The three major U.S. stock indexes closed mixed. $Dow Jones Index (.DJI.US)$ Down 0.07%, $Nasdaq Composite Index (.IXIC.US)$ Up 0.22%,$S&P 500 Index (.SPX.US)$rose by 0.11%.

Popular technology stocks were mixed, $Meta Platforms(META.US)$ Up more than 3%,$NVIDIA (NVDA.US)$An increase of over 2%,$Amazon(AMZN.US)$、 $Apple(AAPL.US)$ Down more than 1%.

Top 5 Gainers in U.S. Equity ETFs

$2x Leveraged ASTS ETF-Tradr (ASTX.US)$ Surged 36.41%, with a trading volume of $86.10 million.

According to the Wall Street Journal: OpenAI founder Sam Altman has repeatedly expressed interest in building data centers in space. Sources say Altman has discussed acquiring or partnering with a rocket company, driving a 18% surge in the space concept stock ASTS.

$2x Leveraged BBAI ETF-Leverage Shares (BAIG.US)$ Surged 31.47%, with a trading volume of $12.88 million.

$2x Long OKLO ETF - Defiance (OKLL.US) Surged 31.00%, with a trading volume of $182 million.

In market news, nuclear power-related stocks remained active. Jensen Huang stated that electricity is the biggest bottleneck for AI development, and the solution is to build numerous small nuclear reactors. Additionally, the U.S. plans to increase investment in key mineral companies. Influenced by this, OKLO surged 15%.

$2x Leveraged Long RGTI ETF-Tradr (RGTU.US)$ rose 30.91%, with a trading volume of $20.44 million.

$2x Long RGTI ETF-Defiance (RGTX.US)$ rose 30.90%, with a trading volume of $143 million.

On the news front, quantum computing-related stocks surged across the board, with RGTI skyrocketing 15%, IONQ rising over 12%, 2x Long IONQ ETF - Defiance (IONX.US) surging over 24%.

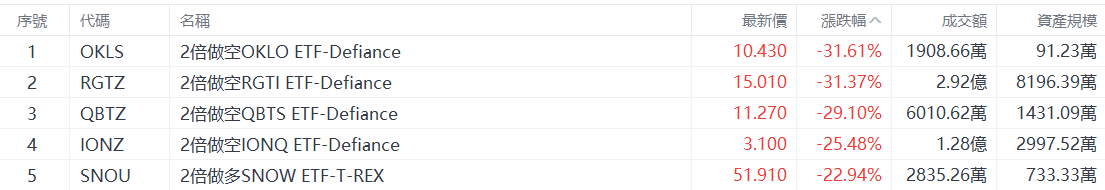

Top 5 Decliners on US Stock ETFs

$2x Leveraged Short OKLO ETF-Defiance (OKLS.US)$ fell 31.61%, with a trading volume of $19.09 million.

$2x Inverse RGTI ETF - Defiance (RGTZ.US) dropped 31.37%, with a trading volume of $292 million.

$2 Leverage Short QBTS ETF - Defiance (QBTZ.US) fell 29.10%, with a trading volume of $60.11 million.

$2x Inverse IONQ ETF - Defiance (IONZ.US)$ declined 25.48%, with a trading volume of $128 million.

$2x Leveraged SNOW ETF-T-REX (SNOU.US)$ Fell by 22.94%, with a trading volume of $28.35 million.

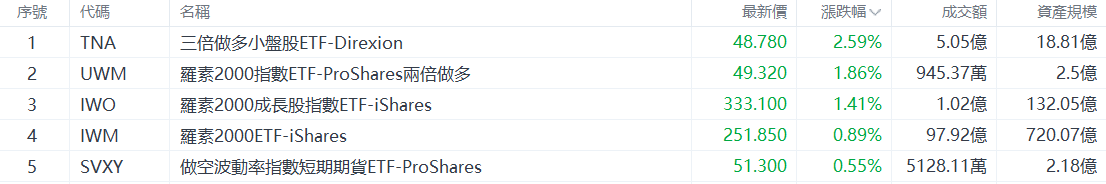

Top 5 Gainers in U.S. Large-Cap Index ETFs

$Direxion Daily Small Cap Bull 3X Shares (TNA.US)$ Rose by 2.59%, with a trading volume of $505 million.

