme uncertainty, the Fed tends to 'proceed cautiously.'

Notably, the Fed also announced that it would halt quantitative tightening (QT) starting December 1, a move viewed by some market participants as a dovish hedge.

The Duration of the Shutdown Determines the Basis for Decision-Making

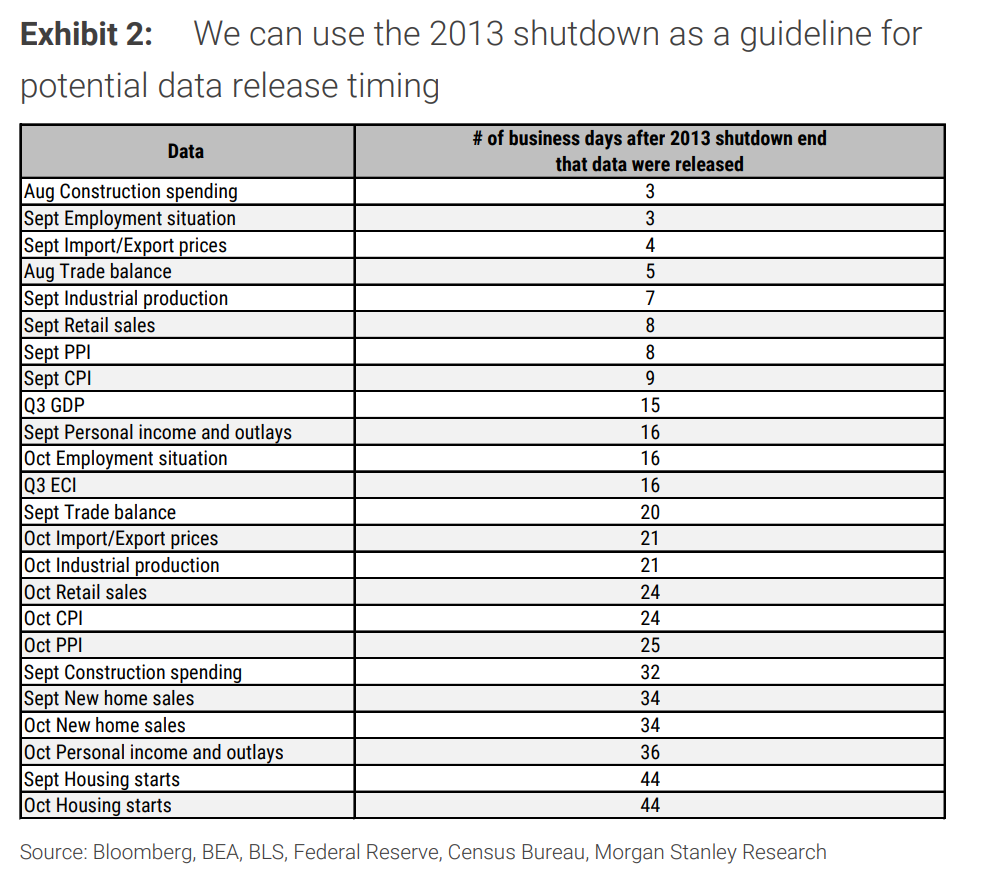

The length of the government shutdown directly determines the data foundation for the Federal Reserve's decision-making. Morgan Stanley's research report conducted a scenario analysis, with the bank’s economist Michael T. Gapen's team referencing the 2013 government shutdown to predict the data the Fed might obtain under different end dates of the current shutdown.

Scenario One: Ends next week. If the government reopens quickly, the Fed is highly likely to receive three employment reports from September, October, and November before the December meeting, as well as key data such as September and possibly October CPI and retail sales. Morgan Stanley believes that this data would be sufficient to support a rate cut decision.

Scenario Two: Ends in mid-November. In this case, the data will become “more limited,” and the Fed may only obtain employment, retail, and inflation reports for September. However, Morgan Stanley noted that state-level unemployment data and private-sector indicators might fill some gaps, allowing the Fed to still potentially proceed with a rate cut.

Scenario Three: Ends after Thanksgiving (late November). This represents the most pessimistic scenario. By then, it is highly likely that the Fed will only have access to September’s CPI and employment reports, while key data like September’s retail sales could be at risk of not being available. Under this “data vacuum,” unless there are strong signals of deterioration from state-level or private-sector sources, the probability of the Fed pausing rate cuts in December would increase.

In short, the longer the shutdown lasts, the lower the probability of a rate cut.

Citi: Shutdown May End Within Two Weeks

In contrast to Morgan Stanley's caution, Citi’s report appears more optimistic. Citi stated that it is “increasingly confident” that the government shutdown will end within the next two weeks.

The report highlighted several imminent pressure points:

Impact on Livelihoods Already Evident: Benefits from the Supplemental Nutrition Assistance Program (SNAP) were halted on November 1, affecting up to 42 million Americans.

An imminent crisis in military pay looms: funds allocated for compensating armed forces personnel are on the verge of depletion.

Political opportunity: the upcoming local elections may generate fresh momentum to break the political deadlock.

Citi forecasts that once the government reopens as scheduled, data releases will resume promptly, and the Federal Reserve is likely to receive up to three employment reports before its December meeting. This will provide sufficient basis for decision-making. Therefore, Citi maintains its baseline forecast unchanged: it anticipates the Fed will cut interest rates by 25 basis points in December, January, and March next year.

Editor/Doris