"The Big Short" Michael Burry has published a significant article titled "The Gluttony of the Supply Side," officially declaring war on the AI bubble. He refutes the notion that "profitability equals safety," bluntly stating that "NVIDIA is the Cisco of today," warning that the market is facing a catastrophic oversupply and depreciation trap. This legendary short-seller asserts that no matter how many people try to prove that this time is different, the history of 1999 is repeating itself.

“This time is no different, no matter how many people try to prove otherwise. Once again, there is a Cisco at the center of it all, providing ‘picks and shovels’ for everyone, accompanied by a grand vision. Its name is NVIDIA.”

After the rumors of fund deregistration and the farce of 'shorting AI funds being exaggerated a hundredfold by the media,' Michael Burry, the prototype character from the movie The Big Short and a well-known investor, fulfilled his promise on November 24 local time by returning punctually.

This time, contrary to rumors, he did not short the market through massive options but instead chose to express his views on 'shorting AI' via his first column article titled 'The Cardinal Sign of a Bubble: Supply-Side Gluttony.'

This time, contrary to rumors, he did not short the market through massive options but instead chose to express his views on 'shorting AI' via his first column article titled 'The Cardinal Sign of a Bubble: Supply-Side Gluttony.'

In this article, Burry officially declared his opposition to the current AI hype, with the storm centering on $NVIDIA (NVDA.US)$ . He directly compared NVIDIA to Cisco from back in the day.

Core Argument: NVIDIA Is the Cisco of That Era

Addressing the prevailing market view that 'tech giants are highly profitable, so there is no bubble,' Burry provided a direct rebuttal in the article. He cited data from the peak of the internet bubble in 1999, pointing out that the prosperity of that era was also driven by high-profit companies, not just small websites with no revenue.

He wrote in the article:

Contrary to the perception that it was driven by unprofitable internet companies, the robust performance of the Nasdaq index in 1999 was propelled into the new century by highly profitable large-cap stocks at the time, including the 'Four Horsemen' — $Microsoft (MSFT.US)$ 、 $Intel (INTC.US)$ 、 $Dell Technologies (DELL.US)$ and $Cisco (CSCO.US)$ ……”

Burry believes that history is rhyming. The current AI boom is dominated by the 'Big Five Public Knights' – Microsoft, Google, Meta, Amazon, and Oracle – along with startups like OpenAI. These companies have pledged to invest nearly USD 3 trillion in AI infrastructure over the next three years.

At the core of all this, Burry sees the shadow of Cisco from back in the day – as the infrastructure provider for network construction during that era, Cisco’s stock price plummeted more than 75% after the bubble burst. He explicitly stated in his article:

“Once again, there is a Cisco at the center of it all, providing ‘picks and shovels’ to everyone, accompanied by grand visions. Its name is NVIDIA.”

The Essence of the Bubble: A 'Glut' on the Supply Side

In a preview dated November 11, Burry criticized tech companies for inflating profits by extending depreciation periods.

On November 11, Burry pointed out on social media that the actual lifespan of AI chips and similar devices is only 2-3 years, yet some companies have extended the depreciation cycle to 6 years. He projected that from 2026 to 2028, large technology firms could overstate their profits by $176 billion due to underestimating depreciation. He specifically noted that by 2028, $Oracle (ORCL.US)$ profits may be overstated by 26.9%, while $Meta Platforms (META.US)$ profits may be overstated by 20.8%. He also committed to disclosing more details on November 25.

In his latest article, he further elaborated on this perspective, defining it as 'Gluttony on the supply side.'

Burry pointed out in the article that the key issue with the current AI boom lies in 'catastrophically overbuilt supply and nowhere near enough demand.'

He believes that tech giants are engaged in an unsustainable capital expenditure spree, pouring astronomical sums into building data centers and purchasing chips, but the actual revenue generated from downstream applications falls far short of covering these costs.

