The three major U.S. stock indexes closed collectively lower,$Dow Jones Index (.DJI.US)$Down 0.89%,$Nasdaq Composite Index (.IXIC.US)$ falling by 0.38%.$S&P 500 Index (.SPX.US)$down by 0.53%.

Most popular technology stocks fell,$Broadcom (AVGO.US)$Falling more than 4%, $Google-C (GOOG.US)$ 、$Microsoft(MSFT.US)$Dropped more than 1%,$NVIDIA (NVDA.US)$、 $Apple(AAPL.US)$ Surged over 1%.

Top 5 Gainers in U.S. Equity ETFs

$2x Inverse BMNR ETF-Defiance (BMNZ.US)$ Increased by 25.66%, with a trading volume of $88.2566 million.

$AdvisorShares MSOS Daily Leveraged ETF (MSOX.US)$ Increased by 21.66%, with a trading volume of $3.9215 million.

$AdvisorShares MSOS Daily Leveraged ETF (MSOX.US)$ Increased by 21.66%, with a trading volume of $3.9215 million.

$T-Rex 2X Inverse Ether Daily Target ETF(ETQ.US)$ Increased by 18.75%, with a trading volume of $2.6733 million.

$ProShares UltraShort Ether ETF(ETHD.US)$ Increased by 18.73%, with a trading volume of $78.8643 million.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) Increased by 16.78%, with a trading volume of $137 million.

In terms of market news, risk assets fell across the board, with cryptocurrencies experiencing a poor start to December as Bitcoin briefly dropped below $84,000 and Ethereum plunged more than 7% intraday; cryptocurrency-related stocks and quantum computing stocks collectively declined, with BMNR falling over 12% and RGTI dropping more than 8%.

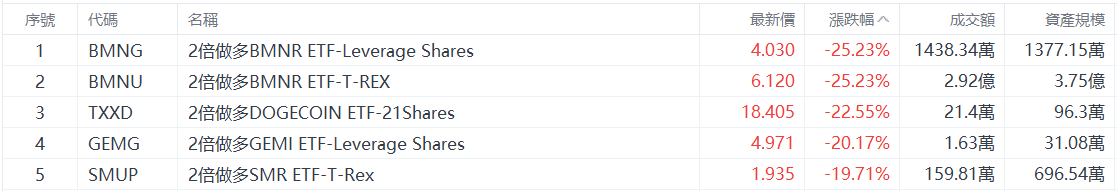

Top 5 Decliners on US Stock ETFs

$2x Leverage BMNR ETF-Leverage Shares(BMNG.US)$ Dropped by 25.23%, with a trading volume of USD 14.38 million.

$2x Leverage BMNR ETF-T-REX (BMNU.US) Dropped by 25.23%, with a trading volume of USD 292 million.

$2x Leverage DOGECOIN ETF - 21Shares (TXXD.US)$ Dropped by 22.55%, with a trading volume of USD 214,000.

$2x Leverage Long GEMI ETF-Leverage Shares (GEMG.US)$ Dropped by 20.17%, with a trading volume of USD 16,300.

$2x Leveraged SMR ETF-T-Rex (SMUP.US)$ Fell by 19.71%, with a trading volume of $1.5981 million.

Top 5 Decliners in Major US Equity Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Fell by 3.59%, with a trading volume of $365 million.

ProShares UltraPro Dow30 (UDOW.US) Fell by 2.40%, with a trading volume of $162 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Fell by 2.35%, with a trading volume of $15.0677 million.

$iShares Russell 2000 Growth ETF (IWO.US)$ Fell by 1.73%, with a trading volume of $100 million.

ProShares Ultra Dow30 (DDM.US) Declined by 1.65%, with a trading volume of $53.9742 million.

In terms of market news, expectations of Japan's interest rate hike triggered volatility across global markets, pressuring risk assets and leading to collective declines in the three major U.S. stock indices.

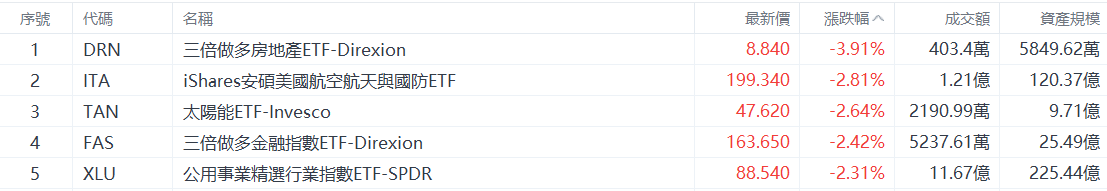

Top 5 Industry ETF Decliners

$Direxion Daily Real Estate Bull 3X Shares (DRN.US)$ Declined by 3.91%, with a trading volume of $4.034 million.

$iShares U.S. Aerospace & Defense ETF (ITA.US)$ Declined by 2.81%, with a trading volume of $121 million.

$Invesco Solar Energy ETF (TAN.US)$ Declined by 2.64%, with a trading volume of $21.9099 million.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ Fell by 2.42%, with a trading volume of USD 52.3761 million.

$Public Utilities Select Sector Index ETF-SPDR(XLU.US)$ Fell by 2.31%, with a trading volume of USD 1.167 billion.

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Fell by 3.66%, with a trading volume of USD 276 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Fell by 2.26%, with a trading volume of USD 6.9731 million.

iShares 20+ Year Treasury Bond ETF (TLT.US) Dropped by 1.25%, with a trading volume of $4.155 billion.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Dropped by 1.17%, with a trading volume of $4.2721 million.

$iShares 10-20 Year Treasury Bond ETF (TLH.US)$ Dropped by 1.02%, with a trading volume of $2.27 billion.

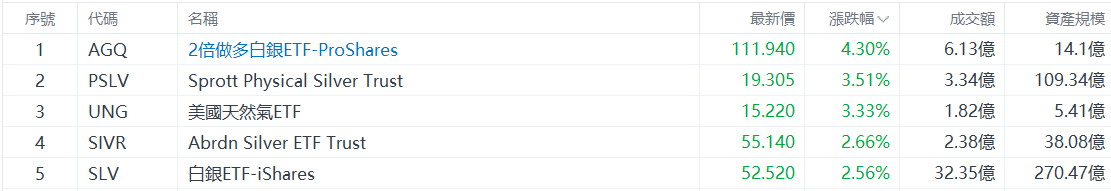

Top 5 Gainers in Commodity ETFs

$ProShares Ultra Silver ETF (AGQ.US)$ Rose by 4.30%, with a trading volume of $6.13 billion.

$Sprott Physical Silver Trust(PSLV.US)$ Rose by 3.51%, with a trading volume of $3.34 billion.

$US Natural Gas ETF (UNG.US)$ Up 3.33%, with a trading volume of $182 million.

$Abrdn Silver ETF Trust(SIVR.US)$ Up 2.66%, with a trading volume of $238 million.

$iShares Silver Trust (SLV.US)$ Up 2.56%, with a trading volume of $3.235 billion.

In market news, silver hit a new high, rising more than 4% intraday, with spot silver approaching $59.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen