"The Big Short" Burry stated that NVIDIA's internal memo responding to his criticism "reads like a scam" and is riddled with "straw man arguments." He bluntly remarked, "No one cares about NVIDIA's own depreciation." The real crisis lies in the significant asset write-down risks faced by its customers due to accelerated technological iteration. The focus is on future risks. Burry indicated he continues to hold put options on NVIDIA and Palantir, each position being approximately USD 10 million.

The round of battle between "The Big Short" and $NVIDIA (NVDA.US)$ is escalating. Michael Burry, the real-life figure behind the movie "The Big Short," has once again directed his criticism at NVIDIA, stating that an internal memo distributed by the company to Wall Street analysts in response to his critique was "disappointing" and filled with "one straw man argument after another."

On Tuesday, November 26, Burry wrote in a post on his newly established Substack blog that he 'could not believe' these responses came from the world's most valuable publicly traded company, adding that the document 'almost reads like a scam.'

This latest statement continues Burry’s recent series of warnings about a bubble in the artificial intelligence industry. Previously, he had expressed his views on X (formerly Twitter) regarding AI stocks being in a bubble. The immediate consequence of this round of exchanges is that the market has become increasingly stringent in scrutinizing AI-related companies, with NVIDIA’s stock retreating approximately 14% from its high on November 3, reflecting a subtle shift in investor sentiment.

This latest statement continues Burry’s recent series of warnings about a bubble in the artificial intelligence industry. Previously, he had expressed his views on X (formerly Twitter) regarding AI stocks being in a bubble. The immediate consequence of this round of exchanges is that the market has become increasingly stringent in scrutinizing AI-related companies, with NVIDIA’s stock retreating approximately 14% from its high on November 3, reflecting a subtle shift in investor sentiment.

Related articles:Right on schedule! The "Big Short" releases a重磅 article declaring war on NVIDIA, officially launching a battle against the "AI bubble."

Burry revealed in his post that he continues to hold put options targeting $Palantir (PLTR.US)$ and NVIDIA. This confirms that he has not closed out his previous short positions, directly signaling his bearish outlook on the prospects of these two AI star companies.

Straw man rebuttal?

The crux of Burry’s rebuttal is that he believes NVIDIA’s memo misrepresents his criticisms by attacking arguments he never made.

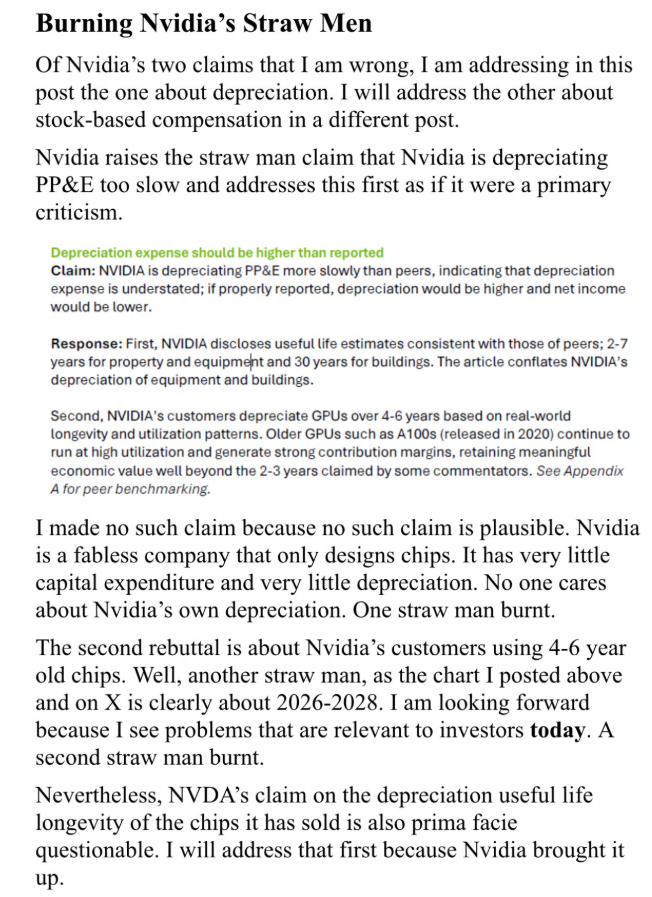

First, Burry pointed out that he never questioned NVIDIA’s own depreciation policy for fixed assets (PP&E). He emphasized that NVIDIA is primarily a chip design company with minimal capital expenditures, so 'no one cares about NVIDIA’s own depreciation.' He argued that NVIDIA’s defense on this issue was the first 'burned-down straw man.'