Burry warned investors not to be deceived by the so-called 'This time is different,' writing in the article:

"No matter how many people try to prove it, this time is no different."

Opponent's Response: 'A Different Picture' in Jensen Huang’s Eyes

Facing Michael Burry’s continuous criticism and the market discussion about an "AI bubble," NVIDIA, at the center of the storm, has not backed down.

According to a Bloomberg report, NVIDIA recently sent a memo to Wall Street analysts refuting Burry’s previous allegations regarding its equity dilution and share buyback issues. Additionally, after last week’s earnings release, NVIDIA CEO Jensen Huang directly responded to the “bubble theory,” stating:

"There has been much discussion about an AI bubble," said Huang, "but from our vantage point, we see something very different."

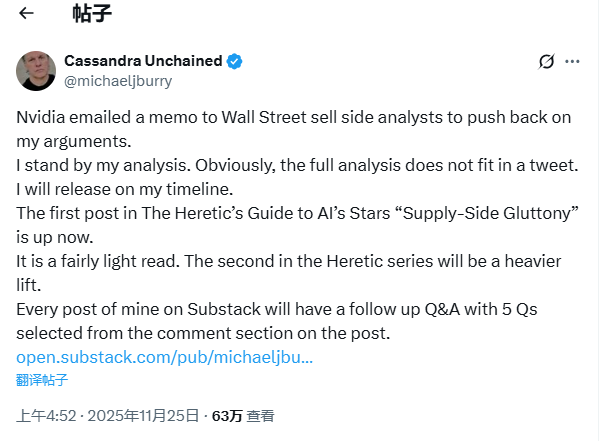

Similarly, Burry remains firmly bearish on AI. Despite NVIDIA opposing his views, he insists on expressing them.

"Unchained": The Transition from Fund Manager to Analyst

This incendiary in-depth analysis was published on Burry’s newly launched paid column, "Cassandra Unchained" (The Unshackled Cassandra), which costs $379 annually. The article, titled "Major Signs of a Bubble: Gluttony on the Supply Side," is the first piece in the column.

Following rumors of the closure of his fund, Burry explained on the column’s “About” page why he gave up fund management to become a full-time writer. He stated that when managing client funds in the past:

The professional management of funds comes with regulatory and compliance restrictions, which have effectively 'muzzled' my ability to express myself. These limitations mean that I can only publicly share obscure fragments.

He stated that now 'it is all over.' Just as Warren Buffett once referred to him as 'Cassandra' during a congressional hearing, he is now in a state where 'Cassandra is unchained,' suggesting that he will share his observations on market bubbles without reservation. 'Cassandra' refers to the priestess from Greek mythology who made accurate prophecies but was not believed.

Wallstreetcn reported that in November this year, after being exposed by the media for 'heavily betting on shorting AI leader,' Michael Burry personally refuted the report, stating that the 'US$912 million short position on NVIDIA' mentioned in the media was a gross exaggeration, with the actual investment being only US$9.2 million—100 times less. Burry pointed out that the media mistakenly took the nominal exposure disclosed by the SEC as the capital size. $Palantir (PLTR.US)$ More notably, he quietly deregistered his fund, Scion Asset Management, and announced a new project to be launched on November 25.

Epilogue: The Unpopular Prophet?

It should be noted that although Burry was previously misreported by the media as holding a 'nearly US$1 billion' short position in NVIDIA (the actual nominal value was only US$9.2 million, part of which had been closed), this did not change his determination to maintain a bearish macro view on AI.

At the end of the first article, Burry quoted a statement from Charlie Munger, Buffett’s long-time partner, seemingly as a footnote to the role he currently plays:

‘If you go around popping a lot of balloons, you are not going to be the most popular fellow in the room.’

![]() Futubull AI: Your Portfolio Manager! Your Stock Selection Advisor!Come and experience it now >>

Futubull AI: Your Portfolio Manager! Your Stock Selection Advisor!Come and experience it now >>

Editor /rice