The three major U.S. stock indexes closed higher,$Dow Jones Index (.DJI.US)$rose by 0.44%,$S&P 500 Index (.SPX.US)$Up 1.55%,$Nasdaq Composite Index (.IXIC.US)$rose by 2.69%.

Major technology stocks collectively moved higher,$Tesla (TSLA.US)$、 $Google-C (GOOG.US)$ Rose over 6%. Chip stocks strengthened,$Broadcom (AVGO.US)$with the share price surging 11%, marking the largest increase since April, adding $178 billion to its market value;$PHLX Semiconductor Index (.SOX.US)$rose 4.6%,$Micron Technology (MU.US)$and climbed nearly 8%. $Advanced Micro Devices (AMD.US)$ rising over 5%,$NVIDIA (NVDA.US)$and rising more than 2%.

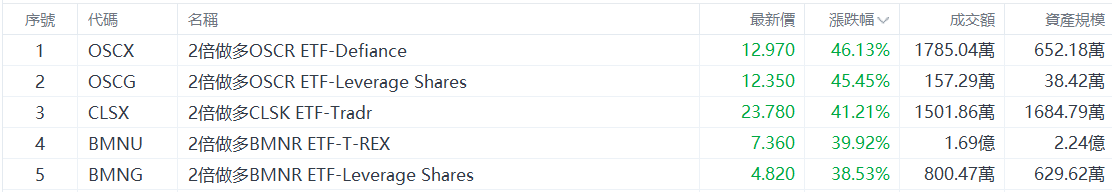

Top 5 Gainers in U.S. Equity ETFs

$2x Leveraged OSCR ETF-Defiance (OSCX.US)$ Increased by 46.13%, with a trading volume of 17.8504 million US dollars.

$2x Leveraged OSCR ETF-Leverage Shares (OSCG.US)$ Surged by 445.45%, with a trading volume of 1.5729 million US dollars.

$2x Leveraged OSCR ETF-Leverage Shares (OSCG.US)$ Surged by 445.45%, with a trading volume of 1.5729 million US dollars.

In terms of news, the White House is set to announce a healthcare policy framework, extending the Obamacare subsidies expiring at the end of next month for two more years. Affected by this, health insurance company Oscar Health surged 22%.

$2x Long CLSK ETF-Tradr (CLSX.US)$ Rose by 41.21%, with a trading volume of 15.0186 million US dollars.

$2x Leverage BMNR ETF-T-REX (BMNU.US) Increased by 39.92%, with a trading volume of $169 million.

$2x Leverage BMNR ETF-Leverage Shares(BMNG.US)$ Increased by 38.53%, with a trading volume of $8.0047 million.

In market news, Bitcoin surpassed $88,000, driving the overall rise of cryptocurrency-related stocks, with BMNR surging nearly 20%.

Top 5 Decliners on US Stock ETFs

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Dropped by 39.63%, with a trading volume of $72.6887 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Dropped by 26.15%, with a trading volume of $55.2935 million.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) Down 25.83%, with a trading volume of $240 million.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ Down 23.69%, with a trading volume of $97.2522 million.

$MicroSectors Gold Miners -3X Inverse Leveraged ETNs (GDXD.US) Down 17.62%, with a trading volume of $26.2671 million.

Top 5 Gainers in U.S. Large-Cap Index ETFs

$ProShares UltraPro QQQ (TQQQ.US)$ Up 7.58%, with a trading volume of $4.631 billion.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Up 5.29%, with a trading volume of $448 million.

$2x Long Nasdaq 100 Index ETF - ProShares (QLD.US)$ Up 5.09%, with a trading volume of $401 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Up 4.32%, with a trading volume of $511 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Up 3.70%, with a trading volume of $14.643 million.

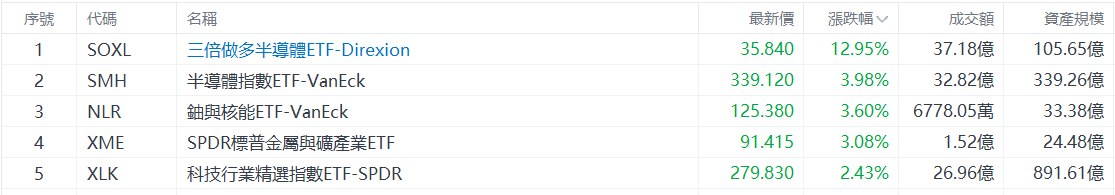

On the news front, expectations of a Fed rate cut have intensified, with tech stocks leading the gains. By the close, the three major U.S. stock indexes collectively finished higher, Nasdaq surged over 2.5%, and the Philadelphia Semiconductor Index rose nearly 5%.

Top 5 Industry ETFs by Increase

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ Increased by 12.95%, with a trading volume of $3.718 billion.

$Semiconductor Index ETF-VanEck (SMH.US)$ Increased by 3.98%, with a trading volume of $3.282 billion.

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Increased by 3.60%, with a trading volume of $67.7805 million.

$SPDR S&P Metals and Mining ETF (XME.US)$ Increased by 3.08%, with a trading volume of $1.52 billion.

$The Technology Select Sector SPDR® Fund (XLK.US)$ Increased by 2.43%, with a trading volume of $2.696 billion.

Top 5 Increases in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Up 1.71%, with a trading volume of $157 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Up 1.20%, with a trading volume of $593,100.

$Vanguard Long-Term Corporate Bond ETF (VCLT.US)$ Up 0.68%, with a trading volume of $304 million.

$Invesco Taxable Municipal Bond ETF (BAB.US)$ Up 0.61%, with a trading volume of $4.5267 million.

iShares 20+ Year Treasury Bond ETF (TLT.US) Up 0.57%, with a trading volume of $2.669 billion.

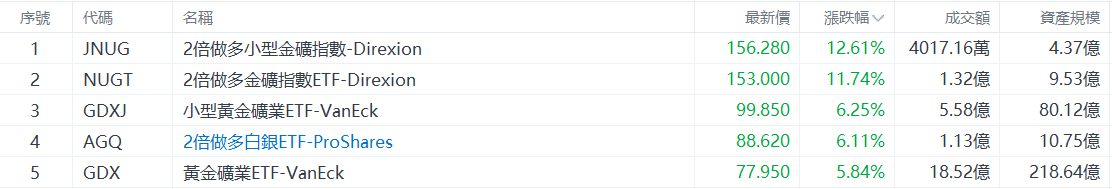

Top 5 Gainers in Commodity ETFs

$2x Leveraged Junior Gold Miners ETF - Direxion (JNUG.US) Increased by 12.61%, with a turnover of 40.1716 million US dollars.

$2x Leveraged Gold Miners ETF - Direxion (NUGT.US) Increased by 11.74%, with a turnover of 132 million US dollars.

VanEck Junior Gold Miners ETF (GDXJ.US) Increased by 6.25%, with a turnover of 558 million US dollars.

$ProShares Ultra Silver ETF (AGQ.US)$ Increased by 6.11%, with a turnover of 113 million US dollars.

$VanEck Gold Miners ETF (GDX.US)$ Up 5.84%, with a turnover of $18.52.

How to choose ETFs?Effectively use tools to select high-quality ETFs.

Editor/Stephen