The three major U.S. stock indexes closed higher,$Dow Jones Index (.DJI.US)$Increased by 1.43%,$S&P 500 Index (.SPX.US)$rose by 0.91%,$Nasdaq Composite Index (.IXIC.US)$rose by 0.67%.

Large-cap technology stocks showed mixed performance, $Meta Platforms(META.US)$ with a rise of over 3%, $Google-C (GOOG.US)$ 、$Amazon(AMZN.US)$Increased by more than 1%; $Advanced Micro Devices (AMD.US)$ Dropped more than 4%,$NVIDIA (NVDA.US)$、$Netflix (NFLX.US)$Dropped more than 2%,$Oracle (ORCL.US)$Dropped over 1%.

Top 5 Gainers in U.S. Equity ETFs

GraniteShares' 2x Leveraged RDDT ETF (RDTL.US) rose by 24.64%, with a trading volume of $37.0184 million.

In terms of market news, potential chip deals between Meta and Google are expected to lower the costs of artificial intelligence training and inference, which has boosted the social media industry. AI application software stocks continued to rise, with Reddit increasing by over 12%.

$2x Leverage WULF ETF-Tradr (WULX.US)$ rose by 20.20%, with a trading volume of $9.0514 million.

$2x Long DKNG ETF-Defiance(DKNX.US)$ rose by 14.92%, with a trading volume of $1.176 million.

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Up 14.49%, with a trading volume of $69.76 million.

$2x Long UPST ETF-Tradr (UPSX.US)$ Up 14.42%, with a trading volume of $5.98 million.

Top 5 Decliners on US Stock ETFs

$2x Leverage BMNR ETF-T-REX (BMNU.US) Down 13.79%, with a trading volume of $195 million.

$2x Leverage BMNR ETF-Leverage Shares(BMNG.US)$ Down 13.69%, with a trading volume of $7.88 million.

In terms of news, Bitcoin has been fluctuating lower, and some cryptocurrency-related stocks have declined, with BMNR falling more than 7%. $2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Increased by more than 14%.

$2x Long SMR ETF-Tradr (SMU.US)$ Fell 12.83%, with a trading volume of $33.315 million.

$2x Long SMR ETF-T-Rex (SMUP.US)$ Fell 12.24%, with a trading volume of $1.0748 million.

$2x Leveraged Long MSTR ETF - GraniteShares (MSTP.US)$ Fell 9.98%, with a trading volume of $426,400.

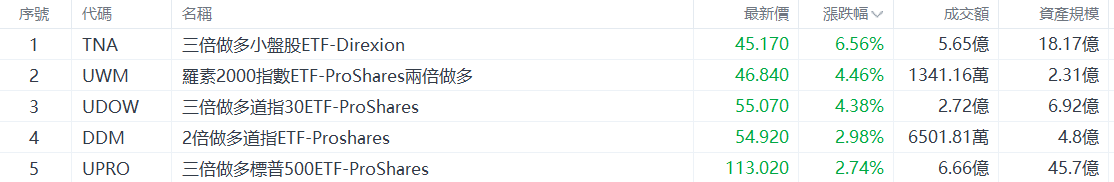

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Up 6.56%, with a trading volume of $5.65 billion.

$ProShares Ultra Russell 2000 (UWM.US)$ Up 4.46%, with a trading volume of $13.41 million.

ProShares UltraPro Dow30 (UDOW.US) Up 4.38%, with a trading volume of $2.72 billion.

ProShares Ultra Dow30 (DDM.US) Up 2.98%, with a trading volume of $65.02 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Up 2.74%, with a trading volume of $6.66 billion.

In terms of market news, the growth of U.S. retail sales slowed in September, boosting expectations for interest rate cuts! The three major U.S. stock indexes rose for the third consecutive trading day.

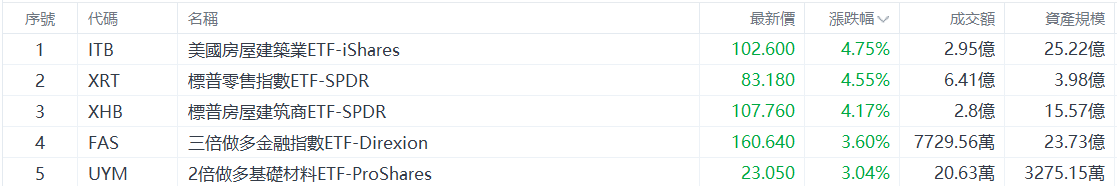

Top 5 Industry ETFs by Increase

$iShares U.S. Home Construction ETF (ITB.US)$ Up 4.75%, with a trading volume of $295 million.

$S&P Retail Index ETF - SPDR (XRT.US)$ Up 4.55%, with a trading volume of $641 million.

$SPDR S&P Homebuilders ETF (XHB.US)$ Up 4.17%, with a trading volume of $280 million.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ Up 3.60%, with a trading volume of $77.30 million.

$2x Leveraged Basic Materials ETF-ProShares (UYM.US) Up 3.04%, with a trading volume of $206,300.

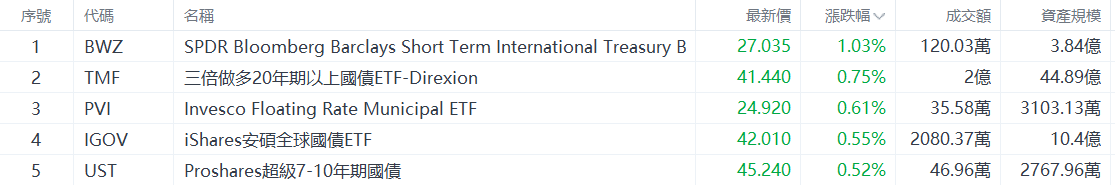

Top 5 Increases in Bond ETFs

$SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (BWZ.US)$ Up 1.03%, with a trading volume of $1.2003 million.

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Up 0.75%, with a trading volume of $200 million.

$Invesco Floating Rate Municipal ETF (PVI.US)$ Up 0.61%, with a trading volume of $355,800.

$iShares Global Treasury Bond ETF (IGOV.US)$ Up 0.55%, with a trading volume of $20.8037 million.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Up 0.52%, with a trading volume of $469,600.

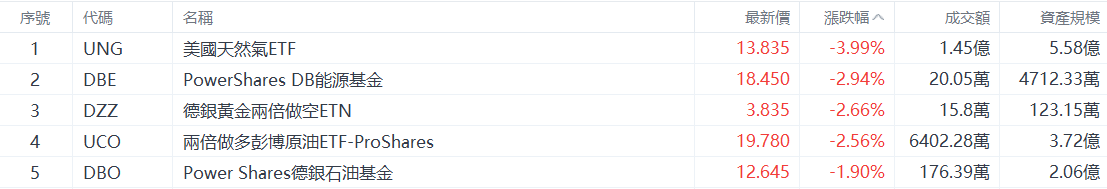

Top 5 Declines in Commodity ETFs

$US Natural Gas ETF (UNG.US)$ Down 3.99%, with a trading volume of $145 million.

$PowerShares DB Energy Fund (DBE.US)$ Down 2.94%, with a trading volume of $200,500.

$DB Gold Double Short ETN (DZZ.US)$ Down 2.66%, with a trading volume of $158,000.

$2x Long Bloomberg Crude Oil ETF-ProShares (UCO.US) Dropped by 2.56%, with a trading volume of $64.0228 million.

$PowerShares DB Oil Fund (DBO.US)$ Dropped by 1.90%, with a trading volume of $1.7639 million.

How to choose ETFs?Effectively use tools to select high-quality ETFs.

Editor/Stephen