The three major U.S. stock indexes closed collectively higher, $Dow Jones Index (.DJI.US)$ Up 0.86%, $Nasdaq Composite Index (.IXIC.US)$ Up 0.17%,$S&P 500 Index (.SPX.US)$Up 0.3%.

Large-cap technology stocks showed mixed performance,$Tesla (TSLA.US)$up more than 4%, $Google-C (GOOG.US)$ Up more than 1%,$Microsoft(MSFT.US)$Dropped more than 2%. $Meta Platforms(META.US)$ 、$NVIDIA (NVDA.US)$Dropped over 1%.

Top 5 Gainers in U.S. Equity ETFs

$2x Leveraged AUR ETF-Tradr(AURU.US)$ Surged 24.71%, with a trading volume of $257,500.

$2x Leverage CRCL ETF-T-REX (CCUP.US) Surged 23.40%, with a trading volume of $13,220,800.

$2x Leverage CRCL ETF-T-REX (CCUP.US) Surged 23.40%, with a trading volume of $13,220,800.

$2x Long CRCL ETF-Leverage Shares (CRCG.US)$ Surged 22.81%, with a trading volume of $41,807,600.

$2x Leverage CRCL ETF-ProShares (CRCA.US) Surged 22.33%, with a trading volume of $70,637,100.

$2x Leverage QBTS ETF-Tradr (QBTX.US)$ Surged 22.21%, with a trading volume of $37,498,500.

In market news, cryptocurrency-related stocks and quantum computing-related stocks surged across the board, with Circle and QBTS both rising over 11%.

Top 5 Decliners on US Stock ETFs

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) Dropped 22.95%, with a trading volume of $42.9324 million.

$2x Short CRCL ETF-T-REX (CRCD.US)$ Dropped 22.29%, with a trading volume of $18.2492 million.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) Dropped 17.81%, with a trading volume of $150 million.

$2x Leverage Short RKLB ETF - Defiance (RKLZ.US) Dropped 13.42%, with a trading volume of $285,200.

$2x Inverse HOOD ETF - Defiance (HOOZ.US)$ Dropped 12.34%, with a trading volume of $14.5257 million.

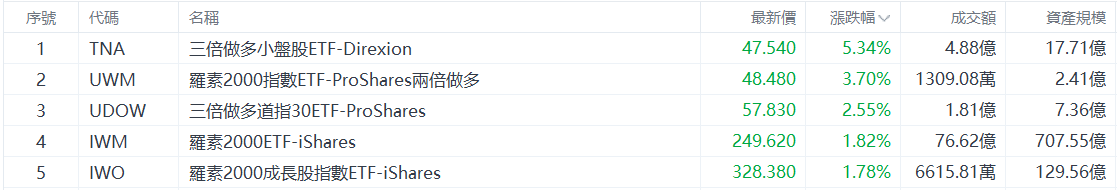

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Rose 5.34%, with a trading volume of $488 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Rose 3.70%, with a trading volume of $13.0908 million.

ProShares UltraPro Dow30 (UDOW.US) Rose 2.55%, with a trading volume of $181 million.

iShares Russell 2000 ETF (IWM.US) rose by 1.82% with a trading volume of $7.662 billion.

$iShares Russell 2000 Growth ETF (IWO.US)$ rose by 1.78% with a trading volume of $66.1581 million.

In terms of market news, weak ADP employment data boosted expectations for interest rate cuts, driving the three major U.S. stock indexes to close higher collectively.

Top 5 Industry-Specific ETFs by Gains

$Direxion Daily Semiconductor Bull 3X Shares (SOXL.US)$ rose by 6.35% with a trading volume of $4.156 billion.

$Oil Services ETF-VanEck (OIH.US)$ rose by 4.41% with a trading volume of $140 million.

$Direxion Daily Financial Bull 3X Shares (FAS.US)$ rose by 3.78% with a trading volume of $59.3994 million.

$2x Leveraged Energy ETF-Direxion (ERX.US)$ rose by 3.68% with a trading volume of $12.1712 million.

$US Natural Gas ETF (UNG.US)$ rose by 3.41% with a trading volume of $168 million.

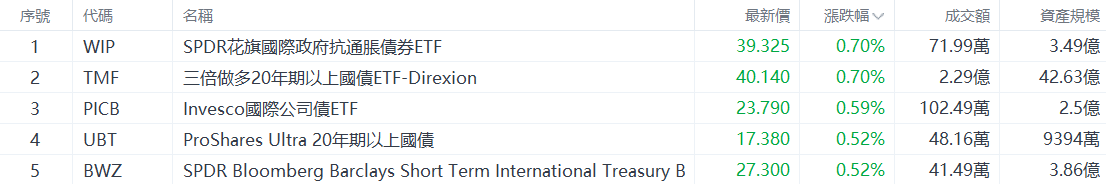

Top 5 Increases in Bond ETFs

$SPDR Citi International Government Inflation-Protected Bond ETF (WIP.US)$ Up 0.70%, with a trading volume of $719,900.

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Up 0.70%, with a trading volume of $229 million.

$Invesco International Corporate Bond ETF (PICB.US)$ Up 0.59%, with a trading volume of $1.0249 million.

ProShares Ultra 20+ Year Treasury (UBT.US) Up 0.52%, with a trading volume of $481,600.

$SPDR Bloomberg Barclays Short Term International Treasury Bond ETF (BWZ.US)$ Up 0.52%, with a trading volume of $414,900.

Top 5 Gainers in Commodity ETFs

$Oil Services ETF-VanEck (OIH.US)$ rose by 4.41% with a trading volume of $140 million.

$Invesco S&P Small Cap Energy ETF(PSCE.US)$ Up 4.07%, with a trading volume of $1.216 million.

$2x Leverage S&P Energy Sector ETF-ProShares (DIG.US) Up 3.75%, with a trading volume of $895,000.

$US Natural Gas ETF (UNG.US)$ rose by 3.41% with a trading volume of $168 million.

$First Trust Energy AlphaDEX Fund (FXN.US)$ Up 2.74%, with a trading volume of USD 6.9294 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen