U.S. stocks closed three hours early due to the Thanksgiving holiday, with the three major indices collectively posting gains for the fifth consecutive trading session. $Nasdaq Composite Index (.IXIC.US)$ Up 0.65%, $Dow Jones Index (.DJI.US)$ Up 0.61%,$S&P 500 Index (.SPX.US)$Nasdaq rose 4.91% this week, while the Dow Jones Industrial Average gained 3.18%, and the S&P 500 Index increased by 3.73%.

The majority of technology stocks trended higher, $Intel (INTC.US)$ closed up 10%, marking the largest single-day gain since September 18. $Meta Platforms(META.US)$ Up more than 2%, $Advanced Micro Devices (AMD.US)$ 、$Amazon(AMZN.US)$、$Netflix (NFLX.US)$、$Microsoft(MSFT.US)$rising over 1%.

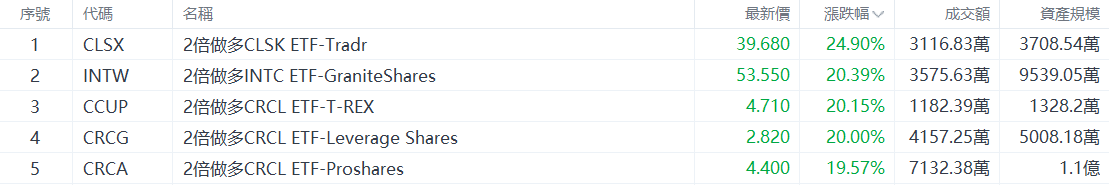

Top 5 Gainers in U.S. Equity ETFs

$2x Long CLSK ETF-Tradr (CLSX.US)$ Up 24.90%, with a trading volume of $31.1683 million.

$2x Long INTC ETF-GraniteShares (INTW.US) Up 20.39%, with a trading volume of $35.7563 million.

$2x Long INTC ETF-GraniteShares (INTW.US) Up 20.39%, with a trading volume of $35.7563 million.

$2x Leverage CRCL ETF-T-REX (CCUP.US) Up 20.15%, with a trading volume of $11.8239 million.

$2x Long CRCL ETF-Leverage Shares (CRCG.US)$ Up 20.00%, with a trading volume of $41.5725 million.

$2x Leverage CRCL ETF-ProShares (CRCA.US) Increased by 19.57%, with a turnover of 71.3238 million US dollars.

In terms of market news, cryptocurrency-related stocks collectively surged, with CleanSpark rising over 12% and Circle gaining more than 10%. Notably, Circle's competitor USDT received the lowest rating from Standard & Poor’s.

Top 5 Decliners on US Stock ETFs

$2x Short CRCL ETF-T-REX (CRCD.US)$ Dropped by 20.23%, with a turnover of 15.3977 million US dollars.

$Proshares UltraShort Silver ETF (ZSL.US)$ Decreased by 12.59%, with a turnover of 57.7594 million US dollars.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ Fell by 10.02%, with a turnover of 43.9706 million US dollars.

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Dropped by 9.10%, with a trading volume of $98.7533 million.

$ProShares Ultra Solana ETF(SLON.US)$ Dropped by 8.73%, with a trading volume of $4.2447 million.

Top 5 Gainers in U.S. Large-Cap Index ETFs

$ProShares UltraPro QQQ (TQQQ.US)$ Increased by 2.30%, with a trading volume of $1.817 billion.

ProShares UltraPro Dow30 (UDOW.US) Increased by 1.73%, with a trading volume of $5,743.75.

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Increased by 1.57%, with a trading volume of $215 million.

$ProShares UltraPro S&P 500 (UPRO.US)$ Up 1.57%, with a trading volume of $224 million.

ProShares Ultra QQQ (QLD.US), which provides 2x daily leverage to the Nasdaq 100 Index, rose by 1.51%, with a trading volume of $297 million.

In terms of market news, expectations for a December interest rate cut have continued to rise, driving the five-day consecutive gains in the three major U.S. stock indices.

Top 5 Industry ETFs by Increase

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ rose by 5.28%, with a trading volume of $2.283 billion.

$US Natural Gas ETF (UNG.US)$ rose by 3.37%, with a trading volume of $85.2656 million.

$2x Leveraged Energy ETF-Direxion (ERX.US)$ Increased by 2.61%, with a turnover of 6.8702 million US dollars.

$Invesco Solar Energy ETF (TAN.US)$ Increased by 2.11%, with a turnover of 27.8934 million US dollars.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ Increased by 1.99%, with a turnover of 33.2364 million US dollars.

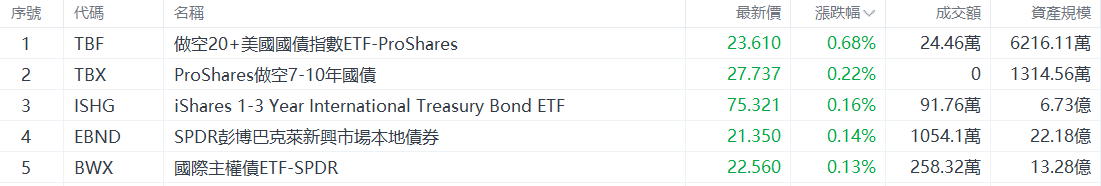

Top 5 Increases in Bond ETFs

$Short 20+ US Treasury Bond Index ETF-ProShares (TBF.US)$ Increased by 0.68%, with a turnover of 244,600 US dollars.

$ProShares Short 7-10 Year Treasury (TBX.US)$ Increased by 0.22%, with a trading volume of $0.

$iShares 1-3 Year International Treasury Bond ETF(ISHG.US)$ Increased by 0.16%, with a trading volume of $917,600.

$SPDR Bloomberg Barclays Emerging Markets Local Bond(EBND.US)$ Increased by 0.14%, with a trading volume of $10,541,000.

$International Sovereign Bond ETF-SPDR(BWX.US)$ Increased by 0.13%, with a trading volume of $2,583,200.

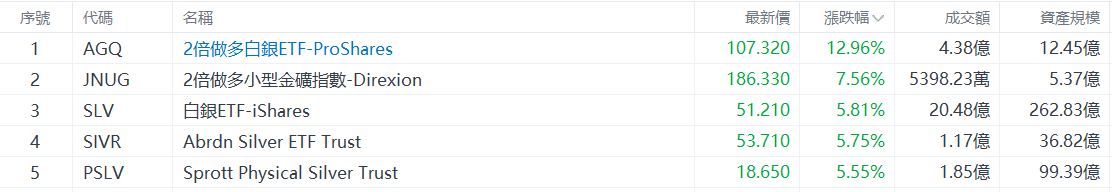

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver ETF (AGQ.US)$ Increased by 12.96%, with a trading volume of $438 million.

$2x Leveraged Junior Gold Miners ETF - Direxion (JNUG.US) Up 7.56%, with a trading volume of $53.98 million.

$iShares Silver Trust (SLV.US)$ Up 5.81%, with a trading volume of $2.048 billion.

$Abrdn Silver ETF Trust(SIVR.US)$ Up 5.75%, with a trading volume of $117 million.

$Sprott Physical Silver Trust(PSLV.US)$ Up 5.55%, with a trading volume of $185 million.

In market news, spot silver broke through the October high, rising to $56.40, up over 5% intraday, setting a new all-time high.

How to choose ETFs?Effectively use tools to select high-quality ETFs.

Editor/Stephen