$ProShares Ultra Russell 2000 (UWM.US)$ Rose by 1.86%, with a trading volume of $9.45 million.

$iShares Russell 2000 Growth ETF (IWO.US)$ Rose by 1.41%, with a trading volume of $102 million.

iShares Russell 2000 ETF (IWM.US) Rose by 0.89%, with a trading volume of $9.792 billion.

ProShares Short VIX Short-Term Futures ETF (SVXY.US) Rose by 0.55%, with a trading volume of $51.28 million.

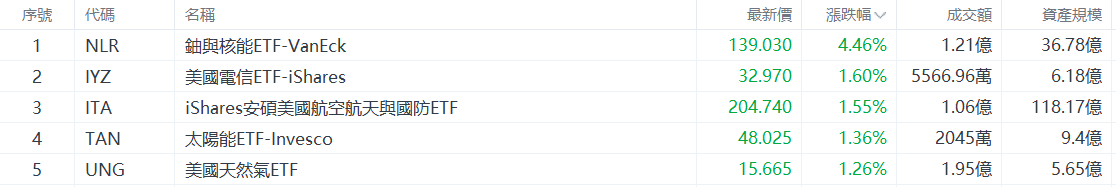

Top 5 Industry-Specific ETFs by Gains

$VanEck Uranium+Nuclear Energy ETF (NLR.US)$ Rose by 4.46%, with a trading volume of $121 million.

In news, Bloomberg reported that the U.S. plans to increase investment in key mineral companies, which has led to strength in uranium and nuclear-related stocks.

$iShares U.S. Telecommunications ETF (IYZ.US)$ Rose by 1.60%, with a trading volume of $55.67 million.

$iShares U.S. Aerospace & Defense ETF (ITA.US)$ Increased by 1.55%, with a turnover of 106 million US dollars.

$Invesco Solar Energy ETF (TAN.US)$ Increased by 1.36%, with a turnover of 20.45 million US dollars.

$US Natural Gas ETF (UNG.US)$ Increased by 1.26%, with a turnover of 195 million US dollars.

Top 5 Decliners in Bond ETFs

$Direxion Daily 20+ Year Treasury Bull 3X Shares (TMF.US)$ Decreased by 1.54%, with a turnover of 158 million US dollars.

ProShares Ultra 20+ Year Treasury (UBT.US) Decreased by 1.15%, with a turnover of 442,300 US dollars.

$iShares Global High Yield Corporate Bond ETF (GHYG.US)$ Decreased by 0.58%, with a turnover of 434,100 US dollars.

iShares 20+ Year Treasury Bond ETF (TLT.US) Decreased by 0.54%, with a turnover of 2.257 billion US dollars.

$ProShares Ultra 7-10 Year Treasury (UST.US)$ Decreased by 0.51%, with a turnover of 323,400 US dollars.

Top 5 Gainers in Commodity ETFs

$Proshares UltraShort Silver ETF (ZSL.US)$ Increased by 4.85%, with a turnover of 41.4148 million US dollars.

$WilderHill Clean Energy ETF - Invesco (PBW.US) Increased by 4.19%, with a turnover of 30.9433 million US dollars.

$2x Long Bloomberg Crude Oil ETF-ProShares (UCO.US) Increased by 1.43%, with a trading volume of $33.64 million.

$Invesco Solar Energy ETF (TAN.US)$ Increased by 1.39%, with a trading volume of $20.45 million.

$US Natural Gas ETF (UNG.US)$ Increased by 1.23%, with a trading volume of $195 million.

How to choose ETFs?Smartly use tools to select high-quality ETFs.

Editor/Stephen