Secondly, Burry also dismissed NVIDIA's claim that its older-generation chips are still being used. He clarified that his focus is on the future, specifically the possibility that new chips may become functionally obsolete between 2026 and 2028.

"I look ahead because I see issues relevant to investors today," he wrote, referring to this as the "second straw man burned." Burry concluded that NVIDIA’s rebuttal was "superficially insincere and disappointing."

Core of the Debate: Depreciation, Bubbles, and Future Risk of Asset Write-Downs

The crux of Burry’s argument focuses on the accounting practices of artificial intelligence companies, particularly the depreciation policies of their clients — the "hyperscalers" (large-scale data centers) investing heavily in AI chips.

He explained that these companies are systematically extending the "useful life" of chips and servers to spread out depreciation costs on their books. For example, lengthening the depreciation period from three years to five or six years can temporarily enhance profits and increase asset book values in the short term.

However, Burry warned that the risk of this practice lies in the rapid pace of technological iteration for AI chips. He cited a recent interview with Microsoft CEO Satya Nadella as evidence: Nadella mentioned that earlier this year, he slowed down the construction of data centers due to concerns about overbuilding infrastructure for one generation of AI chips, as the next generation will have different power and cooling requirements.

Burry believes that if the "planned obsolescence" of chips accelerates, companies that have extended their depreciation cycles will face significant risks of asset write-downs in the future.

Details of Short Positions and Market Context

Burry not only reiterated his bearish stance this time but also disclosed more details about his positions. According to a filing by his asset management firm, Scion Asset Management, on November 3, the company held put options on NVIDIA and Palantir at the end of September.

In his latest article, Burry clarified that although the nominal value of these positions reached $1.1 billion, their actual cost was “only about $10 million each.” This detail provides investors with a more accurate perspective for assessing the true scale of his bets.

The backdrop to this debate is that market enthusiasm for artificial intelligence has driven the share prices of related companies to historic highs this year. However, since early November, concerns have begun to emerge as earnings season unfolded and prominent investors like Burry issued warnings. In addition to NVIDIA, Palantir’s stock price has fallen 20% from its recent high, despite still showing an astonishing increase year-to-date. Burry’s continued commentary undoubtedly adds more uncertainty to the debate over whether AI represents a revolution or a bubble.

NVIDIA’s Internal Memo

Facing pressure on its stock price and market skepticism, NVIDIA recently undertook a series of rare defensive communications.

Over the weekend, NVIDIA distributed a seven-page memo to Wall Street analysts, aiming to “item-by-item” refute allegations raised by critics, including “The Big Short” Michael Burry, such as accounting fraud, circular financing, and the AI bubble. The memo clarified:

Accounting Practices: NVIDIA stressed that its business is economically robust, with reporting that is complete and transparent, and not comparable to historical cases of accounting fraud.

Equipment Depreciation: In response to claims that AI chips have a lifespan of only 2-3 years, NVIDIA stated that its customers typically depreciate GPUs over a period of 4 to 6 years, which aligns with the actual service life of the equipment.

Circular Financing: Regarding this accusation, NVIDIA clarified that its strategic investment in the third quarter was only USD 3.7 billion, a small fraction of its revenue, and described the claim of circular financing as "unfounded."

In addition, NVIDIA publicly stated on the social platform X on November 25: "NVIDIA is currently a generation ahead of the industry — we are the only platform capable of running all AI models and being universally applicable across various computing scenarios." The company emphasized that its GPUs offer "higher performance, versatility, and interchangeability" compared to ASIC chips like Google's TPU.

![]() Futubull AI: Your Portfolio Manager! Your Stock Selection Advisor!Come and experience it now >>

Futubull AI: Your Portfolio Manager! Your Stock Selection Advisor!Come and experience it now >>

Editor /rice